Research Report | Central Bank Digital Currency Watch: Looking at the "Super Currency" Blueprint through Patents

Service providers with payment experience and licenses are expected to become DCEP wallet operators . The market believes that DCEP uses a "central bank-commercial bank" two-tier operating system, and institutions other than commercial banks cannot participate. According to the central bank's patent, we found that the DCEP "wallet" may not directly rely on bank accounts for transfer and payment functions. We believe that service providers with payment experience and licenses are expected to intervene in the DCEP industry chain and are expected to collect payment service fees.

DCEP may load smart contract functions to achieve targeted issuance and monitoring . The market believes that DCEP is just a digital fiat currency. We believe that the market underestimates the vision and possible landing effects of DCEP. The central bank's digital currency is positioned as digital cash. One of the purposes of its issuance is to solve the problem that physical cash is difficult to monitor. According to the patent submitted by the central bank, in order to achieve this purpose, DCEP may load smart contract functions, so that DCEP only meets certain conditions (For example, a specific economic state, time, interest rate, flow to the subject).

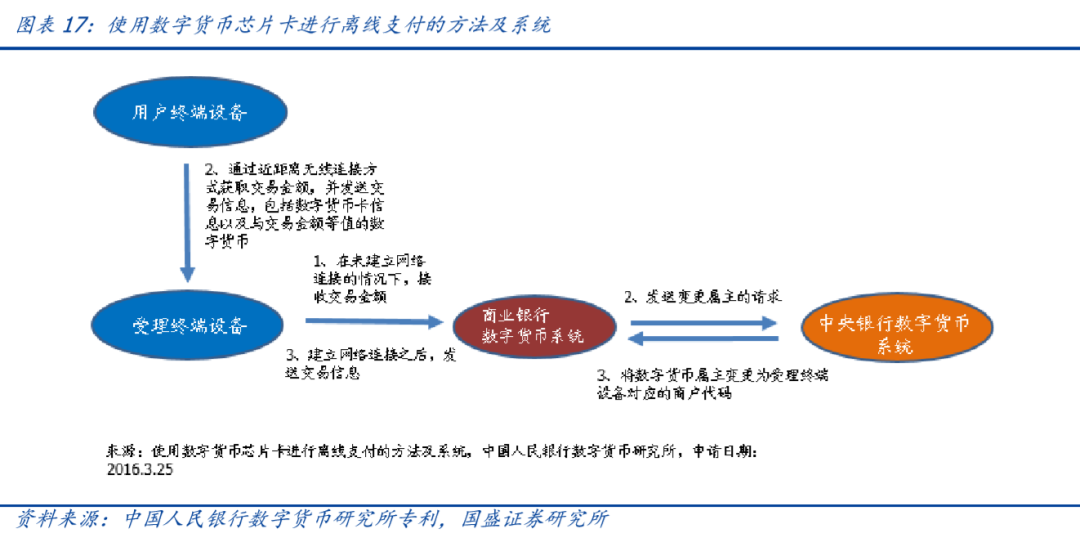

The carrier of DCEP may include a chip smart card . The market believes that the carrier of DCEP is only App. According to the central bank's patent, we believe that the central bank may also consider carriers such as chip smart cards, especially in the plan submitted by the Central Bank's Printing Technology Institute. If this is the case, chip manufacturers with secure storage will also benefit.

- Hangzhou accelerates the creation of the "National Digital Governance First City", creating favorable conditions for accelerating the layout of blockchain and other industries

- Will borrowing in Ethereum DeFi reduce PoS security? Vitalik Buterin: It doesn't exist!

- Global financial markets are picking up, bitcoin has become a "sprint black horse" and "long-term upstart"

The opportunities of DCEP in transaction security and application development cannot be ignored . The market believes that the investment opportunities of the DCEP industry chain are only in the fields of identity authentication and payment services. We believe that opportunities in transaction security and application development cannot be ignored. For example, since DCEP is more secure than commercial banks in deposits, but the face value is the same, there may be an OTC market related to DCEP. This risk is worth paying attention to. In addition, according to the discussion by Yao Qian, director of the Central Bank Digital Currency Research Institute and related central bank patents, DCEP may participate in matching investment and financing or other application scenarios. Manufacturers need to pay close attention to such opportunities.

Investment proposal : Closely follow the industry chain and grasp the three main lines of "Bank IT", "Identity Authentication" and "Payment Service": 1) Bank IT . Whether it is to develop a digital currency system for central banks or commercial banks, whether to add specific fields for digital currencies or develop user access and application systems, DCEP cannot leave the bank IT service provider. For example, Kelan Software, Changliang Technology, Sifang Jingchuang, etc. 2) Identity authentication . Among the patents related to digital currency applied by the People's Bank of China, identity authentication is an indispensable link, and the related technology is encryption technology and identity certification (CA) qualification. We are optimistic about companies with relevant reserves, such as Defender, Digital Certification, Gore Software, etc. 3) Payment service . Although DCEP adopts a "central bank-commercial bank" two-tier operation system, from patents, we find that "wallet service providers" other than commercial banks may also play an important role, and manufacturers with electronic payment experience or licenses are expected to be shortlisted Pilot. For example, New World, Hailian Jinhui, Hengbao etc.

Risk warning: The R & D of the central bank's digital currency has slowed, and the progress of the central bank's digital currency landing has not reached expectations.

1 Investment requirements

1.1 Background

The central bank has been studying legal digital currency for a long time, and its introduction is coming soon . The People's Bank of China (hereinafter referred to as the "Central Bank") has organized experts to establish a dedicated legal digital currency research team since 2014. At the end of 2019, Caijing stated that the central bank's digital currency (Digital Currency Electronic Payment, DCEP) is being piloted in Shenzhen and is already on the "eve of birth" and is about to enter the life application scenario. In January 2020, the central bank said that it has basically completed the top-level design of the legal digital currency, standard formulation, functional research and development, and joint testing. In April 2020, the central bank proposed in the 2020 national telecom conference on currency, gold, silver and security work to strengthen the top-level design, unswervingly advance the research and development of legal digital currency, systematically advance the reform of cash issuance and return systems, and accelerate the promotion of banknote Handling business, issuing bank guard and issuing fund escrow type.

DCEP or being tested . In the DCEP pilot plan reported by Caijing, the DCEP regulatory agency and the pilot plan have been clarified: 1) Supervisory agency: DCEP is led by the central bank's currency, gold and silver bureau, and the central bank's digital currency research institute implements it. The digital currency and anti-counterfeiting management office of the central bank's currency, gold and silver bureau is the only official office related to DCEP. 2) Pilot institutions: including the four major state-owned commercial banks of industry, agriculture, China, and construction and the three major operators of mobile, telecommunications, and China Unicom. 3) Pilot scenarios: including transportation, education, medical care, consumption, etc., will reach C-end users. Pilot banks can choose pilot scenarios based on their own advantages. 4) Pilot location: DCEP is piloting in Shenzhen and is expected to land in Suzhou. Recently, the Yangtze River Delta Financial Technology Co., Ltd. under the Central Bank is rushing to recruit blockchain-related talents. The four major banks have established a DCEP closed development project team in Beijing. 5) Pilot plan: It is divided into two phases. The small-scale scene closed pilot at the end of 2019 will be widely promoted in Shenzhen in 2020. 5) Pilot progress: Testing work related to DCEP standards and payment system access is progressing synchronously.

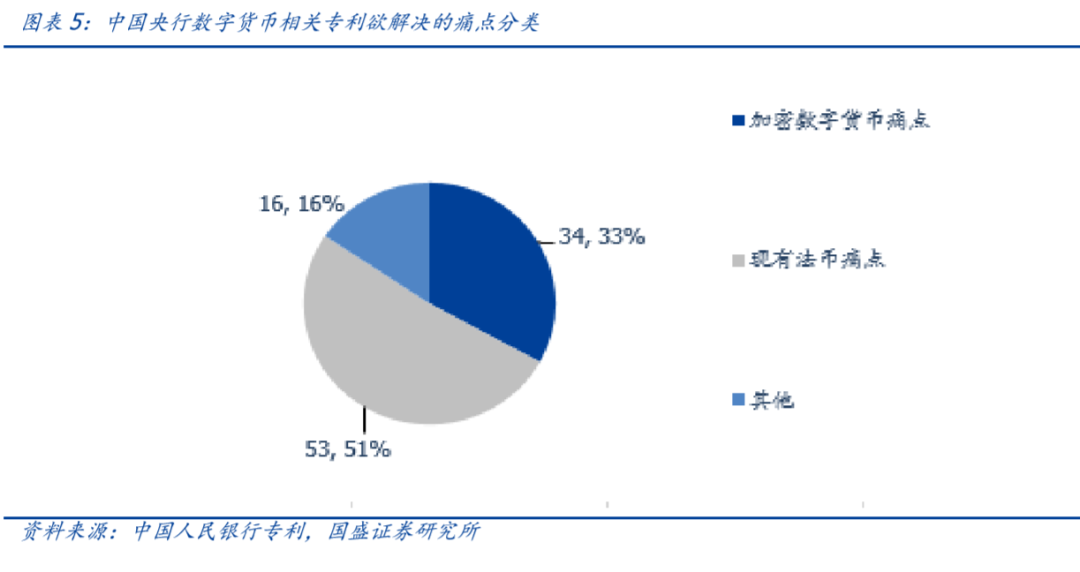

There are multiple reasons for launching DCEP . According to the public statements of central bank officials, it can be found that the main reasons for launching DCEP include: 1. Conform to the wave of digital economy and promote the development of digital economy. 2. There are several problems with the existing paper money system. For example, (1) the costs of distribution, printing, return and storage are high, and there are many levels of circulation systems; (2) inconvenience to carry; (3) easy to be forged, anonymous and uncontrollable, and there are illegal criminal activities such as money laundering risks of. 3. It is conducive to curbing the public demand for private encrypted digital currency and defending the national digital currency sovereignty. 4. Create space for negative interest rates, and solve the problem of the restriction of negative interest rate policies by residents' cash withdrawal from the mechanism.

1.2 Different from market perspective

Service providers with payment experience and licenses are expected to become DCEP wallet operators . The market believes that DCEP uses a "central bank-commercial bank" two-tier operating system, and institutions other than commercial banks cannot participate. According to the central bank's patent, we found that the DCEP "wallet" may not directly rely on bank accounts for transfer and payment functions. We believe that service providers with payment experience and licenses are expected to intervene in the DCEP industry chain and are expected to collect payment service fees.

