Project Research | Canvas: Focused on DeFi, Layer2 Protocol Based on StareWare ZK Rollups

Edit | [email protected]

Table of Contents

1. Project Name

2. Project Vision

- Neutron: A new cross-chain DeFi blockchain on Cosmos

- Standing at the forefront of the Meme trend, how did Ben become a cryptocurrency legend from an unknown person?

- 4.5BTC night market quote video analysis

3. Features and Advantages

4. Development History

5. Team Background

6. Financing Information

7. Development Achievements

8. Economic Model

9. Fundamental Analysis

10. Industry Analysis

11. Risks and Opportunities

1. Project Name

Canvas is a DeFi Layer2 infrastructure based on StareWare ZK rollups. As an extension solution of DeFi, it unlocks Ethereum DeFi DApps, enabling users to access the DeFi world in a cheap, simple, and secure way through fast, zero gas fee transactions.

2. Project Vision

Compared with other blockchain trading platforms, Canvas aims to become a decentralized trading platform that provides users with fast, cheap, and secure trading services while providing users with the same user experience as centralized exchanges and maintaining the advantages and security of decentralization.

Specifically, Canvas hopes to improve transaction processing capabilities through ZK-Rollup technology, achieve high throughput and low-cost transactions, and process massive transactions. Users can achieve the ideal of completing transactions instantly without paying high transaction fees.

Its CEO said: “Our mission is to bring the next billion people into DeFi. We believe Canvas Connect will completely change the way people trade on Layer 1 blockchains and unlock DeFi for everyone.”

3. Project Features and Advantages

(1) High throughput and low transaction costs

Canvas uses ZK-Rollup technology to bundle a large number of transactions into a single transaction and package it into a single Ethereum transaction submitted to the main chain, thus achieving high throughput and low transaction costs. This enables Canvas to process more transactions and users do not need to pay high transaction fees.

(2) Decentralization and security

Canvas is a decentralized trading platform that uses StarkWare technology, which allows it to provide the same user experience as centralized exchanges while maintaining the advantages and security of decentralization. The transaction data of Canvas is encrypted and verified and stored on the Ethereum main chain, ensuring the security and immutability of transactions.

(3) User-friendly interface

Canvas’s clean and easy-to-use user interface helps users trade more easily. Its goal is to provide users with a more convenient and intuitive user experience, thereby attracting more users to its ecosystem.

(4) Multi-asset support

Canvas currently supports assets such as ETH, USDC, DAI, WBTC, etc., which allows users to trade with multiple digital assets and have more choices and flexibility.

CBDCs have a significant potential market in foreign exchange (FX) trading and international remittances. According to data from the Bank for International Settlements, the average daily turnover of the traditional foreign exchange market is $7.5 trillion. In 2020, the total amount of remittances for global cross-border payments was $23.5 trillion.

However, currently, traditional services such as SWIFT do not support 24×7/365 cross-border payments. This limits flexibility, resulting in delays and higher costs. Public blockchains such as Ethereum offer another option, but lack privacy, scalability, compliance, and regulatory capabilities.

Canvas has developed a blockchain-based market infrastructure to facilitate instant trading and transfer of CBDCs and foreign stablecoins.

Canvas Connect is a privacy-focused Layer 2 ZK-Rollup designed to build digital asset transfers, trading, and investment in the financial sector, providing guarantees of privacy, confidentiality, instant transactions, and low fees. The platform adopts an API-first architecture aimed at supporting financial institutions to integrate digital assets, currencies, and CBDCs into their products and trade in the digital economy.

The founding of Canvas is based on the belief that blockchain technology, digital assets, and tokenization will fundamentally change the financial and capital markets in the next decade, and trillions of dollars of securities and currencies will be tokenized and traded 24/7/365 in the globally connected digital economy.

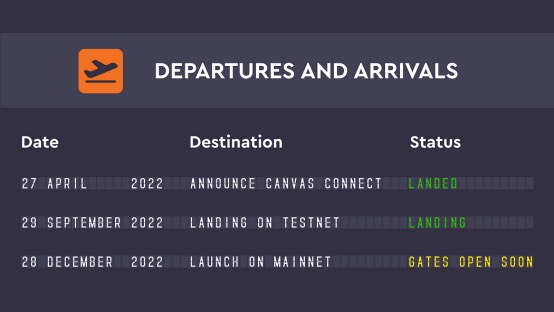

Four, Development History

2018

Canvas was created as a research project by a group of blockchain and cryptography experts to explore how to use zero-knowledge proof technology to extend the processing power of the Ethereum network.

