Fortune Magazine From ambitious to defensive, what twists and turns has the crypto queen Katie Haun experienced?

Fortune Magazine The journey of crypto queen Katie Haun from ambition to defenseOriginal Title: “Katie Haun launched a $1.5 billion crypto fund—and then the industry blew up. How has she navigated crypto’s year from hell?”

Original Source: “Fortune” Magazine Official Website

Translated by: 0x26, BlockBeats

On a sunny morning in April, Katie Haun struggled along a winding path around the Stanford Dish, a large radio telescope near Stanford University in LianGuailo Alto. This three-and-a-half-mile path is a favorite of Haun, who transitioned from being a prosecutor to a VC, but she wasn’t there for leisure. Instead, her team of 11 people needed to rally in order to convince the wealthy investors of her $1.5 billion company that everything was still on track, despite the cryptocurrency industry’s shattered state.

- From hard forks to the Lightning Network, who is supporting the Bitcoin ecosystem?

- Semafor The US Department of Justice is considering fraud charges against Binance, but is concerned about a FTX-style run in the market.

- MicroStrategy plans to sell stocks to raise $750 million to purchase Bitcoin.

After the hike, Haun, her team, and a few accompanying LPs returned to Haun Ventures’ office in Menlo LianGuairk. Here, the team settled among over 70 LPs and the founders of companies Haun had invested in. Seasoned trader Wat presented the Gartner Hype Cycle chart, which has been used for evaluating technology trends over the years, to reassure the attendees. The message conveyed was that the trough of the cycle is the true period of construction.

Cryptocurrencies may experience cyclical fluctuations, but this trough was much steeper than investors had anticipated, and the collapse of many leading projects in the cryptocurrency industry only exacerbated these fluctuations. For Haun, who had risen rapidly in her career from a clerk at the Supreme Court to a key position at the Department of Justice and then to the top of the VC world, the cryptocurrency Waterloo dealt a serious blow to her carefully cultivated reputation.

Connecting the Dots

The timing was terrible. Launching a new cryptocurrency fund in the spring of 2022 was akin to starting a new chain of movie theaters before a pandemic hit. In just a few months, the roaring bull market (with Bitcoin reaching $69,000 at one point) soured; high-profile projects like Terra collapsed; and the VC industry was also hit by rising interest rates. Then, in November, industry leader FTX collapsed in a large-scale fraud case, and U.S. regulatory agencies launched the most severe crackdown in the industry’s history.

The result was that Haun raised $1.5 billion—no small amount even for Silicon Valley VC firms—but many of the best opportunities had already vanished. According to a fundraising document, this capital was spread across two funds, with Haun claiming an investment plan of approximately two years. However, this timeline is no longer applicable.

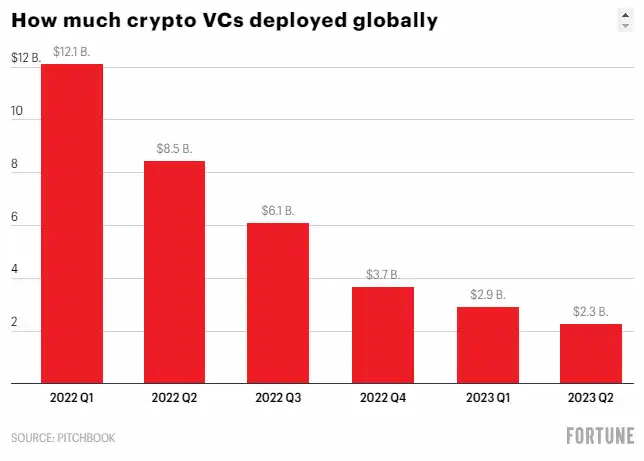

In the second quarter of 2023, venture capital funding for cryptocurrency projects dropped to $2.3 billion, a decrease of over 70% compared to the same period in 2022, as many investors shifted their focus to the more popular field of artificial intelligence. The script for cryptocurrency venture capital is being rewritten.

