A brief analysis of the currency attributes of Facebook's digital currency Libra

Today, after Libra's white paper was published, I read about it about its currency attributes. This review is also limited to Libra's currency attributes and does not cover other content in the white paper. I will intercept some of the contents of the white paper for interpretation, taking the first sentence of the second paragraph as an example:

Our world really needs a solid digital currency and financial infrastructure, and the combination of the two must be able to deliver on the promise of the “money internet”.

Comment: In fact, the world now has these two, such as Alipay's balance and bank deposits are digital "currency", perhaps it is not about the blockchain. In addition, the financial infrastructure is already very rich. Such as the Fed's Fedwire, the New York Mellon Bank as a custody and repo settlement center, and many licensed banks.

Unlike most cryptocurrencies, Libra is fully supported by real asset reserves . For each newly created Libra cryptocurrency, there is a basket of bank deposits and short-term government bonds of relative value in the Libra Reserve to build trust in its intrinsic value. The purpose of the Libra Reserve is to maintain the value of the Libra cryptocurrency stable and ensure that it does not fluctuate over time.

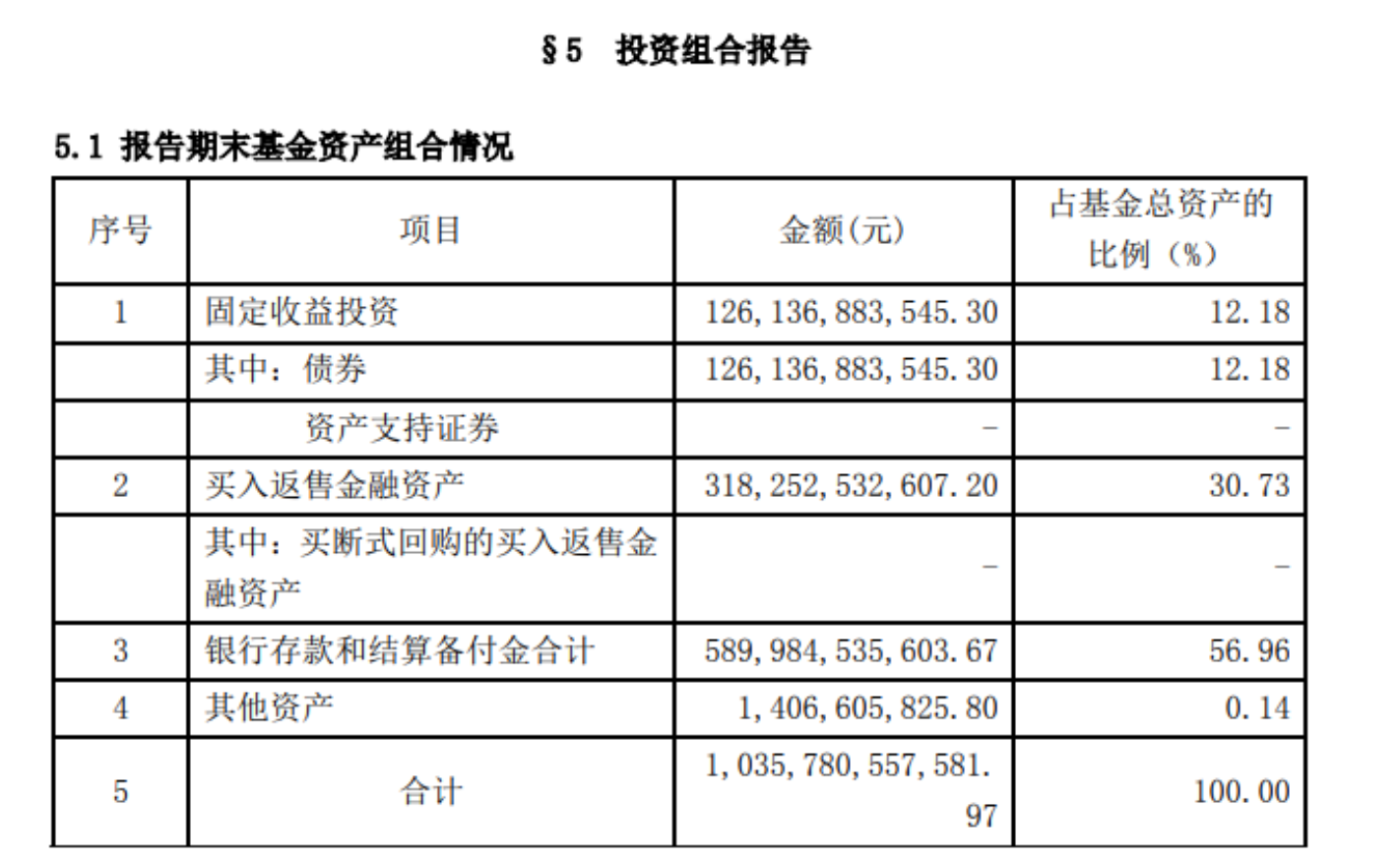

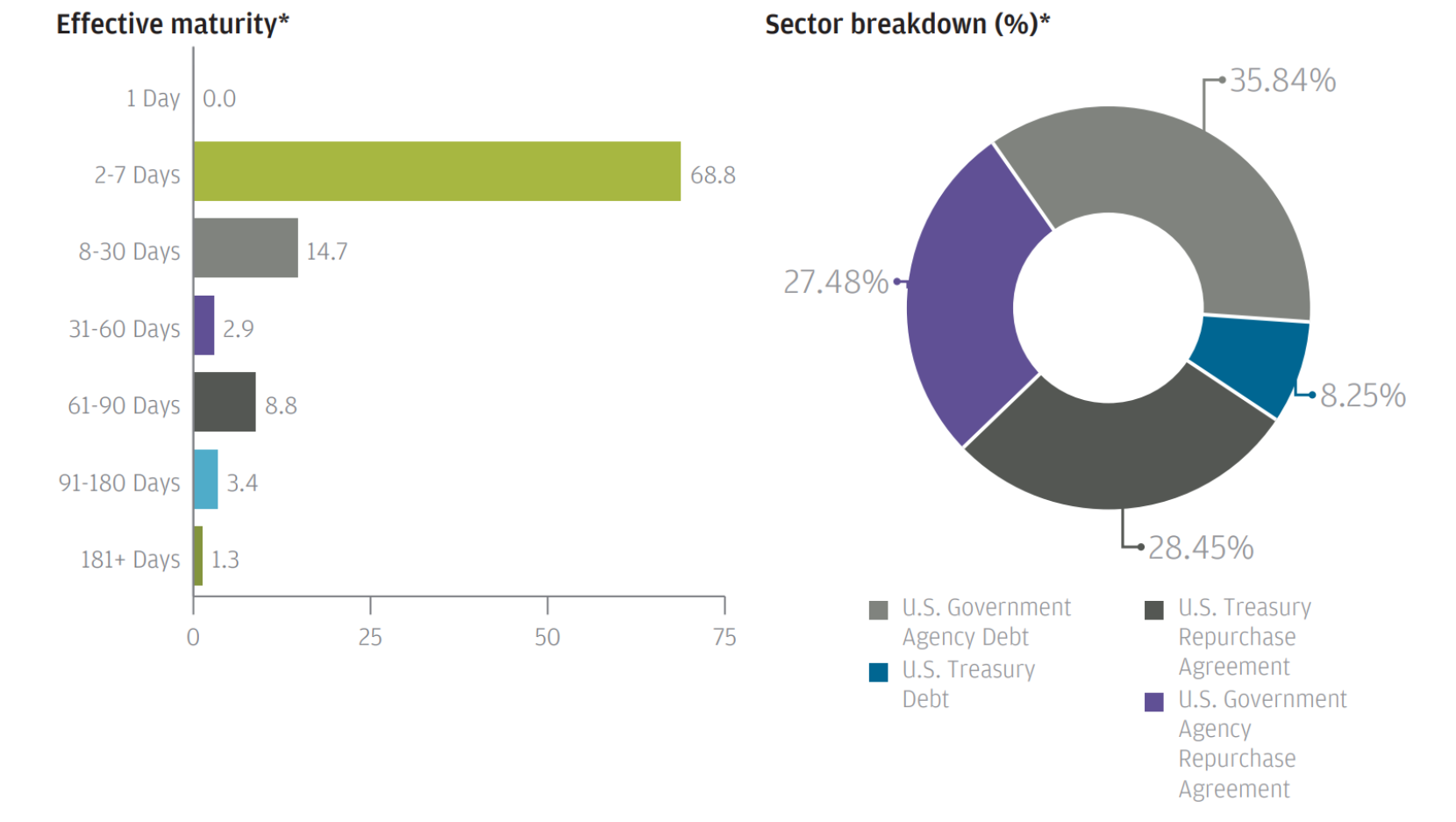

Seeing this, the author has been disappointed. As a new currency issue, Libra supports assets such as bank deposits and short-term government bonds. There are many financial products on the market that are similar to this so-called “real asset reserve” structure, such as the US government-based money fund and the balance treasure that we all know.

