Research Report | Exchange Industry 2019 Q1 Report

In the first quarter of 2019, the digital clearing exchange industry changed dramatically. After a long bear market in the second half of 2018, new hot spots finally emerged and stirred up the market, and it was exciting to increase the bitcoin volume by 700 points on April 2. In this case, TokenInsight released the 2019 Q1 Exchange report.

The following is a summary of the points:

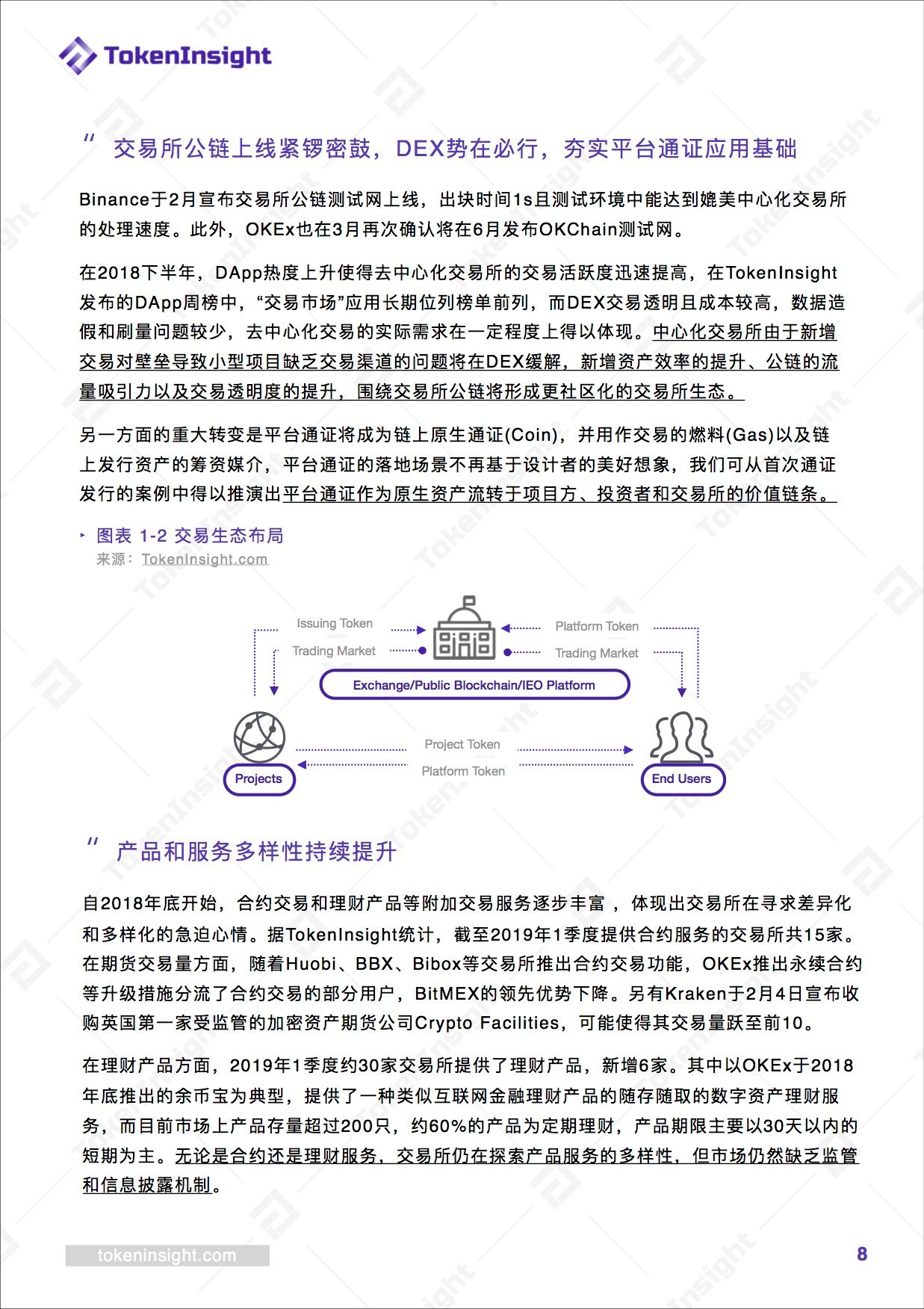

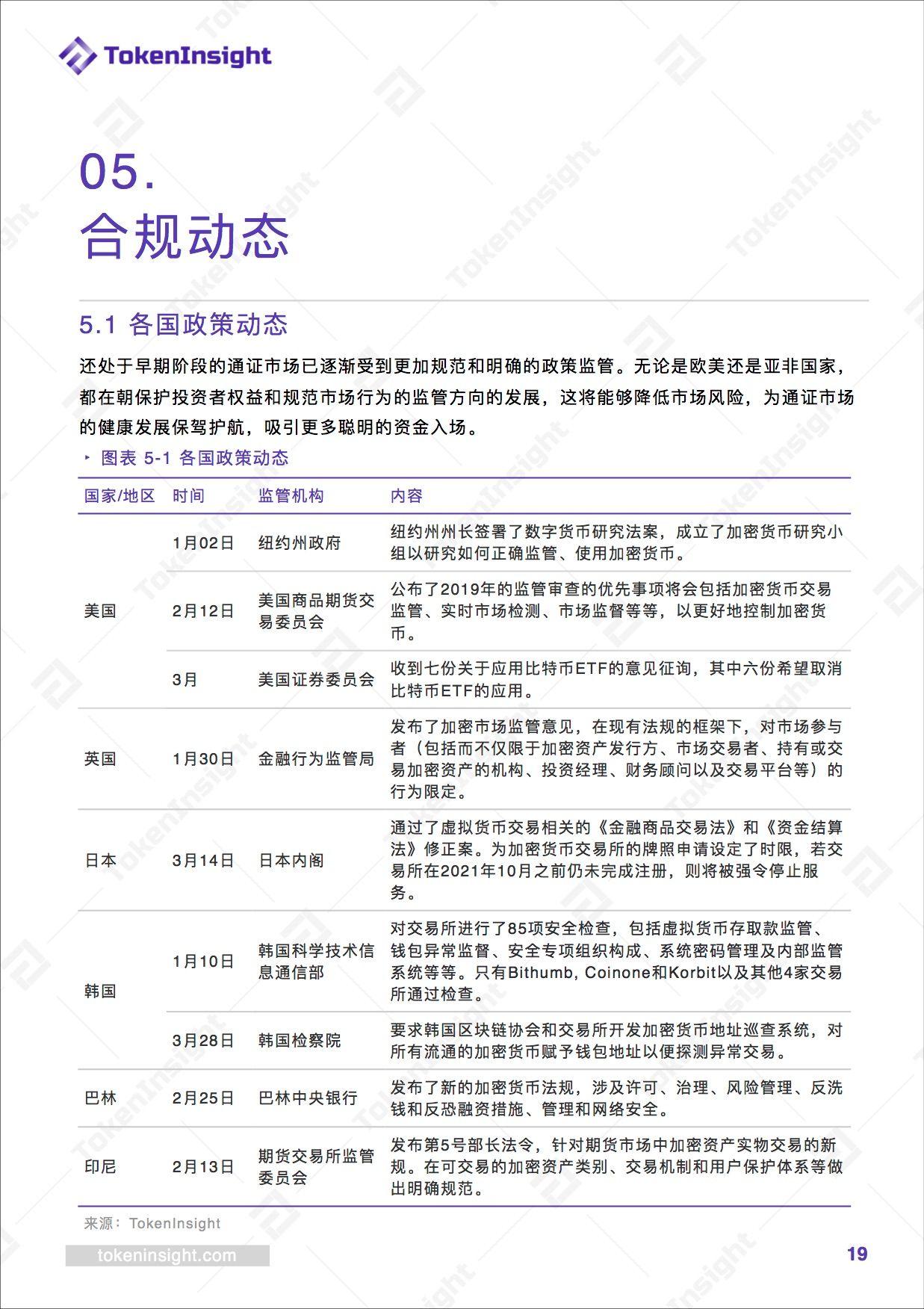

From the bear market in 2018, the exchange faced a traffic loss dilemma, and the constant pursuit of product diversification and differentiation became the core strategy of the bear market in the exchange. Contract trading, exchange public trading, wealth management products, and OTC layout have all become important development directions for the exchange.

Binance led the launch of Launchpad to set off a new wave of trading market. The exchange no longer meets the secondary market, and has already competed with Ethereum for the ecology of the primary market in asset issuance. This round of IEO is already preheating the assets of the exchange's public chain.

- What are the key points for the development of blockchains that restrict the development of blockchains?

- April 14th market analysis: long and short sides will soon fight again, the war will be launched

- Babbitt Column | Deng Jianpeng: Rethinking the Risk Prevention of IEO/ICO Investment

