Behind 106 market cases, we discovered the impact of the BTC spot market structure on price discovery

(Onion Note: "Price Discovery refers to the process by which buyers and sellers reach a transaction price for the quality and quantity of a commodity at a given time and place.)

After analyzing more than 106 “volatility events” (the Bitcoin price changed more than $ 100 in 5.5 minutes) between April and December last year, we found that in most cases, the more trusted exchanges were The platform where the price change first occurs, and subsequent fluctuations will affect other trading platforms.

Argument method

1. Research data sources. Our research includes trading data for 61 spot exchanges from April 2019 to December 2019 (second quarter to fourth quarter), recording multiple fiat and stable currencies based on bitcoin as the base currency (Including USD, Euro, British Pound, Korean Won and Japanese Yen, and USDT).

2. Research object. Our research mainly relies on the confirmation of the price “volatility event” (resulting in a price change of more than $ 100 in 5.5 minutes, hereinafter referred to as “volatility event”) to measure the lead-lag relationship between exchanges. In addition, we have also deleted exchanges with a small trading volume (less than 10 transactions within that 5.5 minutes).

- Crypto crime reports: billions of dollars of money laundered, more than half flow into exchanges

- Blockchain distributed storage: a new storage model for ecological big data

- The post-C-end era of blockchain: not the B-end market

3. Correlation measurement. We performed a correlation analysis between the BTC price of each exchange and each "volatility event" and excluded exchanges with a price correlation of less than 0.5 as the price response of these exchanges was small Or nothing at all.

4. Confirmation of the order of the exchange price response before and after the volatility event. In order to determine the lead and lag sequence of exchange price responses, we performed a cross-correlation analysis on each exchange combination. For a given two exchanges, we measure them with a time difference of 0.1 seconds until the correlation coefficient between the two is maximized. This tells us not only which exchange's price is leading or lagging, but also how long it is leading or lagging. We also performed a visual analysis of this.

5. Fractions of a single exchange. Based on a single "volatility event", we create a score for each exchange. This score is the total number of times that the exchange's price response leads the correlation of an exchange portfolio minus the total number of lags. The score will give the sequence of changes in exchange prices under each "volatility event".

6. Statistics results by ranking. We rank these exchanges based on a single "volatility event". Exchanges with the highest scores (most lead times) rank highest. We designate the top 5 exchanges with the highest scores as "price leaders". Finally, we count the number of times a single exchange appears as a price leader in all volatility events and perform a comprehensive ranking.

in conclusion

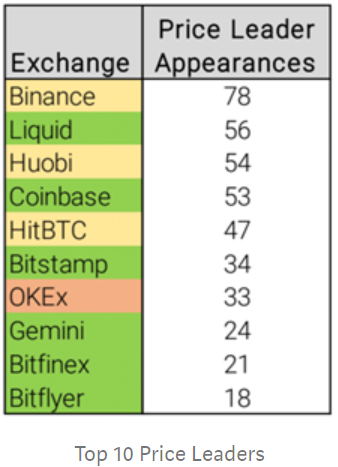

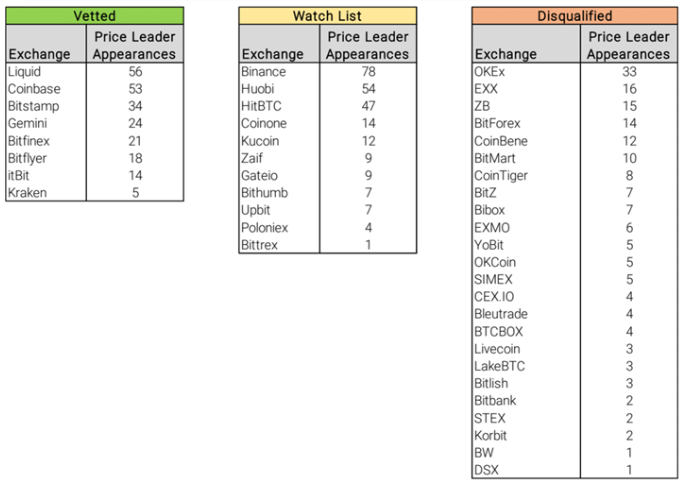

The comprehensive results show that the following 10 exchanges (including Liquid, Huobi, Coinbase, and HitBTC) are the trading platforms where price fluctuations first occurred. And among the top 10 exchanges that frequently cause the first price changes, 9 exchanges are on our "Vetted List" or "Watchlist".

Note: Digital Asset Research's audit framework for the exchange is divided into two parts: quantitative measurement and qualitative measurement. If an exchange passes these two audits, it is listed as the "reviewed list", and if it passes only one, it is a tracking list. Otherwise it is "Failed List".

In summary, in most cases, the more trustworthy exchange is the platform where the price changes first occur, and subsequent fluctuations will affect other trading platforms.

That is, price formation in the Bitcoin spot market tends to occur on more trusted exchanges.

This conclusion alleviates to some extent cryptocurrency investors' worries that price fluctuations in smaller exchanges are even more frenzied than normal, and many of these exchanges have been accused of artificially exaggerating trading volumes.

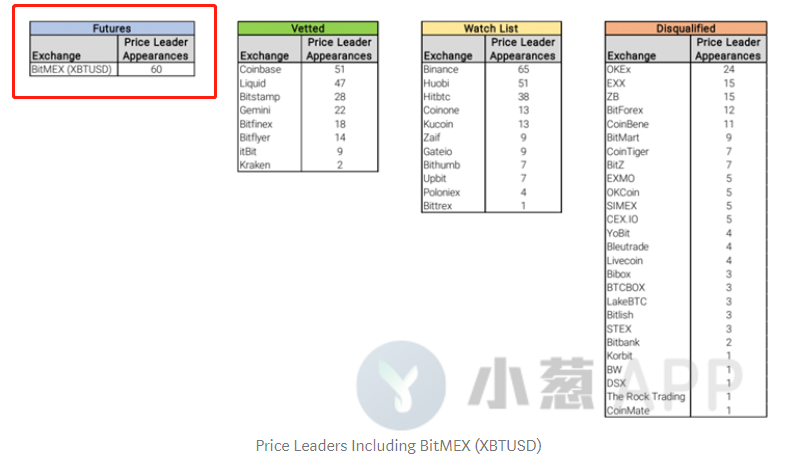

It is worth noting that after initial research, BitMEX's perpetual contract XBTUSD may also have an impact on price discovery.

By adding XBTUSD to our previous analysis, we found that BitMEX became a price leader more frequently than any other exchange except Binance. The area of follow-up derivatives is expected to become the next research direction.

This article is exclusively translated by Xiaosong APP from https://medium.com/digitalassetresearch/an-analysis-of-price-discovery-in-bitcoin-spot-markets-7563fbf1c890 .

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- "National Mining Pool" Admission! Miners no longer "underground" in Uzbekistan, government approves exchange to go online next week

- 2020, Bitcoin has something to say to you

- The Spring Festival is approaching, William will show you the market trend under the mysterious oriental power

- Is the MEV auction mechanism favored by God V a disruptive innovation or a kind of "exploitation" of miners?

- Is Ethereum more attractive than Bitcoin? Satoshi Nakamoto's successor Gavin Andresen may have switched to Ethereum

- Pandora's Box Concerned about Digital Currency——Preface to Digital Currency: Inheritance and Innovation from Slate Economy to Digital Economy

- Yuan Yuming: The four major technological innovations of the blockchain are suitable for multi-party collaborative industrial scenarios