Opinion | PoS is Cheaper: Refute Paul Sztorc's "Nothing Is Cheaper Than Proof of Work" Assertion

Author: Eric Wall

Translation & Proofreading: Anzai C1int & A Jian

Source: Ethereum enthusiasts

Editor's note: Original title was "View | PoS is Cheaper"

- Under review: how to conduct due diligence on a blockchain project (technical articles)

- Financial OneAccount Blockchain Key Security and Password Algorithm Passes Password Security Test of State Secret Bureau

- "National mining pool" enters, Uzbekistan government will not only provide lower electricity prices for miners, but also launch exchange next week

Three months ago, I tweeted this picture with the following sentence:

I heard that some people think "proof of equity is not so wasteful of energy"

-EV charging pile driven by diesel engine-

This tweet was meant to be smart, but it inadvertently triggered one of my most insightful discussions on Twitter. After this discussion, my thinking on this issue has completely changed.

This article is mainly to share the insights that emerged from the discussion and my current thought process for analyzing problems. For the sake of length, please understand that this article only focuses on the economic comparison of proof of work and proof of equity, and does not involve other content.

Intro

At the beginning, the tweet wanted to reiterate Paul Sztorc's assertion that "nothing is cheaper than proof of work", which is probably the most influential public opinion on proof of work and proof of equity (Editor's Note: Chinese translation (See hyperlink at the end of the article).

In Paul's article, he believes that whether it is computing hashes or pledged assets, the labor (and the cost incurred in this process) to win block rewards will eventually be the same as the value of the block rewards paid. In simple terms, if the average block reward value of a certain blockchain is $ 1,000, then the proof-of-work miner pays up to $ 999 (but not higher) to get the maximum probability of block production, and Proof-of-stake miners will also bear the lock-up cost of up to $ 999 (and will not be higher) to pledge in the proof of stake.

Paul also argues that not only personal costs can be compared in this way, but also social costs ! In the world of proof of work, we burn a lot of energy to ensure the security of the chain; and in the proof of equity, we lock a considerable amount of capital for a long time in order to seek a fair amount of security. Paul also believes that isolating large amounts of capital from macroeconomic activities will hurt the market, hinder technological progress and even inhibit economic development. This is Paul's sharp point. It answers the reason why Bitcoin has to maintain the original design from an economic point of view, and expands the solid thinking mode that originally only considered system security issues.

I've been active in the cryptocurrency field for so many years, and Paul's point of view is basically my position when I think about it from a macro perspective. I quoted Paul in my master's thesis in 2016. Since then there have been in-depth discussions with many Bitcoin supporters, and I find that this is basically the mainstream view.

Next, let's look at the thinking that stood on the opposite side of the above point in that fiery debate, and some of my own thoughts.

What David Schwartz said: a more cost-effective PoS

David Schwartz made the following point in this discussion: Yes, miners and pledges will ultimately bear the cost of up to $ 999 to compete for a $ 1,000 block reward. But considering the security of the two systems from an economic point of view, that is quite different. Let's think about it carefully. If we want to launch a double-spend attack on these two different systems, what are the costs?

In the system of proof of equity, the reward is 1,000 US dollars per ten minute block, and the annual block reward is approximately 50 million US dollars. If the pledger considers the 5% annualized profit to be profitable, about $ 1 billion worth of capital will be pledged in. At this time, a double-spend attack must be implemented on the proof-of-stake system. At least sufficient capital must be available to control more than two-thirds of the nodes (that is, about 670 million US dollars). After the attack, these pledged assets will also depreciate significantly.

Although it is not possible to accurately quantify the cost of implementing a double spend attack in a proof-of-work system, it is certain that in some cases it is much smaller than a proof-of-stake system. For example, if a miner has accumulated more than 51% of the hash power, and has already partially or fully recovered through mining. In this case, the cost of launching a block reorganization attack (based on the last seven blocks) is far less than $ 670 million. The direct cost of the attack only required $ 7000 (7 x $ 1000) to generate the last 7 blocks. And if the block reorganization is successfully completed, the attacker can even get these seven block rewards (no matter how much money these rewards have left after completing the attack).