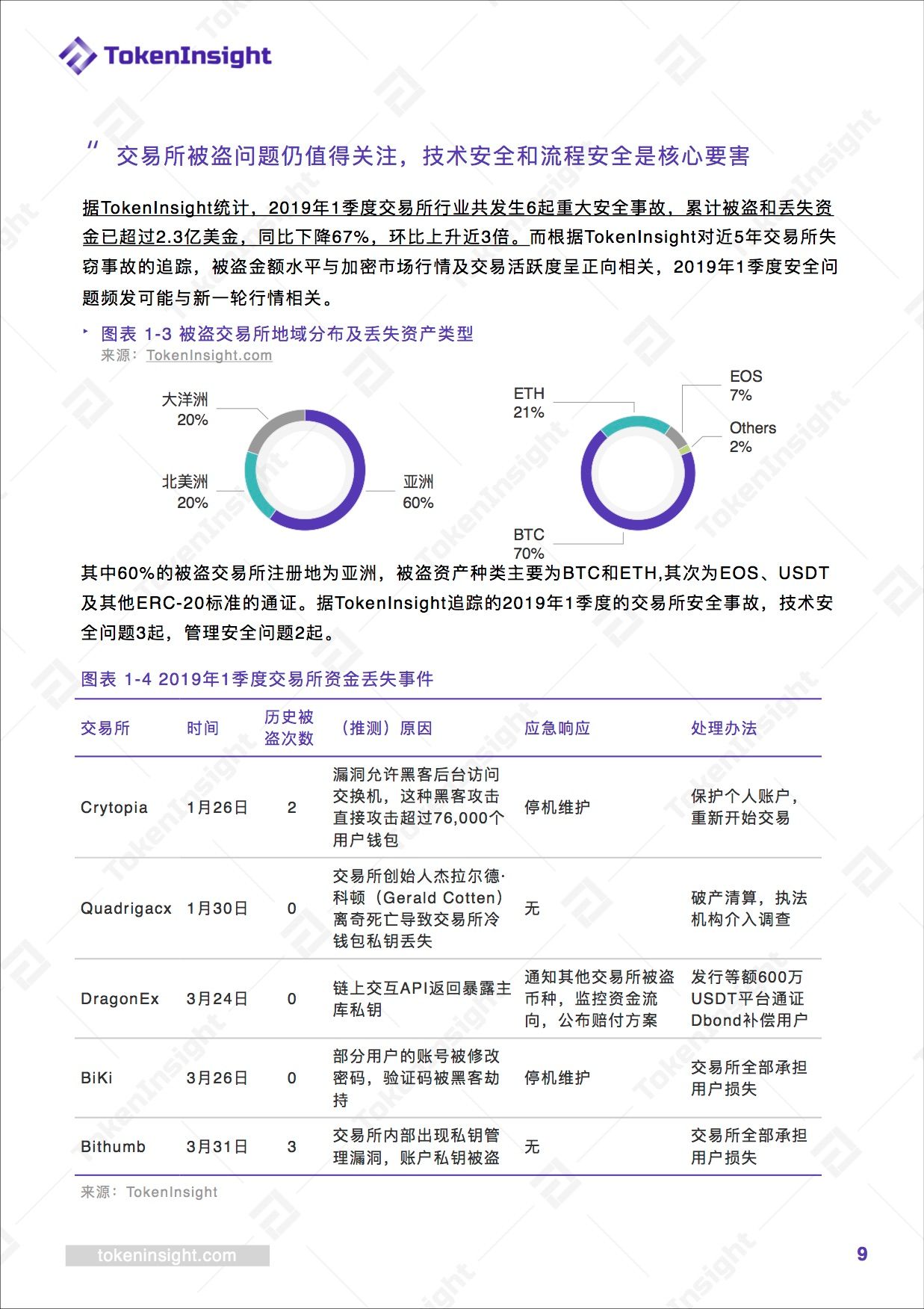

In the first quarter of 2019, there were 6 major security incidents in the exchange industry. The total stolen and lost funds exceeded $ 230 million .

