Read the major cryptocurrency events of 2019 in one article

Author 丨 A Rong

Source 丨 Ronglai Technology

In 2019, the entire blockchain industry has converged compared with 2017's enthusiasm, and has been somewhat milder than 2018's dismal. Although the bubble was created in the first half of the year, it was digested by the rational market and the market was precipitated. It is still worth looking forward to in 2020!

At the beginning of 2019, when the entire cryptocurrency market was at a trough, the market took Litecoin as the hot spot as the hotspot for the whole market, and the exchange queue led by Binance set off another wave of financing. We call this form IEO, platform currency Co-starring with IEO has attracted a lot of popularity. The short-term surge of the IEO project has nothing to do with value, highlighting the false prosperity of the entire market, and the subsequent resonance projects such as vds have given full play to this ugly state. Of course, the capital entering the market has also brought a superficial market value increase to the entire industry. In the first half of the year, mainstream currencies such as Bitcoin have also seen several-fold increases.

- American Computer Society: What exactly can blockchain technology do?

- Babbitt Column | Stocks, Tokens, Who Are the Future Trends?

- Former SEC officials look at China's central bank digital currency: 2020

At the same time, the much-anticipated Bakkt, a parent company of the NYSE, has been delayed for a long time, and Nasdaq added cryptocurrency indexes such as Bitcoin Ethereum to prepare for the launch of its investment futures exchange. Social giant Facebook hurriedly publicized the crypto currency libra white paper to cater to the market, and arrogantly pointed out that it is necessary to build a global financial infrastructure and create a non-sovereign currency, which is a global sensation. In order to resist the infiltration of libra, the central bank exposed the killer, and the central bank's digital currency dcep came out, and pointed out that blockchain technology will be part of the national strategic development direction.

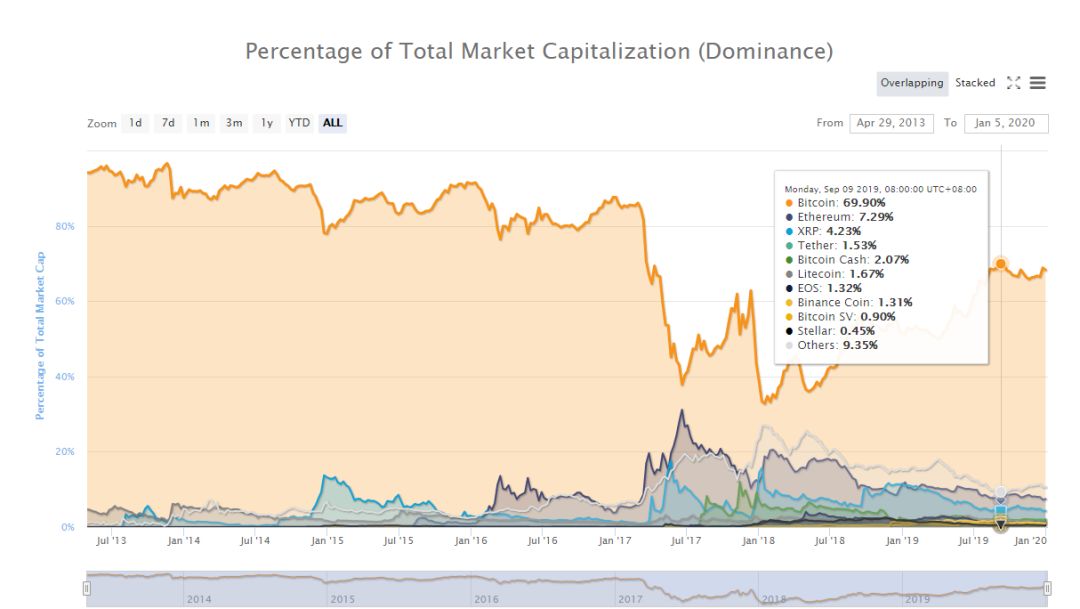

The good times lasted only half a year, and the summit turned around in the second half of the year. The IEO project broke, resonance projects such as VDS crashed, and pyramid schemes such as plustoken ran out of the market to wipe out market funds. Only single digits were traded on the day of bakkt's launch, and the Bitcoin ETF was rejected successively Libra died before it was issued, mainstream countries blocked it all, and Tether, the world's largest stablecoin, encountered a crisis of trust one after another. Successive reactions led to the rapid decline of the entire market. Bitcoin dropped from US $ 16,000 to around US $ 7,000. Other mainstream currencies have basically returned to the low point of the beginning of the year. The ratio of Bitcoin to the entire market has reached a new high of nearly 70% in the past two years.