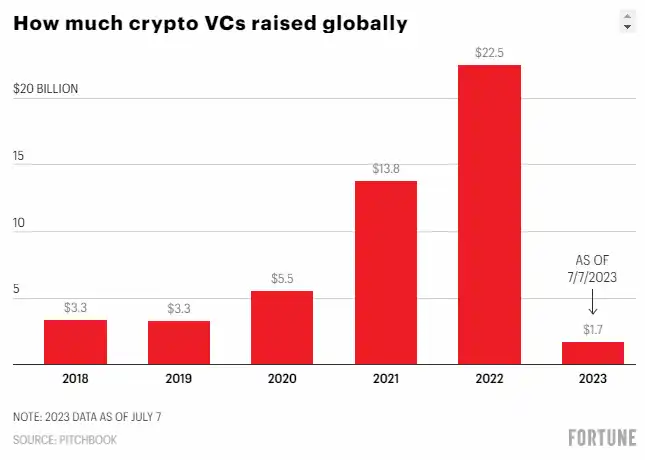

Nevertheless, some cryptocurrency VCs are still spending their reserve funds. For example, Polychain Capital has invested most of its third fund, which was raised in 2022 and 2023. While it has successfully raised $200 million for its fourth fund, other cryptocurrency VCs have not been as fortunate. As of 2023, the funds raised by cryptocurrency VCs amount to only about $2 billion, compared to over $22 billion for the entire year of 2022.

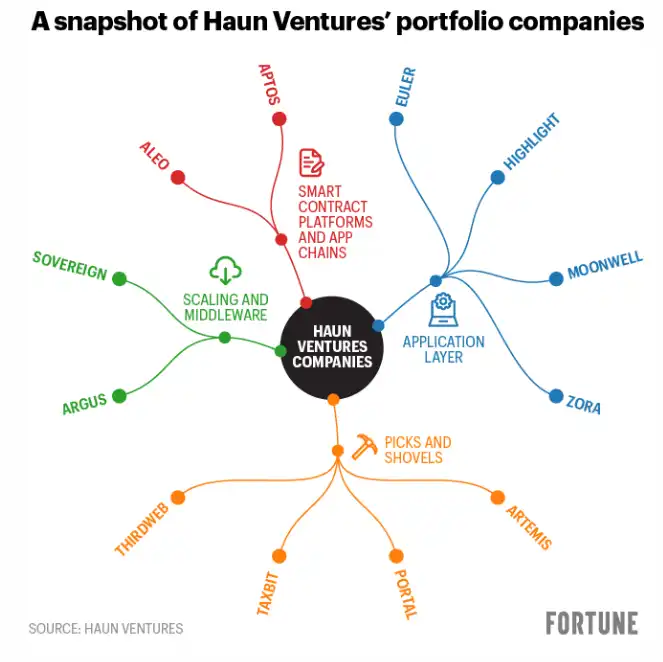

Haun Ventures is acting more cautiously and plans to spend its cash over a period of about three years. As of mid-June, the company has invested about 30% of its funds in around twenty projects, including publicly traded tokens and highly liquid tokens. These tokens include well-known cryptocurrencies such as Bitcoin and Ether, as well as small-cap tokens related to projects, which are often part of the risk investment along with traditional equity. Haun Ventures refuses to disclose the names of the tokens it holds.

Partner Rosenblum stated that during this period, the company’s investments have been almost evenly split between digital tokens and traditional equity. However, as of 2023, the company has been emphasizing investments in startups.

Haun Ventures has invested in companies such as NFT creation platform Zora and Web3 infrastructure platform thirdweb. The company also participated in the $32 million Series B financing of privacy-focused blockchain network Aleo and provided support for encrypted data analysis platform Artemis. The company plans to announce more transactions soon.

Like other VCs, Haun Ventures also leverages its influence to help startups in its portfolio. When Aleo lost access to banking-related services after the collapse of Silicon Valley Bank and First Republic Bank, Haun acted as an intermediary, introducing other banks and dispatching employees to help answer policy questions.

Amid regulatory challenges in the United States, Haun has also been seeking opportunities overseas. She recently returned from a trip to Japan, where she met with a member of parliament who is promoting the adoption of Web3.