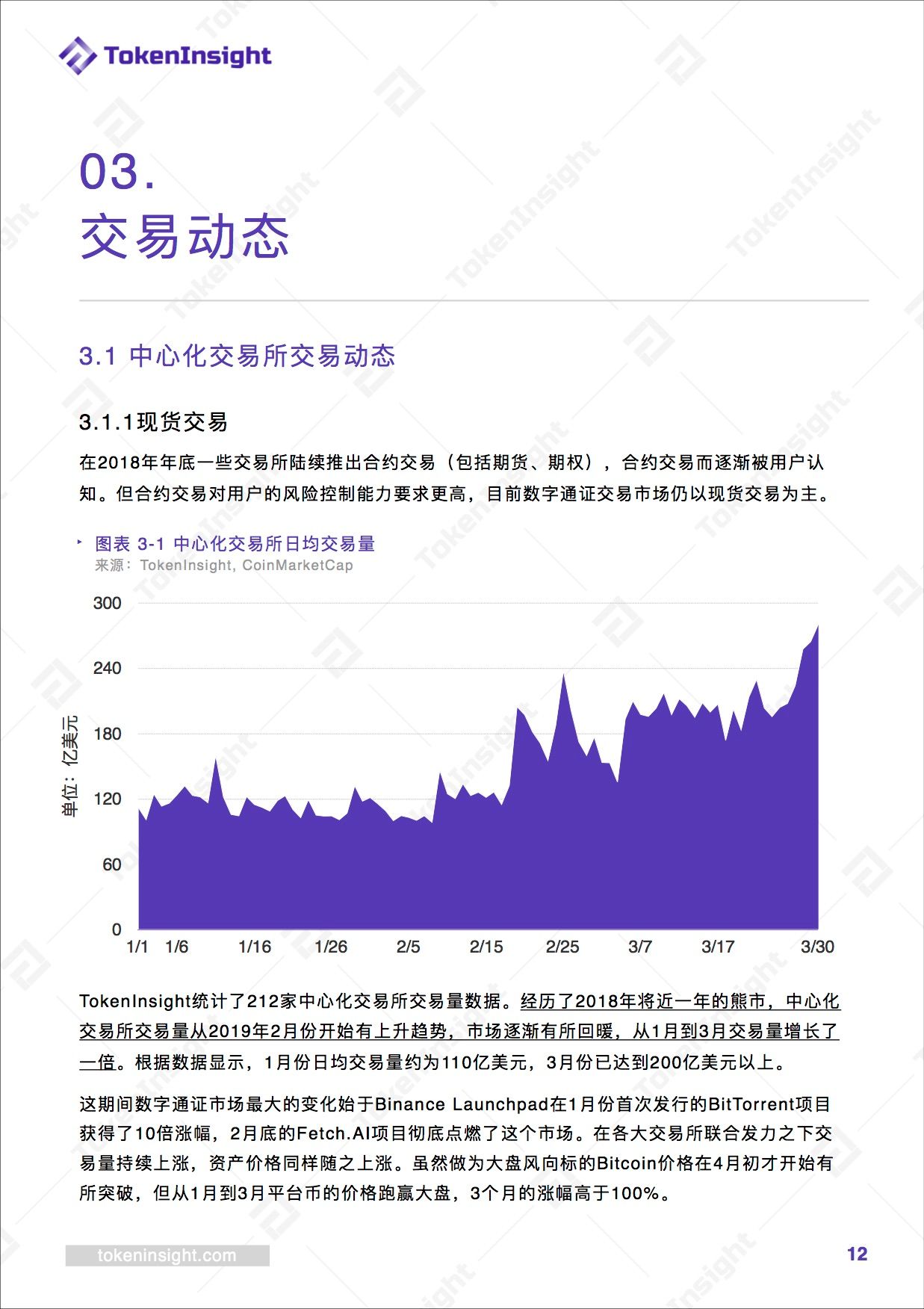

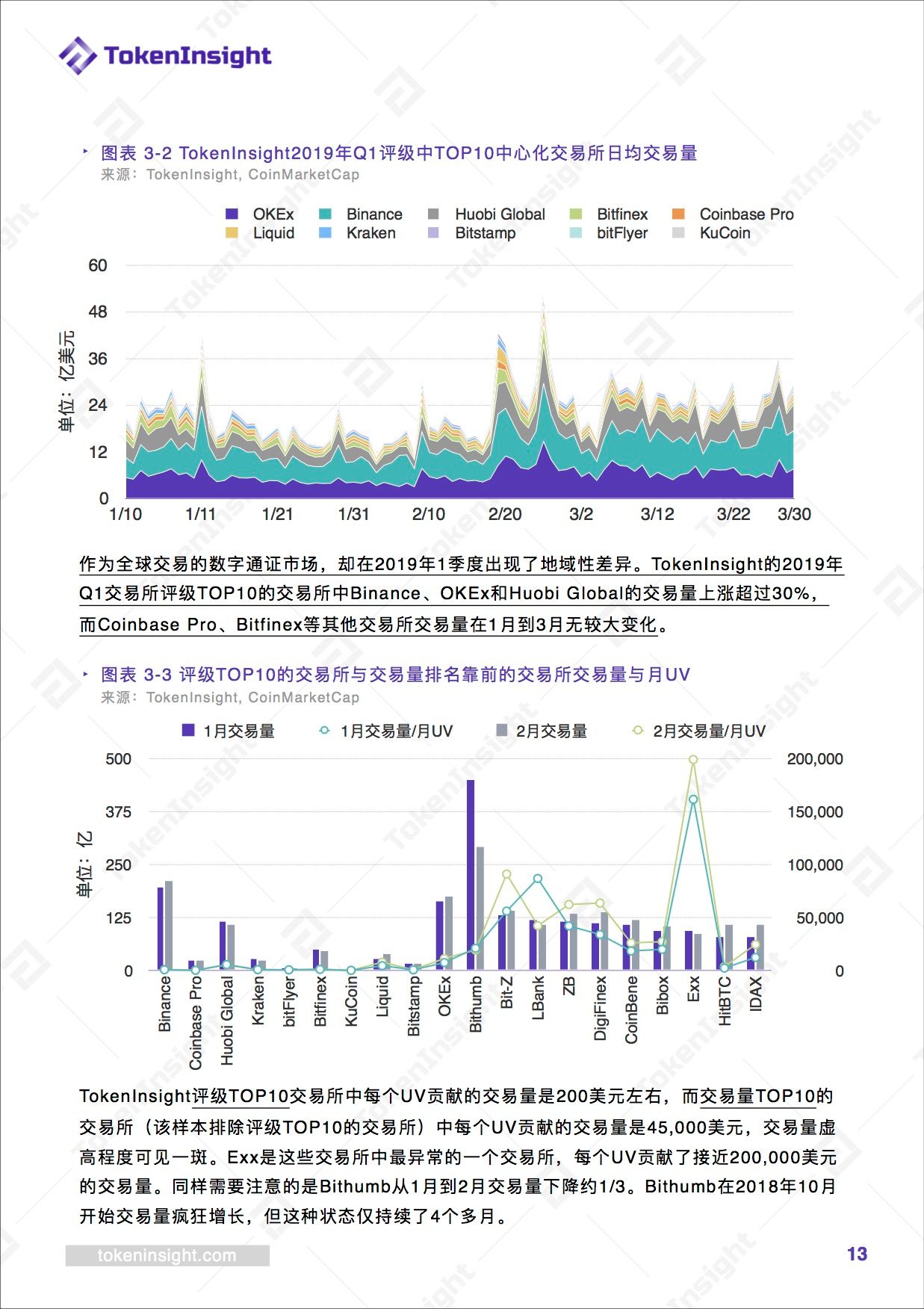

The volume of centralized trading has started to increase from February 2019, and the market has gradually recovered. The trading volume has doubled from January to March.

