Using Messari's on-chain data to select currencies, what investment targets have we found?

Foreword

Many of our currency circle's investment logic comes from large institutions, and many of our currency circle media's favorite projects also come from the investment portfolios of these large institutions.

Are these investment logics, these portfolios bad? not necessarily. But how? Not necessarily.

But we all like these investment logics very easily, and these portfolios are easy to like. There is a strong inflammatory in it, that is, he hit the weakness of human nature. Let you think that others are strong, let you think that you are strong. The investment logic and investor portfolio of these large institutions belong to the strong investment system, and most of us are weak. We do not have many information advantages of large institutions, we do not have the low cost of large institutions, nor do we Anti-risk ability of large institutions.

What is the strong and what is the weak? The strength of the strong is in acquiring information, trend control, in-depth understanding, anti-risk, network relationships, and emotion control. But the weak do not have these advantages and can only help them with common sense, time and odds.

- Research Report | Central Bank Digital Currency Watch: Looking at the "Super Currency" Blueprint through Patents

- Hangzhou accelerates the creation of the "National Digital Governance First City", creating favorable conditions for accelerating the layout of blockchain and other industries

- Will borrowing in Ethereum DeFi reduce PoS security? Vitalik Buterin: It doesn't exist!

Most of us are weak, and what the weak want to pursue is often simpler and more definite, rather than complicated investment hotspots and economic model logic.

The data on the chain may be a very interesting entry point. A simple question is, do you think "a coin, with more people, will its value go up?"

Every network and cryptocurrency are batching economic models and investment stories, but most of the public chains today are not free from "nobody" torture. For many investors here, it is always like a thorn in the sole of the shoe. When you are optimistic about the future of the star public chain and are ready to accelerate into the market, it will stab you from time to time and attack your stud courage.

I think there is a so-called simple common sense influence. This simple common sense (or some kind of latent consensus) is that we believe that "one coin, with more people, its value will go up."

If you also think of a cryptocurrency, the more people use it, the greater the value of the network, and the more investment significance it will have in the future. Why not choose the investment target according to the data on the chain of each currency?

What is the data on the chain? have what?

What is on-chain data? What are they? Simply put, on-chain data is all data stored natively on the blockchain.

These data include (but are not limited to):

1. Detailed information of each block (timestamp, Gas price, miner, block size, etc.);

2. Details of each transaction (transaction sending address, transaction receiving address, amount transferred in the transaction, etc.);

3. Smart contract information called and used

The data on the chain reflects the network activities of a blockchain and judges whether the network development is healthy and fast. Therefore, many who study the theory of cryptocurrency valuation will always like to use the data on the chain to tinker, trying to find Newton's law for the valuation of cryptocurrencies.

Let's take a look at the on-chain data of some currencies provided by Messari

We will try to use Messari's data today to see what investment targets we get from the data on the various currency chains it provides, and what investment opportunities we find.

The data categories we use are the four data categories of transaction volume, NVT ratio, active address, and number of transactions. (It should be noted that the data comes from Messari. There are of course some differences and deviations due to various reasons, and all currencies are not provided, so many currencies are in fact blank. Help everyone understand and use tools to understand what kind of data on the currency chain is better. In addition, due to the technical reasons of anonymous coins, some anonymous coins data will also have a big deviation in it. Is the statistical date)

Transaction value

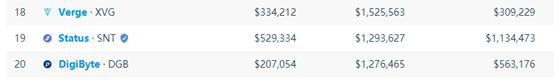

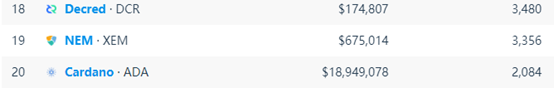

Let's look at the transaction volume first, using the 24-hour transaction volume on Messari as a comparison. The top 20 currencies on the chain transaction volume provided by Messari are:

This is the following quick sorting and thinking points:

- Overall, the correlation between the transaction value on the chain, the top ten and the overall market value is still quite large.

- Bitcoin is an absolute strong presence, and no matter how much Ethereum brags to become a global settlement layer, the absolute position of Bitcoin as an absolute leader in this data is unshakable.

- PoS projects may have lower overall transaction costs due to their low transaction costs.

- The main trading volume rankings are much better than the market value rankings: DCR / DOGE / BAT / KNC / SNT / XVG, etc.

NVT ratio

Let's look at NVT again, let's talk about what is the NVT ratio first? NVT ratio is an abbreviation of Network Value to Transactions Ratio, which is a comparison of the degree of network valuation and network usage.

In the traditional stock market, the PE ratio has been a long-term effective tool for evaluating companies. It is the ratio of the company's stock price to the equivalent earnings per share. High P / E ratios describe companies that are overvalued or have high growth.

The NVT ratio is known as the price-to-earnings ratio of the currency circle, because the essence of Bitcoin is not a company, but a value network of payment and storage. Everyone uses the funds flowing through its network as a substitute for "company earnings."

An increase in the NVT ratio indicates that the value of the network is overvalued, and it is regarded as a bearish price indicator, while a downward trend in NVT indicates the opposite. As for how low the NVT ratio is, I do n’t see a very standard and unified answer for the time being. Some say 30, some say 100, some say 150. We remember that the lower the better.