DCEP may load smart contract functions to achieve targeted issuance and monitoring. The market believes that DCEP is just a digital fiat currency. We believe that the market underestimates the vision and possible landing effects of DCEP. The central bank's digital currency is positioned as digital cash. One of the purposes of its issuance is to solve the problem that physical cash is difficult to be monitored. According to the patent submitted by the central bank, in order to achieve this purpose, DCEP may load smart contract functions, so that DCEP only meets certain conditions (For example, a specific economic state, time, interest rate, flow to the subject).

The carrier of DCEP may include a chip smart card. The market believes that the carrier of DCEP is only App. According to the central bank's patent, we believe that the central bank may also consider carriers such as chip smart cards, especially in the plan submitted by the Central Bank's Printing Technology Institute. If this is the case, chip manufacturers with secure storage will also benefit.

The opportunities of DCEP in transaction security and application development cannot be ignored . The market believes that the investment opportunities of the DCEP industry chain are only in the fields of identity authentication and payment services. We believe that opportunities in transaction security and application development cannot be ignored. For example, since DCEP is more secure than commercial banks in deposits, but the face value is the same, there may be an OTC market related to DCEP. This risk is worth paying attention to. In addition, according to the discussion by Yao Qian, director of the Central Bank Digital Currency Research Institute and related central bank patents, DCEP may participate in matching investment and financing or other application scenarios. Manufacturers need to pay close attention to such opportunities.

1.3 Investment advice

We recommend closely following the industry chain and grasping the three main lines of "Bank IT", "Identity Authentication" and "Payment Services": 1) Bank IT . Whether it is to develop a digital currency system for central banks or commercial banks, whether to add specific fields for digital currencies or develop user access and application systems, DCEP cannot leave the bank IT service provider. For example, Kelan Software, Changliang Technology, Sifang Jingchuang, etc. 2) Identity authentication . Among the patents related to digital currency applied by the People's Bank of China, identity authentication is an indispensable link, and the related technology is encryption technology and identity certification (CA) qualification. We are optimistic about companies with relevant reserves, such as Defender, Digital Certification, Gore Software, etc. 3) Payment service . Although DCEP adopts a "central bank-commercial bank" two-tier operation system, from the patents, we find that "wallet service providers" other than commercial banks may also play an important role, and manufacturers with electronic payment experience or licenses are expected to be shortlisted Pilot. For example, Hailian Jinhui, New World, etc.

In addition, the four major commercial banks of Workers, Peasants and China Construction are responsible for providing digital currency to the public, and the three major telecom operators of China Mobile, China Telecom and China Unicom may participate in the transformation and upgrading of the bank ’s IT system to serve the aforementioned large banks and operations Commercial institutions also have the potential to develop their grand plans in the development of DCEP.