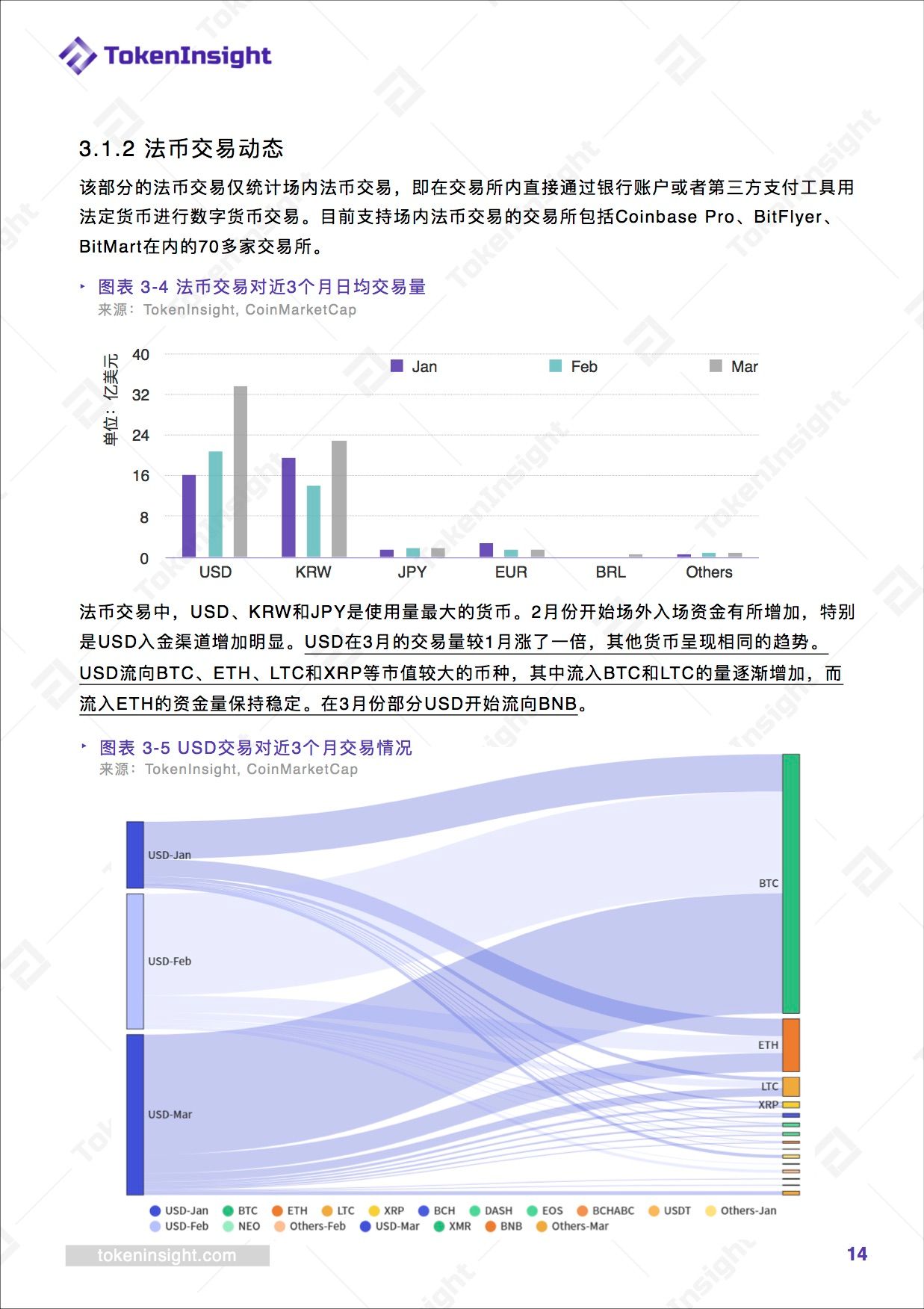

In February, there was an increase in the amount of funds entering the market, especially the increase in the USD deposit channel. USD's trading volume in March doubled from January, and other currencies showed the same trend.