2019

Canvas became a partner of StarkWare and began developing a decentralized trading platform based on StarkWare’s Layer 2 protocol.

Canvas has released its white paper, detailing its technical implementation and business model.

2020

Canvas announced the completion of a $2 million seed round of financing and officially launched its trading platform.

Canvas collaborated with well-known projects such as Chainlink and Kyber Network to provide more services and support.

Canvas released its V2 version, introducing many new features and improvements.

2021

Canvas launched its NFT trading market, supporting users to use Canvas for NFT trading and circulation.

Canvas announced the completion of an $8.5 million Series A financing round, led by Multicoin Capital and other well-known investment institutions.

Canvas collaborated with developers of Ethereum 2.0 to advance the development and application of Ethereum’s Layer 2 technology.

2022

Canvas has launched its testnet.

In the future, the Canvas team stated that they will continue to improve the performance and user experience of their trading platform and actively participate in the construction of the decentralized finance ecosystem.

5. Team background

David Lavecky is the CEO and co-founder of Canvas. David was previously COO and EVP of Pure Commerce, one of Australia’s earliest high-growth fintech companies. After selling Pure Commerce to Euronet, David continued to stay on to drive global business growth and collaborate with major banks and key merchants.

David is an experienced investor and entrepreneur, known in the startup community for guiding portfolio companies. He believes that the Web3 economy represents a paradigm shift in technology that will fundamentally change finance (and many other industries) in the next decade.

Earlier, as a managing partner of DoubleBay Capital, Daniel and his team invested in early-stage startups that disrupted traditional industries through innovation, disruptive technology, or new market approaches. He is also the founder and CEO of Pure Commerce, from its founding in 1997 to its sale to Euronet Worldwide (NASDAQ: EEFT) in 2013.

During his tenure at Pure Commerce, Daniel led the company through an explosive growth period, from managing millions of dollars annually to managing billions of dollars annually, with clients including Citibank, Fiserve, New Zealand Bank, and the Korea Exchange Bank, among some of the largest financial institutions in the world. In 2013, he was hired by Euronet as CEO of Pure Commerce to continue the company’s global growth. PureCommerce’s investors received returns of more than 10 times their investment.

At Double Bay Capital, Daniel and his brother David invest in some of the most exciting fintech startups around the world. Daniel’s entire career has been dedicated to building and expanding companies.

Tim Moddel is the product lead and co-founder of Canvas, and has served as a management consultant in the technology advisory field for over 15 years. As an experienced technology expert, Tim has been interested in blockchain technology for a long time, and began exploring blockchain startups and technology as an investor in 2016. He believes that these new technologies represent a paradigm shift that will completely transform the financial world and many other industries in the next decade. He is passionate about democratizing blockchain to make the new field of financial and investment opportunities accessible to the next 500 million people.

His experience covers organizations from multiple countries, industries (financial services, logistics, retail, and manufacturing), as well as public and private sectors. He has led these organizations in completing complex digital transformations and cross-business application implementations (such as finance, supply chain, and customer relationship management), helping them overcome industry barriers by developing new operational models and process frameworks.

VI. Financing Information

No public financing information has been found for Canvas.

VII. Development Achievements

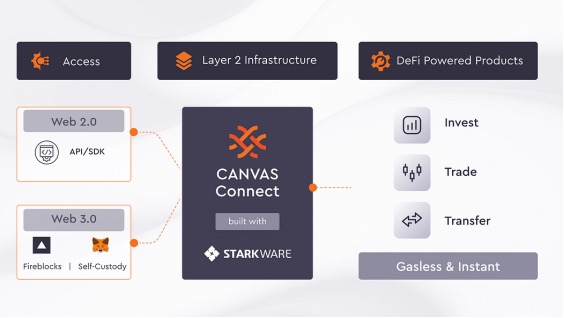

(1) Canvas Connect

Canvas Connect is a Layer 2 solution based on StarkEx technology that batch processes DeFi transactions using STARK proofs, specifically designed to provide centralized investment and trading services for financial institutions. Connect overcomes the barriers of traditional blockchain infrastructure by providing faster, cheaper, and more confidential value transfer and payment-related party information on Ethereum. For financial institutions, governments, and enterprises, they can quickly achieve blockchain-based finance without having to understand Solidity or other blockchain programming languages.

