US traders push the bitcoin bull market to rebound, Asian traders still rely on wait and see

There are obvious regional differences in this year's bitcoin bull market. American traders’ bullish sentiment is much higher than Asian traders. At least, our data is displayed like this.

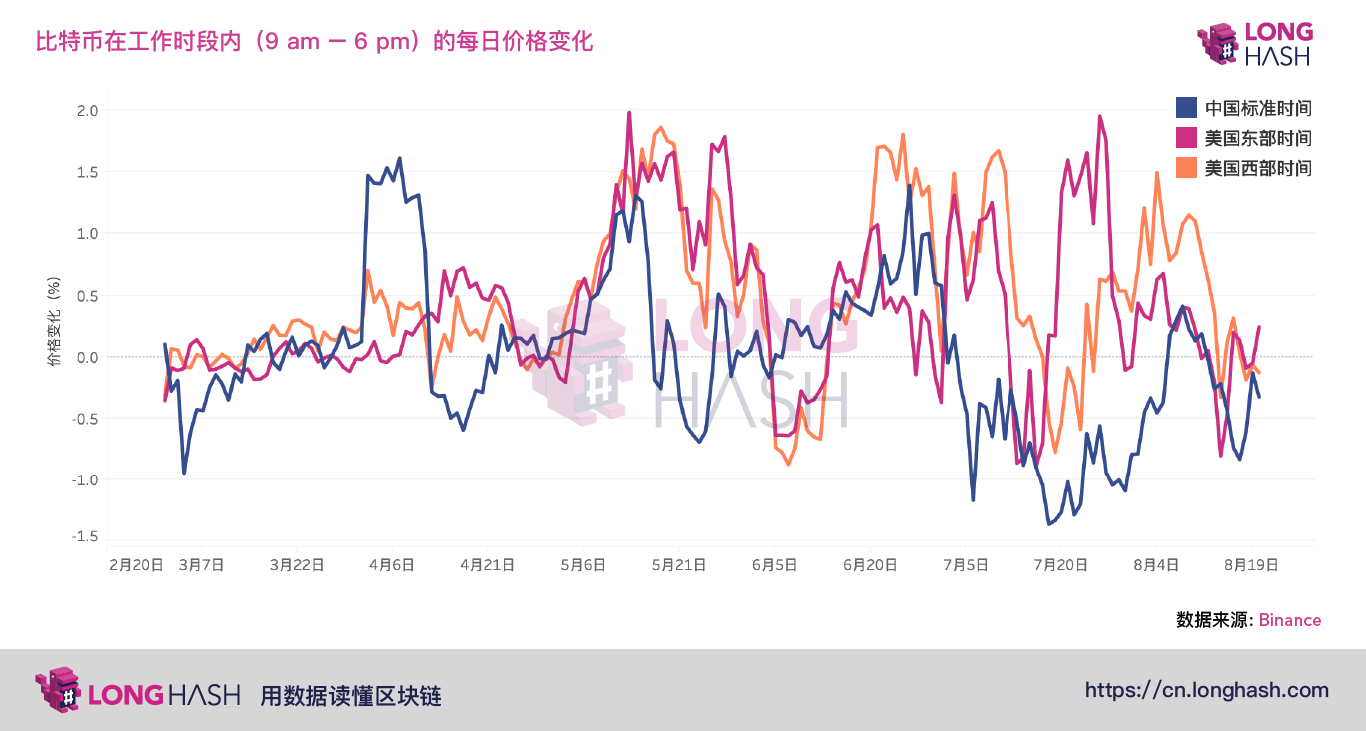

In the image above, we plotted the 10-day moving average of Bitcoin's daily price yield during working hours in different time zones. Obviously, in addition to the short-term surge in bitcoin prices during the Asian trading hours in April this year, during the other periods of the bitcoin bull market this year, Asian trading hours have lagged significantly behind US trading hours.

In particular, since the price of bitcoin reached US$13,000 in late June, the price of the currency has almost fallen during the Asian trading hours, and all major price rebounds have occurred during the US trading hours.

- Bitcoin lost $10,000, and the trend is finally here.

- Viewpoint | Blockchain don't pass the pass?

- The fundraising of $1.7 billion has been low-key, and will the upcoming Telegram blockchain be supervised?

In fact, when we consider the average daily rate of return in different time zones, we will find that, in general, Bitcoin has almost no price increase during the Asian trading hours, and almost all of the rising prices occur during the US trading hours.

In addition, there is further evidence that the purchase behavior of US traders has contributed to the rebound in the price of this bitcoin. In the image below, we plot the bitcoin premium between Coinbase and OKCoin—that is, the cost of buying Bitcoin on Coinbase is much higher than on OKCoin.

We observed two things from the picture above. First, except for two very short periods in late April and late May, the price of Bitcoin on Coinbase is mostly a positive premium. The price of Bitcoin on Coinbase seems to always be higher. Second, the two biggest bull markets this year, one in early May and the other at the end of June, coincided with a sharp rise in the bitcoin premium on Coinbase. This shows that this bitcoin bull market is driven by American buyers.

This trading day has been seen before in the US stock market. At that time, the cumulative return on the trading day's earnings was basically zero for a long time, and all the income occurred after the market trading period. For the encryption market, since the transaction is open 24 hours, we analyzed the earnings during the trading days in different time zones and got an interesting conclusion.

The lesson we learned from this is that although Bitcoin is a global asset, its pricing mechanism in different geographic regions is far greater than we thought. Interestingly, it seems that many Asian traders predict that the market recovery will be slower, so they chose to watch the bullish rebound on the sidelines, while US traders chose to buy Bitcoin more quickly.

LongHash , read the blockchain with data.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- BTC fell below 10,000, 1.5 billion overnight evaporation, CME is the culprit?

- Getting started with blockchain | What are the stable currencies USDT and Libra? what's the effect?

- Jailbreak, low profits, risk-free arbitrage in the currency circle is a dream or a bubble?

- Research Report | There are more newcomers in the stable currency market, and the “institutional giants” are rushing to the beach.

- Economic Daily: Blockchain expands the real economy application scenario

- From the Internet yesterday, look at the blockchain tomorrow

- Deconstructing Chinese Digital Currency in the Patent Library: How to Solve Policy Transmission and Liquidity Traps