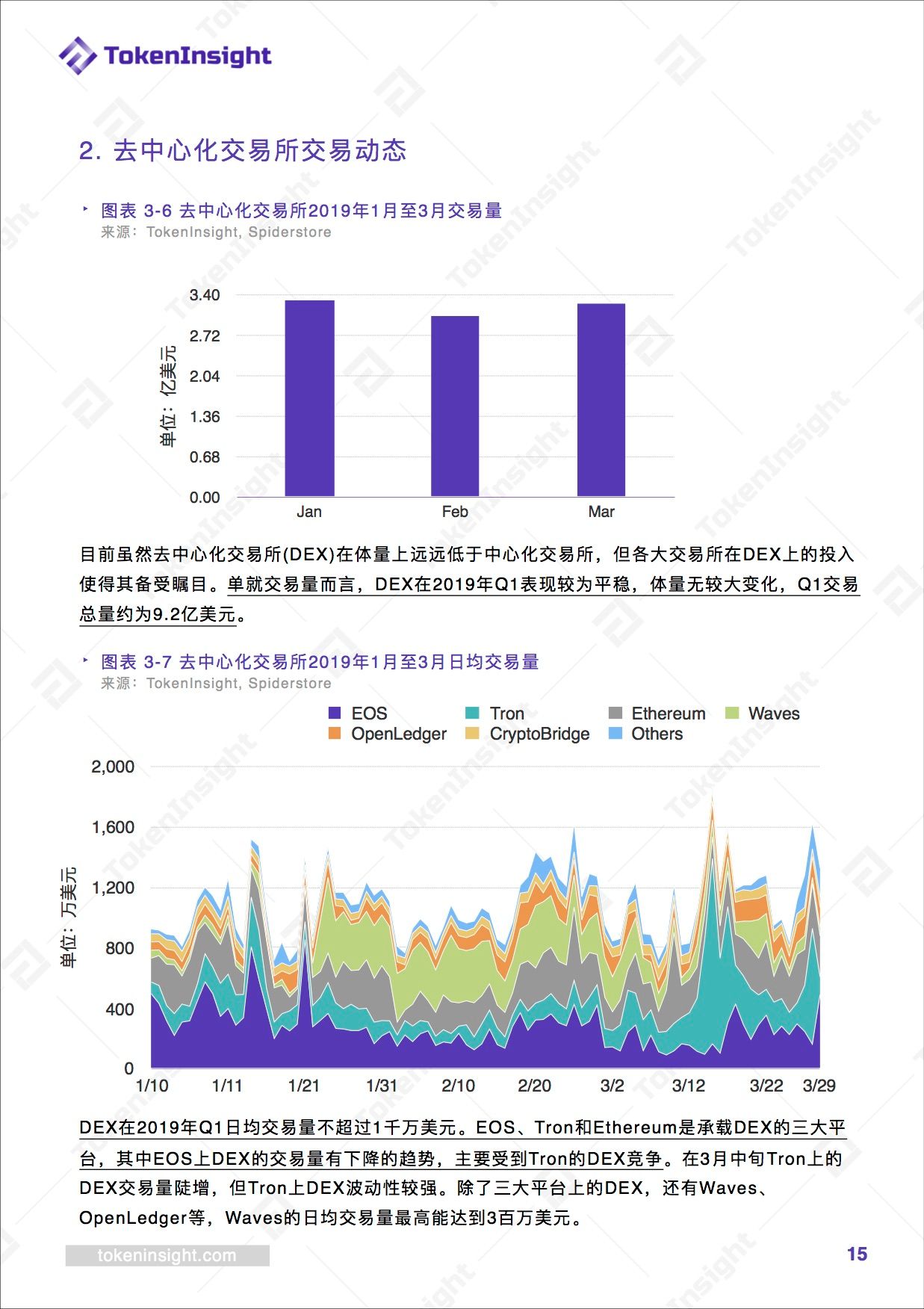

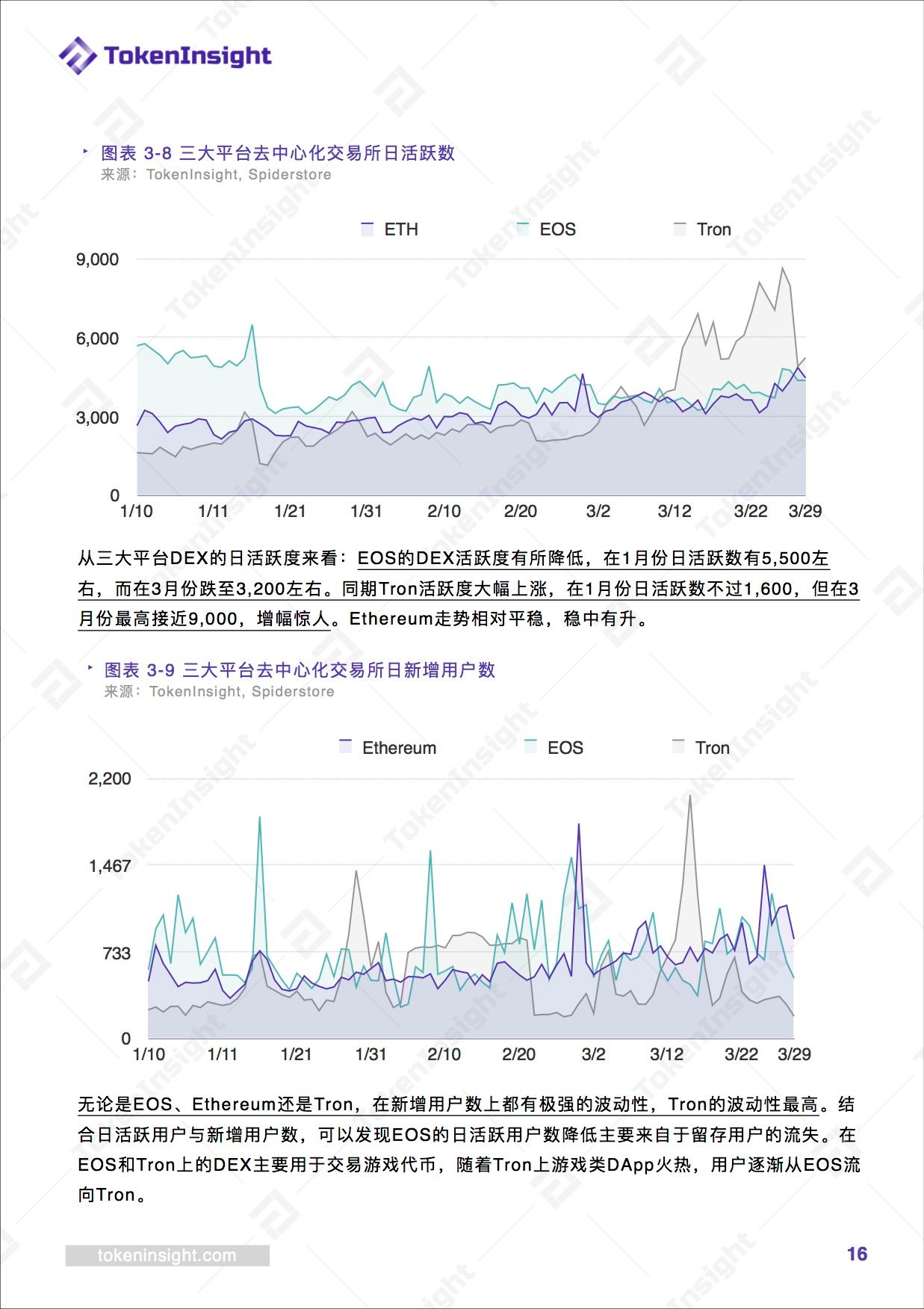

The decentralized exchange (DEX) has an average daily trading volume of no more than $10 million on Q1 in 2019, but the major exchanges continue to invest in DEX.