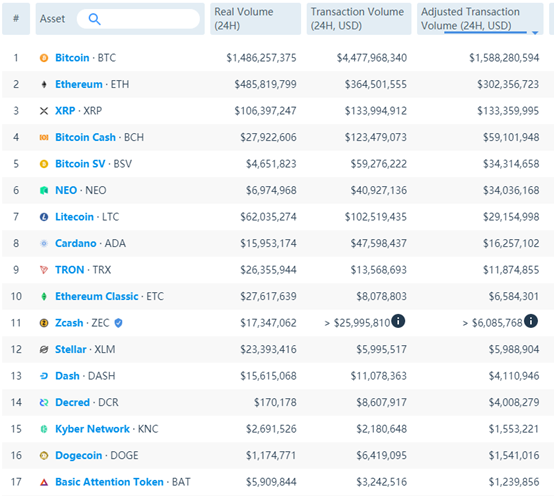

We use the NVT ratio on Messari as a comparison. The top 17 currencies on the chain provided by Messari are:

This is the following quick sorting and thinking points:

- On the whole, the transaction value on the chain and the market value ranking are not closely related.

- Ethereum's NVT ratio is currently lower than Bitcoin, reflecting that Ethereum's network value is slightly more underestimated than Bitcoin.

- PoS projects may have a low NVT ratio due to low transaction costs, which will have a great impact on the significance of reference.

- If the virtual height of PoS coins is not considered, several PoW coins with more network value are: DCR / Zcash / Verge, etc.

Active addresses

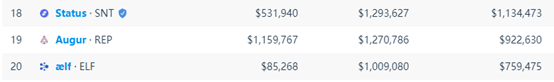

Let's look at the number of active addresses first, using the number of active addresses on Messari as a comparison. The top 17 currencies on the chain provided by Messari are:

This is the following quick sorting and thinking points:

- Overall, there is a certain correlation between active addresses and market value rankings.

- The active address of ERC20 token is obviously not as good as other "mainnet coins" or PoW coins, especially some old mining coins have obvious advantages in this respect.

- In fact, there are still very few users in the currency circle, and thousands of active users can already be regarded as outstanding.

Number of transactions

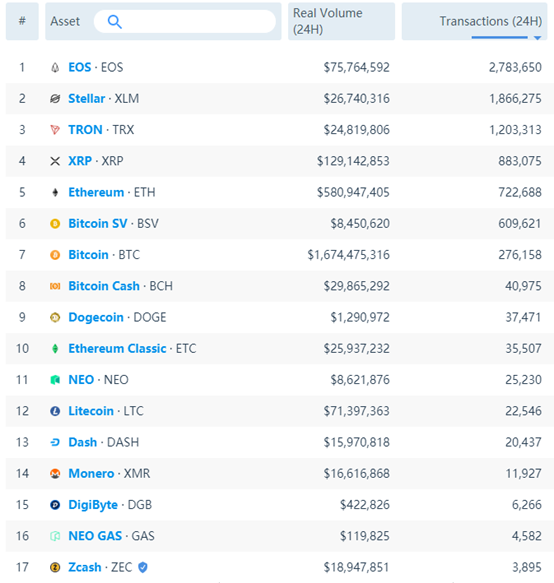

Let's first look at the number of transactions. Taking the number of 24-hour on-chain transactions on Messari as a comparison, the top 20 currencies on the chain transaction volume provided by Messari are:

This is the following quick sorting and thinking points:

- In line with expectations, the EOS and TRX are quite deep, one first, one third.

- Ripple's XRP and XLM are a bit surprising, one second, one fourth.

- BSV is quite unexpected. The number of transactions is almost the same as Ethereum, which is three times that of Bitcoin and 15 times that of BCH.

- Dogecoin has almost the same number of transactions as BCH, which is double that of Litecoin, which means that you don't have a large company to support it and achieve mass adoption.

- Anonymous coins are still used by humans, but in fact, the market is not large, and should not exceed 5%. Monero is not enough, but Litecoin BCH, the main Bitcoin competition currency, is not too much for Monero There is an advantage, Monero is not embarrassed at all.

- Decred is well-formed, continues its consistent style, and always makes the list, but it is not top-notch. Compared with market value, its data on the chain does look good.

Conclusion:

I am a small retailer, and I am a weak person.

I will not tweeted, I will not find all kinds of the latest blockchain industry information; I ca n’t understand the research reports of various institutions, I ca n’t understand how to grasp the development trends of various industries; I do n’t have a variety of gangster resources; I ca n’t manage my investment sentiment, nor can I manage my risk elasticity.

I have to admit that I am a weak chicken.

However, I am willing to admit that I am a weak person. What I can do is often to avoid my weaknesses as much as possible, vote for my ability to match, and vote for what I think meets simple common sense and time will return value.

The data on the chain may be a good entry point. After all, I still believe that the more people who use the network, the greater the value of the network. This assumption will be established and reflected in the long-term investment cycle.

Finally, add where are we looking for the data today? Here is the link:

https://messari.io/screener

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Global financial markets are picking up, bitcoin has become a "sprint black horse" and "long-term upstart"

- Reverting HT moving bricks arbitrage process: "IQ tax" trap in the encrypted world

- Decisive battle in milliseconds, detailed explanation of digital currency high-frequency trading strategy

- From the digital currency, I saw the dawn of inclusive finance-Zhao Guodong commented on "Digital Currency"

- Babbitt's weekly elections halving is approaching, the market is accelerating recovery, is the halving effect coming?

- Babbitt Exclusive | Forty-five-day currency crisis in 35 days, halving or changing the three "Bitcoin" patterns

- Free and easy week review | How will Coda compress data into 22KB