Is the RMB stable currency, and is Tether left behind for the USDT thunder?

The New York Attorney General's Office (NYAG) investigated Tether's hearings. This hot spot has just passed, and Tether has once again been pushed to the cusp of public opinion. This time, it is because of CNHT.

On August 21st, Bitfinex shareholder Zhao Dong revealed in a circle of friends that Tether will issue CNHT and anchor the stable currency of offshore RMB. Subsequently, Zhao Dong explained that the reason for issuing CNHT was only to meet the needs of different users, not to make up for the USDT deficit or to avoid the USDT thunderstorm.

Despite this, the voice of opposition in the industry is still endless. Du Jun, the founder of the node capital, publicly stated: “The platform for any online CNHT trading, I and the node holding company will resist.” Xiao Lei, a financial writer, said that Tether issued stable coins based on offshore RMB, and the operational space will be more Large, the system risks faced by investors will be even greater.

The stable currency USDT issued by Tether currently accounts for more than 80% of the entire stable currency market and is an absolute “overlord”. However, this seemingly big but overwhelming "hegemony" has also been called a "lei" by many insiders, because Tether's bank account is not regulated, and it is always obscured during the audit process. Some core information is not I would like to disclose to the outside world that “freely” issuance of USDT, and the relationship with Bitfinex is complicated…

- The data shows that since 2010, Bitcoin's return on investment has been far ahead of mainstream investment methods such as stocks.

- Blockchain: Man-made Borg people?

- "People" hit each other's central bank digital currency and then "veiled"

If the USDT "thunder" burst, it will undoubtedly have a devastating impact on the entire cryptocurrency market. Therefore, whether as an investor or as a general blockchain enthusiast, we need to have a deeper understanding of USDT.

The birth and development of 01 USDT

In January 2012, JR Willett published a white paper explaining the possibility of building other cryptocurrencies on top of Bitcoin's agreement. After the concept was implemented on the Mastercoin project, the Mastercoin Foundation (later renamed the Omni Foundation) began to promote a "second-tier network" based on Bitcoin.

Tether's predecessor, called "Realcoin", is based on the Mastercoin protocol (later renamed the Omni protocol) and is based on Bitcoin's "second-tier network" cryptocurrency. Brock Pierce, founder of the Realcoin project, is also one of the founders of the Mastercoin Foundation, and another co-founder, Craig Sellars, is the chief technology officer of the Mastercoin Foundation. Later, Realcoin was renamed Tether.

In the article " How does the USDT run on the BTC ", the vernacular blockchain is introduced: The relationship between the USDT and the Bitcoin Omni protocol is like the relationship between the ERC-20 Token and the Ethereum ERC-20 protocol. Just as the address of the ERC-20 Token is the same as the address format of the ETH, the USDT address and the BTC address based on the Omni protocol are exactly the same.

On October 6, 2014, the first batch of USDT based on the Bitcoin Omni agreement was officially born. Tether claims that it will guarantee strict compliance with 1:1 reserves or assets, that is, for every USDT issued, its bank account will be guaranteed with $1 of funds or related assets. In addition to the USDT-based USDT, Tether also launched stable coins based on the euro and the yen.

In January 2015, the established cryptocurrency trading platform Bitfinex (established at the end of 2012) launched the USDT transaction.