Currently, it is too early to evaluate the returns for Haun Ventures, as assessing the performance of startups is still premature, as acknowledged by the company’s LPs themselves. More importantly, many LPs are giant investors, including the sovereign wealth fund of Saudi Arabia, and they are willing to take this risk. One investor of Haun’s company said, “Even if it goes to zero, it won’t break our investment portfolio.”

While some may appreciate the company’s relative caution, there is still pressure to see the company do something with its capital, as Haun Ventures, like other venture funds, charges management fees. The industry average for management fees is about 2%. Haun Ventures declined to comment on its management fees.

Rosenblum acknowledges that the company is threading the needle in a constantly changing market: “There are two ways you can go wrong,” he told Fortune. “One is going too fast. The other is going too slow.”

An Unconventional VC

Like other VCs, Haun also faces the challenge of refining investment strategies in black swan events. But as a woman in a male-dominated industry, she faces more – possibly unfair – scrutiny, having raised the largest ever fund by a female solo founder.

At a venture capital dinner this spring, Haun’s background came up. One diner suggested that Haun might be an authority on regulation, but lacked deep technical and transactional expertise. However, Haun’s supporters argue that this is not important.

“She’s not an engineer, she’s not a repairman, she’s not a builder,” said Fred Wilson, co-founder of Union Square Ventures, who has invested in projects with Haun. Wilson said instead, Haun brings her extensive government experience and connections.

“She’s one of the best socializers I’ve ever worked with,” Wilson said. “She can meet with anyone.”

Haun’s social skills helped her climb to the top of the VC world – and being able to tell her own story helped. While she is now known as one of the first federal prosecutors to handle cryptocurrency cases, she was not involved in the earliest cases, including the landmark takedown of the dark web market Silk Road. Instead, she led a follow-up case that took down former government law enforcement officials who stole cryptocurrency from Silk Road and later participated in investigations into the massive hacks of crypto giants Ripple and early crypto exchange Mt. Gox.

With these experiences, Haun secured a seat on the Coinbase board and later served as a general partner (GP) at venture capital giant Andreessen Horowitz, where she worked for four years and invested in top-tier companies like NFT platform OpenSea.

“Many of the investors with stories come from legal backgrounds and transition into VC,” said Rachael Horwitz, spokesperson for Haun Ventures. “We believe Katie (Haun) is undoubtedly one of the most experienced leaders and traders in the cryptocurrency field.”

Some in law enforcement are frustrated that Haun’s brief experience in the digital asset legal field has earned her wealth and fame, while others who have established themselves in this field have not enjoyed the same benefits. Especially frustrating for some is an article that referred to Haun as the “top crypto cop in Washington, D.C.” – a title she has never held or claimed.

“She didn’t work hard in the government for ten, twenty, thirty years – she only worked on a few encryption cases,” a source said. “I have to praise her for playing the game smarter, not harder.”

A former law enforcement officer recalled a small incident: a former prosecutor from the Department of Justice criticized media reports on LinkedIn, believing that these reports distorted Haun’s role in the government. The unnamed law enforcement officer told Fortune that some dramatic things happened afterwards, and Haun’s friends apparently insisted on taking down the post. Shortly after, the post disappeared.

The former law enforcement officer said that regardless of whether the reports exaggerated Haun’s achievements, Haun clearly benefited greatly from her growing fame. They said, “As far as her career in the government is concerned, she positioned herself in the greatest and best position, and that is the starting point for everything.”

The law enforcement department is a world full of ego and secrecy, and law enforcement officers can only discuss cases in specific situations, so professional disputes should be handled with caution. Other law enforcement officers defended Haun, pointing out that she never misrepresented her record.

Grant Rabenn, former prosecutor at the Department of Justice and current Director of Financial Crime at Coinbase, said, “There are definitely people who dislike her.” He asserted that 99% of the detractors “don’t have her foresight or her success.”

The relationship between the venture capital industry and the media is notoriously tense. While many venture capitalists consider themselves independent thinkers, there are also some who are thin-skinned and strongly criticize negative reports.