Figure: Balance of Baoji Q1 assets

Photo: JPMorgan US Government Money Market Fund

Photo: JPMorgan US Government Money Market Fund

Let's look at the fourth part below:

Let's look at the fourth part below:

We believe that the world needs a global digital native currency that combines the characteristics of the world's best currency: stability, low inflation, global acceptance and interchangeability.

Isn't this the dollar? In addition to the so-called "digital native currency". The ridiculous thing about this description is that even if Libra can get these four "characteristics of the best currency in the world", that is not its original advantage… Why?

Anyone with Libra can get a high degree of assurance that they can exchange this digital currency they hold in their local currency at the exchange rate, just as they would exchange one currency for another when traveling.

Nothing is said, you can even use goods (such as a chewing gum) to convert to any currency based on the "exchange rate" (price). But this so-called commodity and currency liquidity does not mean "high guarantee."

Make sure this currency can be used to exchange real assets, such as gold. The purpose is to help build trust in the new currency and to achieve widespread use in the early days of the currency. Although Libra does not use gold as a support, it will use a range of low-volatility assets (such as cash and government securities provided by a stable and reputable central bank).

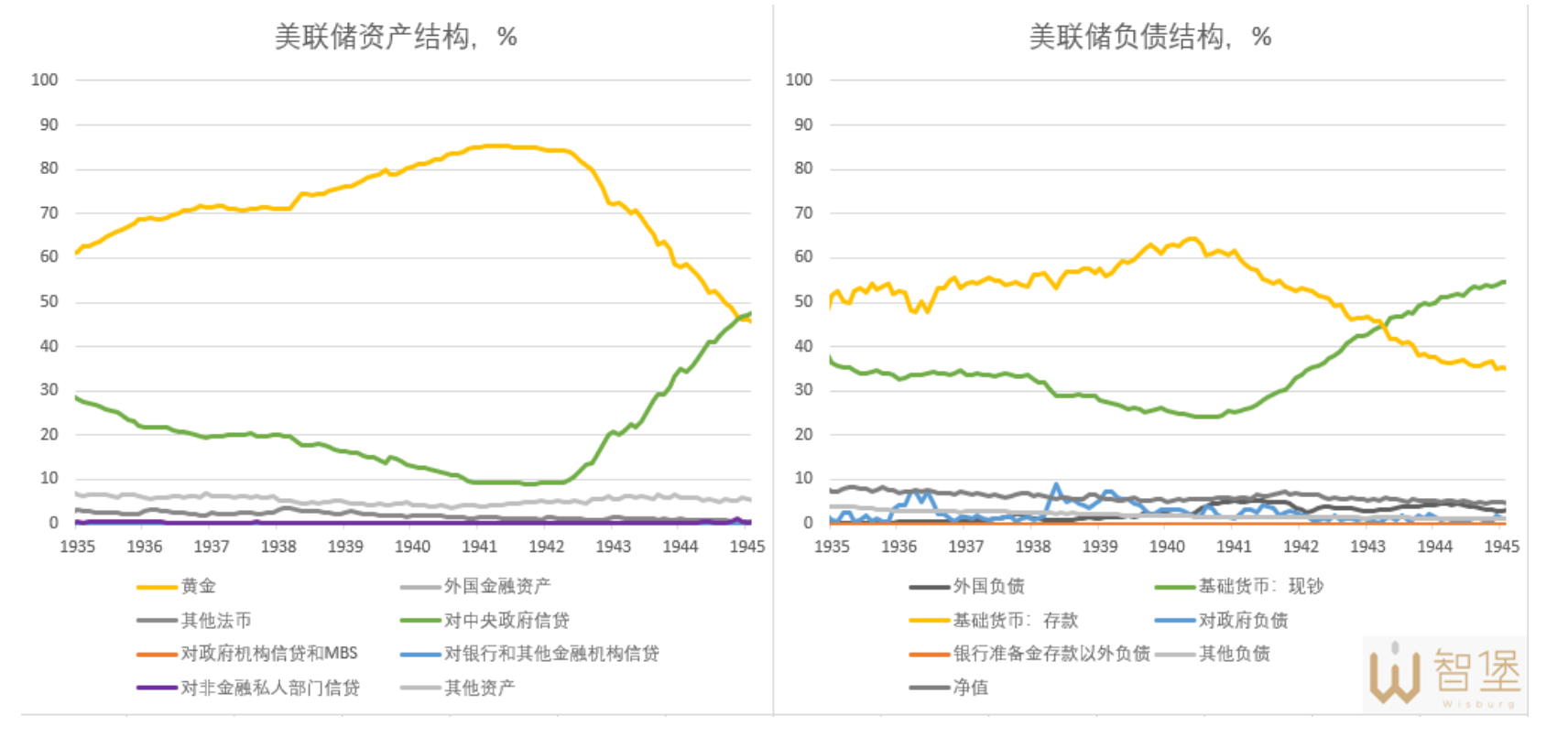

The first half of the sentence is not wrong, and the idea is correct. At the beginning of the establishment of the Fed, a large amount of legal currency was issued based on the gold assets, as shown below. Libra's idea was to use a sovereign credit guarantee to issue currency at first . But the description here is obviously different from the previous one. It used to be “bank deposits” and “short-term government bonds”, but it has become “cash provided by the central bank” and “government securities”. "Cash provided by the central bank" and "bank deposits" are two concepts. The former is the Federal Reserve Note in the United States, that is, cash, which is a claim against the sovereign sector. The so-called bank run is that people do not trust deposits, while trusting cash (deposit credit is bank credit), will convert the bank's claims (deposits) into claims on the sovereign sector (money), both in the national deposit insurance The upper limit is equivalent, but it is clear that Libra's size cannot be lower than the FDIC's deposit insurance limit ; in addition, "government securities" and "short-term government bonds" are two concepts, the former can be very long – such as MBS The latter's term is very short, which refers to the narrowly defined