QKL123 market analysis | Emergency rate cut + quantitative easing again, the dollar fell and gold rose … Bitcoin will welcome the big test (0316)

Summary: Yesterday evening, the Federal Reserve cut interest rates for the second time in a month and launched a US $ 700 billion quantitative easing plan, but US stocks did not buy it, and global capital panic continued. Affected by the news, bitcoin has pinned upwards, but today fell below support and continues to explore for a short time. In the short term, Bitcoin will continue to be limited by global liquidity, but in the future, with the strengthening of quantitative easing in various countries, it is expected to turn around.

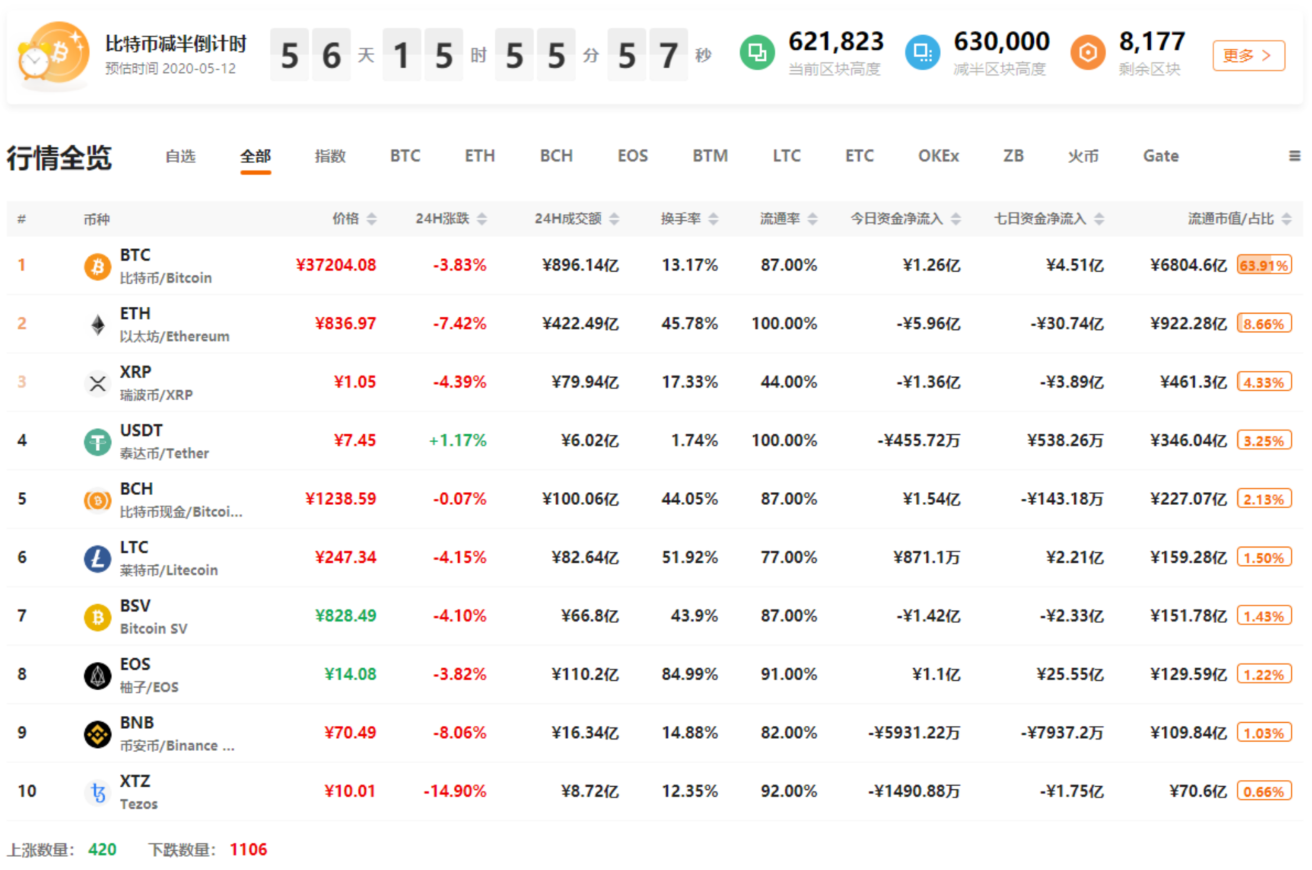

At 15:00 today, the 8BTCCI broad market index was reported at 7223.10 points, which rose to -6.00% in 24 hours, reflecting a sharp decline in the broad market; the total turnover was 886.367 billion yuan, a 24-hour change of + 2.93%, and market activity increased slightly. The Bitcoin strength index was reported at 93.17 points, with a 24-hour rise or fall of 1.44%. The relative performance of altcoins in the entire market has weakened significantly. The Alternative sentiment index is 9 (previous value 12), and the market sentiment is expressed as extreme fear. The external discount premium index was reported at 105.99, with a 24-hour rise or fall of + 1.10%, and the strength of OTC fund inflows increased significantly.

