Is fintech "regulation sandbox" good or bad for blockchain?

Source of this article: Shallot Blockchain

Author: Yanyao Ping, please indicate the source.

The innovation and supervision of blockchain in the financial field is always in the process of dynamic gaming.

On December 5, last year, the People's Bank of China supported Beijing to take the lead in launching a fintech innovation supervision pilot nationwide and explored the construction of a Chinese version of the "regulatory sandbox". As one of the most challenging innovations in fintech, the blockchain naturally entered To key regulatory areas.

- One-week regulatory review | German law allows banks to trade cryptocurrencies, changes in Asian law

- U.K. updates crypto tax guide, highlighting Bitcoin as neither currency nor securities

- Hong Kong Securities Regulatory Commission releases position paper on supervision of virtual asset trading platform [Simplified Chinese]

Once the “regulatory sandbox” came out, it had stirred up a wave of discussions in the field of blockchain and virtual currencies. Some people think that this is a good thing for the blockchain industry to take off. Others think that the introduction of regulations may bring new constraints.

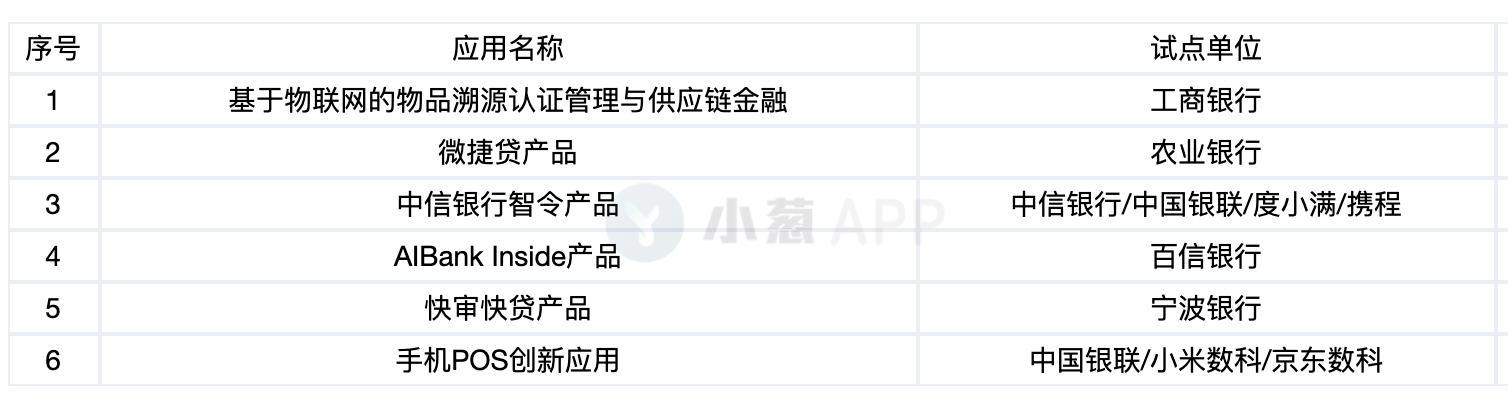

On January 14, the Chinese version of the "regulatory sandbox" made substantial progress. The website of the Business Management Department of the People's Bank of China announced to the public the first six pilot applications of fintech innovation supervision in 2020.

The first batch of applications involves 11 financial institutions and technology companies, focusing on the application of cutting-edge technologies such as the Internet of Things, big data, artificial intelligence, blockchain, and APIs in the financial field, covering multiple application scenarios such as digital finance.

Government regulation has always been an area that blockchain practitioners pay close attention to, because every move of the regulatory authority may represent the mainstream orientation and "minefield" of future development of this emerging field of blockchain. In addition, more traditional large enterprises are also Watch the relevant policies in the field of blockchain to decide whether to enter the market.

So how should we understand the Chinese version of "sandbox regulation" in the field of fintech? What does it mean for the development of the blockchain industry? How will this policy be implemented? What do practitioners think?

On January 12, "When Industry Meets Blockchain-The Second Xiamen International Blockchain Entrepreneurship Summit Forum, arranged a peak dialogue around the hot topics of blockchain sandbox supervision.