1.4 Risk warning

2 Patent overview: 3 institutions have submitted 97 patents in 3 years with different styles

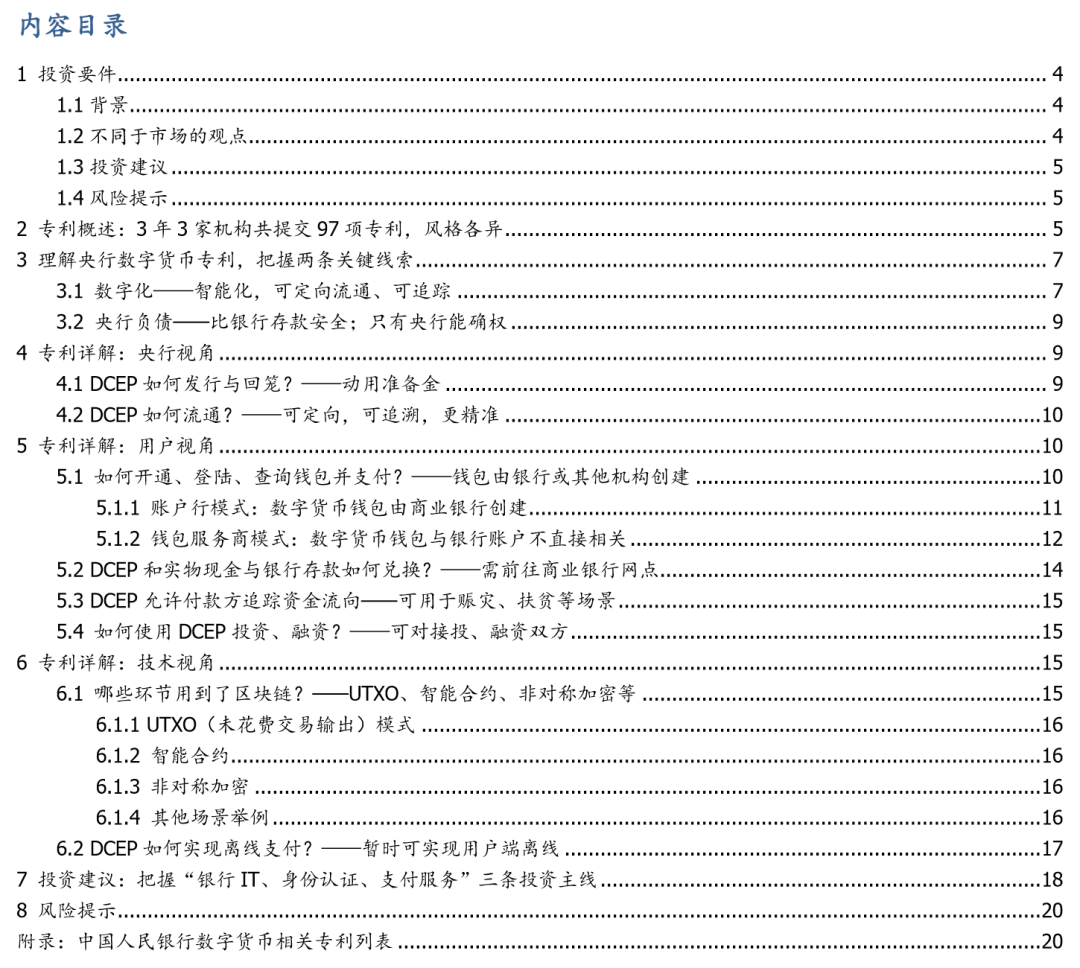

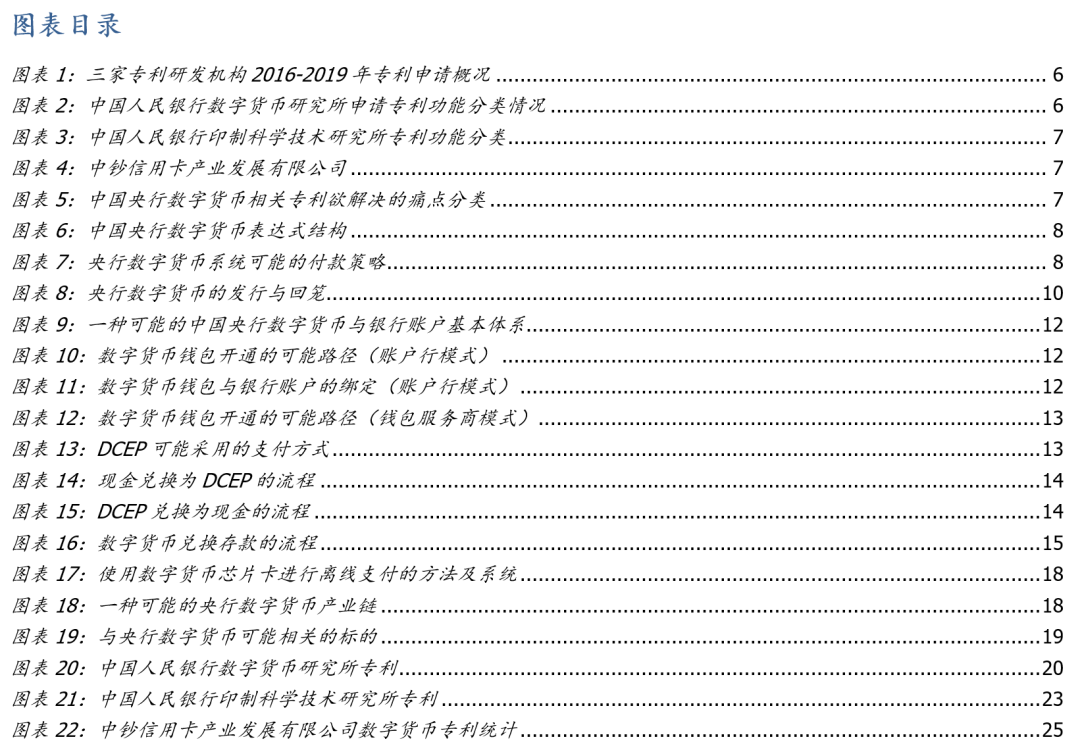

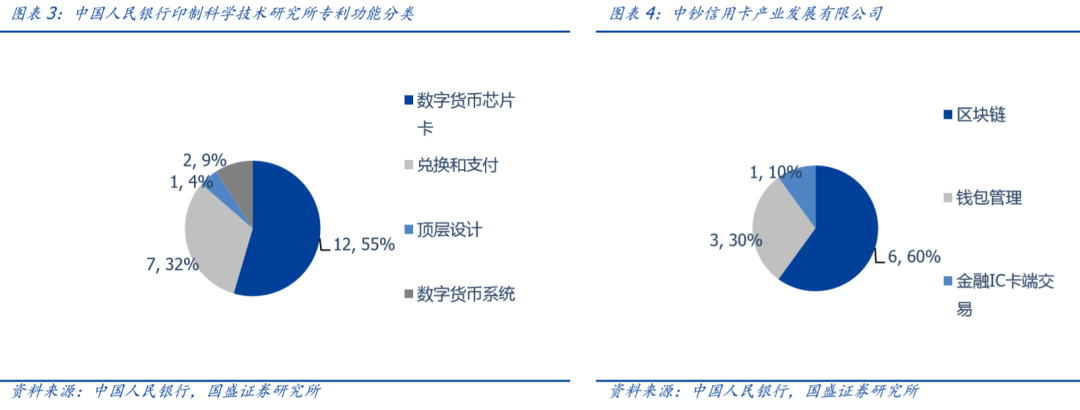

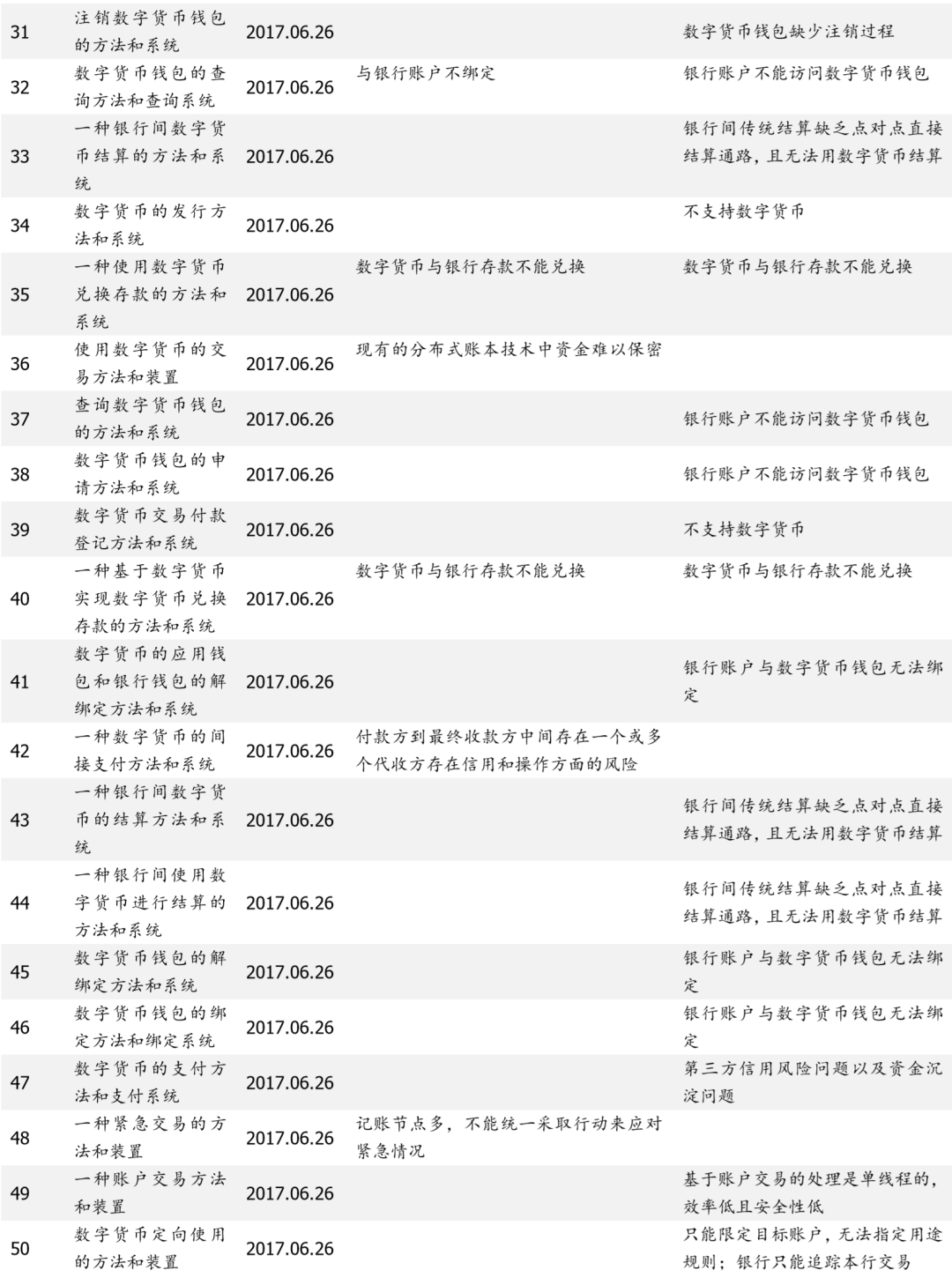

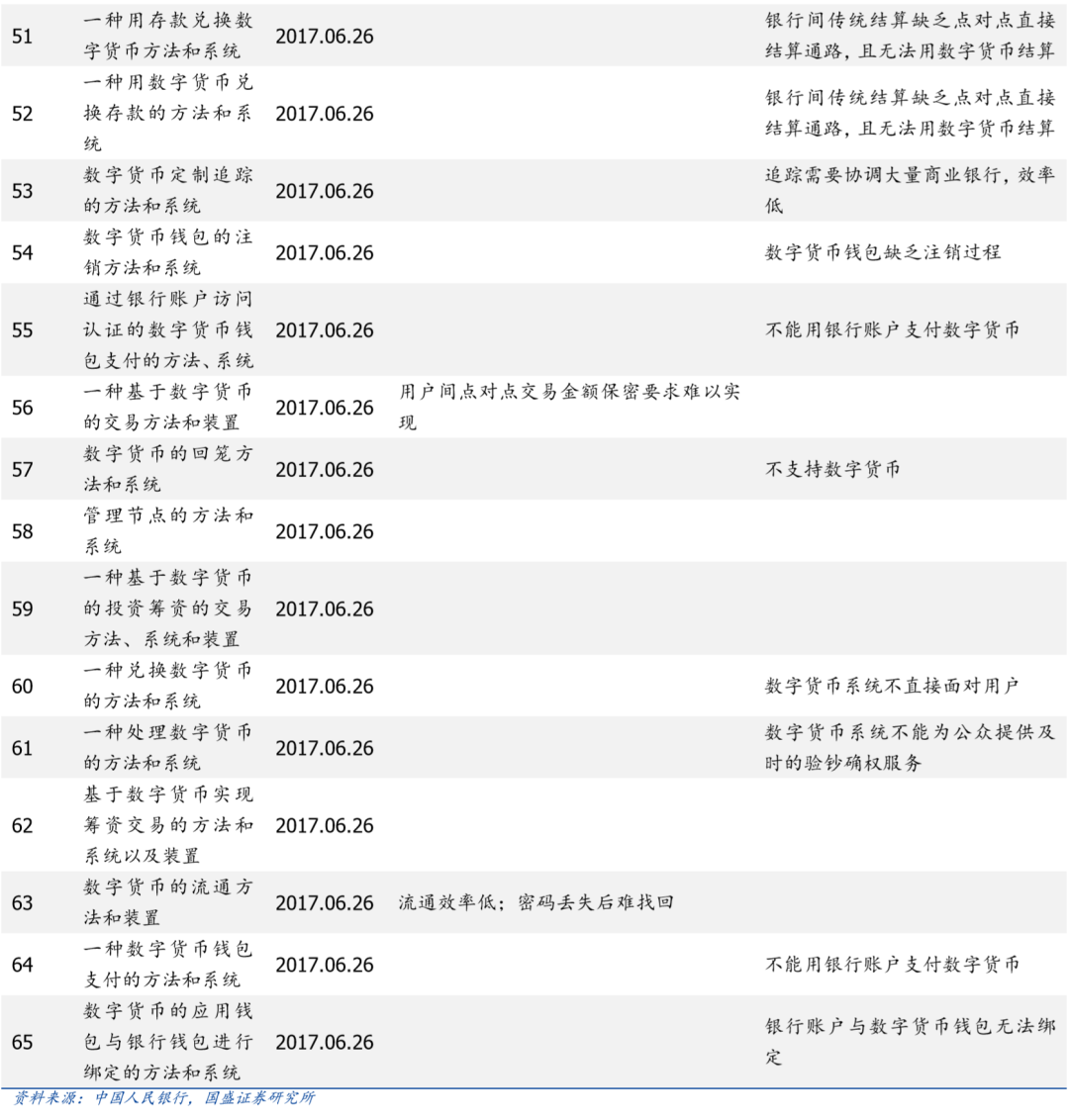

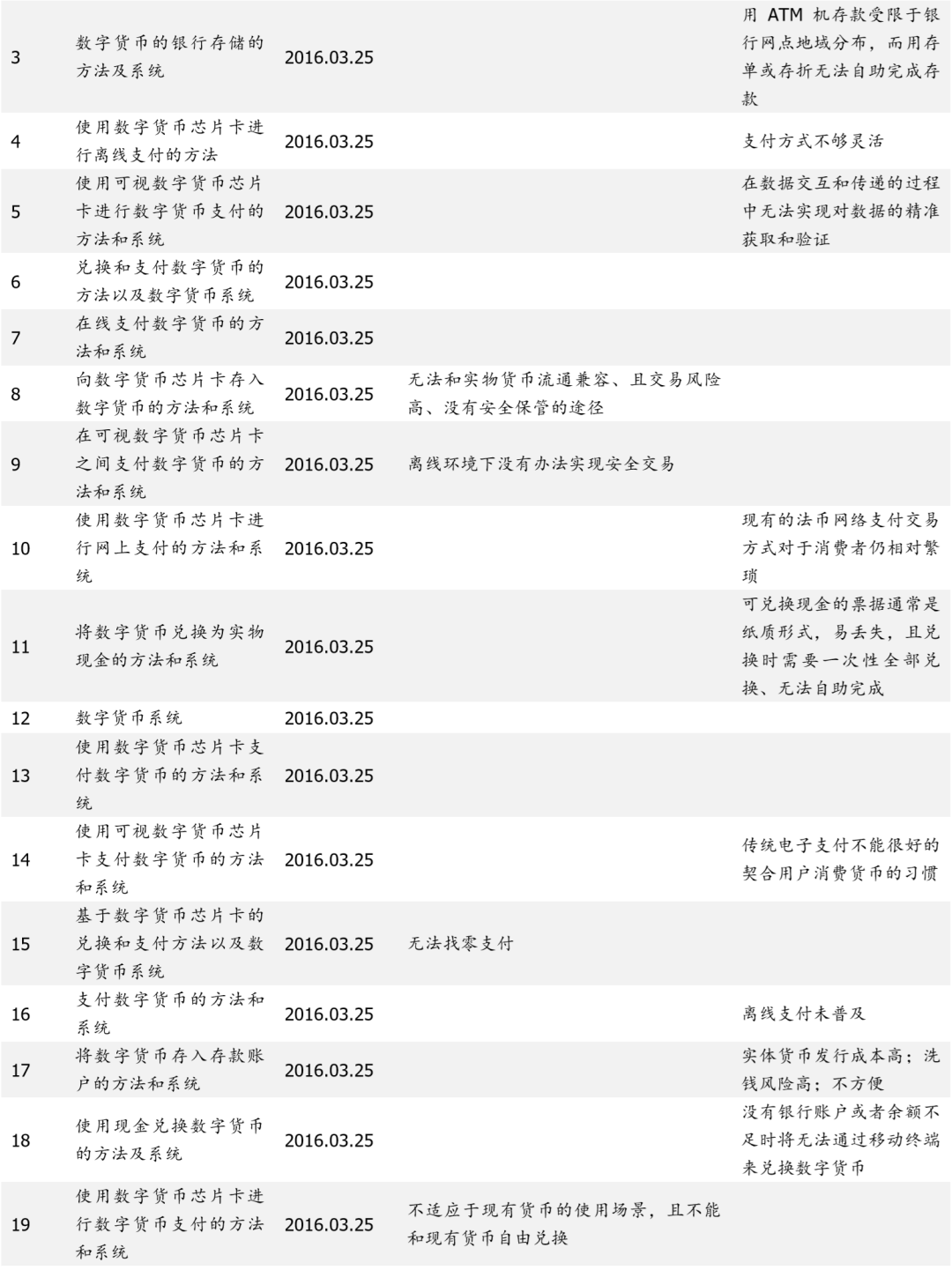

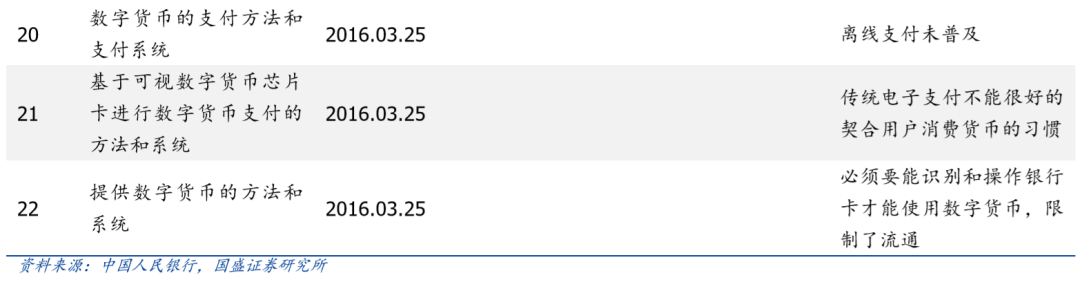

There are three main R & D institutions that propose digital currency-related patents: the People ’s Bank of China Digital Currency Research Institute, the People ’s Bank of China Printing Science and Technology Research Institute, and China Banknote Credit Card Industry Development Co., Ltd. (both have research in Hangzhou and Beijing Institute), they submitted a total of 97 patents between 2016 and 2019. Among them, the People's Bank of China Digital Currency Research Institute has the largest number of patents among the three institutions. From 2017 to 2019, a total of 65 patents (67% of the total) were applied, mainly concentrated in 2017, with a total of 48 patents applied. The two important points are that the time nodes are June 26 (35 items) and December 28 (13 items). In 2018 and 2019, 4 and 13 patents were applied respectively, with a longer time span; The 22 patents (23%) applied by the Institute of Industrial Science were concentrated on March 25, 2016, which was very concentrated; the two institutes of China Banknote Credit Card Industry Development Co., Ltd. applied for the least DCEP-related patents, a total of 10 Items (accounting for 10%), but the time span is large and covered in 2016-2018.

3 Understand the central bank digital currency patents and grasp two key clues

3.1 Digitization-intelligent, directional circulation and traceability

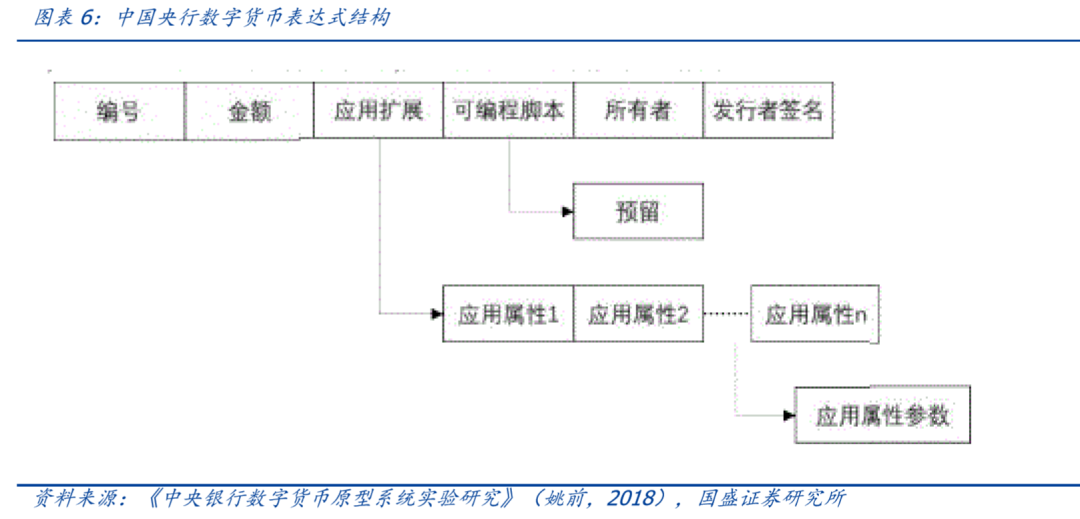

The central bank's digital currency is not simply the electronicization of the renminbi, but also a smart currency. It can be loaded with smart contracts, can be directed to circulation, and can be traced. It is a "super currency". DCEP is an encrypted digital string that is guaranteed and signed by the central bank and represents a specific amount . According to the patent submitted by the Central Bank Digital Currency Research