Analyst perspective:

- A quick glance at Bitcoin's bloody grandson BSV and the man behind him

- Forbes: What effect does the Fed's interest rate cut to zero have on cryptocurrencies?

- DeFi Weekly Selection | After 312 plunge, Maker enters self-help moment

Yesterday evening, after an emergency rate cut of 50 basis points in early March, the Fed suddenly cut its interest rate by 100 basis points for the second time. The target range of the federal funds rate has been reduced to 0% -0.25%, and the quantitative easing program has been launched, and a large-scale stimulus of US $ 700 billion will be launched in a few months. In less than a month, the Fed has extinguished the interest rate cut card, but the market's response has intensified: the three major US stock index futures did not buy it, opened lower and lowered to a meltdown. Affected by the incident, the US dollar index weakened significantly today. Gold, as a safe haven for sovereign currencies, rose as much as 3% during the session.

At present, there is still no obvious inflection point for the new crown epidemic abroad, and the downward pressure on the global economy has further increased. At the same time, the debt crisis on the verge of superimposing once every ten years or so has brought huge systemic risks to economies such as the United States. If it cannot be eliminated within a limited time, it will likely trigger an economic crisis similar to 2008. Over the past decade or so, US corporate bonds have nearly tripled, especially BBB-grade low-level bonds have increased nearly five-fold, and the imminent maturity of "junk debt" has caused market concerns. Moreover, the US Federal Reserve ’s current US $ 700 billion stimulus plan is far less stimulating than the US $ 800 billion in the subprime crisis.

On the Bitcoin Genesis Block, "Satoshi Nakamoto" recorded the headline of the Times headline: "On January 3, 2009, the Minister of Finance was on the verge of implementing the second round of emergency bank assistance." The sentence shows the original intention of "Satoshi Nakamoto". However, Bitcoin, as a decentralized peer-to-peer payment system, has recently shown a high degree of linkage with the performance of US stocks, making investors question "digital gold". Bitcoin has the dual attributes of risk assets and safe-haven assets. Recently, it is mainly affected by the related factors of the former: the risk of capital liquidity triggers a chain reaction of "cash is king", and even downward pressure on gold.

At present, the sentiment of global capital markets is still extremely unstable. Under the downward pressure of risky assets such as US stocks, the price of Bitcoin will be affected. As for when the turnaround will come, follow-up also depends on the intensity and breadth of quantitative easing in various countries. Only when sovereign currencies such as the "King of Cash" and the US dollar are expected to depreciate, mainstream funds will seek safe-haven assets such as gold, and Bitcoin with anti-inflation risk will usher in a real test.

First, the spot BTC market

Affected by the Fed's interest rate cut news, yesterday BTC saw a spike in the market, approaching a maximum of $ 6,000. But in the next hour, it was beaten back to its original shape, indicating that there was a lot of pressure above. Looking at the distribution of chips recently traded, the $ 5,300 area is the most concentrated, but it fell below today and will continue to test support shortly.

