After the delisting of FTX, Binance entered the options market, why did it choose the "American option" that is different?

Binance has been very eye-catching recently, withdrawing its own FTX tokens and preparing to launch new businesses such as options and mining pools. What is different about Binance's options?

On April 3, Binance's official Twitter released a message, revealing a screenshot of TestFlight, which shows "support for option trading." Later, Binance CEO Zhao Changpeng also forwarded the push.

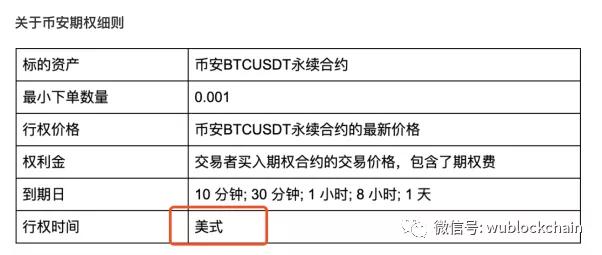

Binance stated in its introduction that “compared to traditional option products, Binance Options simplifies the option trading process to enhance the trading experience. Binance Options is an American option. It allows traders to exercise their rights at any time before the expiration date. Compared with traditional options, Binance Options have a shorter expiration date, ranging from 10 minutes to 1 day. "

- DeFi Review: Maker's leap of faith

- Market optimism shows, ETH2.0 drives prices up 20%?

- Tim Draper, a well-known venture capitalist: The epidemic will prompt people to switch to bitcoin, will stimulate the adoption of cryptocurrencies

The biggest difference from other exchanges in the currency circle is that Binance is an American option; Deribit, FTX, OKEX are all European style. European options can only be exercised on the expiration date, while American options can be exercised at any time.

The American options of Binance mainly have the following two characteristics:

1: Calculated in USDT instead of BTC, reducing the risk of BTC and ETH standard ups and downs. This is also consistent with the perpetual contracts launched on Binance are all USDT standard.

2: American options can be exercised at any time, more playability.

Interestingly, after Binance released options, FTX Exchange CEO Sam liked this post.

This person said that it would be funny if Binance launched such fraudulent two-way options (in fact, American options) after delisting FTX leveraged tokens.

This dear friend thinks that there may be fraud because he does not know the options very well, or think that the options that expire in 10 minutes, 30 minutes, 1 hour, and 24 hours are more risky to users because the time is too short The user's counterparty may be Binance. Be aware that in December 19, Binance announced its strategic investment in the FTX exchange. Later, FTX CEO Sam also expressed his recent views on Binance's delisting of FTX leverage generation. In short, it is "some people win, some lose, the losers are sad, and the winners are quiet." The reason for Binance is to protect users.

Binance and CZ are so individualized. This personality does not even take into account commercial interests, and it looks quite different. Binance delisted BSV earlier, and then OK Xu Xingming immediately reached strategic cooperation with BSV and CSW. This time, the FTX invested by myself was removed from the market, and the matcha MXC and BITMAX went online and pushed hard.

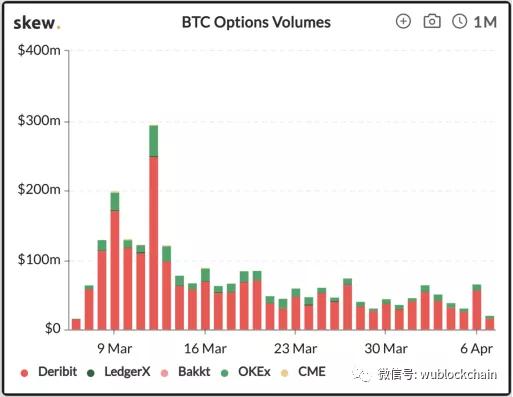

All exchanges are now beginning to increase their investment in options, but in the short term Deribit is still the leading exchange of options. The new gameplay of Binance is mainly aimed at retail investors. After all, the complexity of option trading is much higher than that of futures. Providing a way to buy only call and put options to lower the threshold to get started may introduce the option market to more people.

(Picture from skew)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Where did the Ethereum Foundation spend its money last year?

- The halving effect of BTC: is it "metaphysics", or is it a real "effect" that will have a substantial impact on the market?

- Market analysis: the rise has just begun? How much will ETH rise

- QKL123 market analysis | Buffett cuts his face, the global epidemic slows down, is it good for Bitcoin to halve? (0407)

- The Secret History of Bitcoin: I thought I just lost a few hundred, but I regretted it

- March scan of data on the Bitcoin chain: Before and after the 3.12 plunge, the data reveals the Bitcoin ecological leader

- Babbitt column | Blockchain in the digital economy helps face recognition applications new ideas