Looking back at the history of the conversion of bulls and bears, what year is the most striking similarity in 2019?

The virtual currency market in 2015 started from the crash, but quickly formed the bottom, and quickly entered the upward trend that continued until 2017, reaching the highest historical market value at the end of the year.

In this article, we will explore the frenzy of the huge investment in blockchain startups in 2015, and the important developments of major agreements at the time, to understand how regulators are slowly intervening in this area; the evolution of bitcoin price trends in 2016 and The gradual division of its community, the proliferation of ERC-20 tokens, and technological advances in major agreements.

01

Great investment (2015)

At the beginning of 2015, Coinbase announced in January that it had successfully obtained approximately $75 million in Series C financing, which was the largest round of financing for companies in the blockchain sector. Well-known companies such as DFJ, USAA, Ribbit Capital and Andreessen Horowitz are also involved, which provides legitimacy for projects in the Silicon Valley investment encryption field. Coinbase also attracted the participation of the New York Stock Exchange and other prominent Wall Street figures, such as the former CEO of Reuters Citigroup.

- Opinion: USDT will not thunder, Facebook sends Libra to protect itself

- Report | Analysis of the Development Status of Blockchain Game Industry in June 2019

- Research Report | Impact of blockchain on payment systems, digital records, trade finance and syndicated loans

Coinbase's interface in early 2015

Coinbase's interface in early 2015

In March of the same year, the family was named 21 Inc.'s bitcoin vendor stood out from the obscurity and announced a $116 million investment, setting a new record for startups in the cryptocurrency space.

Also in March, a trader community called the “Whale Club” boarded the headlines of encrypted media, which revealed that investors who hold a lot of bitcoin are in the chat room with major trading platforms such as Bitfinex and BitMEX. The manager and the staff get together.

This is a wake-up call for miners, bitcoin enthusiasts and retail investors, as it is clear that the price of bitcoin is heavily manipulated.

Whale Club UI Screenshot

Whale Club UI Screenshot

In April, financial services startup Circle Internet Financial ended a $50 million round of financing with the support of Goldman Sachs and IDG Capital Partners, a company based in China that aims to socialize the Chinese market.

In August, just a few weeks after the release of the Ethereum Frontier version , the first 1CO on the Ethereum blockchain surfaced – Augur.

Augur's 1CO was launched on August 17th and continued until September 5th, when Augur raised more than $5 million. Augur's goal is to decentralize financial markets and sports spinach by cutting down middlemen.

With a major development in September, the consortium R3CEV added 13 new banking partners, bringing the total number of banks involved in its activities to 22. These bank names include Bank of America, Bank of New York Mellon, Citibank, Commerzbank, Deutsche Bank, HSBC, Mitsubishi UFJ Financial Group, Morgan Stanley, National Australia Bank, Royal Bank of Canada, SEB, Societe Generale and Toronto TD Bank.

Also in September, the smart bond platform established by UBS (Union Bank of Switzerland) at Ethereum surprised the market. Nick Szabo said that bonds are a good example of a financial instrument for smart contracts, because if bond issuers themselves are not insolvent, they can be repaid by other assets stored in the blockchain.

Jamie (Morgan CEO) more than once clearly stated position on Bitcoin

In December 2015, NASDAQ launched its blockchain-based private equity product for the first time: Nasdaq Linq (Nasdaq Link). The Chicago Mercantile Exchange and the London Stock Exchange form a blockchain settlement group that increases the link between traditional financial institutions and the blockchain. As of the end of 2015, Bitcoin was the best performing cryptocurrency in the year, with an increase of nearly 40%.

02

The year of progress in key technologies

1.Stellar (star coin)

In April, the Stellar agreement released a new consensus algorithm: the SCP system (Stellar Consensus Protocol) developed by Stanford University professor David Mazières. He wants the system to verify transactions faster and more reliably, and consumes less energy than Bitcoin's Work Proof (PoW) . The original code for Stellar is based on Ripple, a change that makes it independent.

