Lawyer's interpretation | Blockchain's application in supply chain finance faces three major legal risks

The pneumonia epidemic of the new coronavirus infection in early 2020 brought a devastating disaster to the operation of many small and medium-sized enterprises in China, among which a large number of enterprises experienced a shortage of capital flow. The new model of blockchain asset securitization has been pushed to the front of the era. On February 7, 2020, Beijing's blockchain-based supply chain debt and debt platform was officially launched, providing small and medium-sized enterprises with rights-financing financing services. Alleviate the impact of the epidemic on the production and operation of small, medium and micro enterprises, and help enterprises overcome difficulties and develop steadily. In the era of blockchain, the blockchain + supply chain is here. Can it break the bottleneck of traditional ABS business transactions and find a new way for SMEs with short cash flow after the epidemic? This article will explore the application of blockchain + supply chain, the opportunities and legal risks that accompany it.

I. Understanding Blockchain + Supply Chain Finance

Under the social division of labor, enterprises changed from original independent production to collaborative production between enterprises, from raw materials to intermediate products to finished products, and finally sales were completed by downstream distributors. It was precisely because of the emergence of the supply chain that the Management requires a core enterprise. The core enterprise can take advantage of the scale effect to either purchase credit from upstream companies or demand immediate payment from downstream enterprises. However, it will also cause many SMEs to face the dilemma of cash flow shortage.

The asset securitization (ABS) business of the supply chain refers to the issuance of marketable securities on the financial market through combination and credit enhancement based on stable basic assets (mainly accounts receivable, warehouse receipts, etc.). With the increasing complexity of the design of the ABS transaction structure, the traditional asset securitization financial service infrastructure is unable to meet its development needs. The complexity of asset information and transaction chains has isolated all parties and links, and the risks have become more apparent. The most prominent are the following aspects: First, the penetration and transparency of the underlying assets mainly depend on the issuer's credit endorsement and external ratings; second, the financing process is lengthy, the information lacks timely synchronization, and the manager's information integration timeliness In the end, the information and data are missing and untrue. Because the bills and contracts are paper, repeated verification is required in the circulation process. In the process of multi-party verification, it is easy to forge documents, etc., and after the funds enter the pool, subsequent follow-up Money management is also difficult to track.

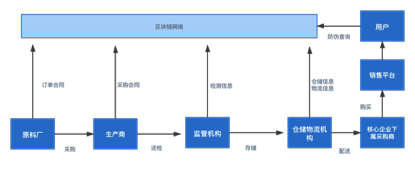

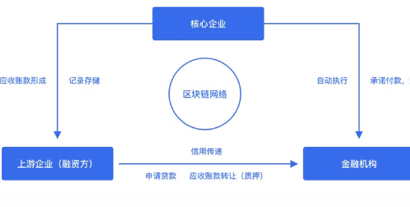

Blockchain is a new type of decentralized protocol.The data on the chain cannot be changed or forged at will, so it provides a credit creation paradigm without trust accumulation. It has the characteristics of Distributed, Disintermediation, Trustless, Immutable, Programmable, etc. These features enable the blockchain to make up for the deficiencies of traditional financial institutions, improve operational efficiency, reduce operating costs, flexibly update market rules, prevent information tampering and forgery, and greatly improve stability and reduce the risk of downtime. Using a blockchain to build a supply chain financial platform can integrate upstream and downstream enterprises, financial institutions, warehousing and logistics, insurance, credit reporting and other information systems in the supply chain to achieve data synchronization. Use the blockchain to digitize paper warehouse receipts, bills, and receivables, eliminating the need for fake links in subsequent circulation and eliminating the need for repeated verifications, because other institutions have already verified them during data entry (see details figure 1). In addition to the voucher function, due to the attributes of the distributed ledger in the blockchain, the process of voucher circulation is completely recorded, including the entire process of contract execution, transactions, pledges, and settlement. Slowly becomes a valuable credit data source (see Figure 2 for details), which is different from the current single-center maintenance of data. The data entered in the blockchain is jointly confirmed and maintained by all parties, and its value as a credit model Has been greatly improved.

- In the era of "Black Swans", learn to use blockchain thinking to improve anti-fragility

- SERO destroys half of the unmined tokens, and the public chain also changes the total amount like the exchange?

- Israeli Attorney General: Israeli banks should not refuse to serve cryptocurrency companies

Figure 1: Blockchain supply chain financial data on-chain

Figure 2: Blockchain supply chain financial credit data source

Blockchain + Supply Chain Finance Examples

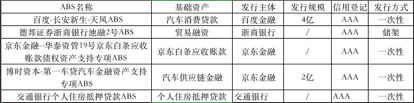

Supply chain finance involves multiple entities, so the form of supply chain finance on-chain is flexible and flexible. In practice, different on-chain schemes should be designed based on the actual conditions of the project, the regulatory environment, and financing needs. Regulatory framework for blockchain asset securitization. Moreover, in the process of project chaining, in addition to the original creditors and core enterprises of debt receivables, several intermediary service agencies are involved, including, for example, stock exchanges, lawyers, rating agencies and other consultants. At present, the combination of blockchain and supply chain financial asset securitization is implemented in China. See Table 1 [i] . Whether it is a blockchain asset securitization product or a blockchain asset securitization platform, it is necessary to achieve asset transparency and rapid capital project Extensive practice has been carried out for the purpose of docking.

