Inventory of the top 5 Ethereum GAS consumers

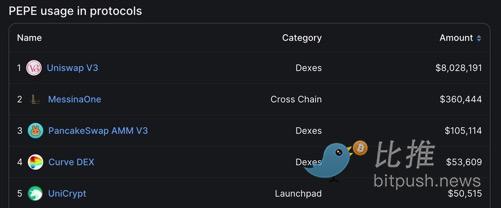

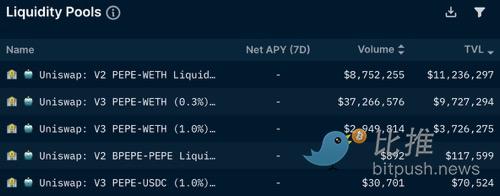

Liquidity for memecoins started in V2, but with professional market makers entering the game, most of the trading volume for more mature memecoins now flows through the more capital-efficient (and complex) centralized liquidity of Uniswap V3 deployment.

jaredfromsubway.eth

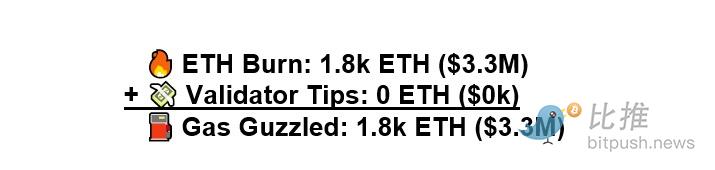

An anonymous MEV sandwich bot has been consuming gas fees, with one address, jaredfromsubway.eth, continuing to attract significant attention.

- Future Development History of NFT Derivatives: From Commodity Speculation to Financial Speculation, Gradually Abstracted Asset Symbols

- Why did Ethereum have two brief outages in a row? An analysis of the causes of the incident.

- After the explosion, searching for the past of BRC-20

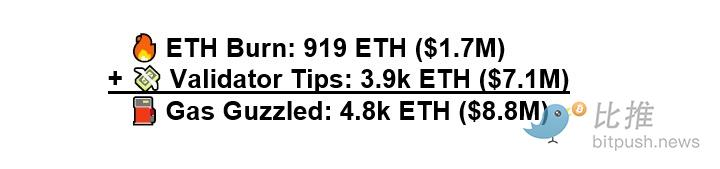

jaredfromsubway.eth launched in late February, emerging as the leading MEV bot in the race, far exceeding other competitors, and netting $6.3 million in less than three months. On April 17th, over 60% of blocks contained transactions from the bot, causing fees to skyrocket, which have persisted since.

Sandwich attacks are a viral form of MEV that manipulate execution prices by front-running user order flow. They are particularly common in low liquidity pools, a common feature of meme coins, as attackers can easily pump prices with relatively little initial capital.

The entire transaction occurs within a single block, with the attacker not bearing any risk in the trade.

However, it should be noted that sandwich attacks are not without risk: bots must have inventory funds to initiate attacks, thus generating risk across blocks. For this reason, many sandwich bots specialize in holding ETH and stablecoins, avoiding exposure to memecoin positions as much as possible. jaredfromsubway.eth profits by concentrating efforts on developing fewer meme coins, which are then exchanged for more stable tokens.

Tether (USDT)

In terms of volatility, USDT and memecoins are almost night and day, with USDT being quite active throughout the entire meme speculation frenzy. USDT’s market capitalization has been on the rise, increasing by $64 million (0.8%) over the past week, which could be a signal of broader crypto market risk aversion.

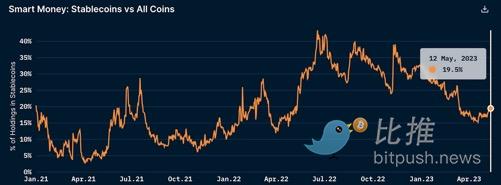

Smart Money continues to increase their net stablecoin exposure, rising 1000 basis points from the low point on April 17th to 19.5%, the day after meme coin prices briefly spiked, which is no coincidence.

