Blockchain Weekly | BTC rose 20%: Is it a rebound or an aerial refueling?

Guide

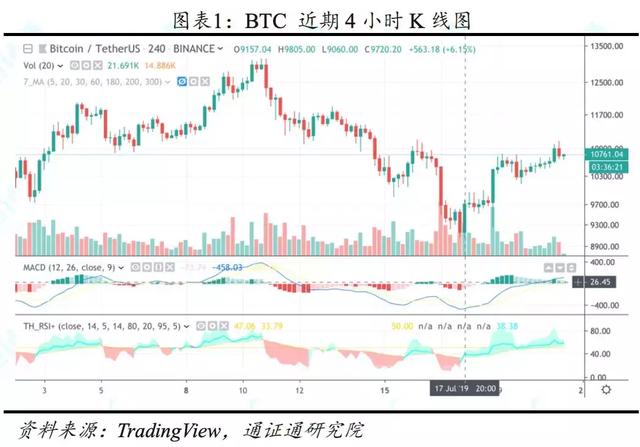

After the Libra hearing ended, the BTC pulled up from the $9,200 position on Thursday night to the $10,000 mark, and the rebound was rapid. In the past two weeks, the digital pass market has experienced large earthquakes. The BTC's recent four-quarter amplitudes are 32%, 23%, 30%, and 22%, respectively. The historical volatility has reached a recent high point. What is the trend of the BTC market? Rebound or air refueling?

Summary

- With $73 million in bitcoin outflows, is Bitmex a bull market "time bomb"?

- Gu Yanxi: Libra, a side attack on the securities industry

- Global blockchain investment trend report for 2019

Topic: The results of the Libra hearing were less than expected, causing the BTC to fall below the $10,000 mark. However, with the end of the hearing, the negative results, plus various technical indicators reflect that BTC is in an oversold state, and there is an objective environmental basis for the rebound. The huge amount of positive lines at the bottom indicates that large funds have begun to buy BTC, which has boosted the short-term price of BTC and returned to above $10,000.

On the news front, important events affecting the BTC trend in the past two weeks include the end of the Libra hearing, the G7 National Finance Ministers and Central Bank Governors Summit, and the Tether Hearing. We believe that the short-term bottom of $9000 is confirmed, but the potential risk of USDT has not been fully lifted. The BTC may fluctuate in the short-term range of $9,200 to $11,000. It is expected to reopen a new round of uptrend after the end of the Tether hearing.

Quotes: BTC short-term bottom, into the shock market. The total market value of digital certificates this week was 286.53 billion US dollars, down by 31.1 billion US dollars last week, down 11.1%; the average daily trading volume was 74.81 billion US dollars, down 3.00 billion US dollars last week, down 3.9%; The hand rate was 26.7%, an increase of 3.0% from last week. The current price of BTC is 10530.7 US dollars, the weekly decline is 10.9%, the average daily turnover is 23.4 billion US dollars; the current price of ETH is 221.3 US dollars, the weekly decline is 19.9%, and the average daily turnover is 8.63 billion US dollars. This week, the exchange's BTC balance was 888,300, an increase of 99,000 from last week; the ETH balance was 8.321 million, an increase of 35,000 from last week. Before the bearish cash is fully realized, the BTC still needs to adjust to the shock.

Output and heat: BTC computing power fell, ETH search volume surged. The difficulty of mining this week is 9.064T. The average daily power of this week is 62.2EH/s, down 3.6EH/s from last week. The difficulty of mining this week is 2200, which is 68.7 lower than last week. The average daily power is 178.4TH/ S, up 3.3TH/S from last week.

Industry: Libra has raised concerns among governments and tightened regulation. The IMF said that the network effect may lead to the rapid spread of digital certificates; the US Securities and Futures Commission approved the start-up of Blockstack issuing certificates; the finance ministers at the G7 summit expressed support for the start of the collection of digital taxes, and that FB should not issue Libra; US regulators are investigating Digital Stock Exchange BitMEX.

Risk warning: regulatory policy risk, market volatility risk

text

1

Topic: BTC rose 20%, is it a rebound or an aerial refueling?

