Prejudice and rationality in the cryptocurrency trading market

There is an interesting phenomenon in the speculative market:

The price of the market is like a magical force, constantly flashing the numbers, firmly grasping the speculators' emotions, then completely losing themselves, and finally becoming a prisoner of market volatility.

In the process of rising prices, under the optimistic frenzy of the market atmosphere, investors' thinking and IQ have risen, as if the market will end up in the sky, only to the sky; in each process of falling, pessimistic Under the endless pressure of the panic market, investors' thinking and IQ suddenly fell, as if the market would fall, only to hell.

As long as the market is turbulent, investors’ urgency for trading has never stopped.

- Getting started with blockchain | Three minutes to understand the difference between ERC-20 and ERC-721

- IEO's first suspected runway project appeared: the price of the currency was close to zero, and the early transaction record was emptied.

- Sun Zhengyi: Behind the huge loss of investment bitcoin

Risk awareness management

The risk perspective has never been in the subconscious, especially the novices, and there is basically no fear of the market. In the process of market transactions, the fear of human greed is vividly displayed.

There is such a fable story to say: One person always dreams of making a fortune, and all day long is full of gold in his mind. Finally, one day, he passed a gold shop and saw a lot of gold on the counter. I have been staring at the pile of gold, and finally I can't help but put the gold in my arms.

When he was sent to the government, the official asked him: "How come you go to get the gold shop under the broad daylight, don't you see so many people around?"

He replied: "When I saw the golden gold, I only had him in my heart. There is no one else."

Is this fable not the status quo of the naked-faced investors? Even in exactly the same way, in the eyes of the coin, there are only opportunities, profits and money, without any external and internal constraints, and there is never a sense of risk. It will not change this situation from now on.

The magic of financial transactions is reflected in the fact that the vast majority of speculators, if they enter it, are like gamblers entering the casino, they will lose their most basic thinking ability and self-control, indulge in illusion and fall into an incapable situation.

The fluctuations in the spot market of the currency circle are already very large, not to mention the futures market, 10 times 20 times or even 100 times the contract. The magic is that there are always people who are lucky enough to try leverage trading, and novices will always be lucky goddess. However, novices believe that it is a manifestation of self-ability.

Endowment effect

Human beings have never been rational, especially in the trading market, and they will completely lose themselves in constant fluctuations.

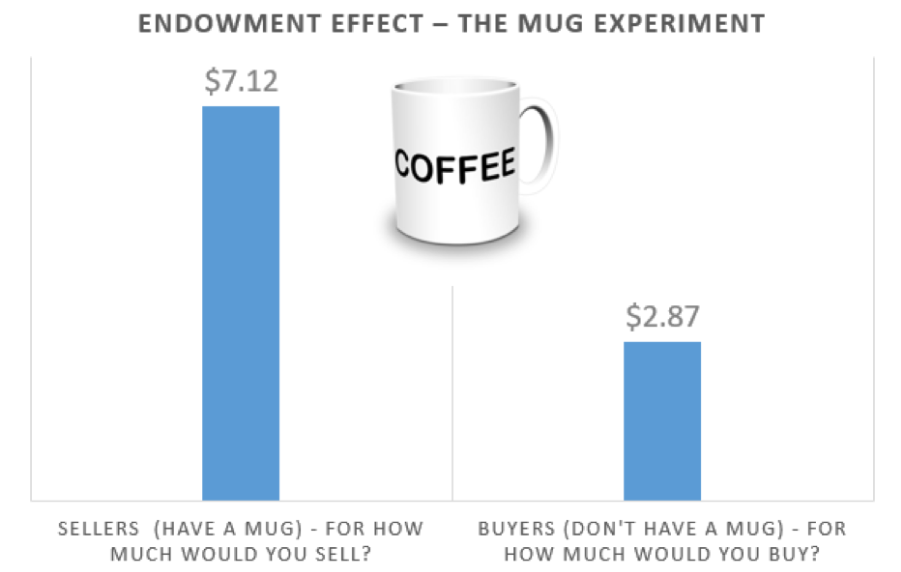

There is an endowment effect in economics that means that when you own an item, you feel it is more valuable.

Let's take a look at the famous Mug experiment. The experimenter randomly assigned the mug as a commodity among the students, and then let the students trade freely. It turned out that there were not many successful transactions, because the mug buyers and sellers for the mug. The valuation is much worse. The median seller's estimate is $5.25, but the buyer's median estimate is only $2.25.

