Deep analysis of Blockstack regulations

Recently, the US SEC first approved Blockstack to issue regulated tokens, and such news flooded the media. What are the US SEC regulations for digital tokens? According to what regulations does Blockstack sell for $28 million in digital tokens? This article will interpret the three ways in which US SEC SME financing: Mini Public Offering, Private Placement, and Equity Crowdfunding, with a focus on these regulations. .

Blockstack offering token summary

First, a brief introduction to the fundraising of the project. At 11:00 on July 11, the US Securities and Exchange Commission (SEC) approved Blockchain, a blockchain startup, to sell digital tokens for a total of $28 million. Blockstack applies for an exemption under the RegulationA+ terms. This kind of fundraising in the form of digital tokens through exemption has been introduced many times in the standard consensus. However, the previous cases were generally exempted from registration with Regulation D and Regulation S. In this case ( Blockstack), apply for the RegulationA+ exemption. It has certain differences in the amount of funds raised, the scope of fundraising, and the scope of the area, as well as Regulation D and Regulation S.

US SEC exemption clause

Financing difficulties are the main bottleneck faced by start-ups and small businesses. The United States intends to solve this problem by creating a variety of securities issuance registration exemption systems. Regulation A+, Regulation D, and Regulation S, which we often say, are bills that are set up to solve financing difficulties.

- Institutional admission to the first portal! Bakkt will become a major driver of the cryptocurrency market

- Bakkt plans to conduct user acceptance testing of hosting and trading today

- North drift girl invests in bitcoin: after adding 200,000 yuan, she is ready to borrow millions

According to the Securities Act of 1933, a company that issues or sells securities to potential investors must go through a registration process or exempt from the law. Therefore, for companies that want to issue securities financing, either register or issue an exemption. The path of registration for small businesses often means cumbersome procedures, high costs and lagging financing. How to find a low-cost, high-efficiency issue exemption is the main consideration for small business financing.

The Securities Act of 1933 created a number of securities issuance registration exemption systems, of which Article 3(b) authorizes the SEC to allow securities issued in a total amount not exceeding $5 million to be exempt from registration, provided that the registration is “exempted” for the public Interest and investor protection are not necessary.

Section 4(2) of the Securities Act of 1933 establishes the framework of the US private equity system and is the source of the US non-public issuance of the exempted registration legal system, but it is only a framework requirement (Article 5 of this Law does not apply) A transaction involving an issuer that is not publicly issued, that is, a sale of securities that does not involve public offerings does not need to be registered with the SEC. Under the authority of the Securities Act of 1933, the SEC enacted Regulation D in 1982, which included three exemption registration provisions—rules 504, 505, and 506. As mentioned earlier, the sources of rules 504 and 505 are derived from Section 3(b) of the Securities Act of 1933, which is a micro-issuance exemption; Rule 506 refers specifically to exemptions from private placements.

Equity Crowdfunding is derived from the third chapter of the Jobs (JOBS) Act, the crowdfunding regulations.

In short, RegulationA+ is a micro-issuance exemption, and the Regulation A+ exemption is also called “Mini-IPO” because its disclosure obligation is very similar to an IPO, and it is prepared to distribute the offering statement and the offering circular. However, the Reg A+ exemption removes the SEC registration. Regulation D and Regulation S are exempt from private placement.

Jobs (JOBS): Steve Jobs' comprehensive content system, including the simplification of IPO issuance procedures for identified emerging growth companies (EGCs), reducing the cost of issuance and information disclosure obligations; reforming registration exemptions in private equity, small-scale, crowdfunding, etc. Mechanisms to increase the convenience of distribution; increase the threshold for becoming a public company.

Regulation A+ used by Blockstack

The Regulation A is also known as the Conditional Small Issues Exemption, which is the United States Securities and Exchange Commission of 1933 authorizing the US Securities and Exchange Commission to "exempt the total amount of issuance not exceeding Specific rules for the issuance of exemptions for the “$5 million” and “public interest” restrictions. The SEC passed the final rule of the Regulation A-Plus on March 25, 2015, and amended the A Regulation. The A+ Regulations stipulate that start-ups and small businesses can raise up to US$50 million in public prosecution within 12 months, subject to eligibility, disclosure and reporting requirements, and 20 million The US dollar is a one-to-two distinction between financing and a direct exemption from the review of secondary issuance at the state level.