The heavy use of Tether contracts is a direct result of the decreased certainty around the direction of crypto prices. It’s not surprising that many are retreating to stable assets as the memecoin projects that have disrupted past cycles’ local tops.

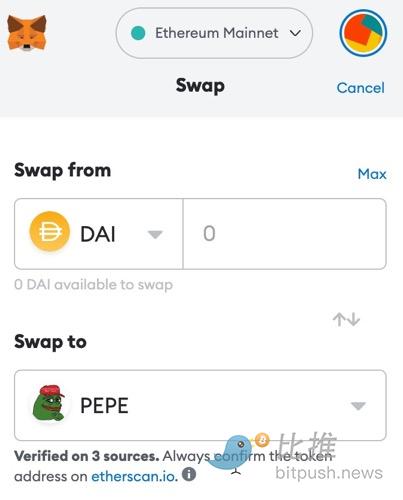

MetaMask

Web3 wallets have been working hard to improve their user experience. The Ethereum gas fees consumed by the MetaMask exchange router is a testament to the progress it has made in this area.

MetaMask Swap is an in-wallet exchange that aggregates data from DEX aggregators, market makers, and DEXs to ensure better prices and network fees and slippage protection (a very useful tool to prevent sandwich attacks).

While charging a 0.875% service fee for all orders, users are not scared away by this feature, and perhaps the most obvious driving factor for the success of MetaMask Swap is that it can facilitate the rapid exchange of memecoins.

The traditional crypto transfer route requires users to go from CEX to wallet to DEX to get their tokens, and MetaMask is streamlining this process, providing a smoother interaction experience for potential token buyers.

Arbitrum

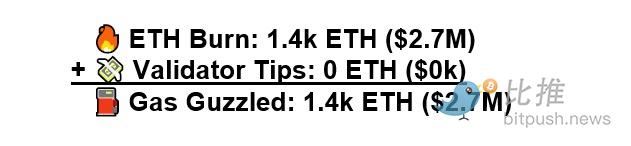

When L1 is congested, users flock to Ethereum’s rollups projects.

The DeFi-centric Arbitrum has been a major beneficiary of this shift, with daily trading volumes staying in sync with Ethereum itself since the release of ARB tokens in mid-March.

Daily trading volume on Arbitrum has been hovering around the one million mark, with memecoins further driving L2 activity. On the day PEPE really took off (April 29), on-chain transactions increased by 342,000 (38%).

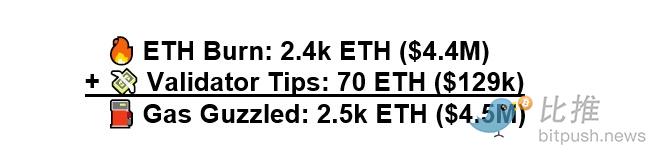

While the correlation isn’t always perfect, changes in transaction count on Arbitrum typically mirror those on Ethereum. As the memecoin frenzy begins to cool off, demand for trading on rollup solutions has decreased, as evidenced by the rapid drop in transaction count on Arbitrum. If the hype picks up again, gas consumption on Arbitrum and rollups could see another increase.

Conclusion

The memecoin season is often simplified as a brute, price-only process.

Some tokens seem to have the ability to achieve multi-billion dollar market caps overnight, making it easy to overlook the widespread impact of this frenzy on the Ethereum landscape. Whether we will see a new wave of frenzy is unclear, but one clear fact is that even in cases of price declines, the memecoin sector can dominate the gas consumption rankings and generate a huge demand for block space.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Facebook’s issue of stable currency is likely to fail

- Vitalik: Radical Market, ZK, Privacy and more

- Interview with She Knows|Exclusive dialogue network project TOP Network, Fetch.AI, IEO will continue to fire?

- Interview with She Knows | Dialogue with IEO Exchange: Really Disguised ICO? Is it going to be a chicken feather? Faced with compliance risks?