2. Ethereum

In May, the Ethereum community released the v.0 Olympic release (the Ethereum Test Network) before the final v1.Frontier was released. This Olympic network provides users with 25,000 Ethernet vulnerability report rewards as an extreme stress test for the Ethereum blockchain. Vitalik Buterin, Gavin Wood and Jeffrey Wilke are judges on the bounty.

The list of winners will be remembered forever in the Ethereum Creation Zone.

The Frontier version was released in late July, which led to explosive growth of DApps and 1CO .

Bitcoin

In June, the Bitcoin network passed the unexpected stress test of the brokerage firm CoinWallet.eu. The test cost 20 BTCs (approximately $5,000) for the transaction and approximately 200MB of data. Ten Bitcoin servers will send transactions at two speeds per second, each transaction being approximately 3KB in size, each sent to 10-20 addresses.

This test sparked a fierce debate within the Bitcoin community about expanding the network and increasing the block size limit. This controversy eventually led to the split of Bitcoin cash in 2017.

Some European regulators expressed dissatisfaction with the test of CoinWallet.eu, and British regulators also questioned its legitimacy.

In July, the number of Bitcoin wallets reached 10 million.

A few weeks later, some Bitcoin developers led by Pieter Wuille proposed a fork to implement quarantine verification, which changed the way the network handles signature data, increasing transaction capacity without increasing block size limits. In fact, the transaction data after the signature is isolated appears to be smaller, reducing network congestion.

Peter Wuille

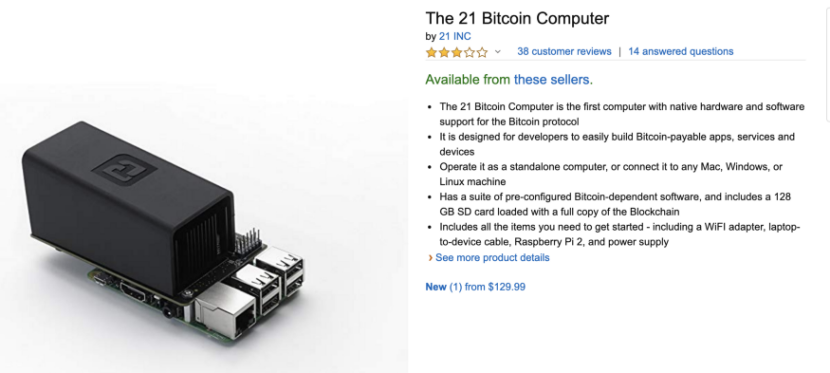

In November 2015, the Dutch broadcast network Vpro documentary launched the “Bitcoin Gospel”, which is the knowledge of bitcoin and blockchain for tens of thousands of Europeans. Also in November, Amazon began shipping the first 21 Inc. product, a 21 bitcoin computer.

In December, in the optimism that Bitcoin prices rebounded, Bitcoin developed a community gathering to try to reach a consensus on the best way to extend the blockchain and discuss potential solutions such as quarantine verification or lightning network applications. Most community members are concerned about the possibility of hard forks, which divide Bitcoin into two different chains that compete with each other.

In 2015, the Blockchain World kicked off with the Linux Foundation's announcement of the creation of the Hyperledger project.

4.Ross Ulbricht was sentenced

Ross Ulbricht, founder of the Silk Road, was convicted in February and sentenced to life imprisonment in May 2015.

Ulbricht is known as the "terrorist pirate Roberts" in the drug sales market. He argued in the defense that the Silk Road platform "allows illegal activities to no longer appear on the streets, reducing the harm suffered by drug users", but this defense is not convincing. judge.

Ross Ulbricht's supporters

Prosecutors said the Silk Road had generated nearly $213.9 million (£140 million) in sales and $13.2 million in commissions before the police closed the Silk Road. Ulbricht is accused of expanding the drug market and causing drug lords to increase their power in drug-producing countries.

5.BitLicense released

In June 2015, the New York State Department of Financial Services (NYDFS) released the long-awaited final version of the digital currency company regulatory framework. After two years of discussion, the final version of BitLicense came out.

Benjamin Lawsky said, “We are excited about the potential digital currency holdings because it helps drive the transformation of our rigid payment system.”