national debt, and the securities issued by the national credit guarantee SPV are not a concept . Therefore, this paragraph and the previous inconsistency make people feel incredible. It seems that the authors of the white paper are not aware of the differences between the various reserve assets. For example, a reserve account is one level higher than the bank deposit account in the entire monetary system. Because not everyone can open a deposit account in the People's Bank of China, only licensed banks can, Alipay can only open a payment settlement account, can not open a reserve account.

Figure: During the Second World War, the Fed unloaded a large amount of gold in the table. In 1945, the largest asset in the asset side of the table was already credited to the government (covering government bonds).

In addition, it is not clear here what Libra will use to get rid of this dependence after borrowing sovereign credit guarantees to issue currency. The dollar’s liberation of gold is through the decoupling of gold from politics, the increase in the amount of US Treasury bonds on the financial side, the establishment of inflation targeting on the policy (stable inflation), and the more free dollar credit creation in the global environment to squeeze out gold. . But Libra does not have a roadmap for extruding legal currency assets (bank deposits and sovereign government bonds). In this case, it seems that Libra is willing to exist as a vassal currency of legal currency.

In addition, it is not clear here what Libra will use to get rid of this dependence after borrowing sovereign credit guarantees to issue currency. The dollar’s liberation of gold is through the decoupling of gold from politics, the increase in the amount of US Treasury bonds on the financial side, the establishment of inflation targeting on the policy (stable inflation), and the more free dollar credit creation in the global environment to squeeze out gold. . But Libra does not have a roadmap for extruding legal currency assets (bank deposits and sovereign government bonds). In this case, it seems that Libra is willing to exist as a vassal currency of legal currency.

It must be emphasized that this means that a Libra is not always able to convert to a local, specified currency (ie Libra is not "linked" to a single currency). Conversely, as the value of the underlying asset fluctuates, Libra's value, which is denominated in any local currency, may fluctuate. However, the purpose of selecting reserve assets is to minimize volatility and allow Libra holders to trust the currency to maintain its value over the long term. Assets in the Libra Reserve will be held by custodians with investment-grade credit ratings across the globe to ensure the security and dispersion of assets.