Sun Yuze, Vice President of Guojin Public Chain, Zeng Hanhong, CEO of UChain Media, Zhang Zhemin, Professor of Xiamen University School of Information, and Wu Peng, Chairman of Ant Network. Get inspiration from practitioners' conversations, questions, and discussions.

What is the Chinese version of the "regulatory sandbox"?

The rapid development of emerging fintechs represented by blockchain, 5G, etc. has led to more new financial products, services and business models. Due to the variety and complexity of fintech's business models and application models, the corresponding regulatory mechanisms are difficult to synchronize development of. How to maintain a dynamic balance between financial innovation and risk prevention and control has become a major problem, and the “regulatory sandbox” emerged at the historic moment.

Zeng Hanhong, CEO of Youchain Media, believes that there are three basic prerequisites for the country to conduct regulatory experiments in the field of blockchain.

- First, there are many companies engaged in financial activities in the blockchain field. In fact, they initially wanted to escape supervision, such as some exchanges or various BTCs;

- Second, there are still many large financial institutions and state-owned enterprises. In fact, they have no intention to enter this emerging market;

- Third, so far, in view of the development of blockchain technology, the state has not been able to make a comprehensive entry into the blockchain in terms of systems and rules. Therefore, some relatively open countries have proposed to supervise this part.

He said that for the supervision of the blockchain, he is most concerned about two points:

- The first is how to determine the relevant regulatory systems and rules;

- The second is the core data requirements that companies need to face during the entire supervision process, and what kind of evaluation agency to prove the rationality of these things.

"Sandbox supervision is the best way to address the rapid development of emerging technologies such as blockchain, and China's" industrial sandbox "supervision model is more suitable for China's industrial ecology." Sun Yuze, vice president of Guojin Public Chain Optimistic about sandbox supervision in the blockchain field.

He said that at present, "sandbox supervision" can be divided into two forms.

- The first is the British sandbox, which is the origin of the concept of sandbox supervision. It is mainly aimed at some special industries such as finance. It validates its technology, market and model within a certain security range, and poses a risk to participants. Control.

- In 2017, China began to implement a sandbox supervision model. Then this year, a Chinese-style sandbox supervision was proposed, called an "industrial sandbox". It is proposed for China's complex industrial structure and is more suitable for Chinese industries. Ecology.

Zhang Zhemin, an assistant professor at the School of Information Technology of Xiamen University, also pointed out that the concept of sandboxes originated from the field of computer security. The earliest refers to the use of sandboxes to run some code that may be suspected to be malicious in a relatively closed environment during software testing. This prevents it from causing uncontrollable damage to other parts of the system.

Zhang Zhemin believes that the blockchain sandbox supervision borrows this concept, hoping to allow blockchain practitioners to innovate in a controlled environment.

According to Onion, the regulatory sandbox, also known as the Regulatory Sandbox, was first proposed by the British government in March 2015. According to the definition of the Financial Conduct Authority (FCA), the regulatory sandbox is a safe space. In this space, the regulatory requirements have been relaxed. On the premise of protecting the rights of consumers or investors and strictly preventing risk spillovers, as far as possible, create a regulatory environment that encourages innovation.

It can be seen from the above that the “regulatory sandbox” is essentially a testing and incentive mechanism for financial innovation products, so as to achieve supervision consistent with the rapid development of the industry.

It is not so much a regulatory mechanism as a learning mechanism, mainly to hope that the three main objectives can be achieved with the help of "regulatory sandbox" experiments.

- First, involve large traditional financial companies in new blockchain technologies and evaluate the benefits of these technologies;

- Second, let the blockchain technology return to the right direction and no longer evade supervision;

- Finally, research and development of regulatory technology, and use technology to regulate technology.

How do practitioners view sandbox regulation in the blockchain field?

For the sandbox supervision of the blockchain industry, the guests at the scene agreed that they should vigorously "embrace."

From beginning to end, Sun Yuze, vice president of Guojin Public Chain, was very sure of the original intention of sandbox supervision. He believed that sandbox supervision itself was to provide new tools, new technologies or new models with a more relaxed and more feasible development space.