The bubble burst and the market settled. In the second half of the year, we also saw the confidence of the market and gave the entire market a backing.

From a policy perspective, the world has reached a high degree of recognition for blockchain technology, and many countries have launched their own cryptocurrency plans;

From the market's main expectations, Bitcoin's next halving will reduce the inflation rate to 1.8%, which is officially lower than the 2% inflation rate target of the sovereign currencies of mainstream countries. Bitcoin is officially moving towards an era of irreversible deflation compared to global sovereign currencies. ;

From the perspective of the public chain market, the infrastructure of the public chain is being perfected. Although Ethereum 2.0 to casper is difficult, it is steadily advancing, giving the market a boost;

From the perspective of governance, the staking mortgage economy of the pos project increases the income of token holders and becomes another option for the pow resource waste governance model;

From the application layer, Defi is still the main battlefield to accelerate the landing of blockchain applications, and the market calls it "the new financial revolutionary movement";

From the perspective of cross-chain interactions, Cosmos and Polkadot bring possibilities for multi-chain interactions, accelerating the arrival of the blockchain-based Web 3.0 era;

From the perspective of the storage layer, the IPFS incentive layer Filecoin test network, which naturally solves the redundant data of the blockchain, is officially launched, providing the infrastructure for the Web3.0 era;

…..

All this gives us confidence in 2020.

Review 2019

Native asset side

In the field of thousands of cryptocurrencies, we divide them into two categories, one is the cryptocurrency with the Coin attribute represented by bitcoin, and the other is the cryptography with the token attribute represented by Ethereum. Currency, the former tends to the payment layer, while the latter tends to the application layer.

Coin

At the beginning of 2019, the market halved the Litecoin hot spot to lead the entire market to stop falling and rebound. Affected by this, Bitcoin is expected to be halved in advance. In just half a year, Bitcoin rose from around 3,000 USD to around 16,000 USD, an increase of more than 400%. Bitcoin's network computing power hit new highs repeatedly, and although Bitcoin's computing power declined, it continued to increase, breaking through 100E.

Many people here are confused about the increase in the Bitcoin security model (increasing attack costs). Why do you expect prices to fall instead? In fact, this is because there is no possibility of increasing the security model of Bitcoin. The corresponding period is the phase-out period of the mainstream mining machine Ant Miner S9, which is eliminated by the new generation of higher-priced mining machines. It may not have an attack cost. Improvement, this is only a manifestation of the progress of hardware technology.

The performance of anonymous coins with the same Coin property is not as good as that of Bitcoin. Affected by the supervision of various countries and the delisting of some exchanges, except for Monero, which has not yet reached a new low, Dash and Big Zero have repeatedly hit lows. High inflation rates continue to hit new lows; the forked coins BCH and BSV have kept pace with the rise and fall of Bitcoin.

Overall, the market value of bitcoin in the entire cryptocurrency market is increasing over the course of a year, up to close to 70%, indicating that the entire market is not too confident about assets other than bitcoin.

Token

Token-based cryptocurrencies are not inherently suitable for POW consensus. To implement a large number of application scenarios for Token, POW will cause a lot of waste of resources and low performance. Moreover, there is no competitive advantage in competing with Bitcoin on the same track.

Although Ethereum represented by Token has not performed well in Bitcoin in the past year, Ethereum 2.0 to Casper is still worth looking forward to. It is important to know that Ethereum finally achieved the POS consensus is the most advanced technology so far. A small step is a big step for the industry.

