Ripple's big customers: a decade of blockchain and banking

With the arrival of 2020, Ripple has become active again.

Throughout 2019, as one of the few cryptocurrency projects that regularly enters into transactions with financial institutions, Ripple is extremely topical in terms of "qualitative XRP", "financing situation", and "XRP price fluctuations". Has received extensive attention and discussion in the industry.

On December 20, 2019, Ripple announced that it has received $ 200 million in Series C funding. This round of funding was led by Tetragon, with participation from SBI Holdings and Route 66 Ventures.

Looking at the blockchain industry for ten years from Ripple, we may be able to see the unique appeal of blockchain technology to the traditional financial industry.

- U.S. SEC makes crypto compliance a priority in 2020, but hints at a more modest approach

- Interpretation of the Background of the Cryptography Law: National Crypto War Showdown Begins

- Operators accelerate the deployment of blockchain, and the 1 billion output value in the telecommunications blockchain field is about to be released?

Ripple's "big brother" customers

For a long time, in the intersection of the cryptocurrency field and traditional finance, banks were a part of the first landing. Ripple's large user base also proves this.

Earlier, Ripple senior vice president Marcus Treacher said in an interview that half of Ripple's customer base was banks and the other half were fintech payment providers. Another 25% of the banks are really big banks, such as Bank of Tokyo, Mitsubishi Bank, Santander and Standard Chartered. Banks and payment companies are most receptive to remittances.

At present, the traditional cross-border payment field is dominated by the SWIFT (World Banking Telecommunications Association) system. SWIFT was established in the 1970s and is currently the main service provider for cross-border settlements among international banks. Due to the lack of standardized payment operation methods between different banks, most transfers can still only be made through the SWIFT agreement. However, with the rapid increase of information transmission speed, the cross-border payment system is often accused of low efficiency, high cost, poor reliability, more stakeholders and responsibility ownership issues, making it difficult for this oligopoly system to pool innovation Power.

Because the main problem that transfer efficiency is difficult to improve is trust and security, blockchain technology can provide good solutions to a large extent.

As early as 2004, RipplePay, a Ripple payment protocol, was born. In 2013, the company officially changed its name to Ripple, began to focus on cross-border remittances, and started cooperation with banks and financial institutions. Ripple builds a distributed digital payment network without a central node and uses distributed identity authentication technology. Currently, Ripple provides three products, xCurrent, ODL cross-border payment platform and xVia, these functions have been integrated into RippleNet by the end of 2019.

Among them, xCurrent has the highest acceptance, and can provide customers with interoperability in any currency or all currencies, and banks can issue their own credit certificates. Banks can synchronize data in real time to transfer funds relatively quickly and cost-effectively from end to end. Since most financial institutions working with Ripple are conservative in cryptocurrencies and the main purpose is to transfer funds quickly, the choice of most traditional institutional customers is xCurrent.

On Ripple's XRP-based cross-border payment platform ODL (formerly known as xRapid), Ripple includes XRP in cross-border transactions. Since XRP is a blockchain-based native asset, when using XRP for xCurrent payment, the counterparty can directly Verify the initiator's XRP reserves and respond quickly. According to reports, some large money transfer service providers, such as Western Union and Moneygram, are temporarily trialling this product in their businesses.

xVia is a standardized API interface using Ripple network services. Users can directly use the above two functions through this interface. It is called "the last stage of the Ripple product ecosystem". Some remittance providers, such as Beetech in Brazil, Zip Remit has previously stated that it is planning to use the product.

Currently, according to Ripple officials, it has allowed banks to pay each other in microseconds in up to 45 countries today and in the future worldwide.

Industries and trends: financial institutions may have no choice

Through blockchain technology and products provided by Ripple, it is not difficult to find why large traditional financial institutions like Ripple.

According to foreign media reports, through XRP, banks and other institutions can exclude intermediaries from cross-border payments and reduce costs. For example, PayPal charges about 3% for electronic payments. If using Ripple, the average transaction fee is currently 0.0009 XRP.

Another reason institutions love Ripple is its scalability. XRP can process 1,500 transactions per second and is likely to match Visa's 50,000 TPS throughput. Previously, in order to verify the efficiency of XRP, TechCrunch founder Michael Arrington had sent $ 50 million. The network took only three seconds to complete the settlement payment, and the transaction cost was only 30 cents.

For many in the cryptocurrency community, however, XRP's partnership with financial institutions has deviated from Satoshi's vision of enabling peer-to-peer currencies to allow people to take back control from banks. However, from the perspective of industrial development, this is yet another negligible intersection between the crypto community and the traditional financial industry.

Graham Bright, head of compliance and operations at the Euro Exim Bank, affirmed Ripple's role, saying it took full advantage of the weaknesses of the existing SWIFT system, and XRP eliminated existing bilateral relationships with foreign banks to preserve foreign exchange Reserve and handle the needs of local fiat currencies.

On Twitter, Marjan Delatinne, who has worked at SWIFT for 20 years, observes that the future of blockchain technology will focus on liquidity and will develop in smaller countries where capital flows are difficult.

It can be seen that in the ten years after its establishment, Ripple had confirmed to the media that the company had established cooperative relationships with 200 banks and financial customers, such as Mitsubishi Tokyo UFJ Bank (MUFG), Brad Brazil Bank of Scotland, Standard Chartered Bank, etc. Imperial Bank of Canada, UBS, Santander, UniCredit, and American Express were the first banks to participate in the Ripple test.

(Some partners in Ripple's official website)

According to Mark Davis, a cryptocurrency enthusiast and industry analyst contacted by Blocklike, "For many years, because KYC-compliant crypto transactions have indeed significantly reduced transaction costs, or more and more large banks will be subject to external forces. And adopt new technology. We must know that if our competitors cooperate with Ripple, the other party will get great convenience and reduce costs and manpower. Traditional financial and financial institutions without cooperation will be under great pressure. When institutions have no advantage to start R & D from scratch, they will not sit still, but will participate more in cooperation. This will also be the future trend of the blockchain + financial industry. "

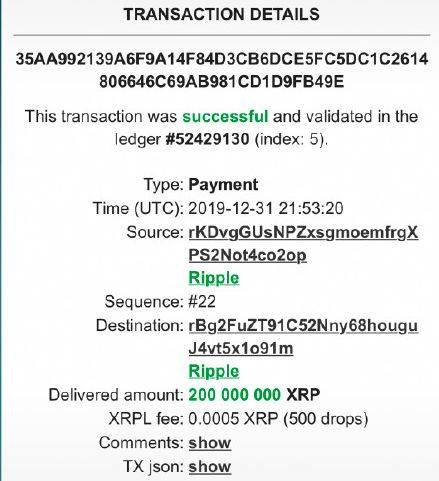

Interestingly, on January 1, 2020, Ripple's escrow account just released 200 million XRP again, valued at about 38 million US dollars. (Note: screenshot time is UTC time).

Let us guess here, which bank or payment institution is this?

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- IMF Chief Economist: National digital currency is fascinating, but it is impossible to replace the US dollar in the short term

- IRS strengthens tax controls on crypto transactions, adds crypto transaction-related issues to tax forms

- Bitcoin doesn't work! So he joined the Libra project

- 2019, I am on the spot 丨 Today, are you γ201?

- The digital currency of global central banks has been divided into three types based on the hegemony of the US dollar

- Blockchain technology cited volume | oracle: the bridge between the blockchain and the outside world

- Opening with 500 million financing, the road to DeFi in 2020