Affected by various factors such as Libra hearings, BTC fell below $10,800 this Tuesday night and fell $1,800 in 24 hours, hitting a low of $9050, almost a month since June 20. New low. BTC hit an annual high of nearly $14,000 on June 26, and the market sentiment was high. But after only half a month, BTC fell 35% and returned to below $10,000, and the main circulation certificate also dipped. ETH fell from $366 to $190, a drop of 48%; LTC fell from $145 to $75, a drop of 48%; EOS fell from $7.4 to $3.3, a drop of 55%; XRP fell from $0.50 to $0.28. The decline was 44%, and the market sentiment quickly changed from extreme greed to extreme panic.

Just after the Libra hearing, the BTC pulled up from the $9,200 position on Thursday night to the top of the $10,000 mark. The rebound momentum was rapid, reaching a pressure of up to $10,800. From the low point, the increase was nearly 20%, and the 4-hour line formed. An obvious "V bottom" graphic. In the past two weeks, the digital pass market has experienced large earthquakes. The BTC's recent four-quarter amplitudes are 32%, 23%, 30%, and 22%, respectively. The historical volatility has reached a recent high point. What is the trend of the BTC market? Rebound or air refueling?

1.1 Why does BTC rise rapidly?

The results of the Libra hearing were not up to expectations, causing the BTC to fall below the $10,000 mark. However, with the end of the hearing, the negative results, plus various technical indicators reflect that BTC is in an oversold state, and the rebound market appears to have an objective environment. The huge amount of positive lines at the bottom indicates that large funds have begun to buy BTC, which has boosted the short-term price of BTC and returned to above $10,000.

On the news front, important events affecting the BTC trend in the past two weeks include the end of the Libra hearing, the G7 National Finance Ministers and Central Bank Governors Summit, and the Tether Hearing.

1.2 US Congress: Facebook is “not trustworthy,” but innovation should not be suppressed

Judging from the contents of the two-day Senate and House hearings, the US Congress is more concerned about the problems of the Facebook company itself, rather than the encryption and certification industry itself.

First, Congressmen believe that Facebook cannot safely save users' private data. Facebook was involved in the scandal of the 2016 US election called the "Cambridge Incident." Former employees of Cambridge Analysis said that during the 2016 US election, “Cambridge Analysis” analyzed the 50 million user profiles leaked by Facebook and placed them with suggestive political advertisements, which may have influenced the outcome of the US election. According to previous sections, lawmakers believe that Facebook cannot fulfill its responsibility to protect users' private information. Libra may collect user authentication and bank account information for other purposes.

Second, Congress believes that there is a difference between Libra and BTC. Meltem Demirors, member of the Panel's Financial Advisory Committee's expert advisory group and CoinShares Chief Monetary Officer (CSO), said Libra is not a true digital pass. Its purpose is not to "build a new payment system" but to manage assets. Libra is trying to become a financial service entity. It is fundamentally different from digital certificates such as BTC. Congress is more worried that Libra will use the issue of digital certificates as a cover to carry out financial services that should be strictly regulated, not digital certificates itself. When people buy Libra, they hand over real-world real assets to the Libra committee in exchange for digital assets. These real-world assets, which are deposited in banks and depository institutions around the world, are a core banking business and may carry out a range of derivatives businesses that pose systemic risks. But lawmakers believe that BTC is an unstoppable innovation force, and regulators need to understand blockchain technology and clarify their policy stance on BTC.

Members of Congress also believe that the Libra Alliance may violate antitrust laws. At the two-day hearing, the term "oligopoly" was often used by lawmakers to describe Facebook. They thought Libra formed a strong corporate alliance and might become "Too big to fail", which reminds people of Banks and institutions that are “too big to fail” in the financial crisis. MeltemDemirors also pointed out that the main decentralized cryptography organization she participated in was not invited by the Libra Alliance and it was not clear how to obtain membership. The Libra Alliance is more like a cartel organization, and the global payment system controlled by technology giants may lead to a de facto monopoly in multiple industries.

In addition, lawmakers are concerned that a basket of legal currency assets held by Libra may affect the monetary policy of these countries.

1.3 G7 Summit: Libra needs supervision

At the G7 summit, the finance ministers and central bank governors of the seven countries unanimously opposed Libra's issuance. They believed that any Libra-like stability certificate could not be launched before the necessary regulatory measures were introduced, and that the regulation of the stability certificate must meet the highest standard". France, the rotating presidency of the G7 summit this year, asked the European Central Bank Executive Committee to set up a G7 task force to investigate a digital pass similar to Libra. French Finance Minister Lemaire, German Finance Minister Schultz, and Bank of Japan Governor Haruhiko Kuroda are all cautious about Libra, expressing concern about data security and regulatory compliance.

