Science | What is the valid balance of validators in Ethereum 2.0

Author: Jim McDonald

Translation & Proofreading: Min Min & A Jian

Source: Ethereum enthusiasts

Proof of equity

For all blockchains, the core competitiveness is the ability to ensure its own security. On a secure chain, transactions are verifiable, and historical transaction data is non-tamperable, that is, on the blockchain, anyone can get details of a historical transaction and ensure that this information has not been forged , And it will not be replaced in history with another transaction or in the order in which they occurred.

- Babbitt Interview | Jamie Burke, Founder of Outlier Ventures: We have been in the industry blockchain for 6 years

- The vision of Twitter CEO's social network: Decentralized network is the original intention, and the advent of blockchain rekindled the "hope" in my heart

- Fidelity Digital Assets: UTXO Model Leads to Overvaluation of Bitcoin's Real Trading Volume

The way Ethereum 2.0 protects itself is for individuals to run validator clients. The verifier executes a computer process that can be considered as a vote: whenever a new block is created on the network, a predetermined set of validators will verify it, determine whether the transaction in this block is valid, and send this The block is correctly linked to the previous block. If the verifier considers the block valid, it will test it (attest). If a block gets enough "attestation" from the verifier, it will be put on the main chain [1].

In order to encourage validators to perform positively and avoid situations where validators are too lazy to provide proof for the block, or intentionally lie about the validity of the block, their actions will be given monetary rewards (or penalties). Before the verifier activates the identity of the verifier, a 32 ETH (Ether) deposit is required to be submitted to the network in full; this is the initial balance of the verifier. Every approximately 6.5 minutes, the network will measure the behavior of each validator and give appropriate rewards and penalties to the balance of the validator. The specific amount of bonuses or penalties depends on the current balance of the validator; validators with a larger balance provide higher rewards and penalties, and vice versa.

It is important to understand the concept of rewards and punishments: rewards are used to encourage behaviors that cause the network to reach consensus, and fines are used to punish behaviors or inactions that prevent the network from reaching consensus. Therefore, validators who seek to maximize benefits will also bring maximum benefits to the overall network.

This article does not elaborate on the proof-of-stake model of Ethereum 2.0. But it is very important to understand that each verifier has its own balance, and the Ethereum network will regularly update its balance according to their performance of duties.

This article explores the relationship between validator balances and rewards and penalties; if there are validators who want to contribute to the network and get the corresponding rewards, there are several points that must be understood.

