Speed | Cryptographic Currency Derivatives Exchange: Clearing Mechanism; Bitcoin and "Great Wealth Transfer"

Today's content includes:

1. Chat with Tang Wei of Parity about the impact of ETH to PoS on ETC.

2. Kyber's DeFi Hackathon Award Winners

3. Bitcoin and "great wealth transfer"

- Ten facts that Bitcoin does not know most people

- Babbitt column | Cold thinking of the central bank's digital currency

- Switzerland promotes cryptocurrency payments, 65,000 merchants will accept bitcoin

4. Cryptographic Currency Derivatives Exchange: Clearing Mechanism

5. The story of Bitsdaq: Another Asian ICO Scam

Talk to Parity's Tang Wei about the impact of ETH to PoS on ETC.

This is the ninth issue of the Fork it blog. The original title is "Talking with Blocky's Tang Wei about blockchain programming." Please come to Parity's Tang Wei and let us talk about block programming. The main contents include:

What are the different characteristics of Rust and Go? What environment are they suitable for? EVM and WebAssembly, what are the advantages and disadvantages of VMs implemented by RISC-V? What is the current development and work of ETC in the community? With the future Ethereum turning to PoS, what will happen to ETC? At the same time, what is the current Ethereum 2.0?

Because I have recently been concerned about the impact of ETH to PoS on ETC, I think that the developer community of ETC is actually unfamiliar, just as Tang Wei has talked about this topic, so I am still very interested, and then Tang Wei was also ETC before. Dev works. Because it is an audio relationship, it is not provided one by one, only some points of interest about ETC are extracted:

Tang Wei:

As for some mines starting to move from Parity to Geth, Parity's focus on Boca may be slower in performance, so Geth will slowly keep up with Parity's progress.

ETC was relatively loose at first. ETC is not entirely taking things from Ethereum. I don't really support DAO forks and open a bad first. But it has become an established fact, and we must take this step.

ETC Dev was disbanded last year because of funding problems, and later pulled to a new team. The current development is still healthy, and the feeling for me is getting better.

The previous idea of ETH2.0 is still intended to use ETH1.0 plus PoS, but choose to do another chain.

Regarding Ethereum to PoS, there will be no more forks out of an ETC: "I just said that my point is that these miners will be transferred to the current Ethereum classics. They estimate that most of them will stay on PoW, but if 2.0 It’s too sudden, and it’s also possible that there will be a fork.”

Full text link: https://forkit.fm/9

In addition, I think Tang Wei’s blog is actually quite cool, [ click here ]

Kyber's DeFi Hackathon Award Winners

The end of the 7-week hackathon of the Kyber Network. Under the auspices of Compound, Chainlink, Synthetix, bZx, Melon and WBTC, it is clear that the focus of this hackathon is on building tools to further the development of the entire DeFi ecosystem. We will look at the winners' work and the trends of most of the winners.

The champion is DeFi Zap

This tool saves time and effort by allowing you to distribute assets across multiple DeFi protocols in a single transaction. Zap is a smart contract that automatically allocates deposits in Compound, Fulcrum, Tokenset, etc. according to preset assignments.

The runner-up award winner is Structured

This tool allows you to purchase structured financial products with the help of the Ethereum blockchain without having to create an account or provide any personal information. Users purchase 40% of USDC interest, 40% of DAI interest, 10% of 2 times ETH currency, 10% of 2 times BTC to form 80% of fixed income, and 20% of leveraged position portfolio. This special basket symbolizes the uniqueness of “structuralization”.

People's choice: dDAI

dDai allows you to lend a DAI to a different DeFi product, which is different because it captures these profits and converts them into different assets of your choice, depending on any given "recipe". Further, turn your interests into other protocol tokens by leveraging tools like Synthetix.

Honorary nomination: DeFi custody

The user can set up a contract to prompt the transfer of assets to the wallet of their choice after a predetermined time. It is suitable for you to prevent sudden accidents, and the family does not know your private key.

Overall trend

We know that cross-chain interoperability is one of the biggest selling points of the 2017 new infrastructure project (Cosmos, Polkadot, Aion, etc.). The total amount of submissions for this hackathon is interesting to coordinate various DeFi products into a new toolbox that spans the Defi application service. Defi applications will also become easier and simpler, with a few clicks, you can use your own smart contracts to perform complex DeFi services. The narratives of Defi and Ethereum's “Legoli Lego” will only continue to grow.

Full text link: https://defirate.com/kybers-defi-hackathon-winners/

Bitcoin and "great wealth transfer"

The article is about a macro environmental opportunity for Bitcoin, and the United States is undergoing the largest generation of wealth transfer in history.

According to the US Census Bureau's population projections, the millennial generation will surpass the richest generation in history, born in 1981-1996, and is the largest adult generation in the United States. The baby boomer generation (born 1946-1964) achieved a record level of economic growth, creating a period of prosperity for wealth accumulation, and they will deliver $68 trillion in huge amounts of money to children, a scale ever The biggest generation of wealth transfer.

Millennials' disposable income is expected to grow to more than $7 trillion over the next decade, and by 2030 they will have five times the wealth (a large part of their wealth transfer from their parents).

The global financial crisis of 2008 has aroused the vigilance of many generations, especially the millennial generation. The seemingly stable institutions have helped many people realize the "American Dream" of owning homes, cars and building homes, leaving millions of debts. The bank knows that a lot of money will never be repaid. The worst result of this greed is that American taxpayers have to bail out to prevent the entire system from collapsing.