1.4 Tether: USDT alert has not been completely removed

The Office of the Attorney General of New York will receive a response from Tether on July 22, and Tether will attend the hearing on July 29. On May 1st, Coindesk reported that Tether's legal counsel acknowledged that USDT's SZ is only a 74% equivalent of cash and short-term securities as reserve assets. In addition, this year Tether also used $850 million in reserve assets to fill the deficit of Bitfinex. The Office of the Attorney General of New York is likely to have a series of evidences about Tether’s alleged violations. If Tether’s violations are confirmed at the hearing, it is likely to ignite another block in the blockchain industry.

On July 19th, the fire currency announced that it would upgrade its HUSD Token, a single stable certification solution. The upgraded HUSD Token is a stable and stable certificate issued by Stable Universal and Paxos Trust based on ERC20. The anchored US dollar reserve is hosted by the licensed trust company Paxos Trust and audited monthly.

Why did the fire coin choose to abandon a basket of stable certification solutions at this time, and then issue its own compliance stability certificate? Perhaps it is just a coincidence that perhaps the fire currency, as the industry's head exchange, has already smelled the potential risks of USDT.

1.5 Short-term trend is more difficult to predict, long-term bull market is confirmed

Technically, BTC faces multiple pressures on the MA30 and the neckline. If it cannot be effectively broken in the short term, it is likely to fall below $10,000. In terms of trading volume, most of the funds for bargain-hunting are bought at a total of 9,200 to 10,000 US dollars, so there will be strong support here, but with the continuation of the rebound, the amount of BTC can continue to shrink and begin to shrink. The situation, no more buying is willing to push the BTC to cross the pressure.

In summary, we believe that the short-term bottom of 9,000 US dollars will be confirmed. In combination with the news, the probability of directly breaking through the pressure level next week is small. Next week (July 22 to 28), the BTC may be at 9200 to 11000. The dollar range fluctuated. The short-term adjustment is also brewing for the next year's BTC production cuts. After the Tether hearing (29th), BTC is expected to restart a new round of upward trend.

2

Quotes: BTC short-term bottom, into the shock market

2.1 Overall market: BTC rebounded sharply and the market recovered

This week, the total market value of digital certificates was 286.53 billion US dollars, a decrease of 11.1% compared with last week's decline of 35.9 billion US dollars. Affected by factors such as Libra hearings, BTC fell below the $10,000 mark this week, but then quickly rebounded and returned to above $10,000.

The average daily trading volume of the digital pass market this week was US$74.81 billion, down by US$3.0 billion from last week, down 3.9%. The average daily turnover rate was 26.7%, an increase of 3.0% from last week.

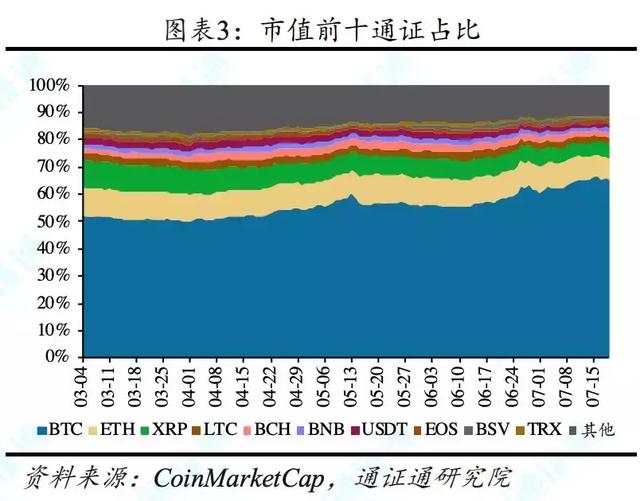

The market share of the top ten passes is 88.5%, of which BTC accounted for 65.5%, further expanding.

This week, the exchange's BTC balance was 888,300, an increase of 99,000 from last week. The exchange's ETH balance was 8.321 million, an increase of 35,000 from last week. The number of chips in the market has continued to increase in the near future, and the selling pressure is large, which may be one of the reasons for the recent poor performance of BTC.