But unlike her former colleagues Marc Andreessen and her cryptocurrency fund partner Chris Dixon at Andreessen Horowitz, the former likes to argue with journalists on social media, while the latter prefers to stay behind the scenes. Haun, on the other hand, tends to participate in mainstream media events. She debated with LianGuaiul Krugman, sat down with Ezra Klein, and even appeared on the cover of Fortune magazine, believing that cryptocurrency and compliance can coexist. In May 2022, two months after Haun’s fund was launched, she appeared on stage with Sam Bankman-Fried and Michael Lewis at a notorious conference held by the founder of FTX in the Bahamas.

However, after FTX collapsed in November, Haun largely avoided the media attention she had once sought – except for a column she wrote for The Wall Street Journal in March 2023 and a brief interview she did for Bloomberg in December. Her team attributed this decision to focusing on trading and working with regulatory agencies. Although she granted an interview for the cover story of Fortune magazine last year, Haun declined multiple interview requests for this story.

Horwitz told Fortune that the best use of company time is to prioritize investing in companies.

They would want a very compact story

When VCs invite investors to “LP Day” events, they are usually lavish affairs. Considering the downturn in cryptocurrencies, Haun Ventures’ April gathering had a slightly frugal vibe: a large water cooler from Peet’s Coffee and picnic box lunches from La Fromagerie. LPs, founders, and the Haun team chatted on the outdoor terrace.

Brian Armstrong, co-founder of Coinbase and Haun’s entry into the crypto industry when she joined the Coinbase board in 2017, also spoke about his company’s continued aspiration to be an American company despite its struggle with US regulators.

The LP Day speeches seemed to temporarily appease investors as no one openly complained or requested a withdrawal. Part of the reason may be that Haun did not choose to invest in FTX, the notorious exchange run by Sam Bankman-Fried, whose parents taught Haun at Stanford Law School. Other top funds, including celebrities and cryptocurrency experts, chose to support this fraudster, resulting in staggering losses: Sequoia Capital lost $200 million of its investors’ funds, and LianGuairadigm allegedly wrote off its $290 million stake in FTX last year.

Avoiding the media she once embraced, Haun’s crypto promotion is now almost completely behind closed doors. She hosts legislators, fundraisers, and educational conferences for major politicians, including Democratic Senator Kirsten Gillibrand of New York, and invites founders like Furqan Rydhan from thirdweb to extol the benefits of blockchain technology.

With very few transactions (as one LP noted, Haun Ventures has not yet entered the race), most of the company’s energy seems to be focused on political PR. Chris Lehane, who led Airbnb’s policy battles and was involved in Democratic Party politics, says he spends about a third of his time on crypto policy PR, including Coinbase’s newly formed Global Advisory Board, which has the vague mission of “strengthening our efforts with stakeholders” and “deploying cryptocurrencies responsibly.”

Katie Haun’s entrepreneurial journey is still in its early stages, and the lifecycle of her first fund is still short. Nevertheless, in a time when cryptocurrencies are fighting for survival, this former prosecutor chose to work predominantly behind the scenes, foregoing the title of public advocate. And even if her company weathers the crisis, whether investors are willing to continue betting on this volatile industry remains unknown.

USV’s Wilson told Fortune, “When they go to raise their second round of funding, they will want to tell a very compact story about what they have done and how they have responded to market changes. Hopefully, they can also talk about some successful experiences.”

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Wu said July mining news Smagma big order and Samsung’s new technology, mainland promotes Fil mining machine, Little Deer Bhutan mining fund, etc.

- Cathie Wood’s latest interview Investors changing Wall Street are betting on Bitcoin and artificial intelligence

- Opinion If Curve dies, the entire DeFi market will need a considerable recovery period.

- Next BRC20? Understanding the Bitcoin Upstream Game Asset Minting Protocol Ord Games in 3 Minutes

- Ord Games Introducing Bitcoin into the Gaming Protocol

- Taking history as a lesson, combining with the macro perspective before the next bull market arrives, we still need to go through a ‘FTX-style major collapse’.

- Weekly Selection | Worldcoin launches WLD token, sparking market discussions; zkSync ecosystem suffers heavy blow; Twitter homepage logo changed to X.