The privacy, confidentiality, instant transaction, and low cost of assets in the transfer, transaction, and investment process are the advantages of Canvas Connect. In addition, it adopts an API-first architecture design to support financial institutions in integrating digital assets, currencies, and CBDCs into their business and participate in digital economic trade.

Canvas Connect consists of the following smart contracts: StarkExchange, Committee, SHARP Verifier Proxy, SHARP Verifier, FriStatement Contract, Merkle Statement Contract, Memory Page Fact Registry, Cairo Bootloader Program.

For the current system, using DeFi technology directly is too difficult. To address this issue, the market’s response is centralized CeFi companies such as Voyager and Celsius. However, CeFi faces many problems and can cause many investors to lose everything when the CeFi company suspends withdrawals and goes bankrupt. These companies collect user deposits and put them into an opaque black box, which separates DeFi from the chain. On-chain DeFi allows investors to have complete control over personal assets. Independent DeFi projects such as AAVE, Compound, and Ribbon have proven that they can withstand multiple market crashes. This is because the platform always maintains custody of the collateral, so the loan always has the ability to be repaid or liquidated immediately before it becomes unable to repay, and there is no counterparty credit risk.

Canvas Connect allows traditional Web2 businesses to easily integrate with DeFi targets without trust in any centralized or off-chain activities, and without any centralized counterparty risks, providing a simple, fast, and secure solution for any Web2 business to gain all the benefits and security of DeFi.

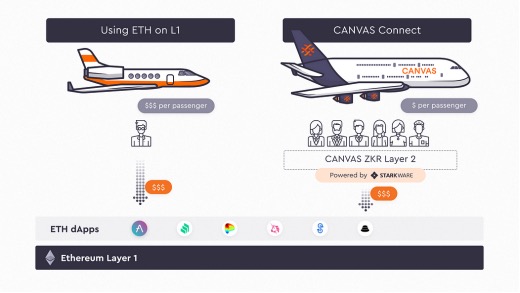

The larger the ecosystem on the blockchain, the greater the value. Ethereum is the largest L1 smart contract-it has the most dApps, the largest TVL and transaction volume, which means it contains the greatest opportunities and the best prices. However, the problem with Eth L1 transactions is that they are very expensive, which causes most investors to hesitate. Ordinary users entering the DeFi field for the first time will choose a small part to invest in (also considering wallet balance, otherwise the transaction will fail due to insufficient balance to pay Gas fee), but when the Gas fee for a single transaction may be as high as hundreds of dollars (in and out), DeFi deviates from its original intention.

Another challenge is dynamic pricing. If many people are trading on the chain, those who are willing to pay higher gas fees will be at the front of the queue.

However, Canvas connect is completely without Gas fees, and users can trade as they please without considering the wallet balance that needs to pay Gas fees.

Canvas believes that the three key functions of DeFi transactions are:

Investment-any amount of Ethereum L1 dApp without gas.

Transaction-a new way to buy/sell/trade on L2 without paying Gas fees.

Transfer (payment)-transfer immediately from one wallet to another without paying Gas fees.

(2) Canvas market application

Canvas Lend – Open Term Lending Market

Canvas Lend is an application that allows market participants to deposit tokenized collateral and lend during an open term. Canvas Lend provides significant transaction cost savings and increased transaction transparency.

Participants can choose between fixed or floating interest rates depending on their preferences and circumstances. All lending transactions are recorded on a distributed ledger accessible to all parties involved in the transaction. This not only ensures transparency, but also reduces errors and reconciliation risks during the lending process.

Canvas Repo – Secure Fixed Term Loans

Canvas Repo is an application that enables financial institutions to exchange tokenized collateral for cash. Borrowers and lenders can access liquidity through a new liquidity pool with flexible terms, low risk, and 24/7 operations. Canvas Repo is committed to improving bank liquidity management processes and reducing operational risks.