The second is the EOS project. As the largest fund-raising project in 2018, the EOS project exceeded US $ 4 billion, and its performance was not as good as Bitcoin in 2019. Enterprise users rejected it because of its centralization. Spinach game DAPPs Most of the applications are funds that cannot carry value. Its founder, BM, knows well that he bet on the Voice social project built on the EOS public chain, similar to steem, and the development is currently in progress.

In addition to this, other POS projects appear extremely bright, occupying the highest point of the stage heat, they are Tezos, Cosmos, Polkadot, Algorand. It is worth mentioning that Cosmos and Polkadot are implementing cross-chain interaction functions between blockchain projects, laying the foundation for the WEB3.0 era. Web3.0 is a decentralized application constructed by decentralized community governance. The centralized network can change the production relations in the current commercial society.

(PS: The implementation of cross-chain and side-chain technology is not a big bottleneck itself.It is mainly how to solve the consensus and let everyone use this chain. It is still in the credit endorsement stage, such as Bitcoin Core for Bitcoin Lightning Network. Core organization blockstream)

The POS consensus project is extremely bright in 2019. In order to further integrate the spirit of the blockchain, that is, to gain for network contributors, it will push the staking economy to the forefront. Staking is mainly used for POS-like projects. The greater the equity in the POS project, the more the tokens are held to participate in mining and the more income is obtained, the individual equity is not obvious and there is almost no mining revenue, you can mortgage it to the equity representative to obtain the revenue. At present, there are more than 70 crypto assets such as EOS, Tezos, Cosmos, etc. supporting Staking, and nearly 20 crypto assets such as Ethereum, Cardano, Polkadot, etc. are ready to support Staking. According to the existing data statistics, the annualized income that Staking can bring to investors can reach 158.10%.

What we saw in the Token field this year was not the impetuousness of the project party, but the down-to-earth construction of the application infrastructure to lay the foundation for the development of the next year.

Stablecoin

The cryptocurrency stablecoin market has been under the tight supervision of Tether's USDT family. Although Tether has been entangled with the Office of the New York Inspector General for many times in the past 2019, the regulatory crisis has come and gone. The share is still not replaced by competitors, and it is still the currency with the largest trading volume except Bitcoin.

According to statistics, as of December 31, the total issuance of USDT was 4.76 billion U.S. dollars, and the total issuance of emerging stable currencies was 1.066 billion U.S. dollars. The USDT market share exceeded 80% of the entire stablecoin market.

It is worth noting that Tether gradually transferred USDT issued based on the Bitcoin omini protocol to other USDTs with Ethereum ERC20 standard, which means that the value generated by the Bitcoin network based on USDT is being lost.

Libra

At 5 pm on June 18, 2019, Beijing time, Facebook's crypto project Libra officially released a white paper that proposed the establishment of a simple, borderless currency and a financial infrastructure that serves billions of people. A group of giant institutions.

In fact, from the perspective of credit endorsement only, Facebook is only a company, even if it includes other consortiums of endorsement companies, it cannot support the credit level required by the global universal settlement currency. This is because foundations may spam and rely on accounts, and it is difficult for the outside world to trust the internal accounts of the foundation.

This project happens to apply blockchain technology. In fact, it also uses its transparency and non-modifiable features to allow the public to review directly, increasing Libra's credibility to a level close to that of a sovereign currency, and making global settlement a Kind of possible.

Therefore, once the Libra project was launched, it caused a global sensation, which deterred the status of a sovereign currency. Many countries jointly blocked Libra. The founder of Facebook was repeatedly asked to participate in hearings in multiple US departments, under pressure from supervision. Libra basically stays on the concept, and there is still a long way to go before it can actually land.

Central bank digital currency

Affected directly or indirectly by Libra, the central bank has stepped up its research on China's digital fiat currency.

On August 10, 2019, Beijing time, Mu Changchun, deputy director of the Payment and Settlement Department of the People's Bank of China, revealed at the China Finance Forty Forum: "The digital currency of the central bank is ready to come out."