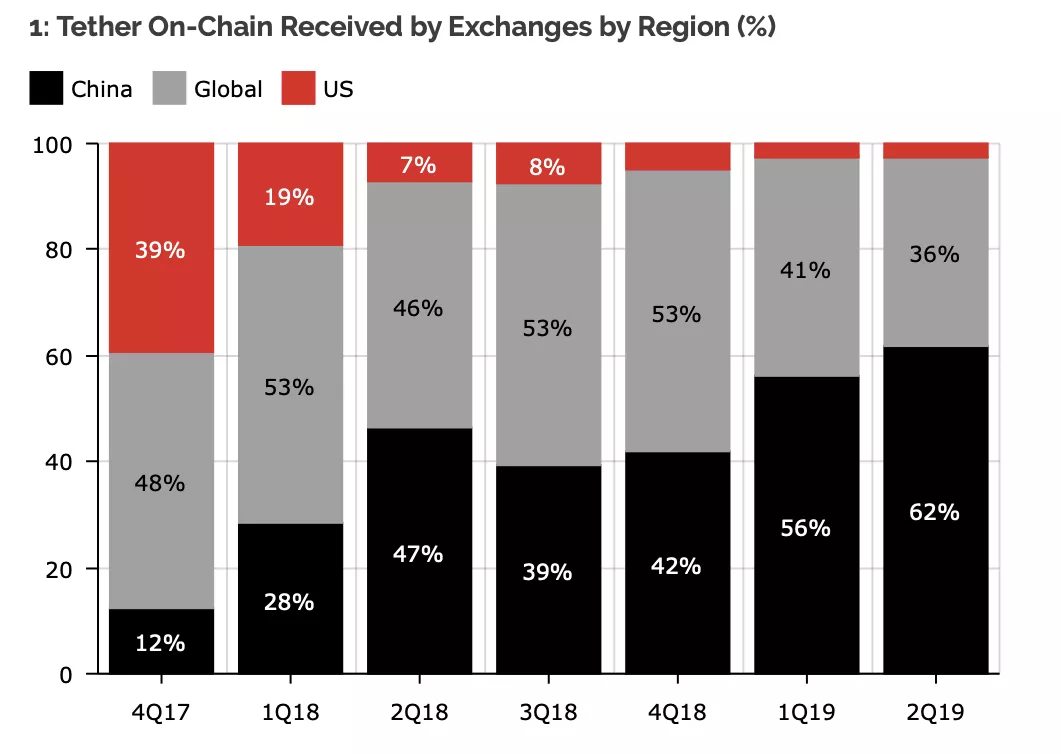

The rapid development of the USDT is largely due to Chinese users. After the “June 4th Incident” in 2017, many trading platforms “goed out to sea” and stopped the RMB direct trading business. USDT became the “middle bridge” for purchasing other cryptocurrencies. According to a research report released by the blockchain data analysis agency DIAR in June this year, the number of USDTs flowing to China accounted for only 12% of the USDT increase in the fourth quarter of 2017, and this figure rose to 62% in the second quarter of this year. In other words, more than half of the additional USDTs now flow to Chinese users.

According to CoinMarketCap, the total circulation of USDT increased by more than 11 times between September 2017 and June 2019.

As demand for USDT continues to expand, in September 2017, Tether announced that it will launch the USDT based on the Ethereum ERC-20 agreement. On April 17 this year, Tether launched a USDT based on TRON (wave field); in June this year, the EOS-based USDT entered the testing phase. In addition, Tether also announced that it will issue USDT on Algorand.

02 negative news ridden Tether company

In the article " USDT over-the-spot price is more than 7 yuan, why the stable currency is unstable ", the vernacular blockchain mentioned: Due to the imperfect laws and regulations and regulatory measures, the USDT can not even be called in the strict sense. It is a kind of "bond" issued by Tether, which can only be regarded as a promise.

Over the past few years, Tether has been suspected by many investors, and negative news is always difficult to prove.

In the " USDT, this thunder once again caused market turmoil, is it not explosive? In the article on Future Impact Geometry , the vernacular blockchain has sorted out some negative news from Tether and USDT in recent years:

1. Questioning financial fraud

On February 8, 2017, an article called "Bitfinex Don't Want to Hear", leaked multiple recordings, showing that the Tether team and the Bitfinex team are discussing bank fraud, money laundering, and even acknowledging financial fraud. An executive at Tether, Phil Potter, even admitted in a leaked recording that the company had set up a company account in Taiwan to transfer money and do something that needed to be "obscured."

2, can not prove that there is a full amount of margin

In April 2017, due to financial fraud, Tether's three bank accounts in Taiwan were banned.

On June 20, 2018, Tether issued a Transparency Report issued by a law firm. This transparent report not only did not reassure investors, but also caused more doubts. Tether explained that because the four major accounting firms are not willing to endorse them, they can only ask for help from law firms.

On October 1, 2018, Bloomberg reported that USDT's custodian bank Noble Bank was insolvent and had lost many customers, including Tether and Bitfinex, and is currently looking for buyers to sell its assets. On October 17, informed sources revealed that the partnership between Tether and Noble Bank has ended. On November 1st, Tether announced that it had established a partnership with the Deltec Bank in the Bahamas and announced the bank's approximately $1.83 billion in assets.

As of today, the total amount of USDT has exceeded $3.99 billion. However, in the past six months, Tether has not provided relevant information to prove that there is a sufficient US dollar deposit.

3, opaque USDT issuance

On January 24, 2018, an anonymous report stated that as of January 4, 2018, Tether had issued a total of 91 additional USDTs. The report also raises questions about whether Tether transfers USDT to Bitfinex's wallet without receiving US dollars, and uses USDT to buy low-priced bitcoins for profit or trade.