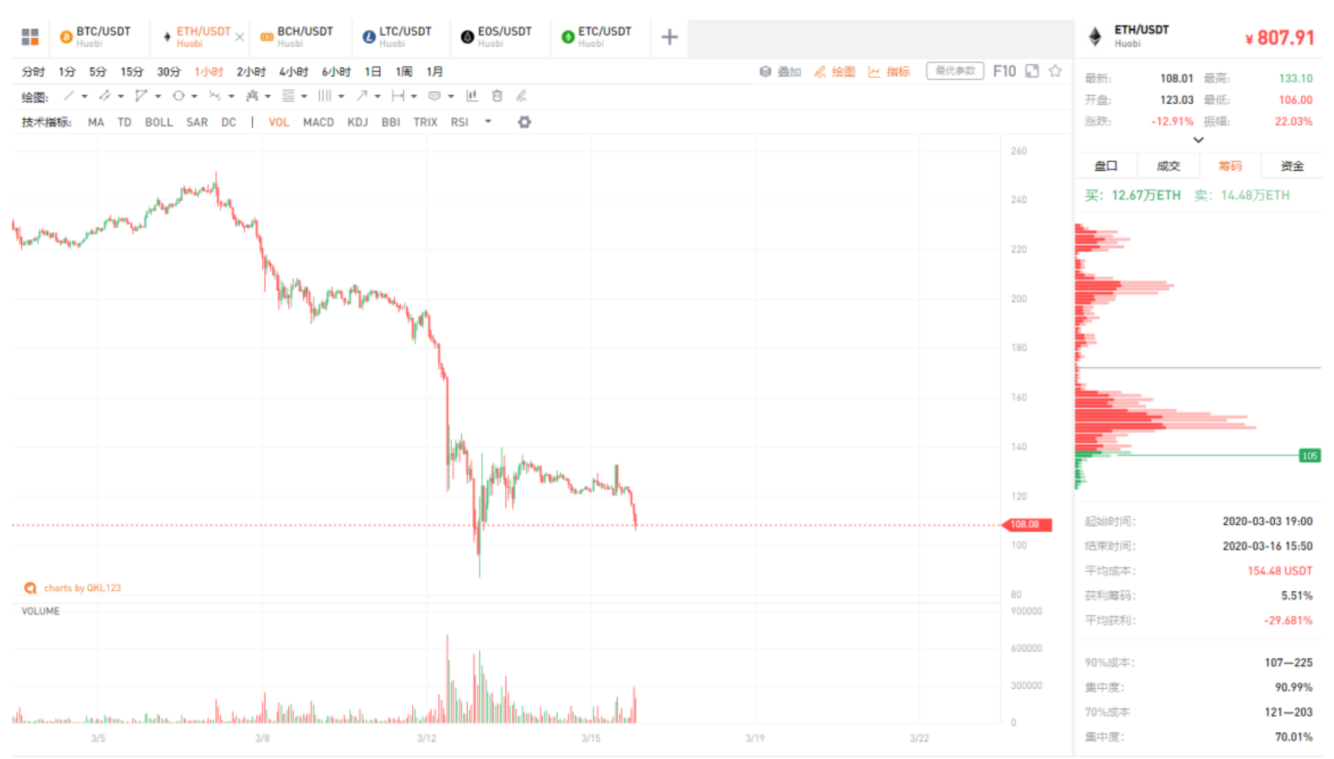

Second, the spot ETH market

ETH linked the bitcoin upward pin, and did not stand at the previous day's rebound high of $ 136. Currently below the $ 120 chip concentration area, support is under test.

Third, the spot BCH market

After the BCH linkage pin-up, the chip concentration area has also fallen by about 176 US dollars, and continues to test support.

