Monthly report|In October, the volume of digital currency transactions increased significantly, and the equity financing market was hot.

Monthly report summary

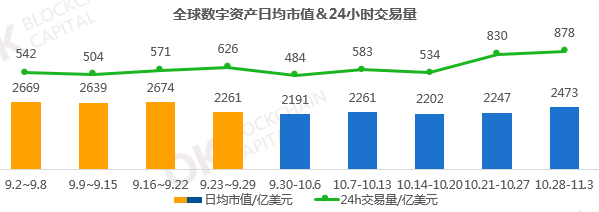

- “Secondary Market Quotes Overview”: In October, the daily average market value of global blockchain digital assets fell by 11.15%, and the trading volume increased by 18.06%.

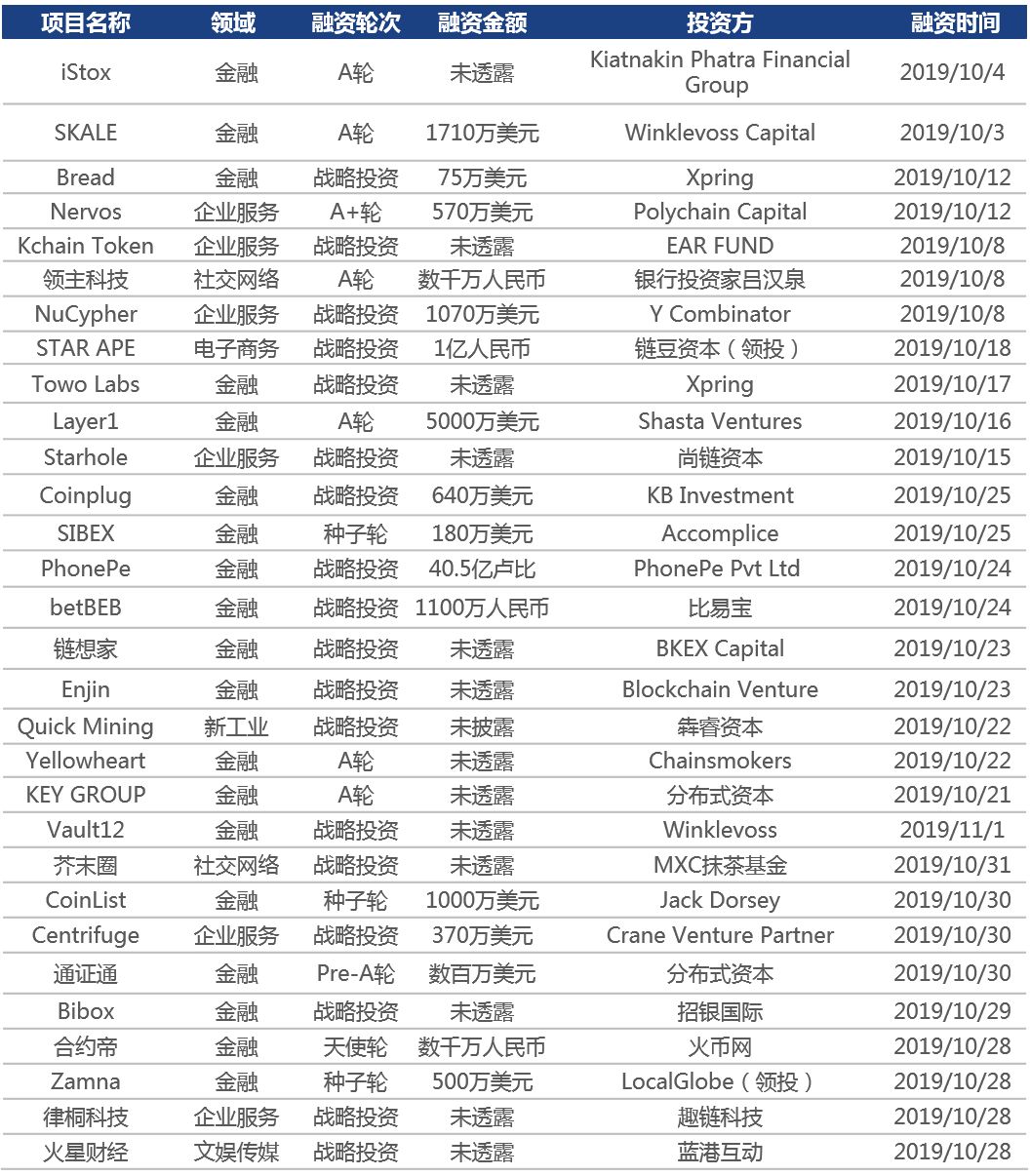

- “Primary Market Financing Analysis”: Public financing continued to face