Market analysis: Bakkt's bitcoin options performance is weak. Will the halving in May usher in a turnaround?

Interpretation Today

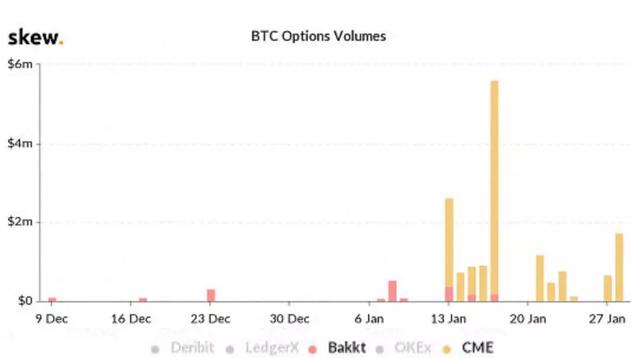

Bakkt's recently launched BTC options performance is weak. According to ICE data, Bakkt's BTC options trading volume from January 20 to 24 was zero.

Bakkt, which was launched in September last year, was born with its own halo. Not only is it backed by the parent company of the NYSE, it has also received investment from many giants such as Starbucks, Microsoft, and the planned BTC physical delivery futures for the crypto industry. The first of its kind is a direct C-bit debut.

Although Bakkt's road to going online has been bumpy, after all, there are major consortia behind it, and all parties hope to use Bakkt's funds to reverse the long-lasting bear market in 2019. And the physical BTC launched in September 2019 has also been well received by the market.

- Ten billion dollars market! How does blockchain empower digital art?

- Creating a national-level payment portal, Cambodia will launch a blockchain-based digital currency

- Under the epidemic | The attacking digital age——Blockchain events

Existing digital token derivatives exchanges are mainly divided into several categories, 1. Mainly based on single products of futures and options; 2 Both products; 3, physical delivery exchanges, etc.

For the futures industry, exchanges include not only the head exchanges known for their futures products in the early days, but also comprehensive exchanges that have performed well in the spot market in the past two years, as well as emerging transactions that want to use the derivatives market as a breakthrough. By.

By placing these companies here, you can feel how fierce the competition is. However, the entry of enterprises and competition in the industry will aggravate the standout of high-quality exchanges, making derivative products more flourishing and the industry more compliant and legal.

But just last week, the BTC options trading volume on the Bakkt trading platform was 0, because the Chicago Mercantile Exchange (CME) launched BTC options products in January 2020.

In the picture, yellow represents CME Group and red represents Bakkt. In contrast, the Chicago Mercantile Exchange (CME) BTC options contract products traded more than $ 2.3 million on the first day, and it seemed that Bakkt was overshadowed. It is worth noting that since the introduction of BTC options contract products by CME Group, Bakkt's trading activity has been decreasing.

CME Group launched a similar product one month after Bakkt BTC options products were launched-that is, January 23, 2020. From the market reaction point of view, investors seem to prefer CME Group, at least from its increasing transactions. The amount of data looks like this. You know, in the absence of any BTC options contract trading last week, CME Group successfully traded 59 options contracts.

CME Group's BTC futures contract products have two years of trading history, and their futures contract products are also one of the most liquid derivatives in the crypto token field. Finally, it remains to be seen whether Bakkt will recover when the BTC block reward is halved in May, or whether CME Group will continue to dominate the BTC derivatives market.

Market research

The current price of BTC is around US $ 9,300, and the trend has been rising recently, with a steady trend of 10,000 yuan. The highest touched 9576 US dollars. The pull up this time continued to rub near the support level. It took the trend of shock and then pull down and completed the dish washing. This kind of pull up will last longer and the space for pull up will be longer. Gradually growing, creating conditions for subsequent highs. From the hourly point of view, the Bollinger Band track opening gradually opens upward, and the short-term trend will start toward 10,000 yuan. However, due to the limited market volume, the short-term may still be dominated by shocks.

risk warning

The price of digital tokens fluctuates violently. Investing in digital tokens is a high-risk investment behavior. Investors are requested to reasonably evaluate their investment capabilities and risk tolerance, and use leverage carefully, strictly control risks, and invest cautiously. Investors are reminded to keep in mind that investment is risky, and you need to be cautious when entering the market.

Disclaimer

Personal opinions are for reference only. The analysis in this article does not constitute a recommendation for buying and selling. Reprinting is welcome, but the source must be indicated.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Super Ledger Fabric 2.0 is officially released, important updates are here

- Former Microsoft researcher proposes a breakthrough "impossible triangle" solution to solve the problem of blockchain expansion

- DeFi Monthly | Lockup Achieves Record High, Cosmos Launches First DeFi Project

- With the arrival of Brexit tomorrow, how will it affect Bitcoin?

- What will 2020 look like after the epidemic

- Ray Dalio: Preliminary Analysis of Coronavirus Impact on Global Economy

- Rethinking the epidemic in Wuhan: What can blockchain do for disease control and early warning?