" Everything is a development process from disorder to order. How to delineate boundaries when disordered, and let all participants feel the existence of boundaries, this is what supervision is doing. "

He believes that this supervision is actually a protection for enterprises and a protection for all blockchain practitioners, investors, and participants, so it must be embraced.

According to Zeng Hanhong, CEO of Youchain Media, " Blockchain practitioners have reasons and need to follow government policies. " Any relevant sector in the entire blockchain industry should adopt a "hug" attitude to supervision for a number of reasons. Two points.

- First, according to the macro analysis of the four dimensions of PEST, it is concluded that the current blockchain is still in the early and middle stages of development, and this stage needs supervision to promote the better development of the blockchain;

- Secondly, companies actively embracing the country's moderate supervision can also prevent practitioners from “developing” in the development process, and prevent negative things like IC0 from flooding the market and bringing negative effects.

Zhang Zhemin, an assistant professor at the Xiamen University School of Information, also expressed the same view, "There must be rules for everything, and blockchain is no exception. National supervision is necessary."

What kind of regulatory standards are "reasonable"?

Although it is affirmed that the blockchain industry needs supervision and a new model of sandbox supervision, how to control the scale of regulation is also a question worth pondering.

Wu Peng, Chairman of Ants.com, believes that there is "no need to be so strict" in the supervision of the blockchain industry . He believes that the blockchain industry must have a certain bubble before it can have capital to chase it to promote a more stable industry Development. Without capital entry and promotion, it is very difficult for the blockchain to develop rapidly.

Similarly, in the opinion of Sun Yuze of Guojin Public Chain, it is better to do “ appropriate supervision ”, but the scope of proper supervision should be a relatively clear scale for different industries, different attributes, and different models.

In addition, Sun Yuze believes that the sandbox supervision of the blockchain should "advance rapidly" and be "large-scale" .

- First, the faster the sandbox supervision model is implemented, the sooner it will land, the more advantageous it is to the development of the entire blockchain industry, because it will allow more participants to operate their projects relatively unburdened;

- Secondly, since sandbox supervision is planned, and it is intended to conduct experiments within a certain range, it should be large-scale and allow trial and error. As long as the original intention of the enterprise and the business logic itself do not have violations, other more model verification can be used.

Zhang Zhemin of Xiamen University proposed that the supervision intensity should be different in different regions . It may be better to conduct "pilot" projects in accordance with China's approach to new things during the reform and opening up, that is, "allow some companies and some fields to explore first". Allow some people to make full use of their innovation potential, and if they explore well, then push the relevant experience to the national implementation.

Zhan Hanhong, CEO of Youchain Media, seems to be more in line with the current Chinese attitude towards the blockchain industry.

He agreed that different levels of regulatory policies should be adopted for different segments of the blockchain.

- In the first category, policies that should be fully supported should be adopted, mainly for the blockchain technology category, such as the use of blockchain technology in combination with industrial development, and the bottom layer of various blockchain technology applications, which should be encouraged and supported.

- In the second category, loose regulatory policies should be adopted, mainly for blockchain applications that are purely financial transactions, such as futures trading. Hainan and Sanya currently support such applications.

- In the third category, high-risk supervision policies should be adopted. High-risk supervision of illegal entrepreneurship that is walking on the edge of the law is conducive to maintaining normal and fair market competition.

At present, the domestic blockchain regulatory policies are basically differentiated according to similar standards.

Support pure technology (domestic "currencyless blockchain") enterprises and severely crack down on fraud and speculative related projects; in addition, middle-level blockchain enterprises are encouraged to a certain extent.

Looking at the entire blockchain industry, the largest number of companies are in the middle tier. They are neither fully technical nor completely non-technical enterprises. Most of them are blockchain technology, encrypted digital currencies and tokens. Combined.

However, the number of blockchain companies in the middle tier is huge, and it is difficult to clearly define them. Therefore, the division of related standards and boundaries is often the most concerned by practitioners, and it is also the most ambiguous in current policies.