Institute, its essence is the encryption of the main properties and ownership of the currency. It consists of long fields. These fields include one or more of the following: currency amount (minimum amount is 1 point, no upper limit), number, issuer ID, owner ID, currency management attribute, currency security attribute, currency application attribute. Parties with different authorities can only decrypt the corresponding content within the scope of authority. The unauthorized party cannot view the digital currency properties. The digital currency expression is essentially the encryption of the main attributes and ownership of the currency. In specific transactions, it can be "one password at a time", which is the basis for the safe operation of the digital currency system.

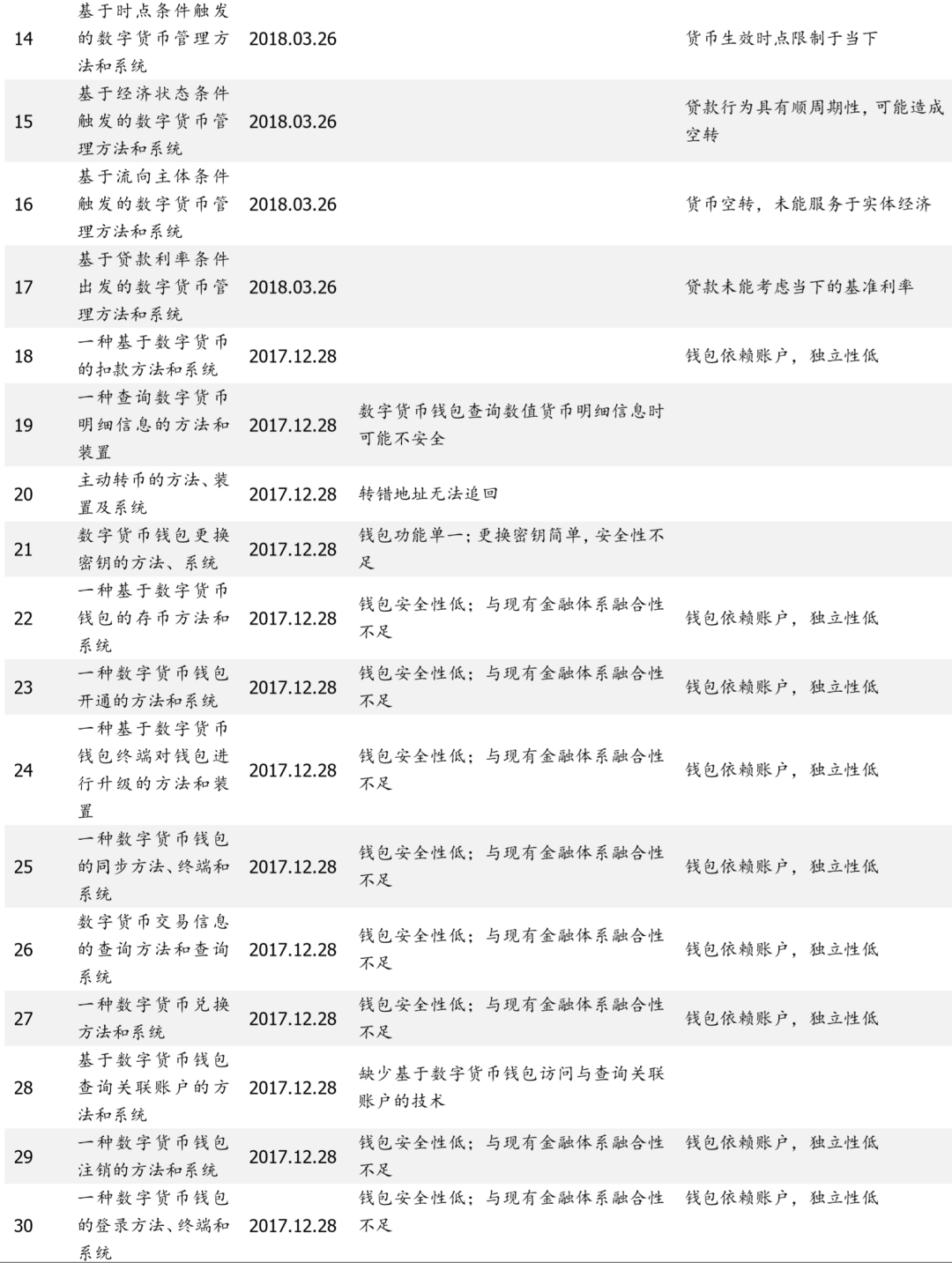

DCEP may load smart contracts . In the field of DCEP, the number is unique; the owner ID can be anonymous, but the real name of the digital currency system background can correspond to the real user through the system background, which can be based on the account, or based on the unspent transaction output similar to Bitcoin ( UTXO, Unspend Transaction Output) to record the currency transfer process; the currency management attribute is a field that supports the currency authority to manage currency issuance and circulation; the currency security attribute is a group of fields related to the security encryption of digital currency, which can realize that digital currency can not be forged , Non-tamperable, non-repudiation, protection of privacy, protection of transaction security and other functions; currency application attributes are a set of fields that digital currencies meet the needs of application scenarios and value-added services, enabling the control of capital flows and smart contracts (up to preset conditions Auto-executable script) and other functions. In order to facilitate the management of the digital currency produced, the central bank digital currency system has set the registration status attribute field of the digital currency in the database in advance, and set the selectable values of the registration status attribute, such as: in production, locked, available, destroyed and Withdrawal status.