The first scholar to design this mug experiment was another behavioral economist, Richard Seiler. The concept of endowment effect was also first proposed by him.

The endowment effect can be explained by the foreground theory, and the prospect theory is the theoretical contribution of Kahneman. According to prospect theory, most people will have different risk preferences when facing gains and losses. In the face of gain, you will be careful and unwilling to take risks; on the contrary, in the face of loss, you will not be reconciled and become risky. In comparison, your sensitivity to loss and gain is different, and the pain you experience in losing is much greater than the happiness you get when you get it. Explain in one sentence that the happiness you get for 100 dollars can't offset the pain of losing 100 dollars.

When we hold an asset up, we don't take risky actions, get a sense of pleasure and give more meaning, and think of ourselves as Buffett possession. However, as assets fall, the situation has turned sharply, the bear market's money-making effect has decreased, assets have fallen sharply, and pain and anxiety have arisen, and they are constantly looking for opportunities to make money. Yes, the most active bear market is the futures market, so find a reasonable explanation.

Thinking fast and slow

Human thinking patterns have inherent characteristics. Under their influence, your quick thinking and intuitive judgment will lead to judgment errors and bias. With this judgment, you think that the rational person hypothesis is untenable, which means that it is difficult to simply set people into an economic animal of rational decision-making. In the face of humanity, rationality is a Luxury.

The author of "Thinking, Fast and Slow," Daniel Kahneman, although an economist, has a reference value for behavior in the trading market.

The trading market has always been a game of prejudice and rationality. How to avoid prejudice and judgment errors as much as possible, and improve the quality of judgment and thinking.

Kahneman is said in this way:

Since prejudice and mistakes are often related to the dominant position of system 1, then, in order to solve the problem, it is very simple in principle, that is, slow down thinking, active activation of system 2, to rationally test the results of system 1's intuitive thinking. To compensate for the shortcomings of System 1 and to reduce the prejudice and illusion generated by intuition.

Kahneman believes that System 2 is lazy. In order for this lazy system to become diligent, it requires deliberate prompts, either self-prompting or external prompts. It’s like a person who loves to sleep late and can’t get out of bed. In order to get himself to get up on time, he either has an alarm clock, this is a self-prompt, or let the family call you to pick it up. This is an external reminder.

Compared to the two methods, external prompts are often more effective.

This is related to a psychological feature of human beings. It is often easier for you to question others than to question yourself, especially when you face major decision-making pressures, and questioning your own decisions will lead to great psychological pain. This is the psychological principle behind the idiom "bystander clear".

When you fight alone and make decisions on your own, there may not be many onlookers around you, and when you are in an institution, there will be many bystanders around you. These bystanders will use their slow thinking from System 2 to help you correct your system 1's quick thinking and possible errors. Therefore, although the collective discussion decision will be inefficient, it still makes sense in many cases, because it can initiate many people's slow thinking and reduce the prejudice and mistakes that may be brought about by quick thinking.

Kahneman taught us a trick called pre-mortem.

It sounds a bit scary. In fact, it is just a conscious activation system. 2. It is a collective decision-making method that starts slow thinking. That is, let us make a decision on one thing, first assume that this thing will fail in the future, and then everyone According to your own understanding, write down the possible reasons for the failure of this event, and sort by importance and probability.

Before the autopsy, it is a gospel for market investors. When you are in a bear market, it is not a bear market panic, but how to ensure that your profits fall into your pocket in the yak market; therefore, when the bull market comes, the market is crazy. What you need to think about is whether you will remain optimistic if the market drops in a second. Rationality and irrationality in the human primitive genes continue to avoid irrational interference through external rational prompts.

I suggest that when you are overly optimistic, your bedside should be affixed with a big character, such as "The bear market is coming", you need a hundred percent vigilance, just like the night watchman in "The Game of Rights". A ghost is a risk-like existence that can swallow you at any time.

(Author: Bitcoin Caesar)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The loss of power, the confusion of the foundation, how to retain the developer in Ethereum?

- YGC Managing Partner: Facebook may threaten the position of Bitcoin King

- Investing $100 when the main currency first landed on the exchange, how much is it now?

- The Ethereum POS pledge proposal proposed by V God is unreasonable?

- Hero chain: 300 million ring dreams, finally broken

- Gu Yanxi: Some compliance considerations for the application of the general economic model in the US market

- Viewpoint: How the blockchain empowers financial technology