In September 2015, Circle received the first New York State Department of Financial Services Bitcoin License (NYDFS) BitLicense.

03

Bitcoin rebounds, Bitfinex is hacked (2016)

From January 2016 to January 2017, the size of the Bitcoin blockchain increased from 50GB to 100GB, and its price rose from $433 to $961, a significant rebound from the 2014 low.

Bitfinex is a Hong Kong-based trading platform that became one of the major trading sites for Mt.GOX cryptocurrency.

In June 2016, Bitfinex imposed a $75,000 fine on the over-the-counter financing commodity transaction, which cast a shadow over the illegal trading of bitcoin transactions.

In August, Bitfinex was stolen from its website with nearly 120,000 bitcoins (approximately $72 million at the time), the second largest bitcoin stolen after the Mentougou incident. Bitfinex had to suspend all trading operations. Subsequently, the price of Bitcoin plummeted by 20% in a few hours.

The first bitcoin self-help mechanism: All Bitfinex users "loss shared" after the historic hacking incident, with an average loss of 36%. These users will be compensated for the BFX tokens in proportion to their losses.

The theft incident has given many unsuspecting retail investors a dangerous signal: the trading platform is not a place for them to safely deposit coins. However, this incident also triggered the rise of the cold wallet market, which eventually promoted the development of hardware wallets such as Trezor and Ledger Nano.

04

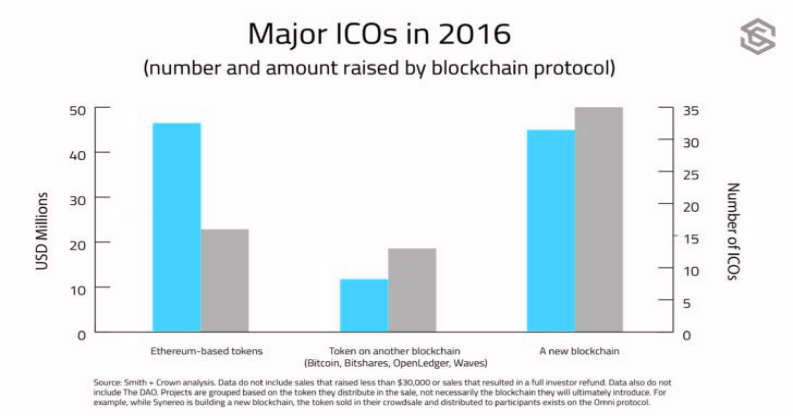

1CO is everywhere

2016 was an iconic year, and the status of 1CO was consolidated, making it the only way to launch new agreements and decentralized applications. Many large projects have launched their 1CO, some important agreements have developed well, and a large amount of investment funds are in place, making the total market value of the cryptocurrency industry continue to increase.

Source: Coindesk

Because the liquidity on the Ethereum network is very good, many agreements and DApp tokens were originally issued in ERC-20, and subsequent tokens can be converted to their own agreements. Other projects use Bitcoin as a direct source to issue their own tokens.

05

Ethereum crisis

Since the release of the Frontier version in 2015, Ethereum has been developing very well. Many developers have joined Vitalik Buterin, claiming that the real world provides a better blockchain, Ethereum's market value is gradually rising, and more and more people in the encryption community expect Ethereum to overturn bitcoin to become the king.

But then, a large-scale security breach occurred on The DAO project.

DAO, the full name of English is Decentralized Autonomous Organization, decentralized autonomous organization, is a concept proposed by V God. This decentralized organization relies on smart contracts to run on the blockchain. Without a legal entity, we can understand it as a "decentralized company."

The DAO is a crowdfunding project initiated by blockchain company Slock.it. In May 2016, crowdfunding was used for crowdfunding, and this crowdfunding became the largest crowdfunding activity in history. More than 11,000 investors have jointly formed an Ether fund worth more than $150 million.

On June 17, an attack against The DAO took place. Attackers exploit a range of vulnerabilities, most of which are vulnerabilities that are called recursively. The attacker can extract one-third of The DAO Reserve Fund (3.6 million Ethernet), which was about $50 million at the time. The attack was not a malicious attack and these funds were deposited into a 28-day account under the terms of the Ethereum contract.