cold, and 22 projects were completed for public offering, but the total number of soft tops was only 31.89 million US dollars; equity financing was fierce, and 30 projects completed equity financing, with total financing exceeding 300 million US dollars.

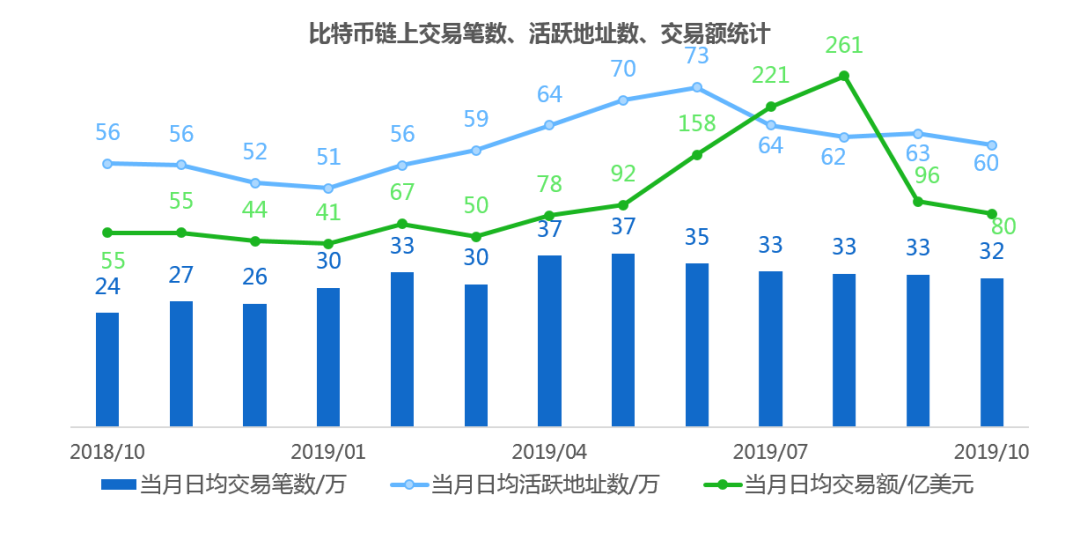

- "Analysis of data on the chain and Dapp activity": The average number of transactions per day, the number of active addresses, and the amount of transactions on the chain in the bitcoin chain have fallen.