On October 28, Huang Qifan, deputy director of the China International Economic Exchange Center, announced that the People's Bank of China is likely to be the first central bank to launch digital currencies in the world.

In fact, the emergence of digital fiat currency has little impact on us, and it has no sense with the daily WeChat Alipay payment, but at a macro level, the state is more likely to control the flow of the economy.

Application side

Dapp ecology

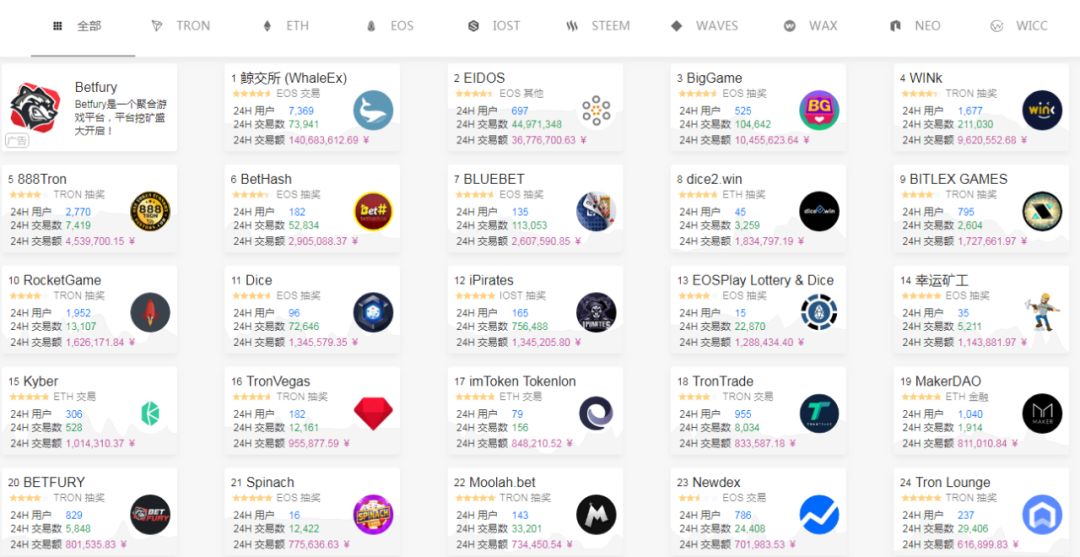

The DAPP ecosystem experienced explosive growth in 2018, mainly concentrated on the Ethereum, EOS, and TRON public chains. In 2019, the DAPPs of these three public chains still dominate the mainstream. Relevant data shows that the monthly turnover of the three major public chains is 10 A billion dollar ecology has been established.

The distribution of Ethereum DAPP transaction volume has not changed much since 2018. Decentralized exchanges account for more than 50% of the transaction volume, followed by spinach.

Dominated by decentralized exchanges, the overall transaction volume is not high, only more than 200 million US dollars, which is not even less than the other two blockchain Dapp transaction volumes. In addition, the ecological distribution of Ethereum's blockchain Dapp is also very different from EOS and TRON. EOS and TRON are spinach occupying a dominant position in their blockchain Dapp ecosystem.

It is worth noting that Ethereum game players are the most active players among all blockchain Dapp users. More than 40% of daily active users are game users, but these users accounted for only 30% of the total active users in the first quarter. We can assume that the game ecosystem based on Ethereum has created a stable community with a loyal audience.

