Interpretation of the market | Sharpening the Huo Huo to the leek: CME wants to push the BTC option contract

Interpretation today

Recently, the derivatives exchange giant Chicago Commodity Futures Exchange (CME) announced that it will launch BTC options in the first quarter of 2020, and the program is currently awaiting regulatory evaluation.

In this regard, Tim McCourt, global head of CME Group's stock index and alternative investment products, said: "Based on growing customer demand and strong growth in the BTC futures market, we believe that the launch of BTC options will provide our customers with flexible tools to hedge BTC Price risk."

- Chang Hao: Everything is UTXO, transfer is trading

- Bitcoin ETF approval and the final decision date, the market is not expected to be optimistic

- Getting started with blockchain | In 2020, bitcoin will be halved or ahead of schedule, the computing power will skyrocket, and the difficulty adjustment mechanism will fail?

He believes that derivatives such as options are designed to help institutional and professional traders manage BTC spot market exposures and hedge futures positions in regulated exchanges.

Stock option contracts were introduced in 1973 by the Chicago Board Options Exchange (CBOE). The option tool is a derivative of a futures contract. It refers to a standardized contract that is uniformly defined by the exchange and that provides the buyer with the right to buy or sell the relevant futures contract at a certain price within the validity period specified in the contract.

The difference between an option and a futures contract is that the buyer of the option contract has the right to execute the contract, but is not obligated to execute the contract. When the market conditions are not favorable to the buyer, the buyer can choose not to exercise the right, for which the buyer needs to pay a certain premium for the option contract.

The role of options in traditional financial markets includes the ease of managing risk, especially the ability to effectively measure and manage volatility risks, and the development of innovative financial products. After the birth of the option pricing BS formula in 1973, people can derive the implied volatility of the market from the fair market price of the option contract and the spot price of the same target, which becomes an important indicator for investors to observe hidden risks in the market.

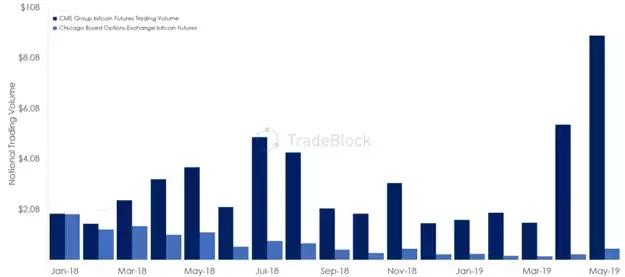

Global digital clearing derivatives trading volume has grown steadily. Since CME launched the BTC futures contract in December 2017, 3,300 accounts have traded the product, and in July 2019, there were 56 institutions holding open BTC futures contracts. CME's BTC futures contracts trade an average of nearly 7,000 copies per day (equivalent to 35,000 BTCs). Digital exchanges such as BitMEX, OKEX, and Huobi DM have an average daily trading volume of several thousand BTCs.

The dark blue in the figure is the volume of CME BTC futures contracts.

JEX, which was acquired by the currency, has already launched an option trading function, but the current trading volume is still far from the futures contract. On the one hand, the rules of options are more complicated than futures. Some small white investors are even unclear about the pricing, direction and leverage of option contracts. On the other hand, the current JEX online option contract has a higher leverage ratio and a higher risk. At present, the blockchain secondary market is still far from mature. Investors may not immediately use tools such as options to manage or hedge risks. Most option contract traders still hold speculative gambling mentality. How can this not happen? Losing money. It is reported that the three major exchanges are stepping up the development of the options contract trading system, hoping that it will not become a tool to cut the leek.

Market research

Overall view

BTC rebounded from the $9,800 yesterday and then returned to the volatility trend, falling back to the range of 10,000 to 10,100 US dollars, located below all major moving averages MA5, 10, 20, 30, 60, 120, the shape is poor. However, BTC's bargain-hunting strength is strong. It has been pulled down several times after breaking through 10,000 US dollars today. The $9,500 is the last strong support of BTC. As long as it does not fall below effectively, it can continue to hold the spot. The main circulation certificate has stagflation, and the kinetic energy that continues to rise is weakened. A leading station is needed to recover the situation. At the beginning of the bull market, long-term holders can buy on dips, and it is still a good opportunity to get on the bus.

In December 2018, we clearly pointed out BNB's investment opportunities in the bear market, and the first to propose that the BNB in the bull market will enjoy Davis double-click (hedging: the platform pass the bear market profit key – the certificate valuation series) 2) In October 2018, we will point out the price cycle of BTC and predict the bottoming time to be around May 2019 ([Classic update reappears] three laws and applications of BTC Bulls and Bears cycle – Freezing Point Outlook A); In April 2018, when the remaining temperature of the bull market had not been exhausted, we indicated that it was a rebound rather than a bull market (whether the bull market is coming? It is the four reasons for the rebound rather than the bull market).

BTC quickly rebounded from the $9,800 yesterday and returned to the volatility trend, falling back to the range of 10,000 to 10,100 US dollars, located below all major moving averages MA5, 10, 20, 30, 60, 120, the shape is poor, the need to continue finishing in the short term . The BTC support level is 9800USDT and the pressure level is 10300USDT.

ETH has been relatively strong recently. Recently, there have been a series of events such as V God attending the event to increase the exposure of ETH. If BTC can't return to strength, ETH will continue to rise after finishing. The ETH support is 205 USDT and the pressure is 230 USDT.

EOS main network upgrade is approaching, short-term investors can temporarily withdraw from the wait and see, and it is bad to make a good landing. EOS support is 3.8USDT and pressure is 4.25USDT.

risk warning

The price of digital pass is fluctuating violently. Investment digital pass is a high-risk investment behavior. Investors should reasonably assess their investment ability and risk tolerance, use leverage carefully, strictly control risks, and invest carefully. Investors are advised to keep in mind that investments are risky and require caution when entering the market.

Disclaimer

Personal opinions are for reference only. The analysis in the text does not constitute a recommendation for trading, and the profit and loss is self-sufficient. Welcome to reprint, but need to indicate the source.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Babbitt Watch | Libra Reserve has 2 major doubts, holding a new round of hearing next week

- Zhu Jiaming: Digital currency may completely change the aggregate demand supply framework of money

- These data analysis results are quite interesting about stable coins.

- Facebook did not start Libra, but launched a currency war

- Explore: Bitcoin and Nash's ideal currency

- The successful landing of the digital renminbi needs to solve three difficulties

- BTC sees more emotions falling back and returning to the shock pattern