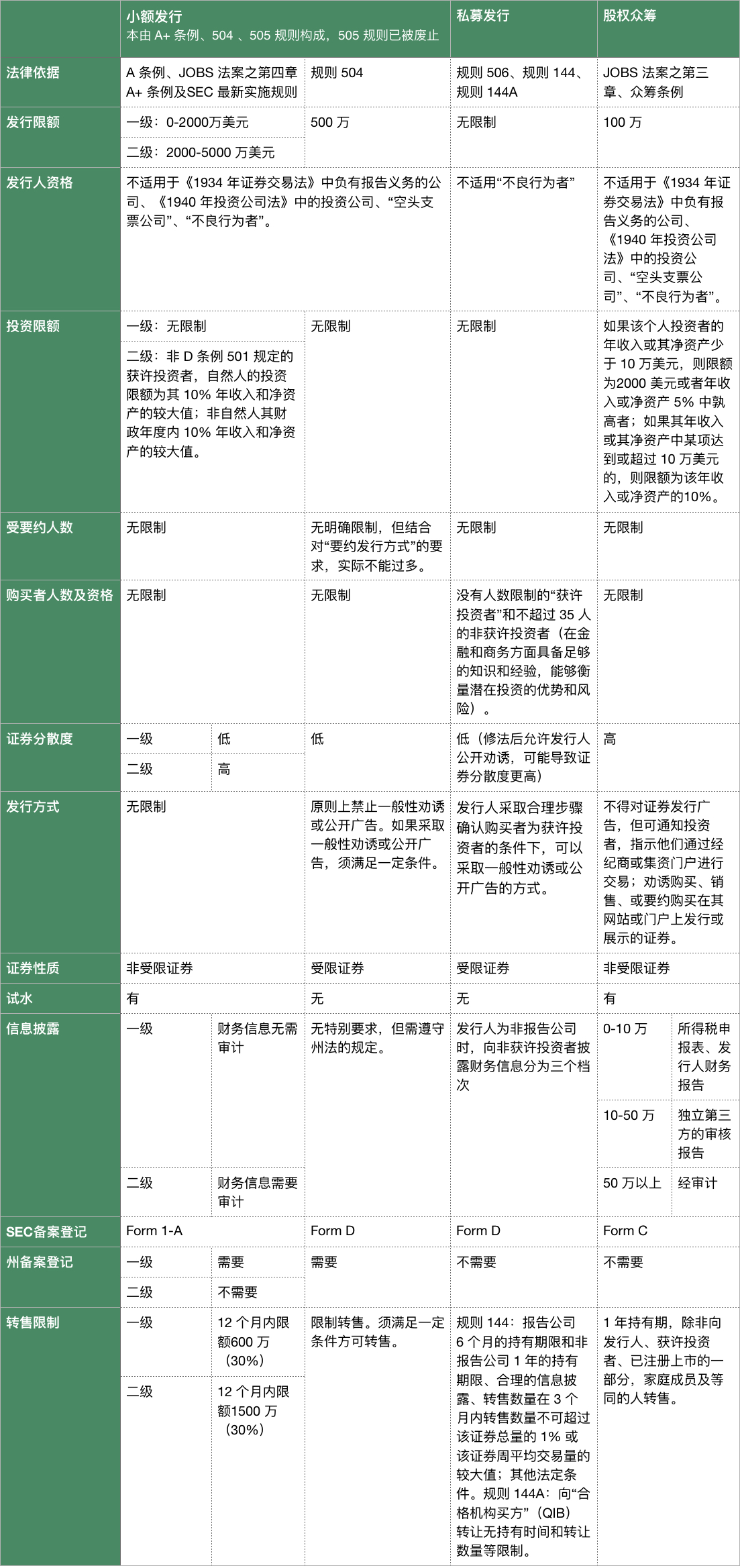

Comparison of micro-issuance exemptions with other financing methods

From the perspective of the existing securities law system in the United States, there are four main financing methods for enterprises, namely, the issuance of initial public offerings (Initial Public Offering and the issue of Seasoned Equity Offering), the mini-distribution ( Mini Public Offering ), and private placement ( Private Placement and Equity Crowdfunding. Since the registration and issuance involves a large number of subjects and complicated rules, it is not appropriate to compare with the other three financing methods. The following table only compares the three types of issuance exemptions except for the registered issuance.

In general, the main differences between micro-issuance and other financing methods are as follows:

- It limits the total amount of the issue. There is no financing limit relative to public offerings and private placements. There is a strict restriction on small exemptions, that is, “the total value of securities issued or sold within 12 months does not exceed US$50 million”, and the upper limit of Regulation D of Regulation 504 is 5 million. The US dollar, while the crowdfunding regulations set a ceiling of only $1 million.

- The supervision is more relaxed. Small-issued securities, like the other two exemptions, can be exempted from registration with the securities regulatory authority (only exempt from registration rather than exemption from supervision), and the information disclosure obligations that the issuer must bear are more publicly available in form and content. light.

- Small-scale issuance enjoys limited general advertising and public temptation. The private placement was originally banned from public seduce, but the JOBS Act made a conditional liberalization of this article, and the advantage of small issuance is no longer particularly obvious.

- There are no restrictions on the number of people to be distributed. In general, there are restrictions on the number of people or qualifications for private placements. For example, private placements are restricted investors who are not subject to quantity restrictions and other mature non-accredited investors within 35, and small issuance pairs There are no restrictions on the qualifications and number of purchasers (only the limit on the investment of non-accredited investors is required).

These characteristics determine that the micro-issuance exemption is suitable for issuers with financing needs of less than $50 million and wishing to issue securities to non-contract investors. These issuers often believe that it is important for investors to understand their corporate culture and support them in fulfilling their social mission. The identity of qualified investors is not important. In addition, some issuers want to issue securities to investors who have established relationships with them. In both cases, if the issuer adopts a private placement, it cannot be achieved because it is subject to restrictions from the permitted investors. In addition, public seizures are also a more attractive feature of micro-issuance exemptions. In today's developed Internet, companies can publicly raise capital through various means including the Internet, but as previously, with private placements This dominant position is also challenged by the release of open persuasion restrictions.

Source: Standard Consensus

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Understand the four core modules of the IRISnet economic model and re-understand the development path and potential value of IRISnet

- New York State updates the Property Collection Act to allow the government to confiscate unclaimed bitcoins

- Lawyer's point of view | Plus Token's illegal analysis and criminal identification

- Why is IPFS interesting?

- Segwit is about 2 years old, what impact does it have on Bitcoin?

- More than 100 million yuan out of funds! BitMEX was investigated and users were anxious

- QKL123 market analysis | Global interest rate cuts expected to strengthen, is expected to regain lost ground in the short term (0722)