This is not to say that double-spend attacks in PoW systems are easier to implement, just a simple thought experiment. Although there are certainly many attack practice details that have not been fully considered in the analysis, it is still a direction to explore this issue from an economic perspective.

Think about it from another perspective: It is obviously better to pledge US $ 5 and recover it after a period of time, so it is better to destroy US $ 5. Therefore, the corresponding option to destroy US $ 5 is to pledge US $ 100 for a whole year. The opportunity cost in this way is equivalent to directly US $ 5 . At this time, although the cost of personal participation in the two systems is equivalent (about $ 5 vs. $ 5), the penalty for breach of contract is extremely unequal ($ 100 vs. $ 5)! Although the current dedicated mining equipment will cause some hardware investments to return to zero directly after the attack, this risk is far less than the huge risk of capital loss in the proof of equity agreement, even if the latter does not need to consume energy to compete. Piece.

We can say that the penalty of proof of equity and proof of work is asymmetric: under the same block reward, there will be more funds in the PoS system to take risks.

The above analysis points to many interesting conclusions. If the proof of equity can achieve higher economic security at the same cost, this means that the security budget of the proof of equity system can be less than the proof of workload, but it can still achieve considerable results. Furthermore, it means that even if we reduce the block reward, we can achieve the same security as the proof-of-work chain.

Opposition Paul: No one can control block rewards

The asymmetry mentioned above and the proof-of-stake system to reduce block rewards are not valid in the Bitcoin world. Bitcoin's operating prospects are: block rewards will stop at some point. Only the transaction fee is left to maintain the security of the system-it is obviously not determined by the consensus algorithm, but by the market's pricing of the block space. At the same time, it can be boldly assumed that these transaction fees are sufficient to support the security of the chain. Therefore, if we agree that the proof-of-work chain works well without block rewards, then the asymmetry mentioned in the above point is meaningless-it will only make the proof-of-stake chain "too safe" for the pledgee.

Eric Eric

Paul makes some sense, but his rebuttal is not inconclusive. His view is based on an inadequate assumption: Transaction costs alone can support the security of the proof-of-work chain. The transaction fees in the blockchain system fluctuate over time. At the same time, the issue of whether transaction fees alone can provide the required security has also caused many differences and debates within the Bitcoin community. We will almost certainly see that transaction fees fail to provide the necessary security budget. From this standpoint, the additional security provided by the Proof-of-Stake agreement under the same incentives is very attractive.

In the worst case (translator's note: remove the block reward), the proof-of-work chain will become unstable after stopping inflation, while the proof-of-stake chain will be sufficient to maintain only by transaction fees (according to the inference above, it can be compared PoW chain is better maintained). What's more, this means that the native assets of the PoS system may have a higher stock-to-flow ratio (Translator's Note: Stock-to-flow, commonly known as S2F, some indicators used by the Bitcoin community to measure scarcity, the more The higher the higher the scarcity)! Speculators will flock, but for a treasure system with an asymmetric security budget, speculative fever is taken for granted.

Dan Robinson says: Money is not a resource

Let us use cows and volcanoes to compare the two consensus protocols respectively. Dan believes that real-world wealth cannot be measured by how much "money" is in society. The truth is self-evident-printing money crazy will not make the world richer. Banknote printing can only enable some people to purchase goods through redistribution, but the society as a whole will not suddenly increase production capacity and make everyone richer.

However, in the currency world of proof of equity, only pledged money is an asset that has withdrawn from the economic cycle. So by the same token, will the product or service be reduced simply because some people have pledged their assets? Will not! This simply means that some people have given up their ability to buy goods and services and chose to pledge assets. For others, the options available for purchase have increased. Pledges will not destroy any assets in the real world, and therefore will not make the world poorer.