Defi

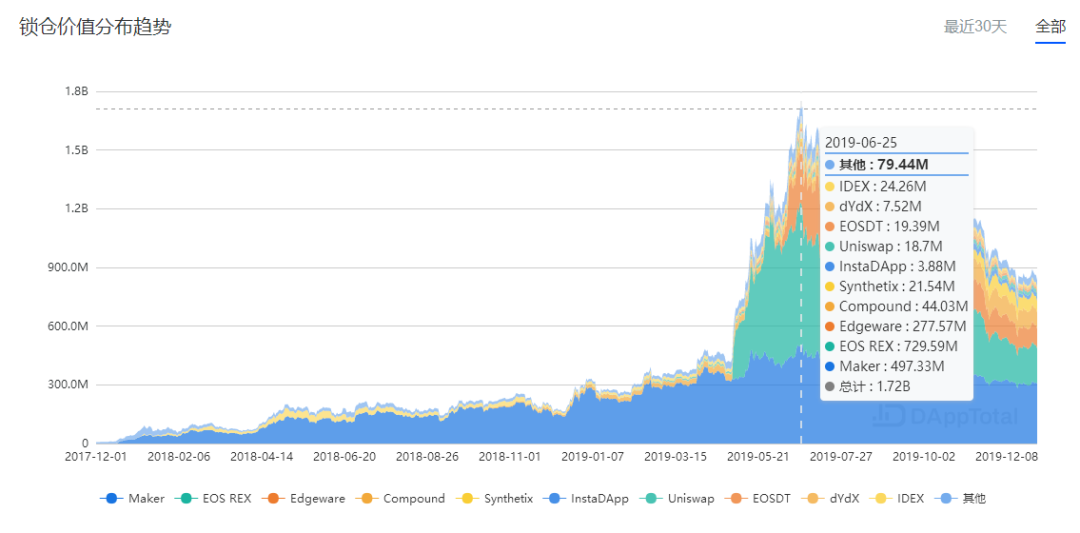

DeFi is the abbreviation of Decentralized Finance, which is designed to allow anyone in the world to carry out financial activities anytime, anywhere. DeFi is considered to be a "new financial revolution movement" such as financing, and is currently the most widely used field in the entire public chain.

According to dapptal data, there has been a large-scale growth in the Defi mortgage application field in 2019 compared to 2018, from a market of nearly 200 million US dollars in 2018 to a current market of nearly 900 million US dollars, with the market growth nearly 3.5 times, the highest at nearly 7.5 billion is 7.5 times.

Defi applications are mainly concentrated on the Ethereum and EOS public chains. The top three are: Maker, EOS REX, and Edgeware. Among them, Maker and Edgeware are applications based on the Ethereum public chain. EOS REX is an application based on the EOS public chain. The former two account for over 50% of the entire Defi market, and EOS REX accounts for about 20%. As a whole, Defi applications on Ethereum Occupies nearly 80% of the entire Defi market, and EOS accounts for nearly 20%.

In general, the entire Defi market has a much higher degree of trust in Ethereum than in EOS. In the final analysis, the latter is too centralized and lacks security.

Server

This section mainly interprets the cryptocurrency exchange center, that is, the exchange.

Platform and IEO

In the past year, the three major domestic cryptocurrencies, OK, and Huobi have all gained momentum in the entire cryptocurrency market, mainly due to the financing of IEO projects, which indirectly contributed to the bubble in the first half of 2019.

The leader of the rise of IEO is Binance, followed by OK and Huobi. The IEO project is characterized by a small amount of public offering on the platform, using the platform's platform currency, hungry marketing, and the project has skyrocketed shortly after it was launched. Causes false false prosperity, but the market is always willing to trial and error many times, buy platform coins to participate in public offerings, go online and throw away, this routine has attracted a large number of people in a period of time, the survivor deviation r makes everyone seem to be short When the time comes to become rich, the entire market is in full swing. For platforms that use IEO projects for financing in the initial stage, traffic has increased and platform currency has skyrocketed.

The short-term scarcity has caused the entire market to have no time to take into account the good or bad of the project. For example, BIKI, matcha, and other exchanges directly listed some funds in the currency, and became a "rookie" in the field of exchanges. Not at all.

In the end, Biter, who has no market operation direction, completely broke through the window of false prosperity of the IEO project, IEO collapsed, the funds in the stock market gradually flowed out, and the market was allowed to continue to focus on Bitcoin and landing applications.

Bakkt

As the world's largest securities market, the parent company of the NYSE has made every effort to create a cryptocurrency futures bakkt, which was highly respected by US giants when it was proposed in 2018, including Microsoft Tencent Goldman Sachs Boston Consulting, etc.

Based on its unique delivery mode, spot delivery can affect the market circulation of bitcoin and promote price increases. It was officially considered to be the flashpoint of a bull market!