Table 1: Blockchain and supply chain financial asset securitization projects

Legal Risks of Blockchain + Supply Chain Finance

Regarding the determination of the blockchain asset securitization supervision principles, according to the latest regulations of the latest "Securities Law", which are comprehensively implemented, step-by-step implementation of the registration system, and cancellation of the issuance review committee system, the overall regulatory attitude towards the securities field is guided by . China's relevant laws currently have the following aspects to consider in the legal risks of blockchain asset securitization.

1. Legality of transfer of accounts receivable

According to Article 80 of the Contract Law: "If a creditor transfers rights, the debtor should be notified. The transfer has no effect on the debtor without notice. The notice of the creditor's transfer of rights cannot be revoked, except where consent is obtained." In the ABS business, two notification procedures are involved. The first notification procedure is that the seller transfers the creditor's rights of receivables to the factoring agency. At this time, the seller should notify the buyer of the transfer of creditor's rights to make the transfer effect for the buyer. The second notification procedure is for the factoring agency to transfer the factoring creditor's rights to the special plan. At this time, the factoring agency should notify the buyer of the creditor's rights transfer to make the transfer effect for the buyer.

At present, the alliance chain is generally used in blockchain + supply chain projects, that is, to ensure the characteristics of distributed accounting of the blockchain, and to ensure the value of data operation efficiency as much as possible. According to Figure 2 of this article, the supply chain participants are used as the alliance chain. The important node data can be updated synchronously, but because there is no clear laws and regulations to determine the type and specification of the uploaded data, the uploaded data may not fully meet the requirements of Article 80 of the Contract Law in such asset securitization projects. The standard of notification is that the first notification procedure is flawed, which may affect the legality of the underlying assets. Therefore, in the first notification process involving factoring institutions, whether through the receivables transfer agreement or through a separate authorization document, the underlying assets and conditions involved in this supply chain finance need to be listed to ensure The legality of the notice procedure for claims management.

2.Legal Risks Caused by Node Evil

Based on the consideration of transaction efficiency and entry threshold, the supply chain usually uses the alliance chain, but the data in the alliance chain is not completely immutable. As long as most of all the institutions in the alliance reach a consensus in the alliance chain, you can The block data is changed, so due to the semi-centralized structure of the alliance chain, there may be the possibility that multiple participants in the node will conspire to commit evil, and the data credibility in the blockchain supply chain finance will also decrease. When node collusion occurs, the issue of verifying the authenticity of the underlying and underlying assets on the chain and the credibility of the evidence on the chain will once again become the core issue in the securitization of financial assets in the supply chain. Article 11 (2) of the Supreme People's Court's Provisions of the Supreme People's Court on Several Issues Concerning the Trial of Internet Court Cases: "The electronic data submitted by the parties shall pass electronic signatures, trusted time stamps, hash value verification, Internet courts should confirm that the authenticity of blockchain and other evidence collection, fixing, and tamper-resistant technical means or certification through electronic forensics and evidence storage platforms can confirm. "It can be considered that although blockchain technology has its reservations Data and other characteristics, but whether it can be submitted as evidence that can be recognized by the court, it is still necessary to prove whether the evidence materials obtained by the application of the blockchain meet the requirements for authenticity of evidence qualifications.

Therefore, in order to avoid the possibility of new types of data fraud caused by node mischief, in the asset securitization of blockchain, technical means and industry supervision can be used to further regulate. On the one hand, for the supply chain blockchain alliance to set various benefits The number of nodes owned by related parties should be controlled and designed reasonably to avoid allowing more than half of the nodes to be held by consenting stakeholders. On the other hand, although the current supervision of the securities field is mainly guided, restricting the administrative power of government review, but It does not prevent the industry associations from guiding and supervising commercial activities that affect the public interest in specific industries, thereby reducing the possibility of asset securitization dominated by business entities.

3. Don't ignore the comprehensive investigation of important debtors

Supply chain asset securitization is an asset securitization business that is carried out around the buyer as a core enterprise. Therefore, although the application of blockchain technology can ensure the transparency and penetration of basic assets to the greatest extent, it conducts a comprehensive investigation of important debtors. It is inevitable that it is still important debtors who need to conduct comprehensive due diligence in accordance with the requirements of the "Guidelines for Due Diligence of Asset Securitization Business of Securities Companies and Fund Management Company Subsidiaries" (hereinafter referred to as "due diligence guidelines"). Otherwise, it may still happen. Although the underlying assets are real, important debtors cannot pay off their debts due to their own problems, which will still bring great investment risks to investors.

Fourth, the conclusion

The emergence and rise of the asset securitization of the blockchain supply chain is of landmark significance to the improvement of the supply chain and investment and financing. With the advent of the blockchain era, emerging technologies have injected new vitality into asset securitization.

Reasonable use of blockchain technology, compliant design of the project structure, careful handling of relevant legal issues, coupled with improved supporting regulations, we believe that blockchain asset securitization will open the door for more investors.

[i] Xie Zhifei, "Application of Blockchain Technology in Asset Securitization", Hebei Finance, Issue 8, 2019.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Large-scale technology companies collectively enter the financial sector, EU securities regulators issue risk warnings

- Stanford Blockchain Conference Day1: New Attack Can Crack Anonymity of Zcash or Monero?

- There is a huge difference between rich and poor. What is the distribution of Bitcoin wealth?

- How long will it take for Bitcoin transactions to surpass Visa at $ 727 billion? Only need to halve once

- Where is the decentralized Chuhe Han Realm? Which is the trend?

- Wanxiang Blockchain Online Charity Hackathon Starts

- Viewpoint | Re-understanding Flash Lending, Blockchain Has Arrived In A New Phase Of Crypto Finance