In April of this year, Tether issued 10 additional shares, with a total amount of up to 745.9 million US dollars. For details, see the tweet before the vernacular blockchain , “ USDT in the whirlpool of public opinion: up to 10 times in April, totaling over 700 million US dollars ”.

On June 22 this year, Tether issued an additional 150 million USDT; on July 2, Tether added another 100 million USDT.

4, the relationship with Bitfinex is complicated

In late November 2014, Bitfinex's Chief Strategy Officer Philip Potter and Chief Financial Officer Giancarlo Devasini founded Tether in the British Virgin Islands. Although Bitfinex is based in Hong Kong, its parent company iFinex is also located in the British Virgin Islands.

The relationship between Tether and Bitfinex is complex. In the indictment of the New York Attorney General's Office (NYAG), Tether was accused of misappropriating $900 million in USDT reserves to help Bitfinex make up for the deficit.

03 USDT Status Quo and Competitors

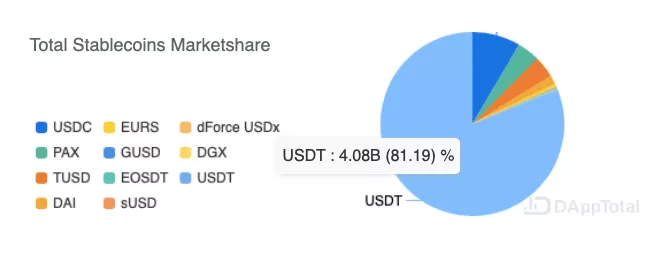

Due to the “trust crisis” on October 15 last year, USDT's stable currency market share has fallen from the previous 95% to the lowest 75%. With a series of additional starts that began early this year, USDT's market share has once again climbed rapidly.

According to DAppTotal, as of today, USDT's market share in the entire stable currency market has climbed to 81.19%.

Stabilized currency market share, source: DAppTotal

Although USDT has further consolidated the status of “Stabilizing the Leading Capital”, competition from other stable currencies is still not to be underestimated.

In the article "The old stable currency is unstable, and the new stable currency can be fully processed", the vernacular blockchain introduces more stable and transparent currency GUSD and TUSD.

In addition, with the popularity of DeFi (decentralized finance) concepts, stable coins that are guaranteed by algorithms, such as the stable currency DAI launched by MakerDAO on Ethereum, have also achieved rapid development.

The status of the USDT is largely due to the blessing of the Bitfinex trading platform. However, some other trading platforms have recently wanted to share a piece of money, launching or planning to launch their own stable currency to weaken the influence of USDT. For example, OKEx launched the stable currency USDK; Firecoin launched its own stable currency solution HUSD; Coin has also begun testing the first stable currency, Binance GBP, which is linked to 100% of the pound.

I believe that the stable currency market will be more diversified and the structure will be healthier. It will not be too far away.

04 summary

In response to the RMB stable currency CNHT mentioned at the beginning of the article, Zhao Dong commented:

“People believe that the offshore RMB stable currency will help the offshore RMB to circulate overseas, which will help the internationalization of the RMB, and supervision may be enjoyable.”

In this regard, the founder of the node capital Du Jun commented: It depends on who issued, Tether certainly can't.

Message Mining No. 315: How do you think about Tether to issue RMB stable currency CNHT? Do you think that the advantages outweigh the disadvantages or do more harm than good? Feel free to share your opinion in the message area.

——End——

Original: JackyLHH

Source: vernacular blockchain

『Declaration : This article is the author's independent point of view, does not represent the vernacular blockchain position, and does not constitute any investment advice or advice. You are not allowed to reprint this article by any third party without the authorization of the "Baihua Blockchain" sourced from this article. 』

Editor's Note: The original title is: "Issues RMB stable currency, is Tether "mad"? Is it left behind for the USDT thunder? 》

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Proficient in IPFS: IPFS Get the content below

- Babbitt column | Liu Chang used: credit currency theory should not kill password currency

- Opinions | Is the financial era coming from a giant company to develop a stable currency?

- Introduction to Technology | Solidity Programming Language: Boolean and Integer

- Opinion | Talking about platform currency, which makes digital currency extension more abundant

- Coinbase Report: The number of top academic students studying cryptocurrency courses doubled in 2019 compared to last year

- Anti-Ruibo selling sentiment is getting worse and stronger, investors want to fork and take over XRP