Under the supervision of cftc (United States Commodity Futures Commission), despite the long-term ups and downs of the launch, it was officially launched on September 24, 2019 after a delay of nearly one year. It was unexpected that the bitcoin transaction amount on the first day of the launch was only a single digit. Count, another big disappointment in the entire market!

It is worth noting that, as the channels for the entry of traditional funds have gradually opened, the turnover of the bakkk exchange has been steadily climbing, and it is expected to catch up with the turnover of mainstream exchanges by 2020, with some bitcoin pricing rights!

In short, as the cryptocurrency market continues to grow and even become a part of the global economy, exchanges can only move towards formalization, and supervision will become stricter, as can be seen from the three major domestic Huobi, OK, and zf negotiations!

Looking forward to 2020

After the bubble and precipitation in 2019, we are more confident to face 2020, and the momentum is strong, and the entire blockchain industry will be more widely integrated into our daily life!

Halved

In the bitcoin world, there is a very famous slogan, called: Long bitcoin, Short the world, which can be simply translated as "long bitcoin, short the world".

In May 2020, Bitcoin will be halved for the third time. This time, the Bitcoin inflation rate will be reduced to 1.8%. At present, the inflation rate corresponding to the sovereign currency of most countries is controlled at 2%, which means that compared with sovereignty, Currency, Bitcoin has officially entered the deflationary channel. In theory, the price gap between Bitcoin and sovereign currencies will become increasingly apparent. This is the so-called "Long bitcoin, Short the world"

In addition, in 2020, there are five major currencies such as ETC, BCH, BSV, DASH, and ZEC, which will usher in half, so 2020 can be said to be a year of halving, and the halving market is worth looking forward to!

Public chain continues to focus on applications

Since the concept of public chain officially entered the public view, its public chain value is highly bound to its application, and 2020 will still be the year of application landing!

In terms of public chain applications, Ethereum is still the first, and EOS is the second. Ethereum needs to improve its performance. Therefore, in 2020, it needs to continue to move steadily in the direction of 2.0, and eos needs to detonate the eos ecosystem with voice , Take a similar route to Tencent!

Defi decentralized finance is still the main battlefield in 2020 and is expected to break through the $ 10 billion market.

The staking economy derived from the pos public chain allows token holders to obtain stable income (currency standard).

web3 implementation one step further

The application scope of web3 in 2020 may not be large. Only in the field of cryptocurrency Unicom, it mainly depends on three technical sidechain technologies, sharding technology, and cross-chain technology.

It can be predicted that in 2020, mainstream currencies such as Bitcoin will cross-chain ushered in unprecedented development. The token economy will mainly rely on mainstream currencies. Chains with low network value will gradually disappear or rely on chains with high network value to survive.

Strong demand for distributed data storage

As the entire ecosystem of the blockchain grows, data storage on the blockchain is limited, and application data relies on centralized storage and blockchain decentralization. The problem of data storage needs to be solved urgently!

Distributed storage naturally matches the decentralization of the blockchain, becoming an on-chain and even off-chain data storage solution.

In addition, blockchain technology is gradually applied to traditional business environments, medical insurance, electronic invoices, e-government, video streaming, etc. There will be a large amount of data that requires a decentralized storage solution.

2020 may be the first year of the outbreak of the distributed storage industry!

Summary: 2019 is long gone. In 2020, amazing power will erupt in many subdivisions. Let us "win" the war 2020!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Six marketing trends for the blockchain industry in 2020

- DeFi weekly selection 丨 High ETH lock-up volume, zero mortgage DeFi for "Great Leap Forward"

- The IRS is here again! Tax assessment required for single cryptocurrency donations exceeding $ 5,000

- How did Libra fail today, and how can it succeed in 2020?

- Blockchain backdating threat: Without identity verification, value transfer can only be performed in specific scenarios

- A review of the privacy coin developments in December 2019. The XMR, Grin, Beam, and ZEC you care about are all here

- Talk about Hayek, Satoshi Nakamoto and Bitcoin