The wave of "absolute deflation" of platform currency is coming. How should the exchange make a choice?

This article Source: Odaily Daily Planet , author: the the

Platform currency refers to tokens issued by digital asset trading platforms.

In the early days of platform currency, it was mainly used for the deduction of fees for the platform, participation in profit distribution, and voting on the platform. Its value is derived from the ecological function construction of the platform currency. However, with the rise of the platform currency repurchase and destruction wave, the price of the platform currency is increasingly dependent on its own supply and demand relationship.

Since the beginning of this year, the OKEx platform destroyed 70% of the platform currency OKB at one time, announcing that OKB has since entered the era of absolute deflation. OKB rose sharply by 87.5%, reaching a historical high of $ 7.51, and led the overall rise of the platform coin sector.

- Important Ethereum Capacity Expansion Solution: Optimistic Rollup Status Report (Part 2)

- February is another milestone, ConsenSys releases latest data report on Ethereum ecology

- Breaking the Impossible Triangle of the Blockchain (6)-Blowing a Whistle on the Activity of the Blockchain

For a time, many exchanges followed suit, and a new wave of destruction aimed at the absolute deflation of platform currency officially came.

Although it is a new bottle of old wine, why this wave of destruction will trigger a new round of platform currency rise? This article will analyze the value of mainstream platform coins around the issue of "absolute deflation".

I. Platform coin price factor model

With the rise of the platform coin repo destruction model, we need to build a new platform currency valuation model to analyze the impact of the destruction model on the platform coin price.

First we assume some parameters.

T is the total demand for platform currency by all participants in a period of time in the market. These requirements include voting with platform currency, deduction of transaction fees, and investment. To simplify, we assume that when people use or invest in platform currency, they also always consider the value of the platform currency, so that T can be measured in fiat currency;

P is the exchange price of platform currency and fiat currency, indicating how much fiat currency can be exchanged for one platform currency;

M is the supply of platform coins, and its total issued amount is fixed;

V is the number of times platform currency is exchanged in a period of time and represents the circulation speed of platform currency. Therefore, the total amount of platform currency used for trading in a period of time is MV.

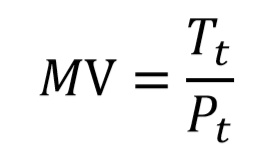

Now let's analyze the demand for the platform currency. The total value of the platform currency we need is T USD, and for every USD 1 corresponding transaction, we need 1 / P digital currencies to complete. Therefore, T / P is the amount of platform currency demand over a period of time, so:

Shift the term and log the difference P (in the economic sense, the price change), and get:

Formula 1)

From the above formula, it can be seen that the price of platform currency will increase with the increase of platform currency demand and decrease with the increase of the number of platform coins, which also explains why the result of the platform currency repo destruction model often leads to the rise of platform currency prices. .

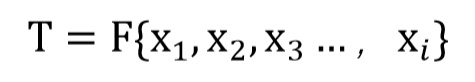

At the same time, factors such as the platform coin ecological construction and function expansion will increase the demand T, so let these influencing factors be x𝑖:

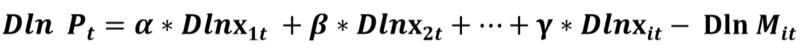

Combining the above two formulas and taking the difference logarithm of P, we get:

Formula (2)

It can be seen that the platform currency ecological construction, function expansion, and other strategic layouts will also drive up the price of the platform. However, because the stimulus effect of these factors on demand often changes, the impact on the price of the platform currency (that is, the coefficient of each influencing factor in the above formula) is sometimes strong or weak, or positive or negative, unlike direct destruction of the platform currency price. The impact is more concise and positive.

This is indeed the case from the actual results. Taking OKB as an example, the ecological construction plan announced in the past few years has not had a greater impact than the direct destruction of 70% of OKB this time.

Second, the price analysis of the three major platform coins under the tide of destruction

After reading the commonalities, let's analyze specifically why there are major platform coins with destruction mechanisms, but the market performance is very different.