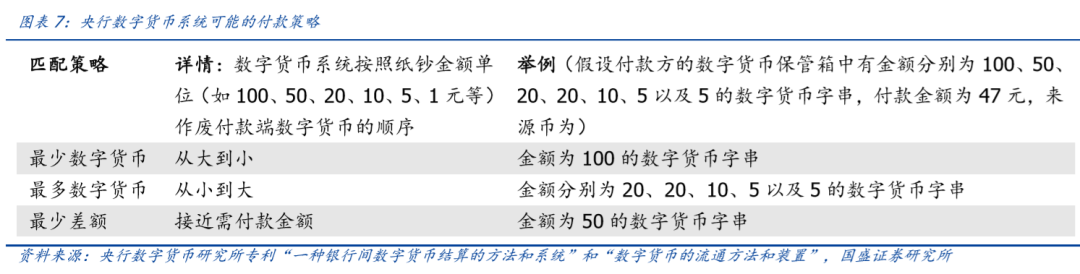

The specific method of DCEP transaction depends on the string preset matching rules. The preset matching rules can be the most digital currency strategy, the least digital currency strategy, or the least difference strategy. The least difference strategy can also be combined with the other two.

3.2 Central bank liabilities-safer than bank deposits; only the central bank can confirm power

Unlike the use of cash transactions that do not require the confirmation of the central bank, the digitized central bank liabilities-central bank digital currency transactions must be confirmed by the central bank. It is for this reason that it is not so important whether the central bank's digital currency distribution agency is a commercial bank or other institutions, that is, both channels can exist.

The issuance and withdrawal of existing paper money is a "central bank-commercial bank" two-tier system. Its issuance is transferred from the issuance fund to the central bank's issuance bank, then from the central bank's issuance bank to the bank's business bank, and then from the bank's business bank Enter the field of circulation. DCEP also uses a "central bank- commercial bank" two-tier operating system . This follows the current paper money issuance and circulation model, namely: 1) the central bank issues digital currency to commercial banks; 2) commercial banks provide digital currency access and other services to the public. Compared with the central bank's model of issuing digital currency directly to the public, the advantages of the two-tier operating system are: 1) It is easier to let legal digital currency gradually replace paper money under the existing currency operation framework without subverting the existing currency issuance and circulation system ; 2) The enthusiasm of commercial banks can be mobilized to jointly participate in the issuance and circulation of legal digital currency, appropriately diversify risks, accelerate service innovation, and better serve the real economy and social livelihood.

The central bank confirms the change of ownership of DCEP transactions. The specific process is to invalidate the digital currency of the payer, produce a new digital currency with the same amount as the deducted digital currency, and register the owner of the new digital currency as the payee. For example, the payer's digital currency wallet has a digital currency with a denomination of 10 and the number is 001. If the deduction amount is 7, the digital currency issuance registration system will invalidate the number 001, and the digital currency issuance registration system will produce according to the preset denomination A digital currency with a denomination of 7, a digital currency with a denomination of 3, then determine the ownership of the digital currency with a denomination of 7 as the payee, and determine the ownership of the digital currency with the denomination of 3 as the payer. The purpose of this step is to prevent counterfeiting of digital currency and further improve the security of digital currency transactions.

4 Detailed patents: the central bank's perspective

4.1 How is DCEP issued and withdrawn? ——Use reserves

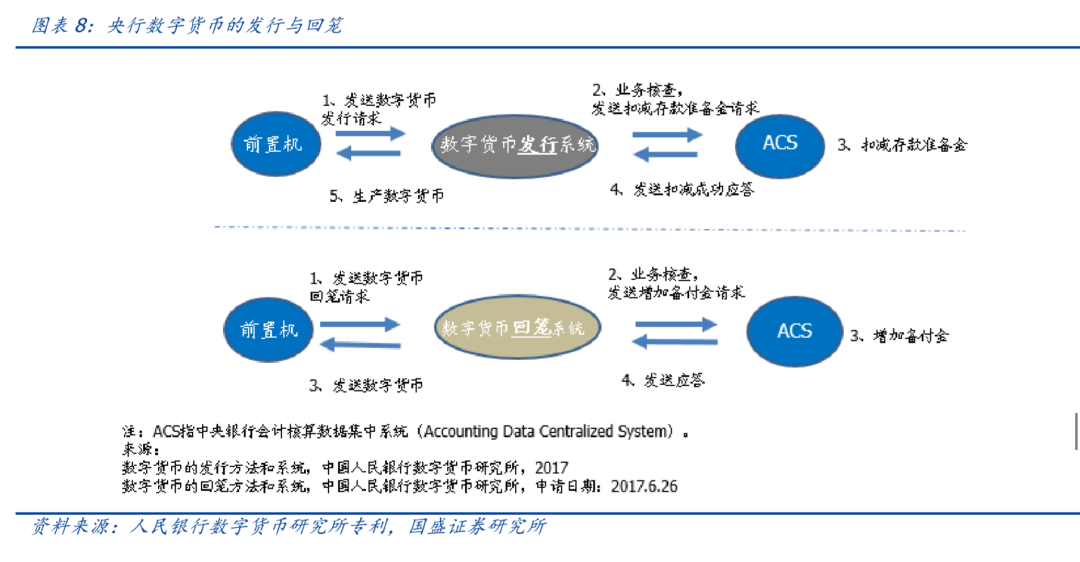

The DCEP issuance process is not much different from the traditional model, or adopts the non-expanded table model. The central bank's traditional currency issuance method is divided into two types: expanded table issuance and non-expanded table issuance. The former refers to the central bank's asset end (foreign exchange, debt to commercial banks and other assets) and the debt end increase at the same time; the latter refers to the central bank's replacement of business The deposit reserve (generally, the excess reserve in this case) that the bank deposits with the central bank belongs to the adjustment of the debt-end structure of the central bank. DCEP adopts a non-expanded table model. The issuance scenario envisaged by the patent “Digital Currency Issuance Method and System” of the Digital Currency Research Institute of the People ’s Bank of China is: a commercial bank sends an application to the central bank through a front-end machine, and the central bank will review Digital currency is sent to the applicant. Contrary to the issuance process, the withdrawal of DCEP has increased the reserve requirements for commercial banks.

It should be particularly emphasized that the central bank may authorize the issuer to issue digital currency on its behalf (for example, banks, refer to the Hong Kong dollar model), and the issuer is responsible for confirming and managing transactions between users. In addition, banks can obtain digital currency indirectly by exchanging with other banks that can request digital currency without using digital currency issuing institutions to exchange for interbank deposits . We judge that in the early stage of the DCEP pilot, the central bank may not issue DCEP to all commercial banks, but only open qualifications to some commercial banks (ie, "agent banks"), and other banks (ie, "participating banks") are opened in the aforementioned commercial banks. Obtain DCEP indirectly.

4.2 How does DCEP circulate? ——Orientable, traceable and more precise

DCEP 's circulation transactions are divided into ordinary transactions and directed circulation. According to the patents “Circulation Method and Device of Digital Currency” and “Method and Device for Direct Use of Digital Currency” by the Digital Currency Research Institute of the People ’s Bank of China

➢ For ordinary transactions, the payment terminal selects the digital currency string based on the amount and the predefined matching strategy. The management terminal invalidates the original digital currency string, generates a new currency string according to the new transaction, and sends the digital currency string to the receiver On the payment side, the owner completes the change registration.

➢ Directional circulation restricts usage rules compared with ordinary transactions. The payment instructions of the payer and the payer need to meet specific transaction purposes. The digital currency system will monitor the usage rules and change the ownership information of the digital currency to Payee, and set as a digital currency that is not restricted by the usage rules.

There are four kinds of DCEP effective trigger conditions in the patent of the People's Bank of China Digital Currency Research Institute . The specific process is: sending digital currency to financial institutions. At this time, its status is invalid, and the digital currency will only take effect when the conditions are met.

(1) Trigger based on economic conditions: able to adjust the return rate of funds in a reverse cycle according to economic information at the time of recovery, thereby reducing the risk characteristics of financial institutions and the procyclicality of their loan behavior, avoiding "liquidity traps" and realizing economic Reverse cycle regulation.

(3) Trigger based on the conditions of the flow direction : can accurately and qualitatively launch digital currencies, implement structural monetary policies, reduce currency idling, and improve the real economic capabilities of financial services.

(4) Trigger based on time point conditions : it can effectively solve the current problem of the current monetary policy operation, extend the effective time point to the future, avoid currency idling, and reduce the time lag of monetary policy transmission.

5 Detailed patents: user perspective

✓ The payment is generated by the CA certificate signature to generate a digital currency transfer request, and then the digital currency transfer request is sent to the digital currency issuing bank and the successful payment result with the digital signature of the issuing bank is received;

✓ Storage refers to that users transfer digital currency to a digital currency wallet when they need it. The digital currency wallet generates a deposit transfer request for the deposit command, and the request is sent to the digital currency issuance registration terminal, the source currency string list is invalidated, and the deposit is generated. Go to the list of coins to complete the storage process;

✓ The transfer is based on the recipient's payment address information to generate a currency transfer request, and the currency transfer operation is performed to the recipient's wallet according to the instructions of the currency transfer request.