This section has laid the groundwork for the later contradictory arguments. First, the stable currency of a single currency, such as Libra and Tether, has drawn a line, so it cannot maintain a parity relationship with a specific legal currency. For deposits of various currencies (such as US dollars, Euros, Japanese Yen, British Pounds, etc.), Libra's pricing is based on the valuation of each currency/Libra currency pair exchange rate combined with the weighting of each currency in the asset side. As the SDR's valuation ultimately chose to be denominated in US dollars and add up to the weighted exchange rate of each basket of currencies. If Libra is very similar in nature to SDR in terms of currency, will its fate be the same as SDR? (The result of the US dollar system is denominated in US dollars …)

There is also an important detail here, that is, Libra's reserve assets are distributed centrally managed by investment-grade (IG) credit institutions. Well, it is wise to know that money business cannot be too decentralized.

The asset behind Libra is the main difference between it and many existing cryptocurrencies. These cryptocurrencies lack this intrinsic value, so prices fluctuate greatly due to psychological expectations. However, Libra is indeed a cryptocurrency, so it inherits several compelling features of these new digital currencies: the ability to quickly transfer money, secure security through encryption, and easy and free transfer of funds across borders.

The first half of the sentence is a bit of a ghost, and now many of the single currency-backed digital currencies are also dollar assets.

The characteristics of the second half of the sentence are nothing special, and it seems to cause trouble. For example, quick transfer – Alipay and the banking system can do it. Easily and freely transfer funds across borders – this is a taboo in the US dollar system, including some capital-controlled countries, such as China (the People's Bank of China will be angry); and some countries that have been sanctioned, such as North Korea (the United States will be angry) .

The interest on the reserve assets will be used to pay for the cost of the system, to ensure low transaction costs, dividends to investors in the early stages of ecosystem start-up (to read the Libra Association here), and to support further growth and diffusion. The interest distribution on the reserve assets will be set in advance and will be supervised by the Libra Association. Libra users will not receive returns from reserve assets.

Expose its deceptive paragraph. First look at the last sentence, Libra users will not receive returns from reserve assets, which means Libra is a zero-coupon currency. Well, I accept this for the time being. After all, if you have Libra Capital Market, I can configure it myself. Go to Libra Security Assets.

But everyone needs to know that the French currency assets you use to cast Libra have the opportunity cost. Facebook took your legal currency and earned a risk-free arbitrage gain. This business is really good. According to the current arbitrage space, at least 1%-2% of the arbitrage gains are OK. If the size of Libra is 10 billion US dollars, it is really delicious to eat 100 million free Portables every year. .

Only the Libra Association can manufacture (mint) and destroy (burn) Libra. Libra coins will only be manufactured when an authorized dealer invests legal assets to buy Libra coins from the association to fully support the new currency. Libra coins will only be destroyed when an authorized dealer sells Libra coins to the association in exchange for collateral assets. Libra reserves assume the role of “final buyer” as authorized dealers are always able to sell Libra coins to reserves at a price equal to the value of the basket.

It is clear to read some words in this paragraph. The Libra Association is the central bank . The so-called authorized dealers are licensed banks and primary dealers of Libra's currency business . These authorized dealers must use different The French currency was minted, and the Libra Association, as the central bank, had to pay the mortgaged legal currency assets to Libra when it was sold to authorized dealers. Of course, the details that are missing here are whether Libra is paid back to the association in real time or is it paid overnight . Is the redemption of short-term assets or legal currency deposits ?

Let's take a look at the information provided on the Libra reserve details page:

Libra coins were given intrinsic value at the outset, helping to prevent speculative fluctuations like other cryptocurrencies.

The use of intrinsic value is confusing. In fact, Libra's value support is not endogenous, it is entirely excreted by collateral.

To create a new Libra currency, Libra must be purchased in a 1:1 ratio using fiat currency and the legal currency is transferred to the reserve. As a result, reserves will increase as users' demand for Libra increases. In short, there is only one way for investors and users to create more Libra, using legal tenders to buy more Libra and increase reserves.

There is no doubt that the legal currency is a dependency . Yes, remind readers that when you deposit RMB cash into the bank, you are using the legal currency to purchase “RMB deposits” in a 1:1 ratio. The bank then transfers the received cash into a reserve (prepared or cash).