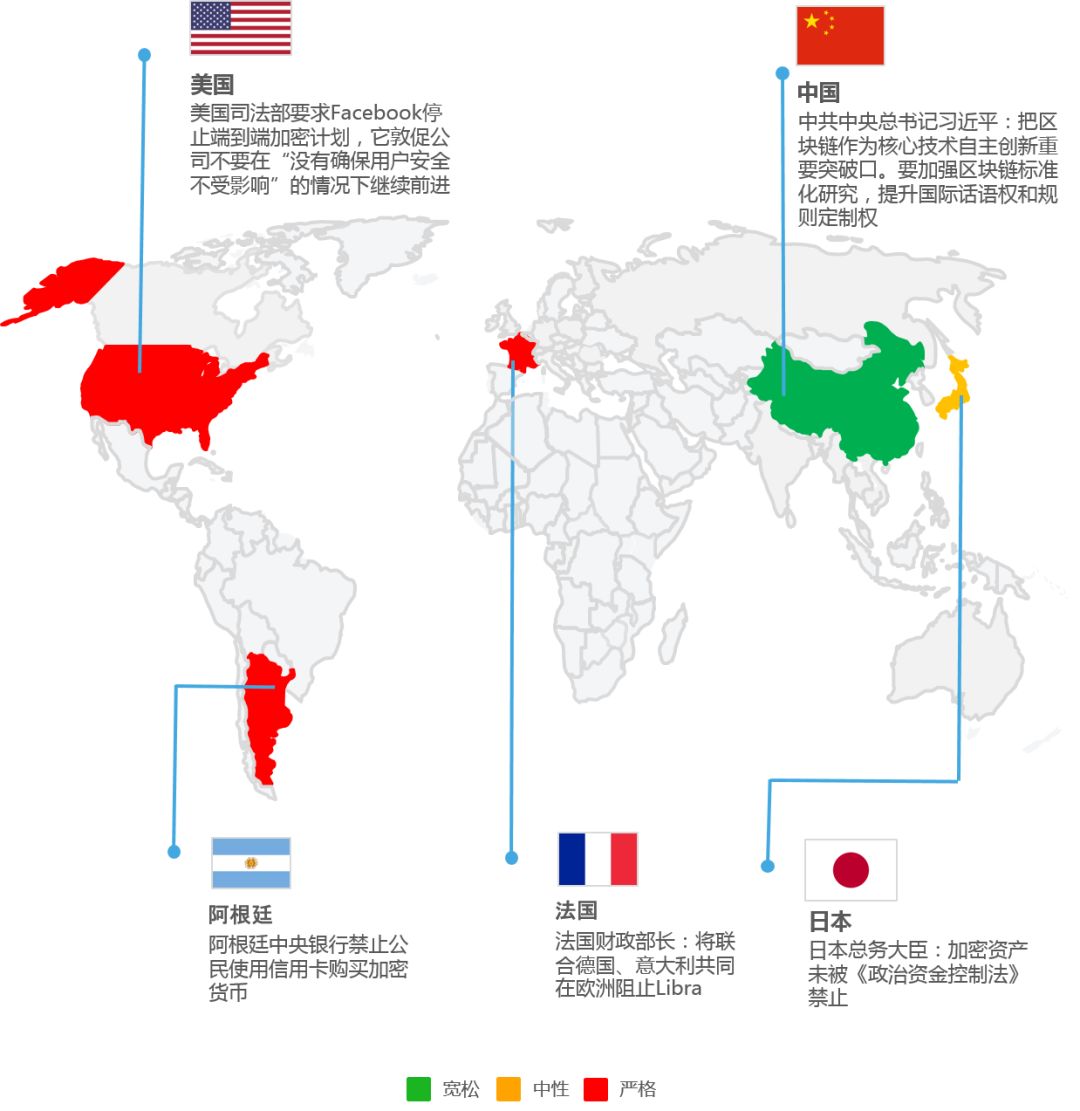

- “Hot Spots of the Month”: Taking the blockchain as an important breakthrough for independent innovation of core technologies, and improving the right to block the international discourse and rules of the blockchain.

Secondary Market Quotes Overview

At the end of October, favorable policies in the Chinese market boosted market confidence, and BTC led the encryption market, but it is still difficult to “hedge” the relatively sluggish market in the first half of the year. Overall, the average daily market value of digital assets continued to fall in October, but the average daily trading volume increased significantly from last month. Specifically, the average daily market value in October fell to 227.49 billion US dollars, down 11.15% from the previous month; daily average trading volume rose to 66.191 billion US dollars, up 18.06%.