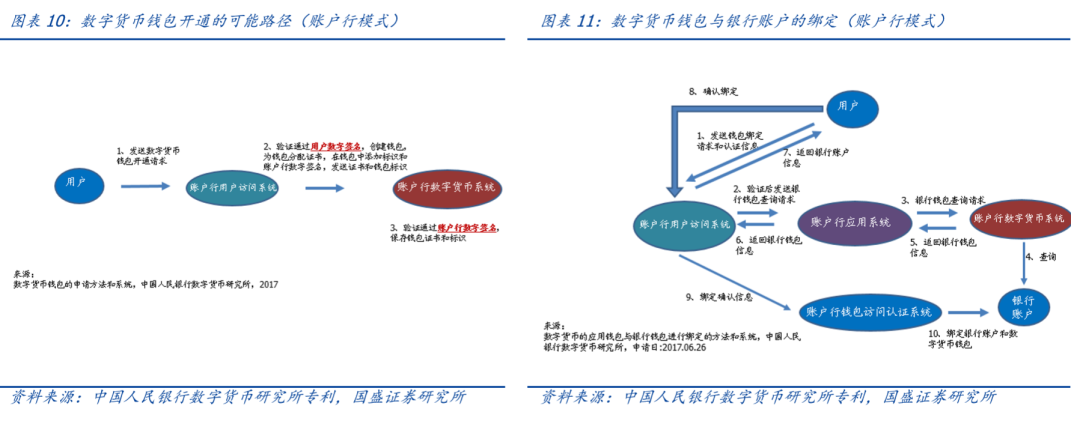

The operation of the central bank's digital currency wallet is divided into two modes: 1 ) account line mode: directly tied to the bank account; 2 ) wallet service provider mode: created and operated by the wallet service provider. among them,

✓ The restricted range of the wallet in the account line mode is small. Although DCEP has weak coupling to accounts, in order to avoid the occurrence of runs, money laundering and other phenomena, the central bank's digital currency will still set a certain friction, and digital currency wallets that are not tied to the account are subject to certain exchange, payment and other aspects. The degree of limitation, only upload more information, the KYC level will increase, the various restrictions will also be reduced accordingly, you can conduct larger transactions.

✓ The wallet in both modes can be bound. According to the patent "Inquiry Method and Inquiry System of Digital Currency Wallet" issued by the Digital Currency Research Institute of the People's Bank of China, users can inquire about the digital currency wallet bound to their account bank account inquiries, and can also inquire related accounts and transactions in the wallet Details and related information such as a detailed list of digital currencies.

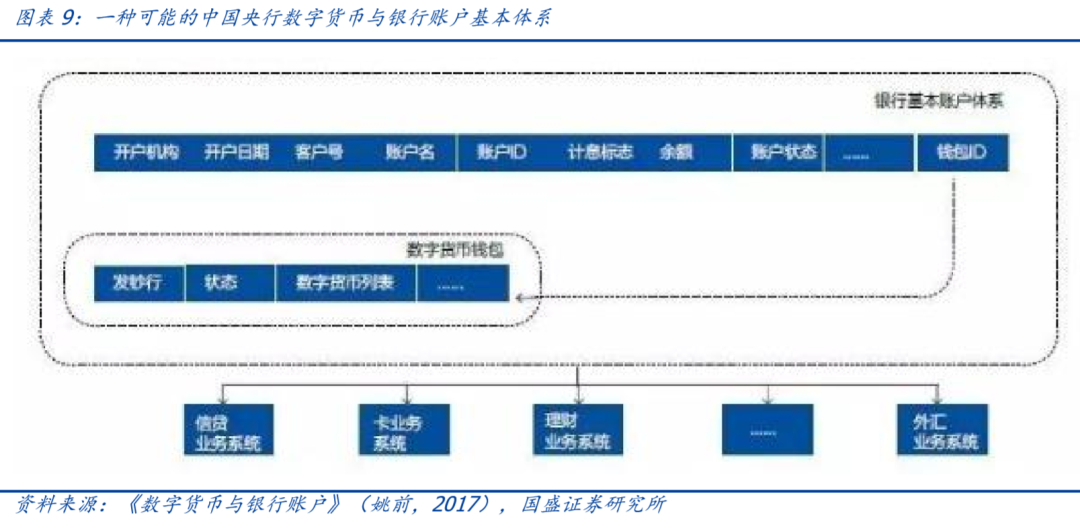

5.1.1 Account line mode: digital currency wallets are created by commercial banks

The digital currency "wallet" attribute can be attached to the type I account in the traditional account system of commercial banks . Like the bank account, it is a strong real-name authentication , and the two can be bound. The bank account can use a basic bank account or a type I bank account. Type I accounts refer to accounts opened through traditional bank counters that meet all the strict requirements of the real-name system, and are fully functional accounts. The bank account to which the user binds the wallet is a basic account or a type I account, which is a real-name full-featured account, and each bank user can only open one such account. At the same time, only one wallet can be opened per bank, and the wallet is bound to the account. Therefore, users can only access as the basic account or type I account to access the wallet bound to the account. The implementation path is to add a digital currency wallet ID to a bank account, and the digital currency wallet also saves the associated bank account ID. An account can manage both existing electronic currency and digital currency.

Electronic money and digital currency have common features, such as account use, identity authentication, fund transfer, etc., but there are also differences . The digital currency wallet is similar to the user's digital currency "safe deposit box", and its management should meet the central bank's relevant wallet design standards. The bank will manage the safe deposit box according to the agreed authority with the customer (for example, there must be two keys for the customer and the bank to open, etc.) , Retain all attributes of digital currency as encrypted currency, and use these attributes to customize applications flexibly in the future.

The account bank digital currency wallet can also be accessed directly without going through the bank account system . According to the patent "Method and System for Canceling Digital Currency Wallet" of the Central Bank Digital Currency Research Institute, there are two authentication methods for account bank digital currency wallets:

✓ The authentication is performed through the account bank bank account access authentication system; this authentication method is the main channel. This method of authentication is equivalent to the user accessing the wallet function by logging in to the bank account access authentication system. It is an extension of the existing bank account access authentication system Access mode. In this mode, users can access both the account core system and the digital currency system.

✓ Authentication through the account bank wallet access authentication system; this method of authentication is equivalent to the wallet having an independent authentication entrance, separating wallet function access from account function access, and providing independent API interfaces for digital currency wallets to provide support for user application services . Users can bind their digital currency wallets and bank accounts through the following systems: 1) account user access system; 2) account bank application system; 3) account bank digital currency system; 4) account bank wallet access authentication system.

When applying for digital currency wallets, the first method is used for authentication, and the other two channels can be used.

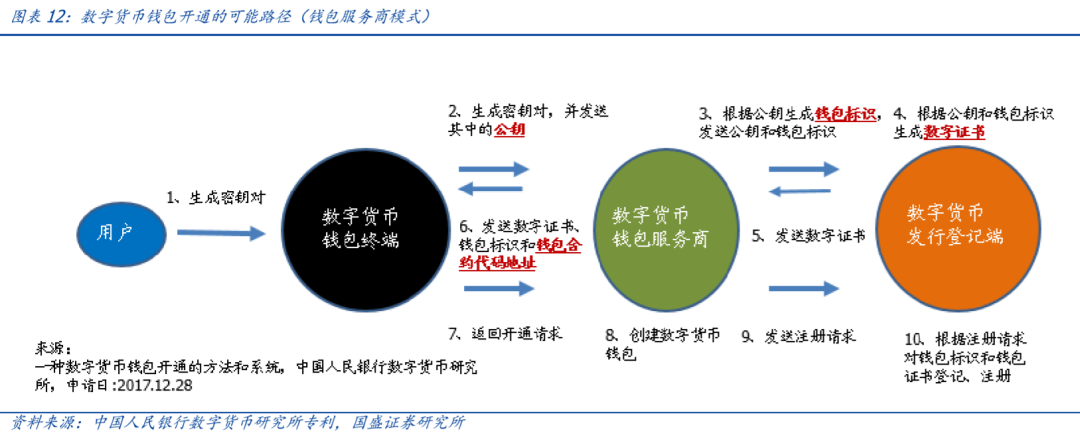

5.1.2 Wallet service provider model: digital currency wallets are not directly related to bank accounts

The digital currency wallet can be independent of the account system and open up with the existing account system. It is the carrier that actually stores the encrypted digital currency . According to the patent “A Method and System for Opening a Digital Currency Wallet” issued by the Digital Currency Research Institute of the People ’s Bank of China, the digital currency wallet created by the wallet service provider reflects the weak coupling to users, that is, the central bank digital currency can be separated from traditional bank accounts The realization of value transfer greatly reduces the dependence of the transaction link on the account and can be achieved without relying on the bank account. The specific process is as follows: the digital currency wallet terminal generates a key pair, sends the public key to the wallet service provider, and then the wallet service provider generates the wallet ID based on the public key information and sends it to the digital currency issuance registration agency, and then the digital currency issuance agency will use the public key A digital certificate is generated with the wallet ID, and the wallet service provider creates a digital currency wallet accordingly. Users who log in for the first time can also update their information to obtain larger payment quotas and other rights.

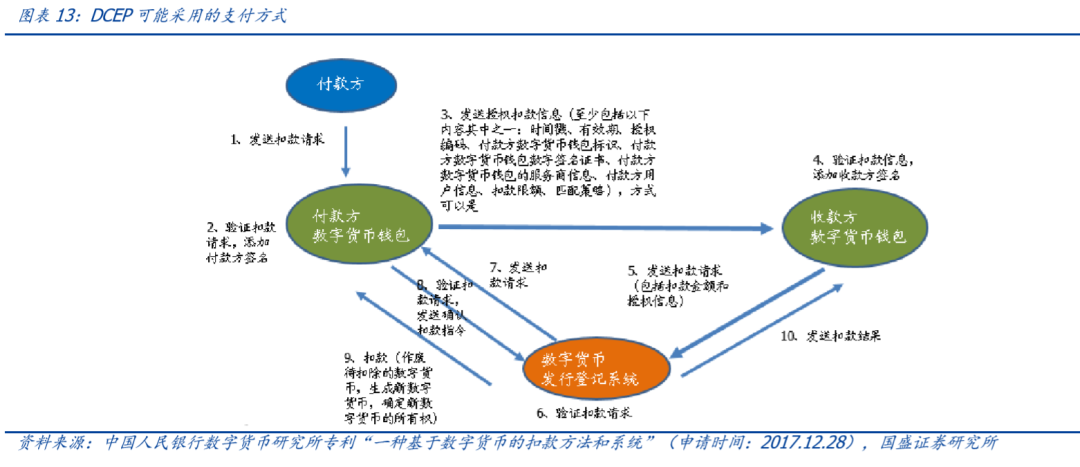

Payments using digital currency wallets can be initiated by the payer or the payee, but they need to be confirmed by the central bank.

✓ The payment process initiated by the payee is: generating a transfer request according to the payment address, generating a transfer instruction according to the transfer request, and transferring the currency to the receiver according to the transfer instruction.

✓ The process initiated by the payer is: the payer ’s wallet sends a debit authorization (in the form of a QR code) to the payee ’s wallet, and after the payee verifies, it sends the deduction application to the central bank ’s issuance registration system. Confirm that the deduction amount does not exceed the balance of the payer's wallet.