The USDT market value was $4.03 billion, an increase of $120 million from last week and the USDT premium rate was 0.3%. The USDT continues to issue additional shares. At the end of the month, Tether will attend the hearing of the allegations of the New York State Attorney General's Office, and there is a risk of fluctuations in USDT prices.

2.2 Core Pass: The main circulation certificate is weak, hitting a new low in two months

The current price of BTC is 10530.7 US dollars, with a weekly decline of 10.9% and a monthly increase of 13.6%. The average daily trading volume of BTC this week was 23.4 billion US dollars, and the average daily turnover rate was 12.7%. BTC fell below the threshold and quickly recovered, or confirmed the bottom of the short line.

The current price of ETH is 221.3 US dollars, with a weekly decline of 19.9% and a monthly decline of 17.9%. The average daily trading volume of ETH this week was 8.63 billion US dollars, and the average daily turnover rate was 36.1%. Although the price of ETH has fallen more, the transaction has remained active and there is room for rebound.

EOS is currently trading at $4.05, down by 16.0% for the week and falling by 41.1%. The average daily trading volume of EOS this week was 2.38 billion US dollars, and the average daily turnover rate was 63.2%. EOS's short-term decline is huge, and there is a heavy burden on the top.

The current price of XRP is 0.321 US dollars, with a weekly decline of 6.8% and a monthly decline of 26.6%. The average daily volume of XRP this week was $1.53 billion, with a daily average turnover rate of 11.5%. Although the increase in the current round of XRP is limited, the current price is close to the annual low, and the risk of continuing to fall is small.

The monthly volatility of the major passes this week has rebounded sharply. BTC monthly volatility was 38.3%, up 6.4% from last week; ETH monthly volatility was 35.6%, up 9.0% from last week; BTC's volatility led the main circulation certificate, which may indicate a new round of big market brewing.

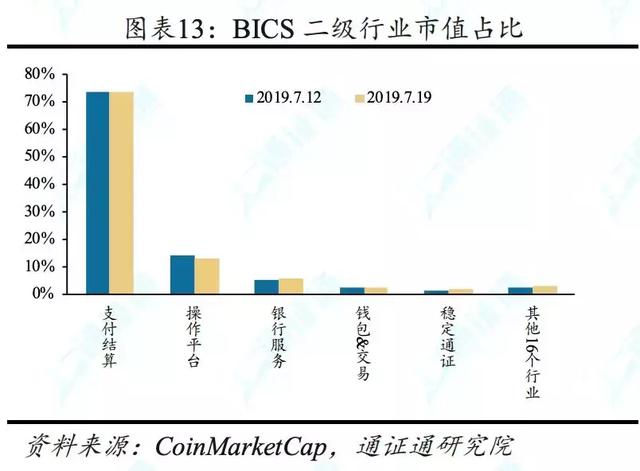

2.3 BICS industry: the proportion of the market value of payment and settlement has further increased, and the number of securities management industry has led the growth.

Based on the top 500 market capitalizations in this week's market capitalization, the market value of the payment and settlement industry rose from 73.9% to the top five BICS (Blockchain Industry Classification Standard) secondary industries with a total market capitalization. 74.0%. From the perspective of the change rate of market capitalization ratio, the market share of Tongzheng asset management and project services accounted for a higher growth rate, which was 32.4% and 23.0% higher than that of last week. The proportion of communication services and supply chain market value decreased more obviously. Weeks fell by 10.0% and 9.4% respectively.

The BICS secondary industry with a relatively large increase in the number of passes this week is a professional service and a pass-through asset, which is 4 or 3 respectively compared with last week. The BICS secondary industry with a significant decline in the number of passes this week is retail electricity. Business, reduced by two.

2.4 Market View: Need to adjust before all cash is honored

Tether will attend the hearing to accept an investigation by the Office of the Attorney General of New York. The Office of the Attorney General of New York will receive a response from Tether on July 22, and Tether will attend the hearing on July 29. The Office of the Attorney General of New York may question the violations of Tether's misappropriation of reserves to fill Bitfinex's deficit, failure to reserve sufficient cash, and cash equivalents as collateral. The coin will issue a compliance stabilization pass HUSD, which may be related to the upcoming hearing of Tether.

The long-term bull market trend has not changed. The short-term bottom of 9,000 US dollars was confirmed. In combination with the news, the probability of directly breaking through the pressure level next week is small. Next week (July 22 to 28), the BTC may fluctuate within the range of $9,200 to $11,000.

