Playing a contract is like gambling. Once you are addicted, you can’t stop.

Yesterday saw the news: Biti founder Hui Yi committed suicide on June 5, and committed suicide on June 5. If things are true, then it is really another tragedy of the currency.

Hui Hui is recognized as the god of speculative operation. "I opened a 10-fold leveraged empty order of 10 bitcoins in the 5 minutes before the waterfall." "I probably opened another 600 bitcoin empty this morning." What has been said in the Bitcome group. Some people speculate that the 600 coins are the last fuse.

According to his staff, Hui Yi is a calm, well-educated, unspoken but very good boss. Such a good boss ended his life because of futures. Cherish life and stay away from futures.

Why are the risks of futures contracts so large that they often lose their money, but investors are rushing to it?

- Blockchain's seven major trends today

- Payment giant Visa launches global cross-border payment network based on blockchain

- Babbitt column | Encrypted currency investment inspiration: no risk, only wealthy

Because the futures contract is full of human greed. The contract leverage doubles the greed of human nature. Futures contracts, like the poison that penetrates the intestines, always make people want to stop.

The magic of futures contracts is that a dollar can be used as ten dollars, twenty dollars, or even one hundred dollars to invest. Vote for small money, big prize.

Everyone wants to "small and big", "a fight, bicycles and motorcycles", ten times, twenty times, fifty times, one hundred times, the greed of humanity is vivid. Once the contract is closed, the position will be broken and the principal will be put in.

Futures contracts magnify the multiples of funds, amplifying the rate of return and magnifying the risk. It can make you rich overnight, and it will make you lose your money.

In the futures market, not only the fledgling "weak chickens" but also the "old birds" who have been through the battlefield, many successful traders have exploded, and many successful traders committed suicide because of the explosion.

In 2015, Liu Qiang, manager of the Ruilin Jiachi Fund in the futures circle, committed suicide by jumping off the building. In 2017, Fu Xiaojun, an old futuresman for more than 20 years, committed suicide by jumping off the building.

In the currency circle, the futures explosions are too numerous to enumerate. Everyone is familiar with the Dfund Zhaodong futures, which has lost tens of millions of dollars. Later, relying on their own network and currency resources, they made off-site OTC and gradually made a comeback.

The Northern Territory teacher of the currency futures also had a futures position, but had to mortgage the car to get funds. Professional teachers often break positions, and ordinary players who have not undergone professional training should stay away from futures.

Last September, the girl in Chongqing promised EOS to explode overnight, with a huge loss of 120 million! According to the promise, the platform was unable to enter at the time. Because as early as more than 20 minutes ago, the OKEx platform trading area was completely paralyzed, and users were completely unable to perform any stop loss operations (closing, replenishing positions).

In the currency circle, the exchange has no regulatory risk and can easily manipulate the currency price. Therefore, the risk is even greater. In the currency circle, playing futures is even more dead. What the exchange often does is pin and cable.

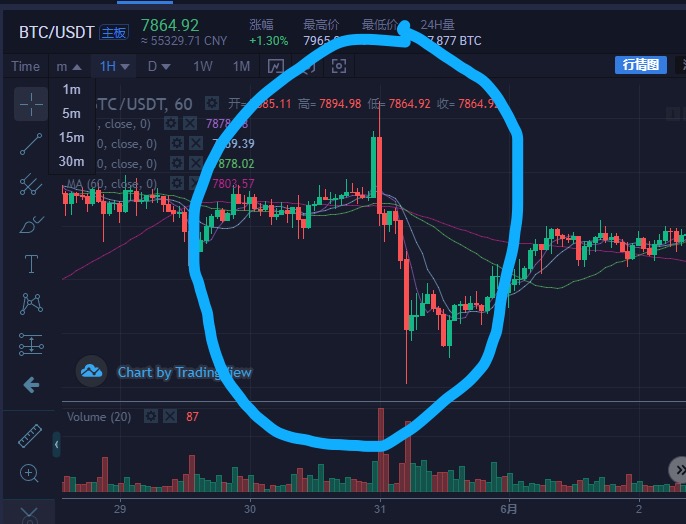

Pin: A long lower shadow line, a long upper shadow line, like an injection, inserted in the K line, this is the fuse line of the explosion warehouse, once encountered, long and double double burst, no life .

Pulling the network cable: When the exchange arrives at a critical moment, the system will take the opportunity to close the position or make up the position, and it will not be able to add a margin. It can only wait for the position to burst, and watch the funds return to zero.

Okex, the largest futures contract platform in the currency circle, is also the platform that has been won the most. The trading system is very bad. From time to time, the network cable is pulled out frequently, and many people are maliciously inserted. Many people have fallen into the pit. Okex's rights protection incidents are also commonplace. Many elderly people help their children to sit down and sit downstairs, but it is difficult to have an effect.

Many people in the spot market, a few waves of operations, can make small profits, immediately overestimate their ability, feel that the spot market is not enough, so add leverage, play futures, play from low leverage, but addiction, continue to increase leverage, Until the last burst.

A futures contract is like gambling. Once you win a few times, you have the illusion of success, and with the illusion of riches, you will become addicted, and you will be addicted to the future, and you will be unable to extricate yourself until you lose the principal. table.

For most people, playing a contract is gambling. Once you are addicted, it is difficult to extricate yourself. The most difficult thing for people to overcome is always the greedy humanity.

The short-term trend of the market is uncertain and difficult to predict. In the short run, the market is either up or down, and there is a sideways market. This is the "truth" that many analysts tell you.

Investing is to stay away from these unpredictable uncertainties and pursue certain long-term gains.

In the long run, the currency market will have a lot of room for growth. At present, it has already transitioned from a bear market to a bull market. For ordinary investors, what you have to do is to bear the currency in the bear market and wait for the bull market dividend. Don't chase up and down, don't play futures contracts, the contract is really a beast.

The bear market takes in the currency, the bull market and other income. Of course, not all coins can wait for the bull market, learn to invest in value, stay away from the air currency, and stay away from the funds.

From the perspective of wealth storage, the best is Bitcoin and Ethereum. They may not be the biggest gainers, but they are definitely the safest and safest for newcomers and aunts.

From the perspective of industry development, it is mainly infrastructure construction, public chain and cross-chain. If the blockchain is the future trend, then the great value of industry development will be reflected in these infrastructures. If you think that the future is a multi-chain pattern, then cross-chaining is essential.

For now, individuals are not optimistic about Dapp, even though I like Voice. Defi's threshold is also high, not suitable for ordinary investors.

Author: Allin block chain

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The cryptocurrency company was exposed to the issue of stocks, and the Nasdaq and NYSE said no to Reg A+

- Market Analysis: The short-term correction of the bit market is completed, and the Litecoin enters the acceleration phase.

- Alipay online blockchain medical treatment system, 60% reduction in medical time

- Gate stopped providing multiple currency transactions to the US. EOS and XRP are no exceptions. Is there a big deal?

- Encrypted currency is a revolution of thought

- Grin's first hard fork plan was launched in July: the division of labor is clear, only the east wind

- Blockchain and Trust: The Advantages of Decentralized Systems