5.2 How can DCEP and physical cash be exchanged with bank deposits? ——Need to go to a commercial bank branch

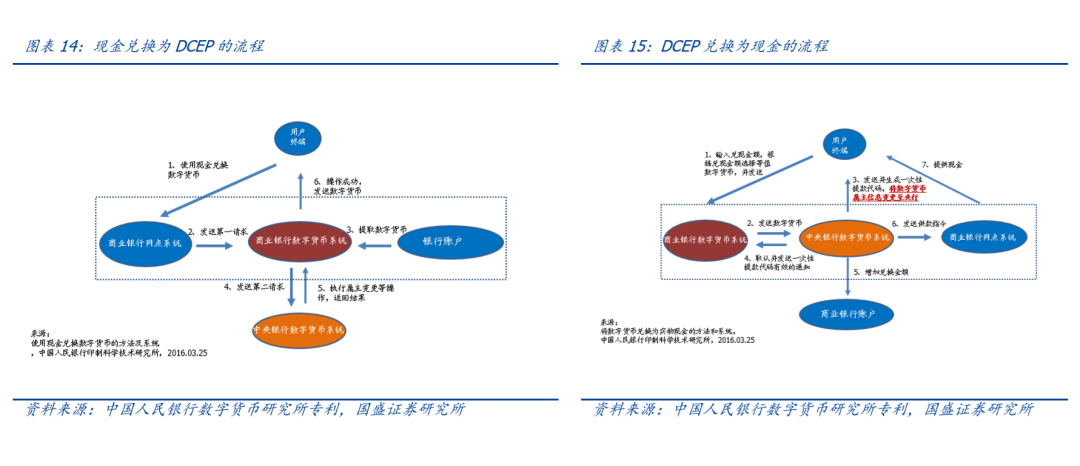

Users can also easily switch between DCEP and cash and deposits as needed . According to the patent issued by the Digital Currency Research Institute of the People's Bank of China "a method and system for exchanging deposits for digital currencies and a method and system for exchanging deposits for digital currencies",

➢ When the cash in the user's hand wants to be converted into DCEP, the commercial bank outlet system will send the request to the commercial bank digital currency system, after which the account bank withdraws the digital currency and sends a second request to the central bank digital currency system for digital currency ownership The main change can be sent to the user's terminal after the request is passed.

➢ When users need to convert DCEP to cash, they first need to select the equivalent digital currency, then transfer this request to the central bank digital currency system through the commercial bank's digital currency system, and then the central bank will take the corresponding digital currency as the owner After the change, the commercial bank will provide a one-time withdrawal code to the central bank. After verification, it can increase the cashed amount to the commercial bank account. Finally, the commercial bank digital currency system issues a contribution instruction to the bank outlet to complete the cash exchange operation.

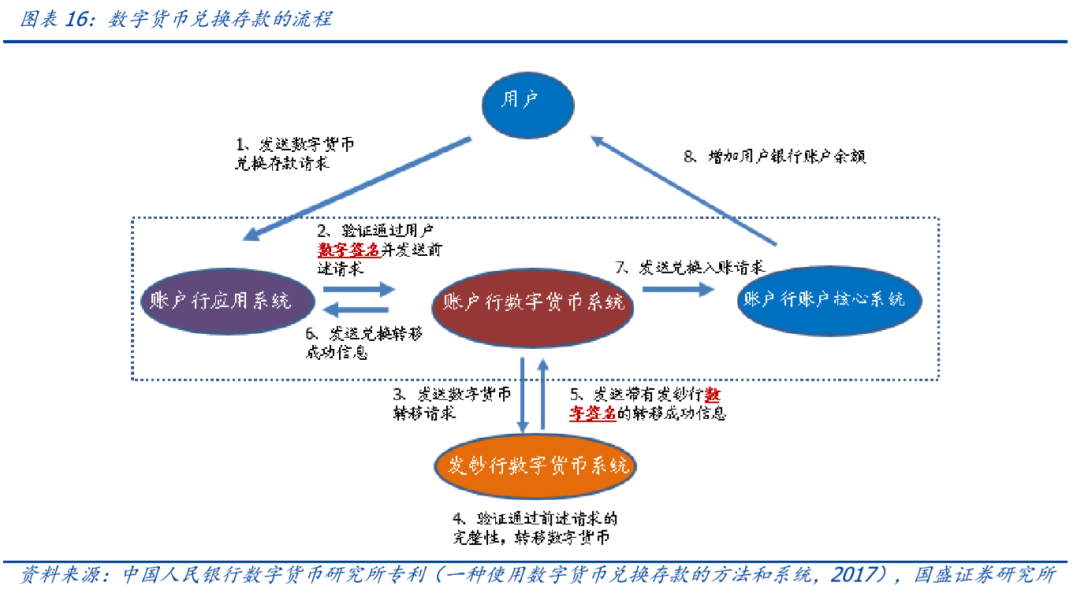

➢ When the user wants to convert DCEP to a deposit, the account bank application system is responsible for verifying the user's digital signature, the account bank digital currency system is responsible for converting the user's exchange request into a digital currency transfer request, and the issuing bank / central bank digital currency system is responsible for transferring digital currency It will return the successful transfer information with the digital signature of the issuing bank to the digital currency system of the account bank. The core system of the account bank account will increase the user's bank account balance for the user.

5.3 DCEP allows the payer to track the flow of funds-can be used in disaster relief, poverty alleviation and other scenarios

Taking precision poverty alleviation as an example, the current poverty alleviation authorities' tracking of capital flow is mainly to aggregate payment records scattered in different commercial banks to analyze and derive the link of capital flow. According to the patent “Method and System for Customized Tracking of Digital Currency” by the Central Bank Institute of Digital Research, the central bank can authorize the opening of the poverty alleviation funds to the poverty alleviation authorities through programmable scripts of digital currency strings, without the need to connect multiple businesses The main body of the bank. The specific process is: 1) Open tracking. The higher-level civil affairs department opened the digital currency tracking function, and the digital currency system marked the digital currency as traceable; 2) authorized tracking. The owner of the subsequent received digital currency, such as the civil affairs departments at all levels, can track and authorize the digital currency with the tracking mark. 3) Turn off tracking. When the owner of the digital currency closes the tracking mark during payment, the tracking chain is broken to ensure the privacy of subsequent transactions.

5.4 How to use DCEP for investment and financing? ——Can connect with both investment and financing parties

DCEP can also realize investment and financing functions through digital currency wallets. According to the patent “A Transaction Method, System and Device for Investment and Financing Based on Digital Currency” issued by the Digital Currency Research Institute of the People ’s Bank of China, users can use digital currency for investment and financing. The specific process is: the investor ’s wallet application device can receive intelligence Contract, and add investment confirmation information, including investment amount, investor digital signature and personal information, etc. After the investment platform verifies the information, the smart contract becomes effective, and the investor ’s wallet application device will pay the digital currency to the fundraiser ’s wallet account.

6 Detailed patents: technical perspective

The application of DCEP to blockchain is not a complete copy of well-known blockchains such as Bitcoin and Ethereum. It may be more reflected in the application of the single technologies that constitute blockchain technology , for example, the use of smart contracts to achieve the directional circulation of funds. Use asymmetric encryption to authenticate identities. Among them, the asymmetric encryption in the Bitcoin blockchain is similar to "traditional" digital identity authentication, or it will be used in a large number of scenarios of DCEP. For example, the security module of the user wallet generates public and private key pairs. In one correspondence, the public key can be made public, the private key is not made public, the private key can be used to sign messages, and the public key can be used to verify the information signed by the private key to confirm the identity of the owner of the private key.

6.1.1 UTXO (unspent transaction output) mode

Bitcoin has no account, and its transactions are based on UTXO (Unspend Transaction Output). In the traditional account transaction mode of electronic transactions, there will be an intermediary party (such as a bank) to write down the payment amount in the payer's account and add the payment amount to the payee. Bitcoin has a shared ledger. For example, if A pays B2 bitcoins, but there are 3 bitcoins before A, the bitcoin ledger will generate two transactions, one for 2 bitcoins for B and one for A bitcoin , The latter is a change transaction.

DCEP borrows some of UTXO's design . Patents such as “an account transaction method and device” and “digital currency directed use method and device” and “a digital currency-based transaction method and device” of the Central Bank ’s Institute of Mathematics explicitly mention that the digital currency may borrow from the UTXO model. This model does not pay attention to the account. When a transaction occurs, the digital currency system reads the unspent currency owned by the full payer, uses it as an input and locks it, and then generates the currency owned by the payee according to the transaction amount and belongs to the payer. The change currency of, and finally change the status of the input currency to spent. The way DCEP confirms transactions is to invalidate the payer's digital currency (called "source currency") and validate the payee's digital currency (called "going currency"), which is similar to the UTXO model.

6.1.2 Smart contract

Smart contracts are program scripts that can be automatically executed to meet predetermined conditions , and are widely used in blockchains such as Ethereum. For example, the token issuer can use Ethereum's smart contract ERC20 to set the number of digital currencies to be issued, effective conditions, etc.

DCEP may apply smart contracts in functions such as directed circulation and preferentially use them in the application layer. According to the patent “Method and Device for Directed Use of Digital Currency” by the Central Bank Institute of Mathematics, the process of formulating smart contracts is to create a smart contract executable by the digital currency system after digitally signing the usage rules specified by the user at the business level. The initial smart contract is deployed in the lowest application layer of the digital currency system. During the deployment process, part of the content will be transferred to the digital currency system of the commercial bank and the central bank, and finally the mutual call relationship of the smart contract will be formed.

6.1.3 Asymmetric encryption

In 1976, public key cryptography was widely used in scenarios such as Bitcoin and CA (trusted authentication) that required digital identity authentication and digital signatures . Its basic principle is: the private key corresponds to the public key one by one, the public key can unlock the information encrypted by the private key; the public key can be generated from the private key, but the private key cannot be derived from the public key. It allows the user to show the public key externally, but proves that he is the owner of the private key without showing the private key externally. For example, when A encrypts a message with his private key and sends it to B, if B can decrypt the message ciphertext with A's public key, B can be sure that the message comes from A, because only A has the private key to encrypt the message. Usually called digital signature. This technique is therefore called "asymmetric encryption".