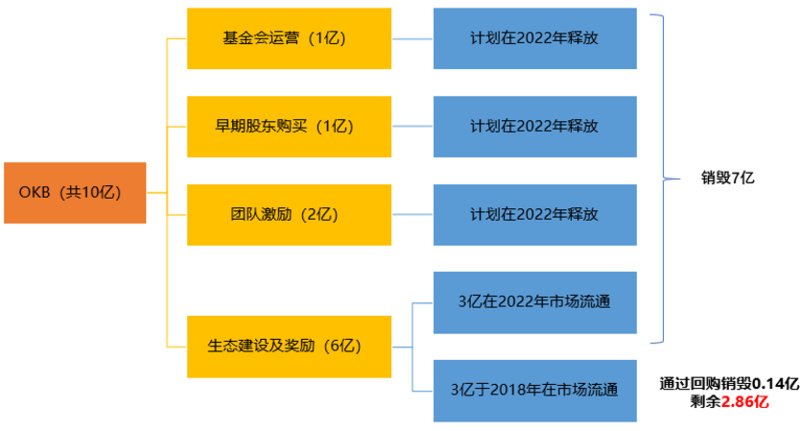

(1) OKB

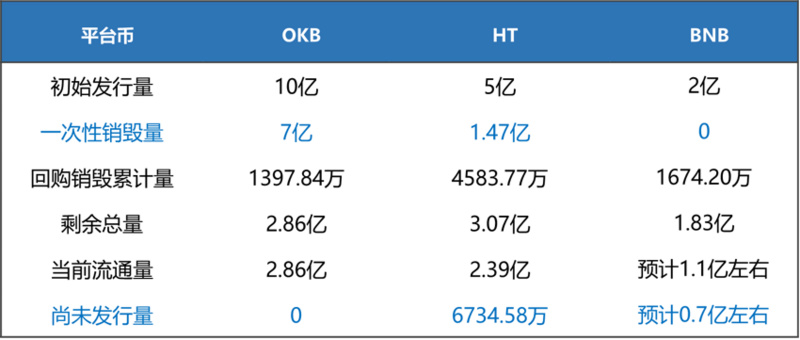

OKB originally planned to issue one billion, of which 10% was used for foundation operations, 10% was used for early shareholder purchases, 20% was used for team incentives, and 60% was used for ecological operations; and of these 60%, another 300 million OKB was distributed during the 2018 Spring Festival red envelopes and point-of-purchase pre-paid card to OKB activities, and entered the market.

In this wave of OKB destruction, OKEx directly destroyed 70% of OKBs that have not yet entered circulation. Since then, the existing OKB has only 286 million OKBs in circulation, and OKEx officials have subsequently announced that OKB's repurchase and destruction measures will remain unchanged and that contract revenue will be included in the repurchase funds in the future. Since then, OKB has become the first Absolute deflation platform currency.

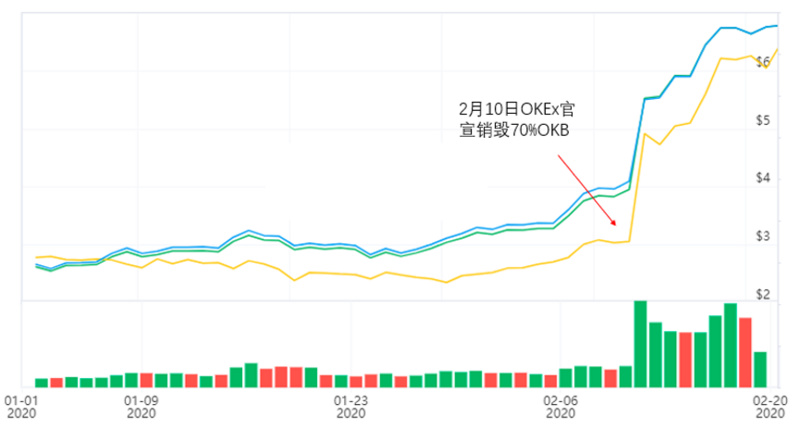

Combining formula (1), it can be seen that the destruction of 70% of the amount of OKB may bring about a 70% increase in price, and the market performance is more in line with the model results: On February 10, OKEx announced the destruction of 70% of OKB and also announced the launch of OKChain and OKDEX The two good news of starting the internal test, OKB rose 36% that day, closing at $ 5.37, and then rose to a maximum of $ 7.51 in the next few days, an increase of 90%.