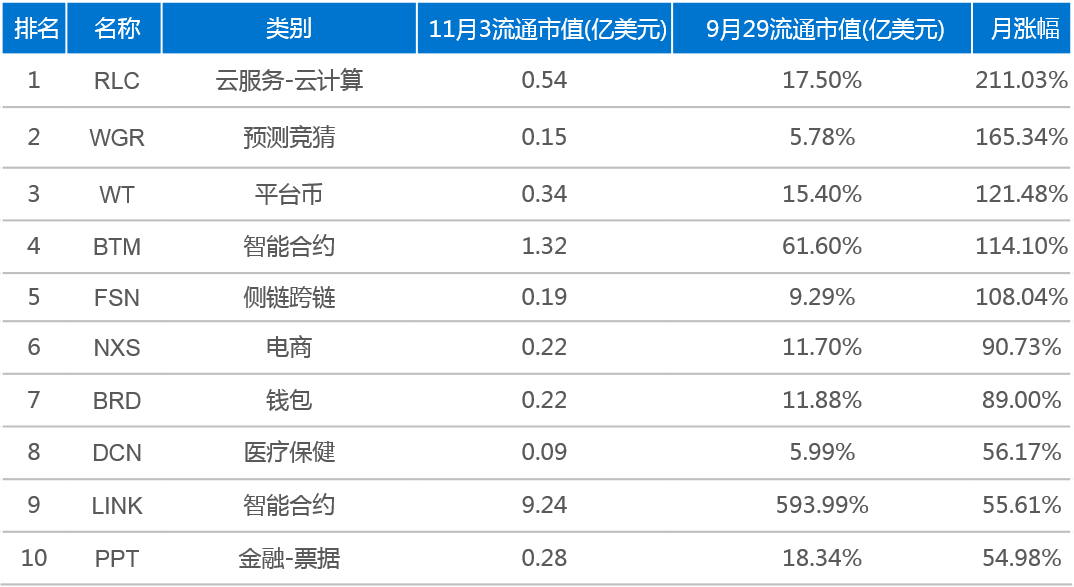

The digital assets of the market value of TOP200 are blooming.

The digital assets of the market value of TOP200 are blooming.

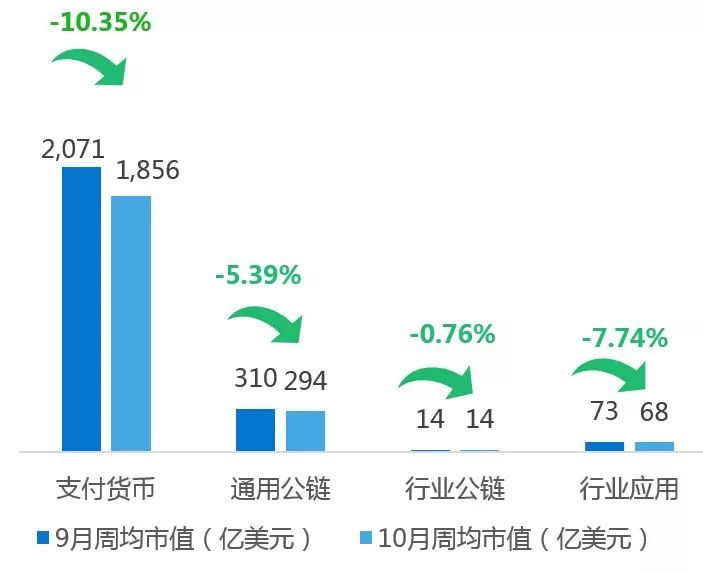

The overall weekly market capitalization of Top200 digital assets fell by 9.6% from the previous month. According to the payment currency, general public chain, industry public chain and industry application basic dimensions, this year's four major areas fell. The largest decline in October was in the payment currency sector, which fell by 10.35%.

- How to prevent personal information from leaking? Here are 2 big data blockchain application cases

- Fun! Use the Google form as a side chain and send and receive ETH with an email address.

- The listing was delayed until December, and the first coal miner will be listed on November 21.