3

Output and heat: BTC computing power is falling, ETH search heat is booming

The daily average computing power of BTC has declined, and the difficulty of mining has not been adjusted; the average daily computing power of ETH is growing steadily. The difficulty of mining this week is 9.064T. The average daily power of this week is 62.2EH/s, down 3.6EH/s from last week. The difficulty of mining this week is 2200, which is 68.7 lower than last week. The average daily power is 178.4TH/ S, up 3.3TH/S from last week.

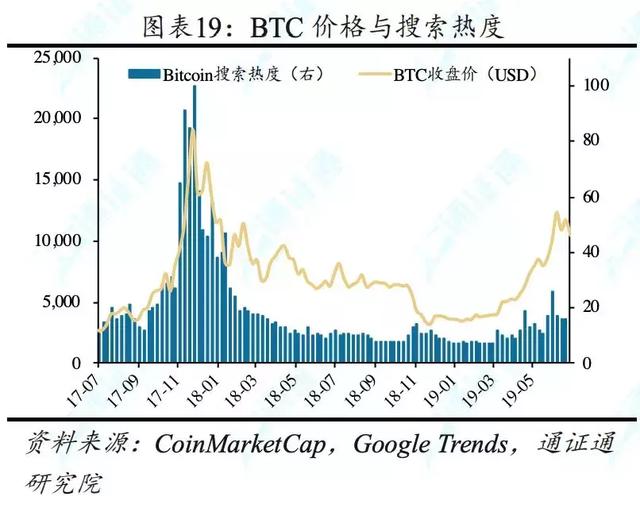

This week, Google Trends's Bitcoin entry search heat was 16, which was similar to last week; Ethereum's entry search heat was 33, a large increase. Google shows that the most recent Ethereum entry search area is China, and the current ETH search fever reached one-third of the beginning of 2018.

4

Industry Highlights: Libra raises concerns among governments and tightens regulation

4.1 IMF: Network effects may lead to rapid adoption of digital passes

According to a new report released by the International Monetary Fund (IMF) on July 15, the IMF believes that the network effect may lead to the rapid spread of digital pass. The International Monetary Fund hopes to create a conceptual framework for categorizing emerging digital assets such as Facebook's cryptocurrency Libra and other stable passes, and to think about the impact they have on central bank policies. In addition, the International Monetary Fund identified six factors that could drive rapid growth in its payments: convenience, universality, complementarity, low transaction costs, trust and network effects.

4.2 SEC approves the start-up of Blockstack issuance certificate

Blockstack's pass issuance plan is essentially a regulated “first-time token issue” (1CO). 1CO enables start-ups to bypass traditional financing channels and easily raise funds from the public. Although similar in some respects to IPO, there is a big difference between the two. First, investors do not hold shares in the company, but merely obtain a digital certificate similar to BTC, which can be used as currency in the Blockstack network.

4.3 G7 Summit: Support countries to levy digital taxes, FB does not have the right to issue coins

G7 finance ministers and central bank officials said on Thursday that Facebook's stability pass Libra raised serious concerns and must be as tightly regulated as possible to ensure they do not disrupt the global financial system. In addition, the finance ministers of various countries also agreed to impose a digital service tax on technology giants. French Finance Minister Lemaire (France is the G7 presidency) said at a news conference on Thursday that the G7 opposed the idea of companies that can issue money like sovereign countries without even having to exercise the necessary controls or Take the necessary responsibilities. Lemer said: "We cannot accept private companies issuing money in the absence of democratic control.

4.4 US regulators are investigating the Digital Stock Exchange BitMEX

The US Commodity Futures Trading Commission (CFTC) is investigating whether BitMEX violates regulations and allows Americans to trade digital passes on the platform. In response, a BitMEX spokesperson responded that according to company policy, BitMEX owner HDR Global Trading Limited does not comment on any media reports about investigations or investigations by government agencies or regulators.

Source: Tongxuntong Research Institute

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Depth | How digital currency changes financial ecology

- Read all the G7's regulatory response to Libra

- The value of BTC holdings in this country may exceed the gold reserve

- Market Analysis: There are more uncertain events. At this time, radicalism is no different from thunder.

- Babbitt Depth | Xing Shi asked "the most" OTC, the old money entered the crisis

- How to distinguish between currency currency and fund tray?

- Blockchain engineering: one of the most overlooked places in the industry