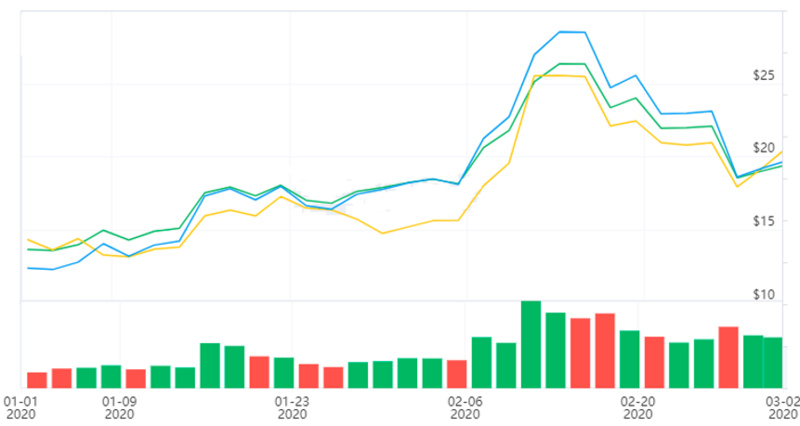

OKB price chart since this year

(2) HT

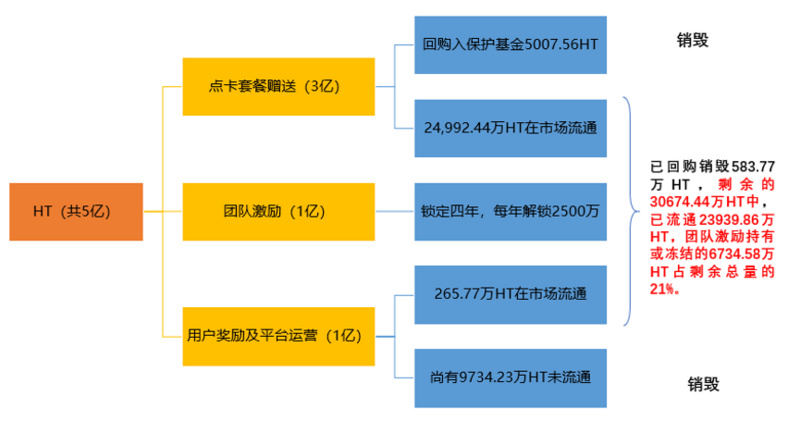

HT originally planned to issue 300 million HT, of which 100 million HT was used for ecological operations, 100 million HT was used for team incentives, and 300 million HT was used for gift card package gifts and has entered the market circulation.