How to promote the implementation of this "sandbox supervision" experiment?

" I think this landing is more difficult. " Zhang Zhemin, an assistant professor at the School of Information Technology of Xiamen University, believes that the sandbox supervision of blockchain is difficult to implement. This kind of experiment is similar to pseudoscience.

He pointed out that the country hopes to conduct some clear technology and innovative financial concepts in the blockchain to conduct experiments in a relatively safe, closed and controllable environment, but it is very difficult to ensure the reliability and credibility of such experiments.

In response to this problem, he believes that more technical measures can be tried to do some more in-depth simulations to promote a better implementation of the regulatory sandbox environment.

For example, integrating artificial intelligence, designing more intelligent products, simulating some current automated trading systems, and repeating tests in this area, the results obtained will be more credible.

Sun Yuze, vice president of Guojin Public Chain, believes that from a national perspective, different regulatory models should be formed in various regions and industries, so that new technologies such as blockchain and new technologies can be added to various industries and various rules. The new model can be quickly and effectively verified.

As a practitioner, you should follow the new regulatory rules, do what you should do within the boundaries, and let others see it.

He said that in the long run, in the future, provinces, cities, counties, districts, various regions and industries may adopt this model of sandbox supervision, so that new models such as blockchain can operate reasonably and safely in it. Keep all participants secure.

Zhang Zhemin, an assistant professor at the School of Information Technology of Xiamen University, pointed out that as industry practitioners, in addition to actively embracing sandbox supervision, they should also try their best to find a way to self-certify with the regulatory authorities .

"Blockchain practitioners, while embracing supervision, must also proactively propose some methods to prove the safety and reliability of their technology to the corresponding national regulators."

Zhang Zhemin explained that software development companies will have a large number of test reports when they deliver systems that they consider to be safe and reliable to customers.

In the same way, in the supervision of the blockchain field, enterprises actually need to continuously prove to the regulatory authorities that a certain system is reliable, can operate stably in society, and can create wealth for the society instead of causing harm.

Therefore, he believes that the blockchain industry should have a standard method of self-certification, which needs to prove to the society that the new system has been repeatedly tested and rigorously tested.

In specific thinking, he believes that we should explore some more complete, systematic, and engineering methods to build self-certification channels.

summary

In general, the sandbox supervision experiment of domestic fintech has just begun.

And most of the blockchain practitioners in various places think that sandbox supervision is a policy benefit of the blockchain industry. It is an encouragement and a protection for practitioners who do solid technology and project.

Although there are still many uncertainties in the actual implementation of sandbox supervision, in general, this is a step forward for the blockchain industry in supervision.

Previous practical experience shows that blockchain technology, as one of the most challenging innovations in the field of fintech, is like a double-edged sword. Strict one-size-fits-all supervision of it will damage the interests of enterprises and cause excellent enterprises and Outstanding talents are drained; and if the policy is loosened collectively, and imagination is overwhelming, some companies may evade supervision and move to the edge of violations.

The "regulatory sandbox" hopes that within a certain and controllable scope, some enterprises are allowed to boldly test financial innovation products, so as to achieve supervision consistent with the rapid development of the industry.

This shows the government's attitude in encouraging financial innovation, and it also shows that the regulatory authority supports the general trend of "blockchain + finance" development.

It is hoped that the sandbox supervision experiment will help the blockchain industry to find the correct development model and expandable innovation experience in the follow-up practice, and formulate a mature supervision system for the blockchain industry, and construct supervision suitable for the domestic industrial structure. Technology.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- 19 days, 44 policies are favorable, the blockchain industry is accelerating into the fast lane

- Forbes: Will the IRS Kill Cryptocurrency Trading

- Monthly Report | Blockchain policy released in November, supervision and support

- Supervision clearly "open the door to block the evil door" ideas "chain Shanghai South" into a digital asset test field

- Switzerland will make extensive amendments to blockchain regulations

- US Treasury: FB Libra Coin needs to meet the highest standards of anti-money anti-terrorism

- SEC Chairman: The future of the Bitcoin ETF "has a long way to go"