The DAO and the Ethereum community disagreed and debated whether to proceed. The main solution they proposed was to re-adapt the Ethernet or completely shut down The DAO. In order to retrieve the Ethereum, the entire network must be rolled back to the date before the attack.

This has caused the community to split into two factions. One group insists that investors should take responsibility because the blockchain cannot be tampered, while the other group is worried that if the stolen Ethereum is not restored , this hack will lead to investment. They lost trust in the Ethereum project.

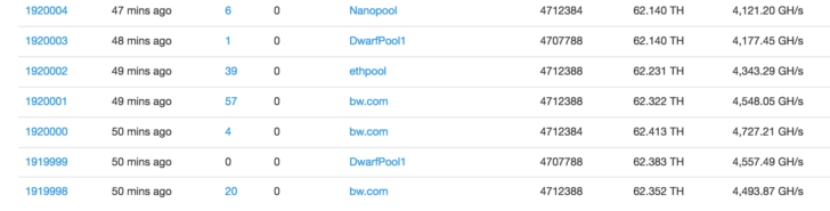

On July 20, 2016, at the block height of 1920,000, the Ethereum community decided to hard fork the Ethereum blockchain and restore all funds to the original contract.

The mining pool bw.com dug out the first Ethereum fork block

The mining pool bw.com dug out the first Ethereum fork block

Those who strongly maintain the unchangeable modification are separated from the Ethereum. They maintain the original blockchain as the Ethereum classic, which makes Ethereum divided into two separate blockchains, each with its own encryption. Currency, but the Ethereum Foundation does not support the Ethereum Classic.

06

Great Leap Forward for major projects

In addition to Bitcoin, Ethereum and the emerging 1CO, projects launched in previous years are booming and their technology and community are growing.

It is worth mentioning that several industry trade groups have also joined the creation of a global blockchain forum. The Global Blockchain Forum is from the Digital Chamber of Commerce, which was founded in 2014 by Perianne Boring.

Coinbase

In May, Coinbase was renamed GDAX (Global Digital Asset Exchange) and began offering Ethereum transactions. In July, they added retail support to Ethereum to integrate it into the same level of Bitcoin.

2.Ripple

In June, Ripple Labs received the BitLicense (Digital Money License) from the New York State Department of Financial Services and became the fourth company to receive the license.

In September, Ripple announced that it had raised $55 million in Series B financing. Their investors include Accenture Ventures, SCB Digital Ventures and Santander Innoventures, which give the Ripple project the strongest support from the company.

A few days later, Ripple Labs announced an agreement with its financial partners to set up the Global Payments Steering Group (GPSG). These two important milestones have caused Ripple to be smashed and its price has risen by 80% in a few days.

3.Monero

Monero was the fastest growing cryptocurrency in 2016, in part because the Silk Road was closed for use in the deep online market due to its anonymity.

07

summary

The huge investment in 2015-2106, the technological progress of the star project, the involvement of the regulatory authorities, the rise of Ethereum 1CO, and the occurrence of The DAO incident jointly promoted the industry to continue to develop.

The follow-up development of the blockchain industry will be introduced in the next issue.

No. 283: A good project, from birth, has a strong consensus. Who do you think the next “Ethernet” will be? why? Feel free to share your opinion in the message area.

——End——

Original: Listen to the wind

Source: vernacular blockchain

『Declaration : This article is compiled from "medium" and does not represent the vernacular blockchain position, nor does it constitute any investment advice or suggestion. 』

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- “Hyperledger Fabric is a fake blockchain!”

- Deep analysis of Blockstack regulations

- Institutional admission to the first portal! Bakkt will become a major driver of the cryptocurrency market

- Bakkt plans to conduct user acceptance testing of hosting and trading today

- North drift girl invests in bitcoin: after adding 200,000 yuan, she is ready to borrow millions

- Understand the four core modules of the IRISnet economic model and re-understand the development path and potential value of IRISnet

- New York State updates the Property Collection Act to allow the government to confiscate unclaimed bitcoins