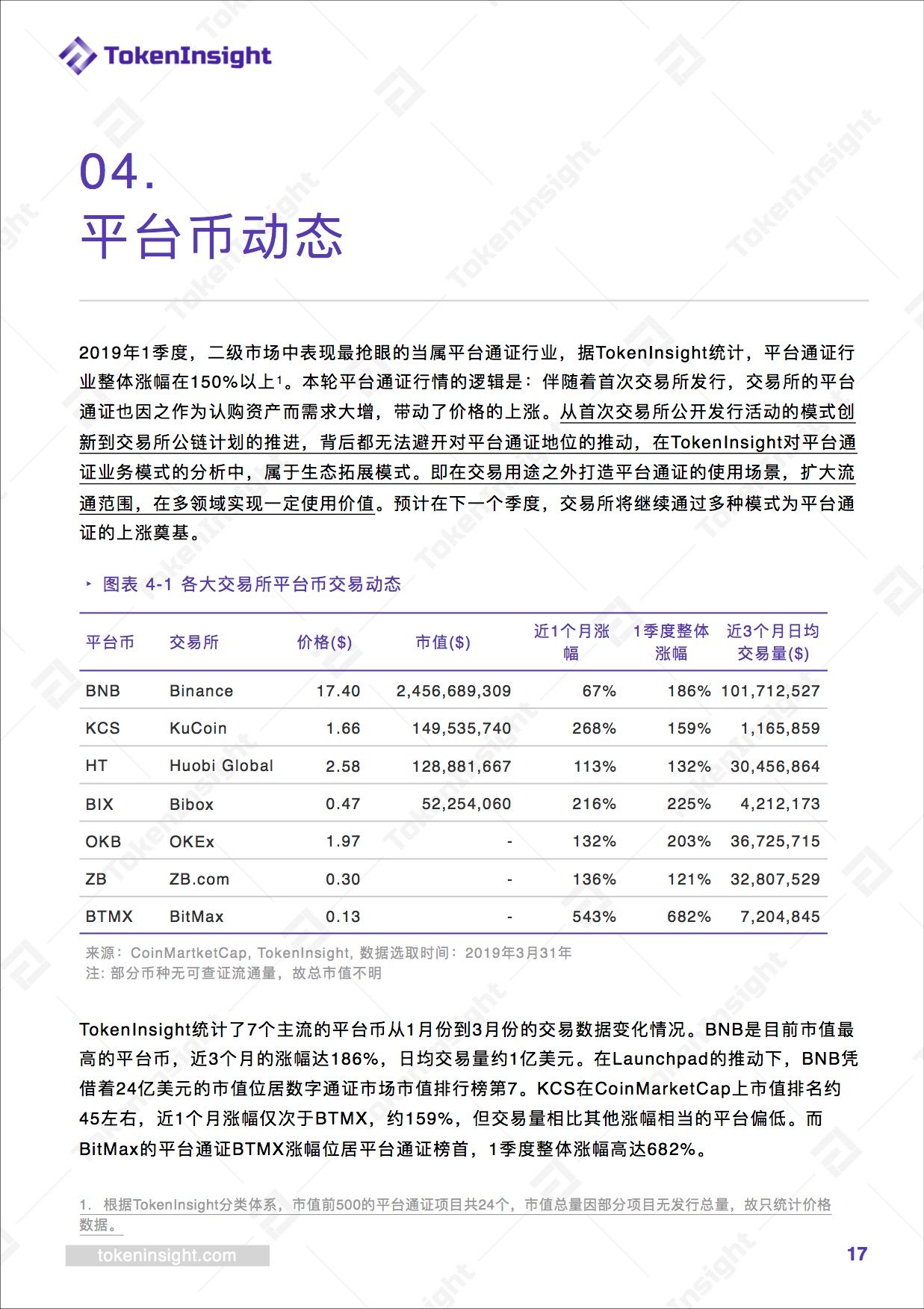

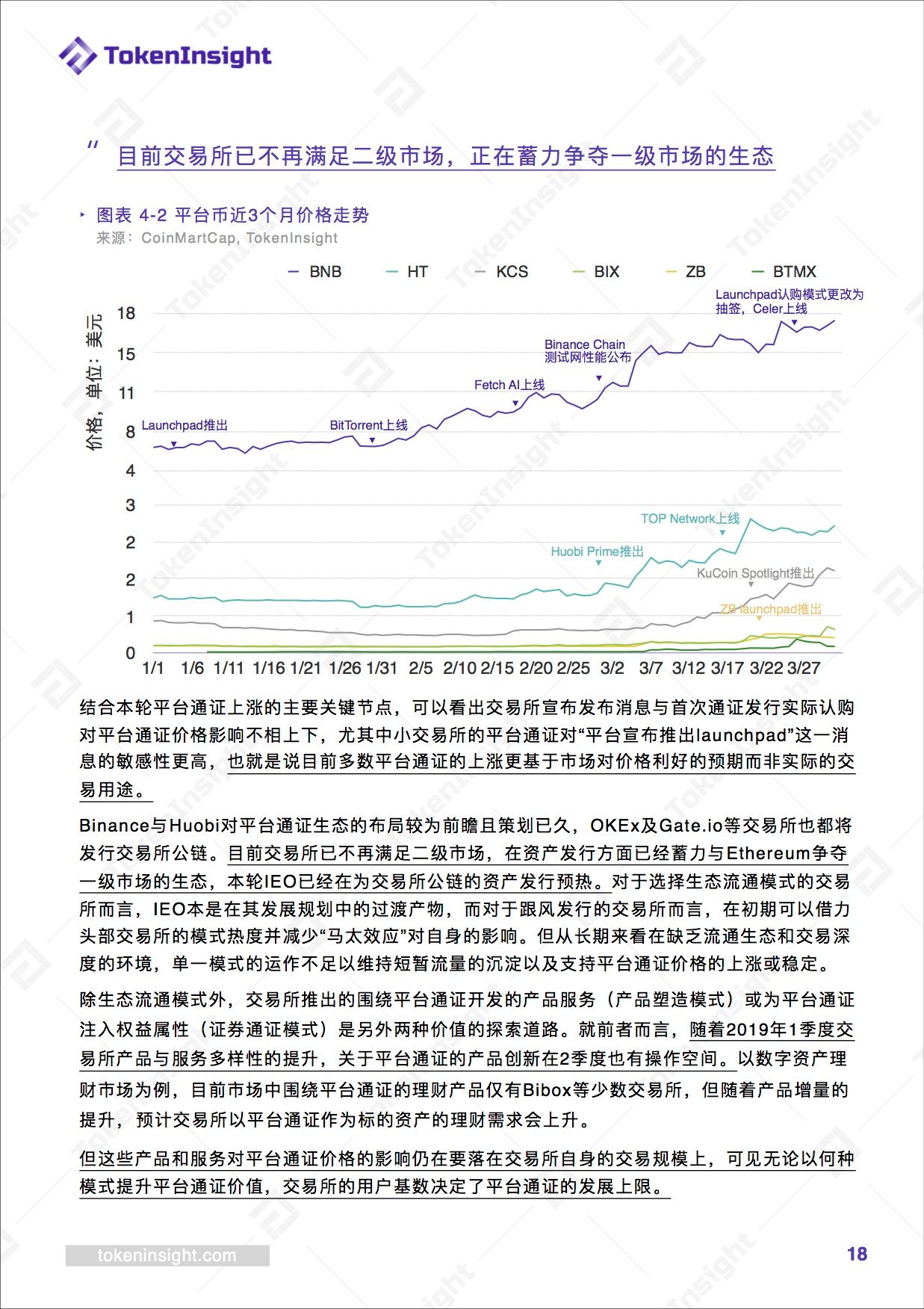

Driven by Launchpad, BNB has increased by 186% in the past three months. BitMax's platform certifies that BTMX's gains are at the top of the platform, and the overall increase in the first quarter was 682 %. KCS has risen only BTMX in the past month, about 159% .

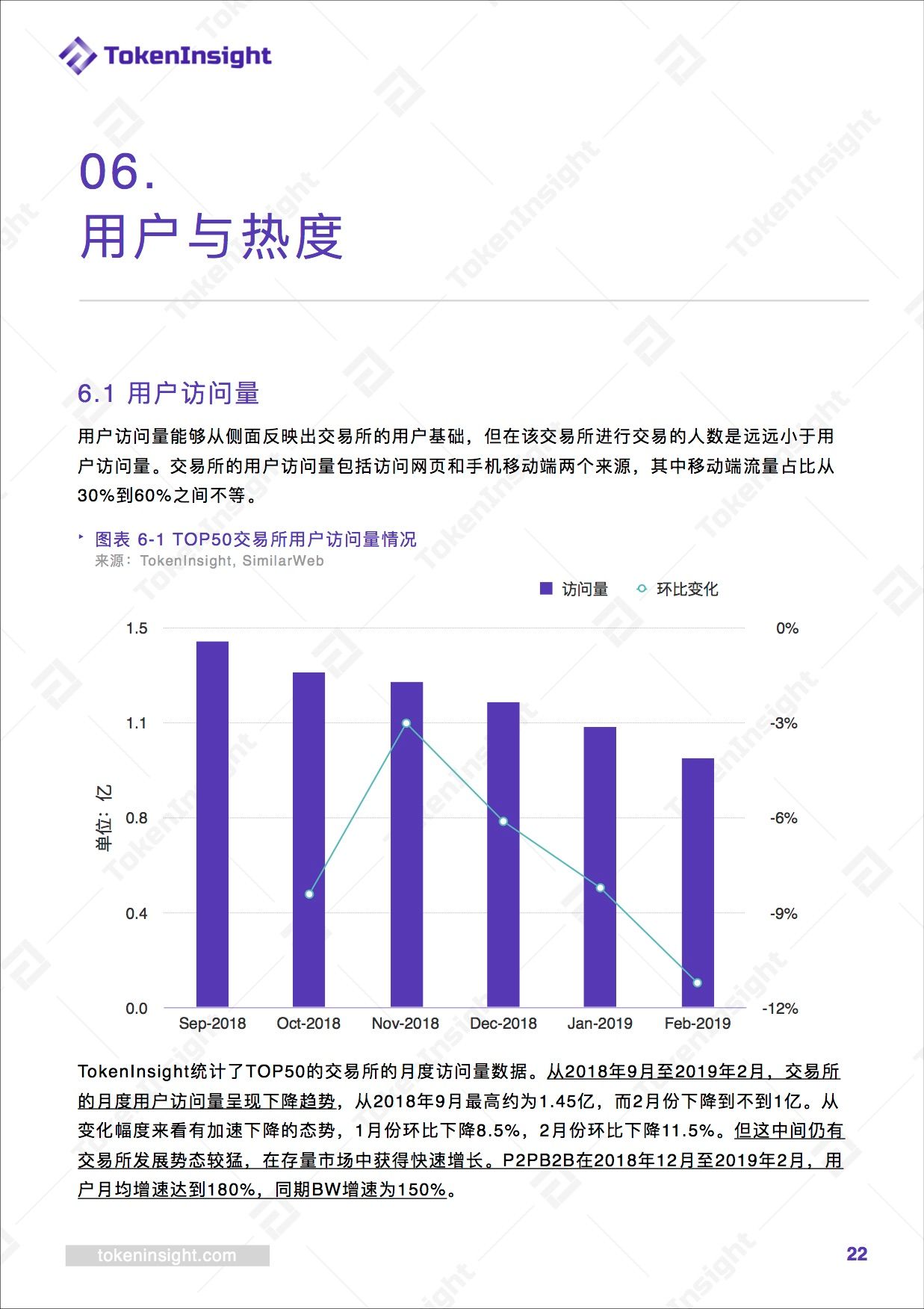

The monthly user traffic of the exchange showed an accelerated downward trend, with a decrease of 8.5% in January 2019 and a decrease of 11.5% in February .

This article has been edited by Babbitt News and has been deleted. For the full version, see TokenInsight

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- After Baidu, Netease, and Xiaomi blockchain games are silent, can Tencent's fire be?

- The future of decentralized Internet – storage is the key

- How long can the IEO still fire? Is it honey or poison?

- Zcash CEO Zooko Wilcox is brewing a major development plan…

- Xia Kedao talks about visual China: This is a blockchain technology that takes only a few minutes and costs a few bucks.

- Encrypted exchange: a combination of Nasdaq and investment bank

- Blockchain + Justice: Evidence Chaining, Lawsuit Chaining