Using blockchain technology, Canvas Repo transforms the repo process by enabling instant trading and settlement through cost reduction. Canvas Repo can facilitate loan terms of days or even minutes, which is impossible in the current system. Participants can choose terms, borrowing amount, collateral commitment, deposit amount, and payment currency.

CFX – Tokenized Forex Trading

Canvas’s CFX is a low-cost, low-risk, 24/7 forex trading platform.

CFX enables frictionless, 24/7 trading of CBDCs and digital currencies in forex trading and international remittances. Compared to traditional forex trading and remittance networks, CFX significantly improves speed, reduces risk, and lowers costs.

All trades on the CFX platform are settled atomically, reducing counterparty risk and improving reconciliation. This ensures financial institutions can execute trades with complete confidence and reduces the risk of cancelled trades.

Prime – Digital Asset Portfolio Management

Prime is Canvas’s portfolio management system that provides a web-based comprehensive reporting system for financial institutions and their clients to manage the entire digital asset portfolio.

Prime has four native modules: valuation and performance; analysis and research; trading and execution; ecosystem partnership.

Sicuro – Confidential Information Transmission

Sicuro is a communication system that uses Canvas Connect (privacy Layer2) to securely transmit financial transactions and confidential information between two parties on a public blockchain. The system ensures that parties can communicate securely on a public blockchain while protecting the privacy and confidentiality of transaction details. Information packets are encrypted with Ethereum, and message confidentiality prevents unauthorized access to sensitive information.

Canvas Pay – Payment and Liquidity

CANVAS Pay is Canvas’s real-time payment infrastructure that enables instant transfer of multiple currencies between financial institutions. By providing an instant end-to-end solution, Canvas simplifies cross-border payments, enabling financial institutions to transfer CBDCs, tokenized bank deposits, and stablecoins. Transaction information is secured by Canvas Connect Layer 2 for privacy, meaning immutable transaction data is written to the blockchain but is not visible to the general public.

Eight, Economic Model

Canvas currently has no token.

Nine, Fundamental Analysis

When analyzing Canvas’s fundamentals, it is best to start with the most basic business it needs to address. One of the biggest challenges that DeFi faces on its path to mainstream adoption is the high transaction fees that users encounter on Layer 1 (L1) blockchains such as Ethereum. It’s like an individual flying on a private jet, where one person pays for all the fuel costs. Like fuel prices, L1 transaction fees can be highly volatile and make investing in L1 DeFi a risky game because users cannot determine the cost of entry and exit. Additionally, these fees pose an important obstacle to the adoption of mainstream trends.

What Canvas is doing is batch processing multiple DeFi transactions into a single proof through DeFi pooling, CANVAS Connect, allowing investors to “share L1 bills” and benefit from efficient, gasless, and ultra-low-cost transactions while still enjoying the security provided by the Ethereum mainnet. The logic is similar to a major change in the airline industry. When Airbus and Boeing introduced high-capacity commercial aircraft such as the A380, it provided the general public with the opportunity to travel by air at low cost and high speed because the more passengers there are, the less each person pays in fees.

The Canvas team has stated that Canvas Connect is committed to being the leading airline, providing users with cheap tickets to the most popular DeFi destinations on Ethereum L1. At the same time, it makes it easy for more ordinary users to invest in DeFi in an intuitive way.

Currently, Canvas’s TVL (Total Value Locked) is 8.43 million, which is lower than Starknet’s TVL of 43.6 million. TVL data can also indicate that networks focused on DeFi projects have lower scale and value anchors than comprehensive networks.

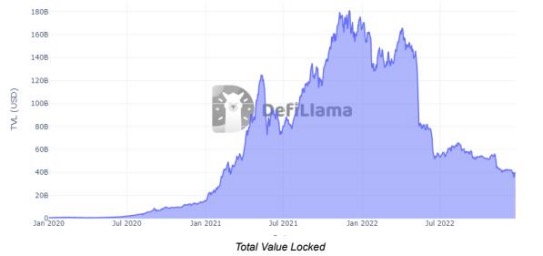

10. Industry Analysis

Looking back the development history of DeFi, DeFi emerged in 2019 and was defined as the first year of DeFi. At that time, the total value locked (TVL) of DeFi was $270 million. The momentum continued into 2020, until Compound launched its governance token COMP and initiated the first wave of liquidity mining. Since then, the TVL of DeFi has continued to grow.