How to invest in reserves? Libra users will not receive returns from reserve assets. The reserve will invest in low-risk assets that will generate interest over time. The proceeds from interest will be used first to pay for the association's operating expenses, including: investing in ecosystem growth and development, funding NGOs, and funding engineering research. After paying these fees, the remaining portion of the proceeds will be used to pay the initial investment dividend to the early investors of Libra Investment Token. Because reserve assets are low-risk and low-yielding, early investors will only get a return if the network is successful and the reserve size is greatly increased.

It is also a blackmail section that clearly shows that its currency business is an interest-free business. Then what is the “investment in the growth and development of the ecosystem”? How to define? In addition, interested bad guys can check out how much Facebook spent in the past two years to buy back their own stocks.

In terms of capital preservation, the association will only invest in stable government-issued bonds that are unlikely to default and are unlikely to have high inflation . In addition, by selecting multiple governments and not just one government, the association will further reduce the potential impact of investment activities, thereby diversifying reserves. In terms of liquidity, the association's plan is to rely on these short-term securities issued by the government and traded in liquid markets to guarantee liquidity. The daily trading volume of these liquid markets is usually tens of billions or even hundreds of billions. This allows the size of the reserve to be easily adjusted as the number of Libras increases or decreases.

Hello, we are a money fund.

It is unlikely that defaults + unlikely to have high inflation are the prerequisites that can be screened out. There are only a few alternatives, such as US debt, German debt, and Japanese debt. There have been many sovereign debts that have defaulted in the past 100 years. Interested readers can check out the papers of Aiken Green and Reinhart. Here I put a graph of Moody's. Of course, the default is a small country.

Our goal is to have Libra coexist with existing currencies . Since Libra will be a global currency, the association decided not to develop its own monetary policy, but to follow the policy of the central bank represented by the basket. As mentioned earlier, the mechanism by which an entity interacts with our reserves determines how our approach works in much the same way as a currency board (such as the Hong Kong Currency Board). Unlike the central bank's discretion to print money, the currency board usually prints local currency only when it has sufficient foreign exchange assets to fully support the new banknotes and coins. Two of the main reasons for implementing such a system are: first, stability, because the choice of underlying assets is based on its lower volatility; second, to prevent future abuse, for example, to create more in the absence of support. Currency.

Once again prove that you are only a legal currency vassal, now go back and read "It can integrate the characteristics of the world's best currency: stability, low inflation, global acceptance and interchangeability." Is it ironic? These advantages are not given by themselves, but by the policy of “the central bank represented by the basket”, which is the modern central bank’s inflation target system, financial stability target, the dollar’s offshore market and the global financial system. Granted by Wan’s bank and Broker-Dealer, not by your white paper…

The author of the white paper is mistaken. The currency board system is linked to a single currency. Libra is more like SDR, and it is similar to the euro zone in the parallel currency hypothesis (that is, the hypothetical situation in which the euro and the Italian lira, franc, and Deutsche Mark are simultaneously circulating). In short, they are all monetary systems that cannot be equal to the dollar system.

The so-called "central bank's decision to print money" is also a wrong description. All central bank currency issuance is based on the credit currency of the asset. The currency board system issues domestic currency based on a single currency, such as dollar assets (as assets) – Hong Kong dollars (as liabilities). The choice of assets was originally determined by the central bank within the scope of its statutory mandate. It can be based on domestic treasury bonds, claims based on the domestic banking system, or dollar assets. Therefore, the so-called "making more money in the absence of support (which should be the translator does not understand, in fact, is a mortgage)", as long as you operate the currency business, everyone is the same.

Ok, just write this, I am still reading the content of the governance structure.

Author: Mikko Source: Fort wisdom wisburg

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The Libra white paper on the Facebook Stabilization Coin Project has been released, and this potential risk is still worth noting!

- Luo Jinhai: Facebook's "ambition"? The real currency war has just begun

- Exploring how to establish blockchain interoperability from the Web system (2)

- Xinhua News Agency Financial Watch: What is the new round of rising momentum of Bitcoin?

- See Facebook's Open Finance (WIP) from the design of the Move language

- Facebook Stabilizer Libra: What is the impact on Bitcoin and Ethereum?

- Blockchain Finance: Rewriting the history of accounting, sad "consensus" off | Zinc