Remember the coins? Venezuelans really started using it.

As the government-approved exchanges and the latest remittance platforms continue to increase their support for oil coins, the country’s cryptocurrency is growing stronger.

Remember the coins?

Perhaps the encryption community is now immersed in the turmoil of market recovery and has forgotten the world's first national cryptocurrency.

- Blockchain city map

- Babbitt Column | How will blockchain technology transform the “Great Moving Cloud” system? (on)

- Does Belarus use nuclear power to dig the bitcoin economy?

However, with the recovery of the cryptocurrency market, Venezuelan oil currency transactions have begun to grow steadily. In fact, since the initial release in February last year, many people think that PetroChina may be fraudulent or even non-existent. However, according to information from some exchanges and Venezuelan natives trading the digital assets on social media, the coins are very real and can be used to redeem some goods and services.

Interestingly, given the highly politicized nature of the oil coin, the community’s attitude towards the country’s cryptocurrency seems to have also become extremely divergent. For example, the supporters of Venezuelan President Nicolas Maduro believe that the potential of the oil coin is huge and capable. Helping them get rid of US sanctions, and the opposition leader, Juan Guaido, who is self-proclaimed as "interim president", called it a complete scam, and the government he led had identified the coin as an "illegal currency." .

However, no matter how the political stalemate develops, and no matter who ultimately truly controls the Venezuelan regime, an indisputable fact is that the oil coin has really begun to trade in the state-approved exchange, and the Venezuelans have gradually accepted the cryptocurrency.

There is a "speculative" space in the current trading price of petroleum coins.

In fact, since the death of Venezuela’s last president, Chavez, the country’s economy has gone out of control. At the time of this writing, Venezuela’s domestic inflation rate reached 1,623,656%, making the country’s legal currency, Bolivar, almost worthless. President Nicholas Maduro, who took over in 2013, has been seeking a solution, thus creating a coin supported by the Venezuelan oil reserve. According to government data, the initial valuation of a single coin is about 246,332 Bolivar or $60. (The current market price has changed).

Since the release of the oil coin, President Nicolas Maduro has been advocating the national cryptocurrency on social media and television. However, for a long time, most Venezuelans did not see the oil coin being used in real life. use. But now, this situation has changed.

According to the latest reports, Venezuelans have been able to purchase coins directly through the national encryption remittance platform Sunacrip, and can directly exchange coins in Bitcoin, Litecoin and other cryptocurrencies. At this stage, Sunacrip provides a block explorer service that bundles transaction interfaces and is expected to release a full-featured petroleum coin block browser on April 30th.

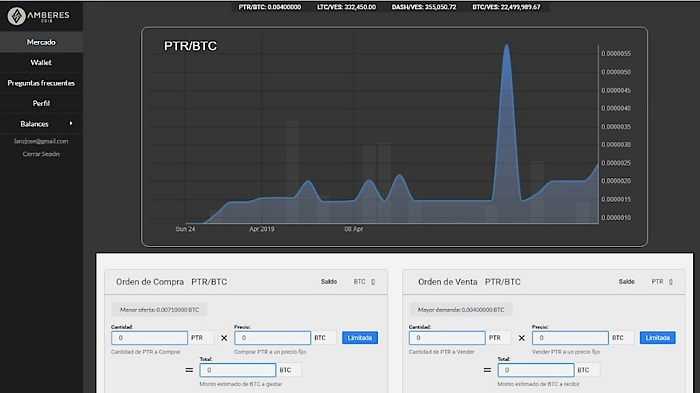

Not only that, but Sunacrip also provides the public with convenient transaction support services to allow Venezuelans to purchase and trade coins on nationally recognized trading platforms, including Cryptoexca.io, Afx.trade, Amberes, Bancarexchange.io, Cryptiaexchange. .com and Criptolago.com.ve. However, it should be noted that the exchange rate of each currency exchanged for each exchange is different. On average, the current transaction price of a petroleum coin is about 30-40 US dollars (0.00555-0.007411 BTC).

For example, Amberes, a cryptocurrency exchange, is the only exchange in Venezuela that has launched a “PTR/BTC” trading pair, and the volume of transactions is rising. (Since the PTR/BTC transaction pair was activated only two weeks ago, the exchange spokesperson did not provide accurate transaction data.) So far, the exchange has sold more than 300 coins, but they said they could not track these The transaction history of the token transaction pair.

An Amberes exchange trader said:

"Someone comes in and buys, that's it – almost all of them are buyers. As long as someone releases any order, they will be caught by these buyers immediately, but the transaction history can't be seen. I sold some coins, but sold The record can't be seen."

In general, the trading volume of petroleum coins has shown a growth trend in Venezuela and opened a door for Venezuelans to seek new currency alternatives. At this stage, the oil currency transaction needs to open an official “account unit”, but the Maduro government has not explored the use of oil coins, nor has it repurchased oil coins from its citizens. In this market environment, Venezuela has created an open investment environment for some pragmatic traders, allowing them to “invest” in oil coins, just like investing in other altcoins.