Millennials have made it clear that they will not accept any apologies. A Harvard study found that only 14% of millennials trust Wall Street to do the right thing "all time or most of the time." At the same time, 83% of all Americans believe that Wall Street's ethical standards today are no higher than in 2008.

This inherent distrust of the institution lays the foundation for a new investment approach. According to a survey by eToro, millennials see cryptocurrencies as an asset, at least more trustworthy than traditional stock markets operated by Wall Street. Millennials are already reshaping the economy. This includes new dynamics, new realities, and complete digital reality.

When it comes to the “great wealth transfer” of the baby boomer generation to the millennial generation, we can definitely know one thing, Bitcoin is positioned as a tool to store newly acquired wealth. Millennials have shown a strong tendency to embrace the digital age with open arms while turning to the traditional financial system.

Full text link https://rhythmofbitcoin.substack.com/p/bitcoin-and-the-great-wealth-transfer

Cryptographic Currency Derivatives Exchange: Clearing Mechanism

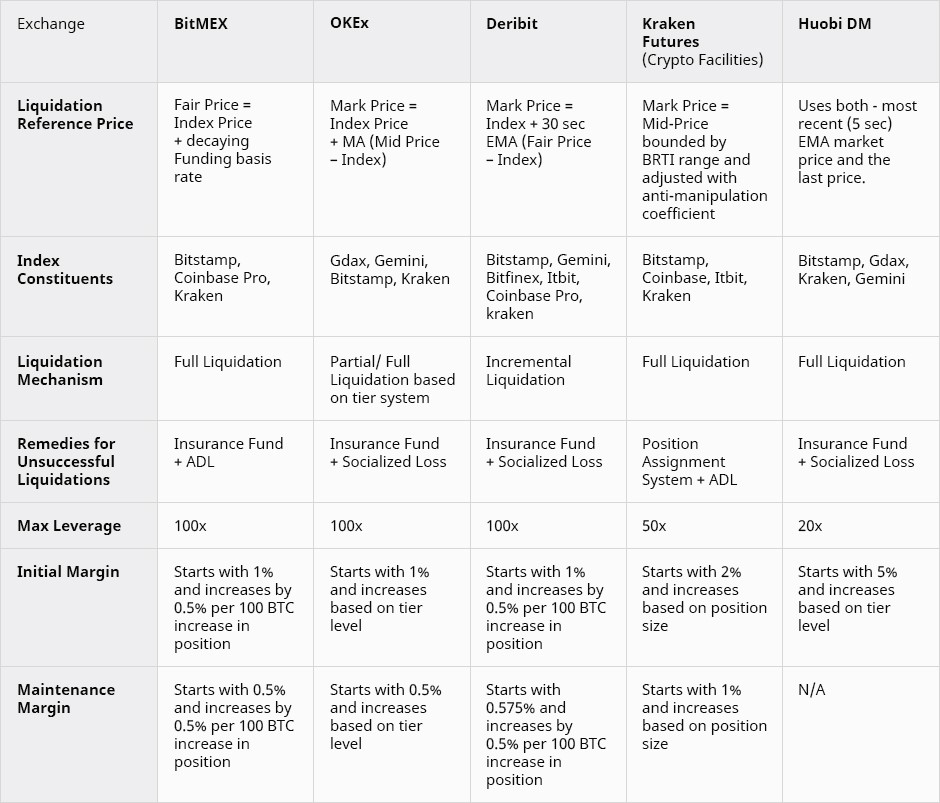

The article by Deribit analyzes the various clearing mechanisms used in different local cryptocurrency derivatives transactions and their differences from traditional derivatives exchanges.

Liquidation is defined as the following event: When the account's margin balance is lower than the maintenance margin, the risk engine automatically reduces the trader's position.

The following is a comparison table of different exchanges on how to handle liquidation:

Full text link: https://blog.deribit.com/insights/crypto-derivatives-exchanges-liquidation-pioneers/

The story of Bitsdaq: Another Asian ICO Scam

The author of the article is the founder and CEO of DAO MAKER, who confessed to Bitsdaq, and the words were fierce, and another Asian scam? Interested parties can look at the full-text story, the main condemnation is Bitsdaq's non-honest marketing, a large number of zombie users, and abuse of airdrops and promises. However, I feel that this industry is like this? I am not sure if the article will be too subjective, but the frustration revealed by the full-text story is quite interesting.

In December 2018, a new Chinese exchange suddenly appeared, and they called it Bitsdaq. In short, Bitsdaq copied the existing code to take advantage of the infrastructure provided by Bittrex.

As DAOMAKER, we are helping new projects. A project to plan an IEO project on Bitstaq contacted us and asked us what we thought of Bitstaq. When we introduced the story of Bitstaq, radical marketing methods and false numbers determined that the project cancelled the Bitstaq IEO.

Full text link: https://hackernoon.com/the-story-of-yet-another-asian-ico-scam-r01o3xif

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Jianan Road Show PPT Exposure: The release range is 9 to 11 US dollars, and it is planned to be listed in the US next week.

- Half-monthly article: What is the blockchain of the Central Political Bureau collective learning?

- Decentralized Identity (DID) Research Report: An Important Practice for Web 3.0 Development

- Why Libra may be "in the womb": talk about the trend of digital currency, the rise and fall of the monetary system and the evolution of the international monetary system

- Hangzhou Financial Office hosted the blockchain training matchmaking meeting, Babbitt Ma Qianli 45 minutes to explain what is the blockchain

- 2019 Deloitte Global Blockchain Survey: There is no common model for blockchain industry applications, depending on industry characteristics

- "Dark net" black trading eco exposure: buying and selling personal information, drugs, using bitcoin transactions, multiple large cases were investigated