Dan then countered: "It does not happen that a lot of capital is isolated from macroeconomic activities." Just as the government made everyone poorer by printing money, so did pledgers make others richer (for a period of time) by locking in their own funds. Since everyone is a little richer, the amount of net capital in the entire system will not change.

Opposition Paul: Money is indeed a resource

Paul's point of view is that money is not water, and it doesn't fall anywhere, anywhere. In fact, it is more critical that capital can be concentrated in certain areas, and money needs to flow to useful places. Promoting society by injecting capital in a timely manner in a potential industry is far more than adding 5 knives to the pockets of every passerby on the street.

Dan's point of view is: money as a unit of measure does not hold this point of view, but the distribution process of money will release great value. (Ideally) the market will distribute money to where it generates value, and society relies heavily on these "stacked money bags" being used in production processes. Pledges will significantly impede the circulation of these capitals in the market for a considerable period of time, which means that some innovative projects that could have been funded would be difficult to continue. This is the social cost of the pledge model.

The opposite of the opponent Eric (# 1)

I understand Paul's point through the concept of "entropy." In thermodynamics, we think:

Low entropy = order = high energy

High entropy = chaos = low energy

I think this logic can be applied to economics.

Low entropy = order = high economic potential

High entropy = chaos = low economic potential

"Stacked money bags" are actually "orderly" islands in a chaotic system. Accurate capital allocation can increase the economic potential of the entire system.

Although the lock-in of some entities can make everyone else in the system a little richer, this wealth falls on everyone's head evenly. The overall economic potential of the system remains suboptimal. So Dan ’s point of view is actually “the pledge did not take away the money in the system”, and Paul believed that “though it did not take away the money, but the proof-of-stake system took away the economic potential and created system confusion!” The redistribution of wealth brought by pledges has lost the energy of the original concentrated capital.

The opposite of the opponent Eric (# 2)

The last point is not a rebuttal. I actually agree with Paul. Here are the real antithesis arguments for Paul.

Although I think Paul is correct in principle, if we think a step further and think about who will pledge, the picture of the whole problem will change immediately.

Environmentally friendly energy for mining

First of all, we reiterate the fact that the competition between pledge and mining is equally fierce. In mining, if a miner has a way to find cheaper hardware equipment and energy, he can defeat other miners because his joining makes mining more difficult. Therefore, from a macro perspective, mining is most likely to occupy the cheapest available electricity resources on the planet. The interesting thing is that the "trapped" energy that cannot be used in other scenarios is the cheapest energy.

Most of these so-called "trapped" energy sources come from natural gas, solar energy, wind energy and a large amount of hydropower. The fact that the above-mentioned energy accounts for increasing proportion in mining (the fact that green energy is used for mining) is also often emphasized by Bitcoin proponents when discussing the environmental impact of PoW. The environmental protection mentioned here is limited to the type of energy used in mining, and does not involve the energy used in the production of mining equipment.

Pledged "environmental" capital

The same can be applied to pledges. You can never compare in pledge. What is the cheapest "capital energy"? Taking Ethereum as an example, pledgers are often long-term investors in Ethereum. If a person is bullish on Ether for a long time and has decided to bullish Ether in the next 5 to 10 years, then he has absolutely no economic zero economic sost to staking on pledge. Moreover, for the entire economy, whether these people hold or pledge, the impact will be the same. More importantly, this pledger is willing to accept lower and lower returns, this feature will make them invincible in the pledge competition! These unintentionally trapped capital will defeat non-trapped capital, which will flow into production and creation, just like the mining example above.