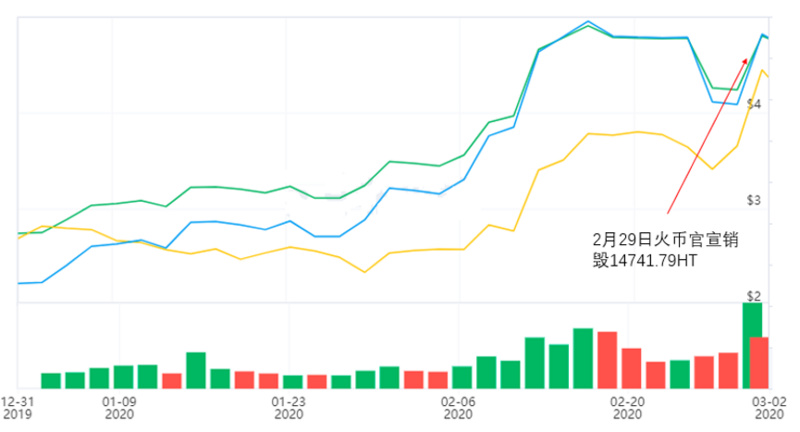

On February 29, Huobi's official website announced that it would destroy 147,479,79 HTs, accounting for 29% of the total HT. The price of HT rose from US $ 4.89 at the opening day to US $ 5.48, with a maximum increase of 12.07%.

The 14.74179 million HTs destroyed this time are mainly from two parts:

(1) 97.423 million HT of unissued part of HT operation, this part of HT accounts for 19.4% of the total issued amount;

(2) The investor protection fund previously established totals 50.756 million HT.

It should be emphasized that this part of the HT of the investor protection fund is the HT that Huobi used to repurchase from platform revenue in the past. The market has previously expected that this HT will not enter the market again, so the price of this part of the HT destroyed The impact is not significant.

According to formula (1), the HT price increased by up to 19.4%, which is not far from the actual situation on February 29 (the highest increase was 12%).

HT price chart since this year

(3) BNB

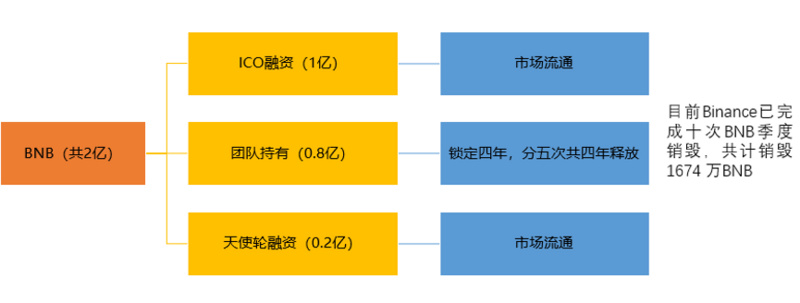

The total amount of BNB issuance is constant 200 million, of which 100 million is publicly issued in the form of ICO. The founding team members hold 80 million and another 20 million are used for angel round financing. According to the Binance White Paper, BNB will continue to be destroyed until the total is reduced to 100 million BNB.

Although BNB was the first platform coin to be repurchased and destroyed, in the wave of platform coin destruction this year, BNB did not follow up. Therefore, the market performance of BNB in mainstream platform currencies is not outstanding this year.

BNB price chart since this year

Third, the conclusion

Judging from the current destruction of mainstream currencies, OKEx chose to destroy 700 million OKBs, and all existing OKBs have been circulated on the market. Therefore, with the development of future repurchase and destruction, OKB officially entered the era of absolute deflation; Huobi also followed up In view of this destruction tide, a total of 147 million HT were destroyed at one time, accounting for 29.48%. The difference is that 50 million HT has been withdrawn from circulation, so the increase in destruction brought by it is limited; Binance has not followed the destruction wave, so The performance is not eye-catching.

As the center of the digital currency industry, the exchange has attracted much market attention. The operation of platform currency is one of the core business of the exchange. When the repurchase and destruction of platform currency forms a trend, only by passing the benefits of the exchange team to customers and implementing "absolute deflation" can we win market recognition.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Beijing issued the first blockchain electronic invoice, parking tickets and park tickets will be included

- "Half" and "Fed rate cut", the two big exams Bitcoin faces

- Heavy! Indian cryptocurrency ban unconstitutional by Supreme Court, Indian crypto community wins victory

- Open up on-chain and off-chain assets, Chainlink and DMM aim to create the first blockchain-based currency market

- Lies of the trading platform——how to dynamically check the authenticity of transactions on the exchange

- U.S. Federal Reserve cuts interest rates sharply

- Babbitt Column | Why Don't Use Leverage in Investment Coins