Getting started with blockchain | What kind of auction method is the Algorand Dutch auction opened today?

Recently, there have been a lot of high-profile things in the industry. For example, yesterday (June 18), social giant Facebook announced the white paper of the encryption stable currency Libra, and today (June 19) Algorand blockchain project The main network will be officially launched and the Dutch auction of Token will be opened.

Due to the halo effect of project founder Silvio Micali, the famous American computer scientist and the highest award winner in the computer world, the Algorand project has received a lot of attention from the beginning. This time, Token's innovative use of Dutch auctions has attracted a lot of attention.

So, what is a Dutch auction?

The most common auction method we usually use is a British auction, also known as a price increase auction. In the auction process, whoever has the highest price, who is the auction item. The biggest advantage of a British auction is that it maximizes the value of the auction. The downside is that bidders take a certain risk because the bidder may be attracted by the exciting bidding process and the bid exceeds the estimated price. This psychological phenomenon is called the "winner curse."

- Facebook cryptocurrency Libra or facing review by European authorities

- Born for blockchain games, ERC-1155 became the official token standard for Ethereum

- Forget Facebook, Bitcoin is the future of money, automatic micropayments will debut

Dutch auctions, also known as price reduction auctions, originated in the Dutch flower market, where bids for auctions descended from high to low, but eventually all bidders traded at the same clearing price.

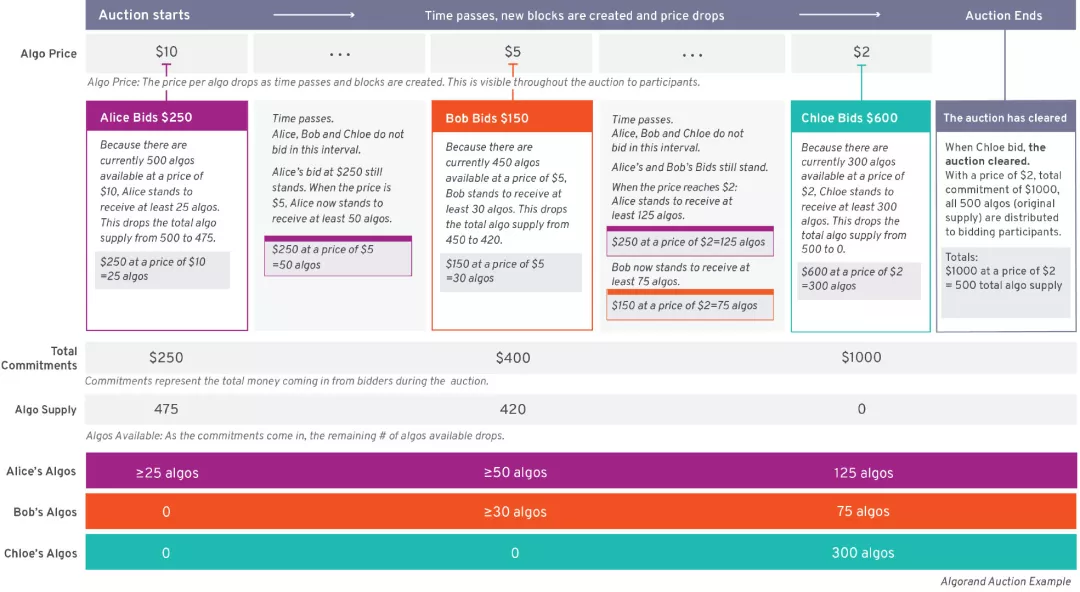

We use a simple example to illustrate the Dutch auction of the Algorand project.

Suppose there are now 500 Algos (Tokens of the Algorand project) for Dutch auctions. The highest price is $10 and the lowest price is $0.1. The auction starts from the highest price.

▲ Algorand's Dutch auction

Suppose that at the auction price of $10, Zhang San took 25 Algos, which is $250 into the promise pool. The auction price continued to drop. When it fell to $5, Li Si took 30 Algos, which is $150 to enter the promise pool. The auction price then went down. When it fell to $2, Wang took 300 Algos, which is $600 to enter the promise pool.

At this time, the promise pool has $250 for Zhang San, $150 for Li Si, and $600 for Wang Er, which is a total of $1,000, divided by the last bid of $2 (when Wang’s bid), which is exactly equal to 500, which is The total number of Algos for this auction.

Therefore, at the end of the auction, the final liquidation price is 2 US dollars, which means that Zhang San, Li Si, and Wang Er are all sold at a price of 2 US dollars, according to the proportion of each of the promised pools (250: 150: 600). Zhang San, Li Si, and Wang Er can get 125, 75, and 300 Algo respectively.

In the Dutch auction of the Algorand project, the most important formula is: Total funds in the commitment pool ÷ Latest auction price = total number of auctions

When the total amount of funds in the commitment pool is divided by the latest auction price, and the obtained quotient (that is, the required quantity) is greater than or equal to the total auction quantity, the auction ends and liquidation begins. If they are exactly equal, the price of liquidation is the latest auction price; if it is greater than the total number of auctions, the price increase will be based on the recent auction price until the balance is reached, or on a first come, first served basis.

From the above example, we can see that in the Dutch auction, although the bidders have different bids, they are all bought at the same clearing price in the final liquidation, but the quantity purchased will change. For example, the first bid for Zhang San, bid $10, originally wanted to buy 25 Algo for $250, and finally bought 125 for $250.

Of course, if Zhang Sancai is rough and buys all at $10, the final liquidation price is $10, and 500 Algos are all owned by Zhang, and the auction is over. But in reality, it usually happens very rarely, because the initial auction price of the Dutch auction will be set high, and then decremented.

If you have 100 Tokens that you want to auction out, read this article, would you use a familiar British auction or a Dutch auction? why? Feel free to share your opinion in the message area.

——End——

Author | JackyLHH Produced | Vernacular Blockchain (ID: hellobtc)

『Declaration : This series of content is only for the introduction of blockchain science, and does not constitute any investment advice or advice. If there are any errors or omissions, please leave a message. 』

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Analysis of Cross-chain Atomic Interchange Protocol

- Quote analysis: normal adjustment, no panic

- Will the future be converted to a PoS public chain? Facebook's Libra blockchain reveals this possibility

- The battle of "618": Which is the source of the blockchain products in Ali, Jingdong and Suning?

- Facebook brings a bull market? Pour cold water for you

- Talking about the Present Situation and Development of Digital Asset Management

- Gu Yanxi: Facebook's stable currency Libra brings opportunities, challenges and a visible future