In fact, compared to the initial price of $60 for petroleum coins, the current transaction price of around $30 allows some people to accumulate tokens. If the Venezuelan government expands the oil currency transaction and starts to buy back coins, these people will May benefit from it.

Of course, some people buy petroleum coins for the sole purpose of being curious. A Venezuelan businessman who asked for anonymity said that he believes that the oil currency transaction may be affected by the political influence of the US government, so what kind of trend will be unknown in the future. The anonymous businessman also said that once Venezuela's cryptocurrency exchange became more liquid, he would convert the oil into Bolivar, the legal currency of Venezuela. He said:

“I bought some coins, but this is just to see what it looks like, and more importantly, it’s out of curiosity. But I personally don’t confirm whether the coin will become a recognized cryptocurrency for Venezuela, although the current oil The currency is as smooth as a bank transfer."

However, although the oil coins have gained some attractiveness among Venezuelan traders, the current number of transactions is still small. After all, the various uncertainties surrounding the oil coins have not been eliminated. It should be noted that Venezuela's identification requirements for oil currency traders are very strict, and the steps to register on the country's certified exchanges are also very cumbersome. It is necessary to provide the identification number, telephone number and bank statement issued by the Venezuelan government. And a private service invoice showing the address. In addition to mandatory identity documents, some cryptocurrency exchanges require users to provide social media account information, such as Bancarexchange.

Oil currency over-the-counter trading is active

Although the current transaction price of petroleum coins is much lower than its original setting of $60, the Venezuelan national encryption remittance platform Sunacrip claims that since the introduction of petroleum coins in 2018, its trading system has become very solid, reliable, transparent and inclusive.

However, OTC's over-the-counter trading is extremely active compared to the approval of the “legal” exchange by the Venezuelan government that has only traded more than 300 coins.

On social media channels such as Facebook and Telegram, many Venezuelans are trading coins. There are a lot of tagged oil coin sales groups on Facebook (called "El Perolero") where people exchange goods and services. According to the advertisements published in these groups, it seems that many sellers are willing to accept the coins. In a Facebook El Perolero sales group with more than 293,000 members, more than 9,000 ads for oil currency transactions are seen every day, and Venezuelans use this method to access food, medicine, and other basic necessities.

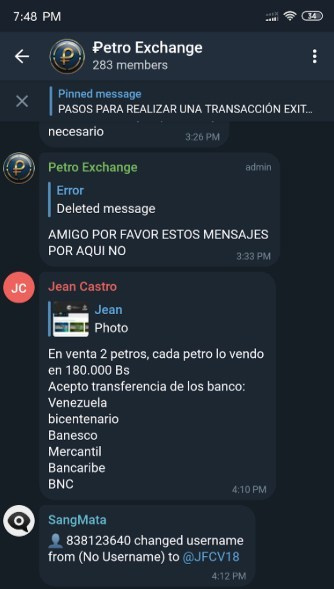

And Telegram is more of a P2P transaction, allowing people to buy and sell coins directly on it. Taking a group called "Petro Exchange" as an example (as shown below), the group claims that its purpose is to allow the purchase and sale of petroleum coins using any digital currency, and to purchase any products and services using petroleum coins as a payment method. There are currently approximately 321 members.

However, if you want to interact with a coin trader, the seller must send them identity documents, as well as a selfie and a handwritten confirmation with date and time, and all files must be readable and not encrypted. In addition, Petro Exchange group users can also directly convert Venezuelan French currency Bolivar, US dollars or other cryptocurrencies, and users can even pay a small fee to the group administrator to host the transaction funds.

The future of petroleum coins

It is undeniable that the launch of the oil coin was very difficult, because its credibility was questioned when President Nicholas Maduro announced it for the first time. Afterwards, the oil coin suffered from the failure of the exchange to fulfill the promise of the currency, and the trading platform was closed for unknown reasons, which further damaged its reputation.

However, the purpose of the existence of the oil coin is very firm and clear, that is, to bypass the Donald Trump administration's sanctions against Venezuela. It is with this firm confidence that the oil coins have come step by step, and Venezuelans have now begun to use petroleum coins to obtain the assets they need. As the government-approved exchanges and the latest remittance platforms continue to increase their support for oil coins, the country’s cryptocurrency is growing stronger.

Perhaps this is the power of encryption.

Original author: Jose Antonio Lanz and Jamie Redman

This article is from decryptmedia and Bitcoin.com, https://decryptmedia.com/6593/venezuela-trading-petro .

Odaily Planet Daily Translator | Moni

Source: Planet Daily

Please indicate the source if you reprint.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- When the currency goes to the centralized exchange, can DEX open a new era of trading?

- Babbitt column | Can the coin push the public chain and the decentralized exchange, can it surpass Ethereum?

- The source of Bitcoin's thought: Zhuang Zhou Mengdie, will the robot dream of an electronic sheep?

- Lightning Network takes a new height! Lightning Lab released the first Bitcoin main network lightning network desktop application

- Societe Generale issues $112 million in bonds at Ethereum

- Market Analysis: BTC blood-sucking breakthrough, other mainstream coins still have opportunities?

- Prejudice and rationality in the cryptocurrency trading market