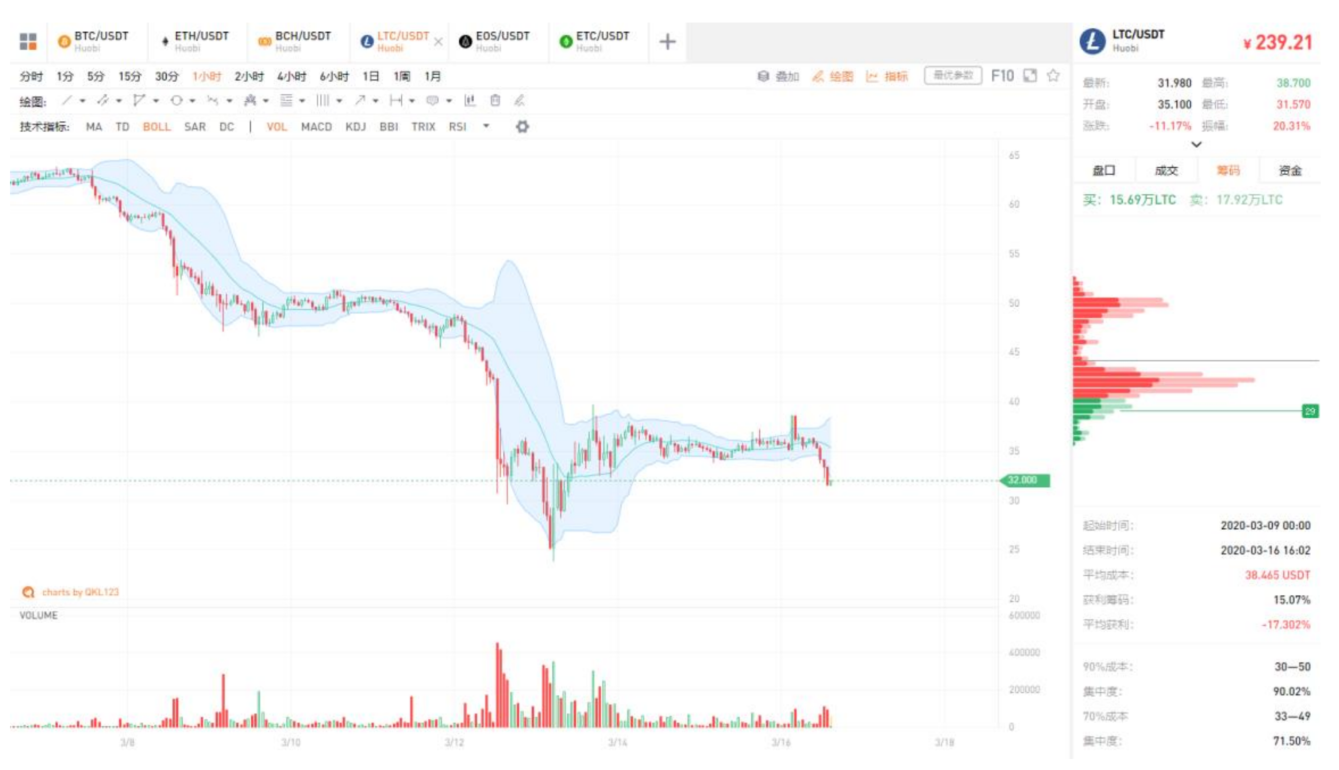

Fourth, the spot LTC market

The LTC Bollinger Band opened downward, and today fell below the $ 35 shock zone. The amount of current release is not obvious, and there is no obvious panic.

V. Spot EOS Quotes

EOS broke down and fell, and the amount released could tend to increase, showing wide fluctuations in the bottom range. A break below $ 1.8 will test the previous low.

Six, spot ETC market

After inserting ETC upwards of USD 5.2, the volume is obviously around USD 4.5, and it is more likely that the short-term detection will be lower. On the news, it is expected that the second production cut will be completed tomorrow afternoon, with a reduction of more than 20%, and there may be a slight rebound, but it will not have much impact on the trend.

Analyst strategy

1. Long line (1-3 years)

Although the long-term trend of BTC is bad, but the price is not far from the bottom, it is a good time for Tun Coin to invest. You can refer to the coin storage indicator. The smart contract platform leader ETH, altcoin leader LTC, DPoS leader EOS, BTC fork currency leader BCH, and ETH fork currency leader ETC can be configured on dips.

2. Midline (January to March)

Affected by the financial environment, panic persists, and there is a possibility that Bitcoin will continue to bottom out, and those with small positions will be involved in batches.

3. Short-term (1-3 days)

Short-term instability, wait and see.

Appendix: Interpretation of Indicators

1. 8BTCCI broad market index

The 8BTCCI broad market index is composed of the most representative tokens with large scale and good liquidity in the existing global market of the blockchain to comprehensively reflect the price performance of the entire blockchain token market.

2.Bitcoin Strength Index

The Bitcoin Strength Index (BTCX) reflects the exchange rate of Bitcoin in the entire Token market, and then reflects the strength of Bitcoin in the market. The larger the BTCX index, the stronger the performance of Bitcoin in the Token market.

3.Alternative mood index

The Fear & Greed Index reflects changes in market sentiment. 0 means "extremely fearful" and 100 means "extremely greedy." The components of this indicator include: volatility (25%), transaction volume (25%), social media (15%), online questionnaire (15%), market share (10%), and trend (10%).

4.USDT OTC Premium Index

The ChaiNext USDT OTC INDEX index is obtained by dividing the USDT / CNY OTC price by the offshore RMB exchange rate and multiplying by 100. When the index is 100, it means the USDT parity, when the index is greater than 100, it means the USDT premium, and when it is less than 100, it means the USDT discount.

5.Net Funds Inflow (Out)

This indicator reflects the inflow and outflow of funds in the secondary market. By calculating the difference between the inflow and outflow of funds from global trading platforms (excluding false transactions), a positive value indicates a net inflow of funds, and a negative value indicates a net outflow of funds. Among them, the turnover is counted as inflow capital when rising, and the turnover is counted as outflow capital when falling.

6.BTC-coin hoarding indicator

The coin hoarding indicator was created by Weibo user ahr999 to assist bitcoin scheduled investment users to make investment decisions in conjunction with the opportunity selection strategy. This indicator consists of the product of two parts. The former is the ratio of Bitcoin price to the 200-day fixed investment cost of Bitcoin; the latter is the ratio of Bitcoin price to Bitcoin fitting price. In general, when the indicator is less than 0.45, it is more suitable to increase the investment amount (bottom-sweeping), and the time interval accounts for about 21%; when the indicator is between 0.45 and 1.2, the fixed investment strategy is suitable, and the time interval accounts for about 39. %.

Note: Crypto assets are high-risk assets. This article is for decision-making reference only and does not constitute investment advice.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Research Report | Application of Industrial Blockchain in the New Crown Epidemic: Demand continues to expand, and applications are far from being met

- Fed throws "king bomb", cuts interest rate to 0, community: opportunity for bitcoin is here

- Babbitt Column | Should the long-term investment in the blockchain sector continue under the slump?

- Circle CEO: Stablecoin demand has increased significantly during this plunge, and blockchain-based currency infrastructure is working

- SheKnows: 34 trillion! Discover "blockchain opportunities" in new infrastructure

- Analysis: The market plunges "the scourge" of DeFi, which will be more resistant after the market is perfected

- Misunderstanding the blockchain, starting from the day of misunderstanding Satoshi Nakamoto