Primary market financing analysis

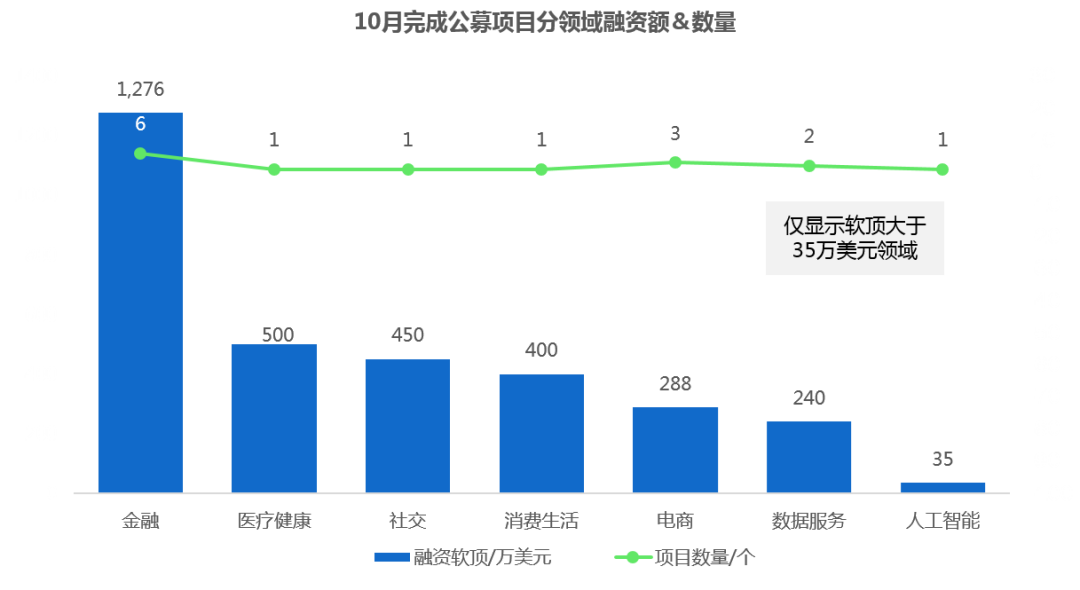

The financing situation in the primary market is less than ideal. Although in terms of quantity, the number of public offerings reached 22, up 15% from the previous month; but the total number of fundraising soft tops has not yet reached 32 million US dollars, a 93% drop from the previous month. Among them, the financial sector has the largest number of project financing and the highest soft top.

Another 30 projects completed equity financing, the number of projects increased by 10%, and the total amount of financing exceeded 300 million US dollars.

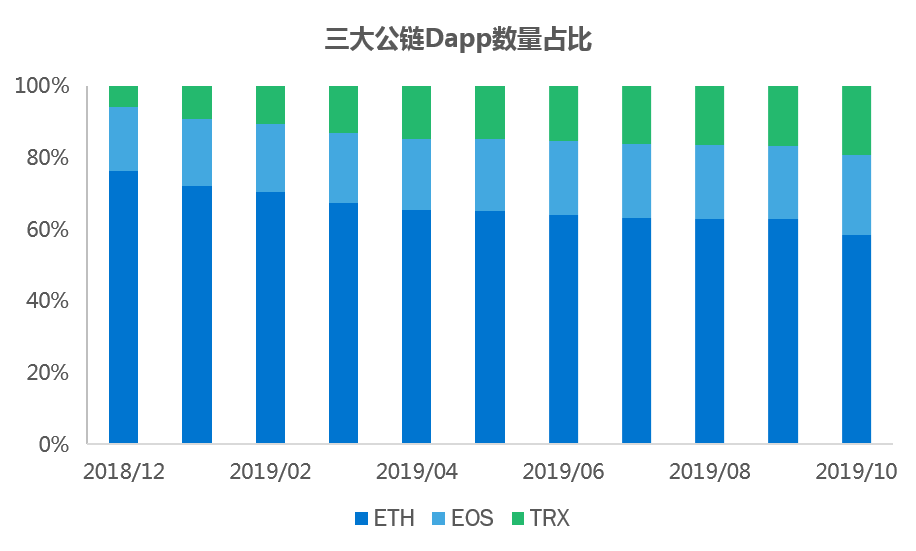

Link data and Dapp activity analysis

Source: https://bitinfocharts.com

Source: https://bitinfocharts.com  Source: https://spider.store

Source: https://spider.store Note: The above data was jointly written by OK Capital in conjunction with OKEx.

List of important global policies

Giant layout

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Counterfeit legal digital currency, "Li Gui" is rampant! The central bank reminded me three times, and there is a lot of information.

- Yao Qian: The “Before and Present” of the blockchain and the central bank digital currency

- Building a group defense group governance platform Wenzhou enterprises use "blockchain" to create a "chain of trust"

- Smart Contract Series | Smart Contract Engineering Brief: Smart Contract Engineering

- Wyoming, USA Announces First Encrypted Hosting Rule for Blockchain Banking

- Three seasons of DApps data: gaming is the leader, DeFi has sprung up

- China Blockchain Development Report (2019) | Distributed Digital Identity Development and Research