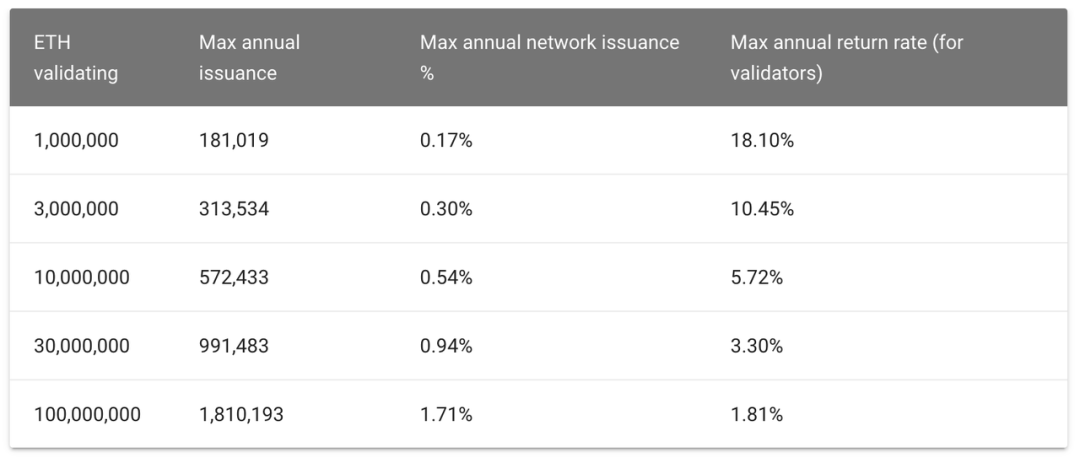

-With the expansion of the size of the pledge pool and more and more fierce competition, the income of pledges has continued to decline (source)-

When someone says "proof of equity is not so wasteful of energy"

Going back to the beginning of this picture, I thought it was funny because it mocked the proof of equity and only poorly covered the proof of work.

But the inversion came. Looking at it now, driving a charging pile with a diesel engine is not the same as letting the car burn diesel directly. A Tesla that is fully charged with a diesel charging pile can go farther on the road than a diesel car that burns the same amount of fuel! Electric engines make more efficient use of energy and are therefore really less wasteful!

By the same token, more capital is involved in proof of equity than mainstream Bitcoin supporters think. The idea of "environmental capital" is an interesting perspective that I have found myself, and it is also my transformation. I think it is worth exploring the reasons for the potential advantages of the proof-of-stake system from the perspective of social impact.

What does this mean for proof of work?

From a narrow perspective of economics, proof of equity does have advantages that I have not considered before, but I still believe that proof of work is the most robust consensus protocol in securing blockchain security and the most reliable support for building digital currencies.

This article has omitted many of the technical security issues in the proof-of-stake system—many of them are related to the impact of the transfer of equity assets (that is, the assets that guarantee system security are produced by the system itself) on the system security. I still feel confident that the workload proves to be the best consensus system after considering all the factors, but the position may change in the future. I will closely monitor the development of equity consensus.

This article is a preparatory work for a podcast show (see here) with Chorus One, a validator of multiple proof-of-stake chains.

Many thanks to Hasu, James Prestwich, Dan Robinson, Brian Crain, and Torbjørn Bull Jensen for their contributions to this article, and also to Paul Sztorc, Alex Mizrahi, Emin Gün Sirer, Zaki Manian, David Schwartz, Georgios Konstantopoulos, and many others Participation in the discussion.

-Image from Ethereum developer John Adler-

Finally, thanks to Dan Robinson, Hasu and Brian Fabian Crain.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Chengdu "Chain Technology" has recently received multiple rounds of financing, counting a total of 10 million yuan.

- Babbitt Original | FPGA Mining Machine is back in the arena, is it really profitable to mine small coins with it?

- UN experts: Don't participate in cryptocurrency conference hosted by North Korea

- Views | Ethereum "smart contracts" are too naive, Bitcoin is the real smart contract platform

- Ethereum expansion research organization Plasma Group transforms into company with $ 3.5 million investment

- Will the establishment of a regulatory sandbox in six places in China become the place for China's blockchain financial innovation special zone?

- Looking at the Future of Digital Currency Payments from the Perspective of the Li Zichen Phenomenon