I read why the SegWit adoption rate of Litecoin is higher than Bitcoin.

In the past few years, Litecoin has become a testing network for Bitcoin to some extent. As the benchmark for the digital silver in the status of Bitcoin digital gold, the best example of this view may be April 2017. When SEGWIT is activated on the Litecoin network, the upgrade has not yet been activated on the Bitcoin network.

The Litecoin did not actually need SEGWIT at the time, because its network was far from reaching the capacity limit. The Litecoin network had a block ceiling of 8MB and a 2.5-minute block interval. Having said that, the activation of SEGWIT also made Litecoin play a role in the development of lightning networks.

A few months later, SEGWIT was activated on the Bitcoin network. Some people think that deploying SEGWIT on the Litecoin network is to activate this upgrade path on the Bitcoin network. SEGWIT works flawlessly in a network of cryptocurrencies pledged by real money and is circulating, and the market and users seem to have positive feedback on the activation of SEGWIT on the Litecoin network, both of which support SEGWIT in The key to activation on the Bitcoin network.

Although the Bitcoin network seems to be the one that urgently needs SEGWIT to increase capacity and increase transaction scalability (which can also help Layer 2 protocols such as Lightning Networks run more efficiently), two years later, SEGWIT is on the Litecoin network. The adoption rate is higher. Let's take a closer look at why things are going to grow like this.

- Standard Chartered Bank uses the blockchain platform Voltron to complete the first international letter of credit transaction

- How to accelerate the development of digital currency in the second half of the year, eight former and current central bank officials have outlined

- In the first half of the year, 27 policies in 13 provinces and cities involved more “one-to-one” blockchains.

What does the data tell us?

