Data: Bitcoin investment traffic is expected to exceed Visa after next halving

Source: Cointelegraph Chinese

Author: William Suberg

Compile: Zweig

Bitcoin ( BTC ) has contributed 1% of global GDP, and this proportion has grown "exponentially" with each halving cycle.

- Lawyer's interpretation | Blockchain's application in supply chain finance faces three major legal risks

- In the era of "Black Swans", learn to use blockchain thinking to improve anti-fragility

- SERO destroys half of the unmined tokens, and the public chain also changes the total amount like the exchange?

Statistician Willy Woo analyzed data from Coin Metrics, a cryptocurrency monitoring resource. According to him, Bitcoin's investment flows are $ 727 billion per year.

BTC processes $ 727 billion annually

This number is almost 10% of the annual transaction volume of payment processor Visa-Visa processes $ 8.8 trillion in transactions each year.

Bitcoin's investment flow (ie annual investment speed) is currently increasing by an order of magnitude (10 times) every 4 years.

Woo concluded.

According to statistics, Bitcoin should "catch up" with Visa sometime after the next halving in May. According to Cointelegraph, smaller fiat currency operators like PayPal have lost their way to competition-in 2018, PayPal only processed a total of $ 578 billion.

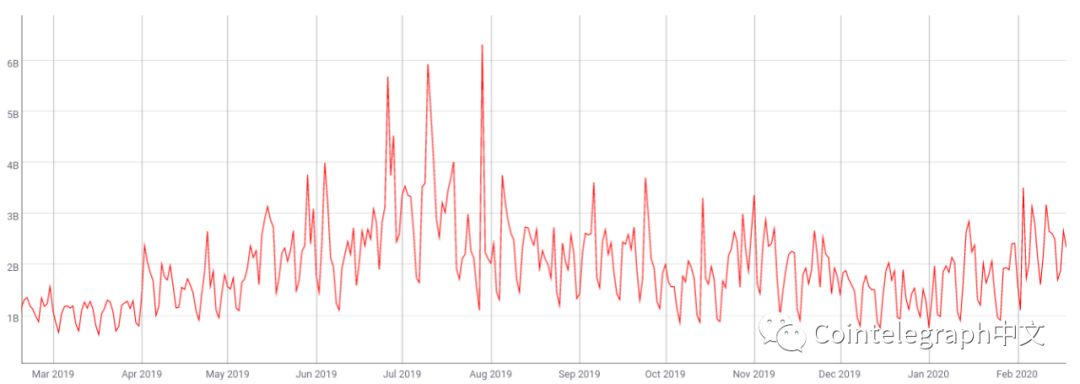

Bitcoin's 1-year adjusted trading volume Source: Coin Metrics

Small Wallet Hits Record High

These impressive numbers came at a time when the number of low-balance bitcoin wallets hit a new high, suggesting that more and more private investors are trying bitcoin.

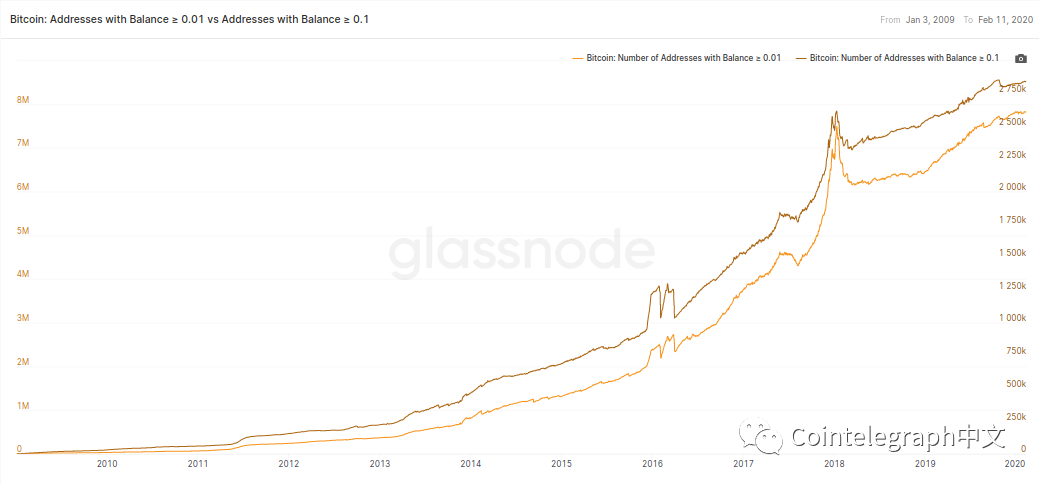

According to Glassnode, existing wallets have more balances than ever before, with balances greater than or equal to 0.01 BTC ($ 101) and 0.1 BTC ($ 1080).

Bitcoin wallet growth since 2009 Source: Glassnode

Nonetheless, when it comes to cryptocurrency fund storage, both private and institutional investors value convenience over security. For example, a recent survey showed that more than 90% of institutional investors use trusted third parties (such as exchanges) to store their bitcoins.

The industry is developing "key proofs" in an effort to raise awareness of the importance of wallets' self-management of private keys, but as of now, the plan is still difficult to achieve.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Israeli Attorney General: Israeli banks should not refuse to serve cryptocurrency companies

- Large-scale technology companies collectively enter the financial sector, EU securities regulators issue risk warnings

- Stanford Blockchain Conference Day1: New Attack Can Crack Anonymity of Zcash or Monero?

- There is a huge difference between rich and poor. What is the distribution of Bitcoin wealth?

- How long will it take for Bitcoin transactions to surpass Visa at $ 727 billion? Only need to halve once

- Where is the decentralized Chuhe Han Realm? Which is the trend?

- Wanxiang Blockchain Online Charity Hackathon Starts