Asymmetric encryption is a technology that DCEP uses very much . For example, according to the patent “Method and System for Customized Tracking of Digital Currency” by the Central Bank Institute of Mathematics, in the context of targeted poverty alleviation, when the higher-level civil affairs department needs to inquire about the use of the transfer of rescue funds, the digital currency used for the previous appropriation and the representative ’s With the private key certificate, the digital currency system uses the public key of the civil affairs department to verify its relationship with the digital currency. If it passes the verification, the department is judged to be the owner of the digital currency that submitted the query.

6.1.4 Examples of other scenarios

✓ Central Bank Digital Currency Research Institute

Some patents of the Central Bank Digital Currency Research Institute clearly mentioned that the digital currency system may use a "confirmation chain" to confirm the status of the digital currency, and the confirmation chain can be constructed based on the blockchain; it also mentioned that the blockchain may be used to store multiple parties Payment request information to increase the privacy of the transaction (for details, see the patents "Transaction Methods and Devices Using Digital Currency", "Return Method and System of Digital Currency" and "A Method and System for Processing Digital Currency").

✓ China Banknote Credit Card Industry Development Co., Ltd.

Six of the agency's 10 patents related to digital currency mentioned the use of blockchain for digital currency wallet address management, digital currency transaction supervision and verification, and digital bill transaction and management. The number of patents exceeded half. These patents reflect,

Blockchain can be used for the management of digital currency wallet addresses. After the smart contract verifies the transaction initiated by the transaction party based on the digital currency wallet address, it will update the wallet address so that the next transaction will be launched based on the new transaction address. This can cut off the relationship between the original wallet address and the user, so even if the outside world traces the original currency address, the address and identity information cannot be matched, which can effectively protect the user's privacy.

Blockchain technology can be used for digital bill transactions. First, the blockchain receives the input digital bill transaction application. Among them, the digital bill transaction application includes the ticket registration application, the acceptance acceptance application, the reminder collection application, the endorsement transfer application, the discount application, the rediscount application, and then the blockchain meeting Perform the operation corresponding to the digital bill transaction application to complete the digital bill transaction.

6.2 How does DCEP realize offline payment? ——The user terminal can be offline temporarily

The electronic payment check for repeated payments that may occur during the offline payment process is lagging, that is, it can only be implemented after the payment is completed. The system can set the maximum payment limit for offline payment (such as 1,000 yuan), and adopt an ex-post accountability mechanism to record bad records into the credit reporting system for punishment.

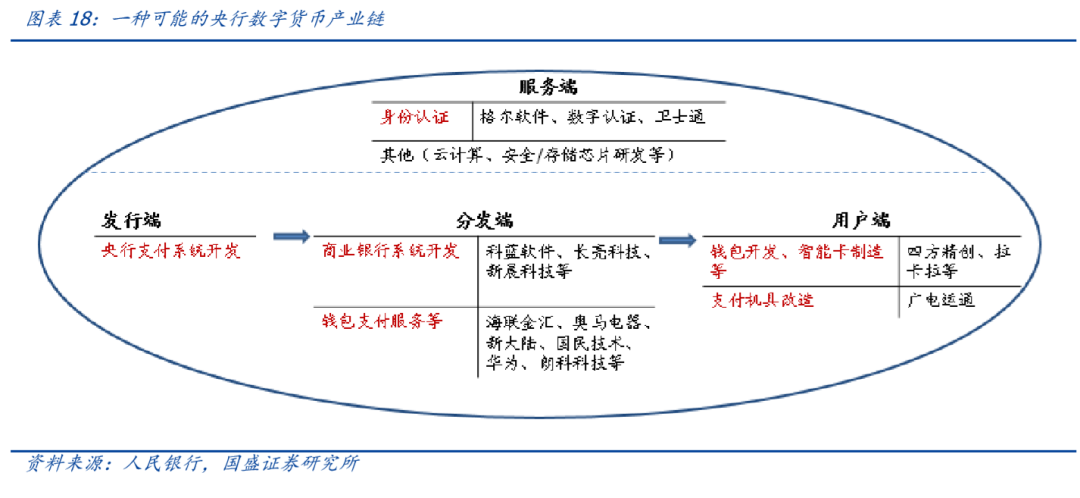

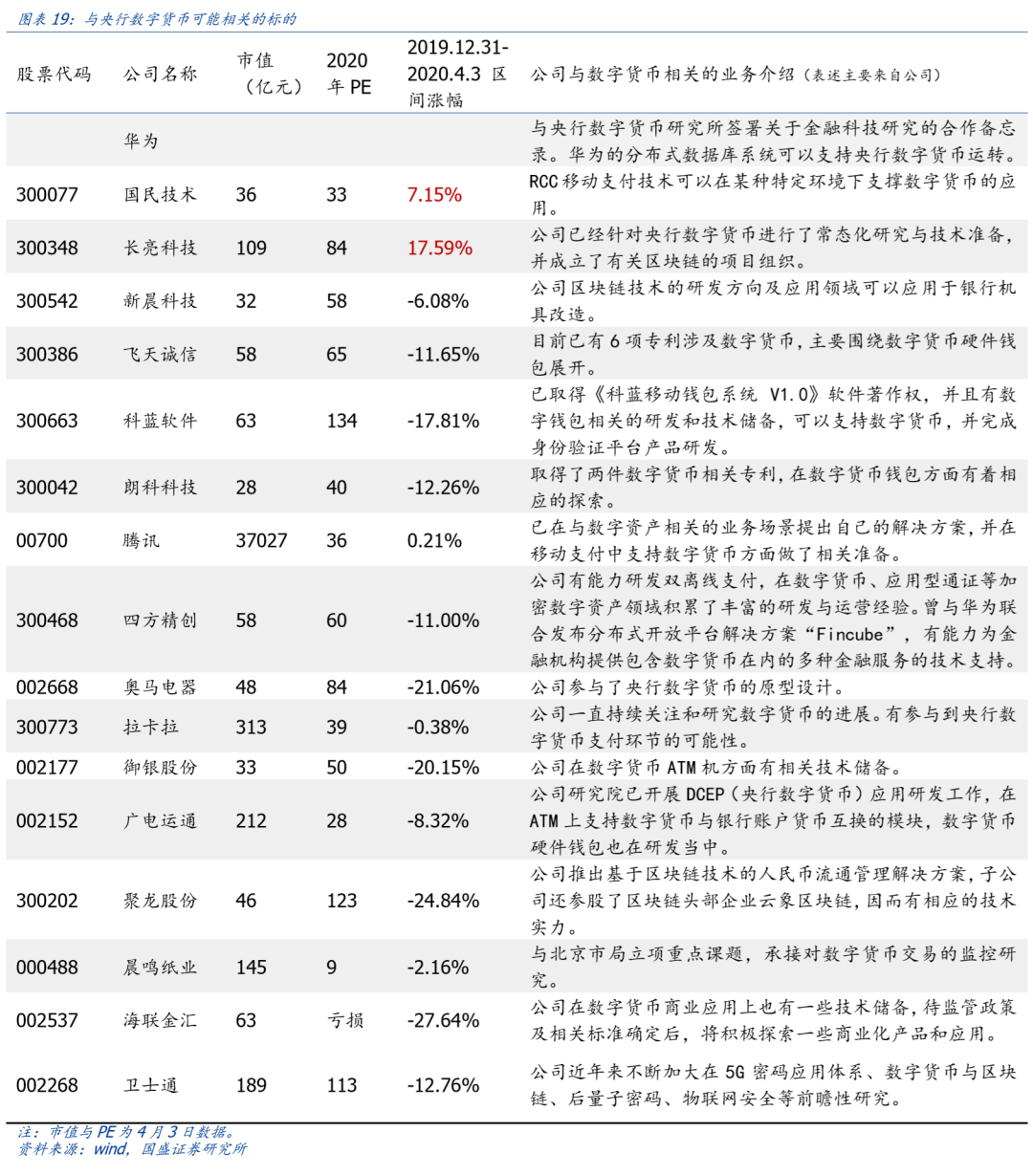

7 Investment advice: grasp the three main lines of investment of "banking IT, identity authentication, payment services"

Related companies: Huawei, National Technology, Changliang Technology, Xinchen Technology and other four companies claim to have relevant technology reserves. 2) Distributor . Many companies are exploring digital currency wallet patents. Related companies: Feitian Chengxin, Kelan Software, Netac Technology and other three companies claim to have corresponding technical reserves. 3) User side . A number of payment systems such as dual offline payment, digital currency ATM machines and payment systems are undergoing transformation. Related companies: Tencent, Sifang Jingchuang, Omar Electric, Lakala and other institutions may participate in the corresponding system transformation. 4) The server . Related companies: Chenming Paper and Hailian Jinhui are also conducting corresponding technology research and development.

We recommend closely following the industry chain and grasping the three main lines of "banking IT ", "identity authentication" and "payment service": 1) Banking IT. Whether it is to develop a digital currency system for central banks or commercial banks, whether to add specific fields for digital currencies or develop user access and application systems, DCEP cannot leave the bank IT service provider. 2) Identity authentication. Among the patents related to digital currency applied by the People's Bank of China, identity authentication is an indispensable link, and the related technology is encryption technology and identity certification (CA) qualification. We are optimistic about companies with relevant reserves, such as Defender, Digital Certification, Gore Software, etc. 3) Payment service. Although DCEP adopts a "central bank-commercial bank" two-tier operation system, from the patents, we find that "wallet service providers" other than commercial banks may also play an important role, and manufacturers with electronic payment experience or licenses are expected to be shortlisted Pilot.

In addition, the four major commercial banks of Workers, Peasants and China Construction are responsible for providing digital currency to the public, and the three major telecom operators of China Mobile, China Telecom and China Unicom may participate in the transformation and upgrading of the bank ’s IT system to serve the aforementioned large banks and operations Commercial institutions also have the potential to develop their grand plans in the development of DCEP.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Reverting HT moving bricks arbitrage process: "IQ tax" trap in the encrypted world

- Decisive battle in milliseconds, detailed explanation of digital currency high-frequency trading strategy

- From the digital currency, I saw the dawn of inclusive finance-Zhao Guodong commented on "Digital Currency"

- Babbitt's weekly elections halving is approaching, the market is accelerating recovery, is the halving effect coming?

- Babbitt Exclusive | Forty-five-day currency crisis in 35 days, halving or changing the three "Bitcoin" patterns

- Free and easy week review | How will Coda compress data into 22KB

- Learn the Methodology of DAO Movement from the Swedish Pirate Party