According to industry data, as of early 2022, the total value of the DeFi market has exceeded $40 billion, compared to $2 billion at the same time in 2021 (as of November 3, 2021, TVL has reached $269 billion). In the first quarter of 2023, DeFi TVL will exceed $83 billion (DappRadar).

Compared to traditional finance, the decentralization and openness of DeFi, the autonomy of assets, and the low threshold and low cost of entry for users to enter DeFi, all make DeFi more and more popular.

Currently, DeFi projects are also showing a trend of mutual competition. Maker protocol, Compound lending protocol, Aave lending protocol, decentralized exchange SushiSwap, liquidity staking Lido protocol, DEX Curve, etc., all attract more users with their own advantages in the DeFi field.

Especially liquidity staking has attracted a considerable market share in 2021-2022, mainly driven by the Lido protocol. The Lido protocol is built on the Ethereum blockchain using proof of stake (PoS) consensus, which allows users to stake the blockchain’s native asset to earn staking rewards and tradeable tokens representing their staked position.

Another factor driving the growth of DeFi TVL is yield farming protocols, which reward users for staking or providing liquidity on their platforms rather than directly in the target protocol. The driving force behind this is Curve.

Looking at the development achievements of Canvas, Canvas mainly solves the problems faced by traditional finance, including collateral, liquidity, security, privacy and services, and has less involvement in the core of DeFi. For example, the Canvas Repo application only tokenizes collateral, which the author believes is only superficial.

11. Risks and Opportunities

Opportunities

The Digital Finance Cooperative Research Center in Australia, in conjunction with the Reserve Bank of Australia, has invited a small number of companies to explore 14 use cases for eAUD (digital Australian dollars). These use cases range from facilitating offline payments to providing businesses with tokenized invoices and even livestock auction business. Canvas is one of the few companies participating, and it will pilot forex settlements using Circle’s USDC stablecoin and eAUD in collaboration with StarkWare.

In Canvas’ view, the Web3 economy made up of blockchain, digital assets, and DeFi will be the driving force behind a paradigm shift over the next decade, fundamentally changing finance and capital markets.

Canvas CEO said: “Web3 will revolutionize the way we interact, transact, and share digital assets in the digitized information world of the Internet. Investors can execute investment strategies simply and securely with Canvas. Issuers can tokenize assets, unlock liquidity, and enter a new global capital market based on blockchain technology.”

Risks

Canvas’ risks are almost identical to those of the DeFi market.

Security risk: DeFi projects often require users to store digital assets in their smart contracts, which carry the risk of vulnerabilities or attacks.

Legal risk: DeFi projects typically involve unregulated financial activities and may face legal challenges from regulatory authorities.

Market risk: The token price of DeFi projects is subject to market supply and demand factors, including market volatility, competitor activity, and overall cryptocurrency market performance.

Liquidity risk: If the market depth of a DeFi project is insufficient or there is a lack of sufficient liquidity providers (LPs), users may not be able to trade at the desired price or withdraw assets.

For Canvas, smart contract vulnerabilities, policy, market price volatility, and liquidity are all challenges facing Canvas.

Reference:

https://canvasdefi.medium.com/canvas-connect-the-layer-2-scaling-solution-for-defi-ea088ee41b07

https://canvasdefi.medium.com/canvas-connect-c7bad54f14d7

Disclaimer: This is a Web3 Chinese editorial work. The content only represents the author’s position and does not constitute investment advice. Please handle it with caution. If the article/material infringes, please contact official customer service for processing.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- What is the problem with the current peak game of players less than 3 ‰ of Steam?

- Axie Infinity, a cute blockchain game

- Can 2020 games become a solution to the blockchain game?

- Blockchain + football: is grass or leeks on the green field?

- Not enough for 1000 years: a crypto art piece sold for 160,000

- Decentraland: Will it be the "Second Life" in the blockchain era?

- Virtual world Cryptovoxels on Ethereum-investment logic behind 30x plots