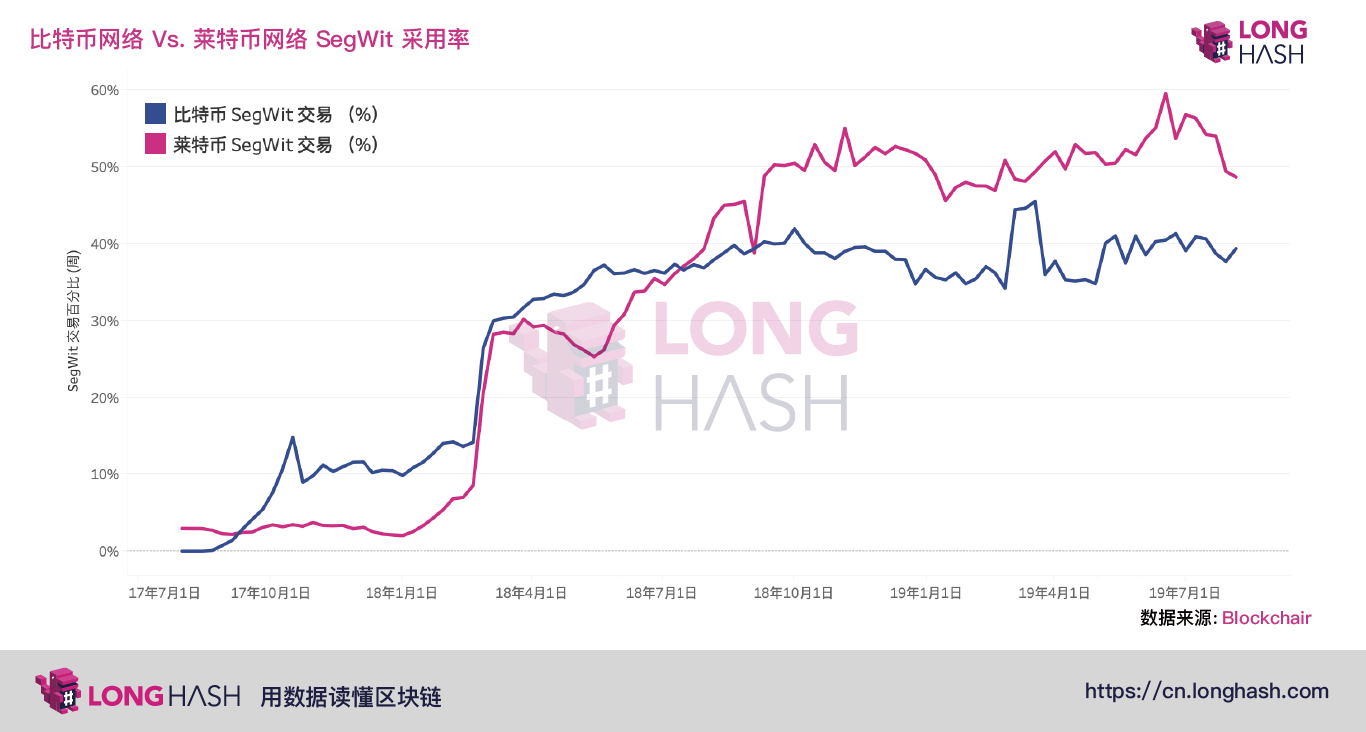

When observing SEGWIT adoption rate data on Bitcoin and Litecoin networks on BLOCKCHAIR, SEGWIT was first adopted on the latter network, so it is clear that SEGWIT will adopt higher rates on the Litecoin network earlier. As exchanges and wallet providers began to integrate this new transaction type into their platform, the bitcoin adoption rate quickly rose to around 10%.

COINBASE's adoption of SEGWIT at the end of February 2018 is a critical moment for Bitcoin and Litecoin. Bitcoin's SEGWIT adoption rate rose from 14% to 30%, while Litecoin rose from 9% to 28%.

SEGWIT's adoption rate on Litecoin rose from 24% in mid-May to more than 50% in September after a decline in adoption rates in the months following the expiration. Since then, SEGWIT's adoption rate on the Litecoin network has remained at around 50%.

On the other hand, after COINBASE integrated this upgrade, Bitcoin did not show much sustained growth in SEGWIT adoption, and only increased by 9% since then.

What are the reasons?

As far as the adoption rate of SEGWIT on the Litecoin network is higher than that of the Bitcoin network, it seems that several key factors are at work.

First of all, it is worth noting that BLOCKCHAIN has not yet integrated SEGWIT. This wallet still accounts for at least 20% of Bitcoin network activity, so as long as BLOCKCHAIN adopts SEGWIT, the SEGWIT adoption rate of Bitcoin can be pushed higher and exceeds Litecoin.

Another influencing factor is VERIBLOCK. As discussed recently in the article on the relationship between Bitcoin transaction fees and SEGWIT adoption rates, VERIBLOCK has a huge impact on SEGWIT adoption rates. In the above picture, we can see that the SEGWIT adoption rate of Bitcoin has surged in March this year. The reason for this surge was that VERIBLOCK migrated from the test network to the main network. As shown, if VERIBLOCK's non-SEGWIT transactions are not included in the chart, the bitcoin's SEGWIT adoption rate will be very close to Litecoin.

For ease of understanding, VERIBLOCK is a project that uses bitcoin transactions to increase the security of the competing currency blockchain.

It can be understood from a rough calculation that if VERIBLOCK does not exist and companies like BITPAY and BLOCKCHAIN can upgrade to SEGWIT, the SEGWIT adoption rate of Bitcoin may reach nearly 70%. As a result, the adoption rate of Bitcoin's SEGWIT will be much higher than 50% of Litecoin.

Having said that, it is clear that although SEGWIT has helped the development of Lightning Networks, there is currently no strong demand for Bitcoin users.

Both BLOCKCHAIN and BITPAY indicate that their users are currently needing other features. Bitcoin transaction costs have remained fairly low for more than a year, which may explain why SEGWIT adoption rates have stagnated during this period.

If the fee rises to a high enough level, then BLOCKCHAIN will likely use SEGWIT, while VERIBLOCK will use the Bitcoin blockchain less. Until then, Litecoin may continue to maintain its advantage in SEGWIT adoption.

Note to the author: Thanks to ANDREW YANG of ALTO FINANCIAL for his help in the research of this article.

LongHash , read the blockchain with data.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Four central banks cut interest rates within two days, and Bitcoin “safe haven properties” received attention

- Blockstream turned into a mining giant, saying it will launch the Betterhash protocol pool

- Market Analysis: From the perspective of the nature of funds, it seems that only the leader can benefit from it.

- Don't let the analytics company sell you: read the privacy and privacy of Bitcoin

- Getting started with blockchain | What is token destruction, why destroy tokens?

- Coinshares 2019 Encryption Report for the First Half of the Year: Institutional Investors Are Pushing Bitcoin Bull Market (Full Text)

- Ethereum 2.0: How to achieve finality?