Rewards and punishments

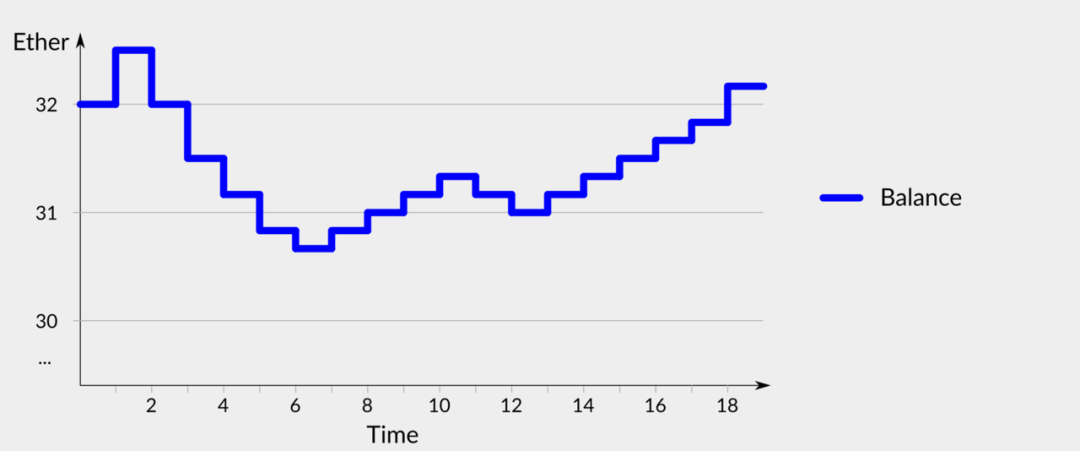

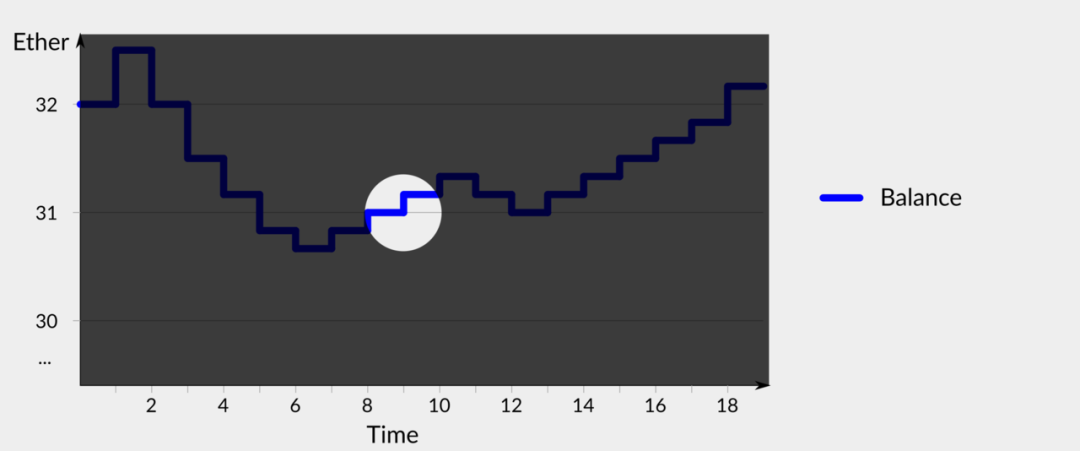

As mentioned above, validators who perform their duties are rewarded, and those who fail to perform their duties are punished. The reward and punishment situation will be reflected in the balance of the verifier, as shown in the following figure of the fictitious verifier balance change:

-Figure 1: Change of fictitious verifier balance-

(Please note that the reward and punishment weights shown in the above picture and the following pictures have been enlarged for a clearer comparison.)

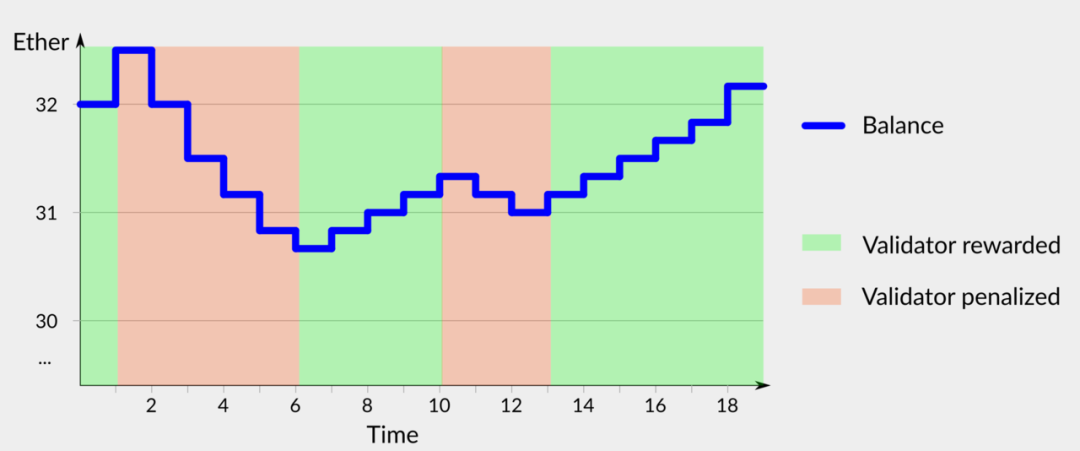

Every other time period, the network will evaluate the participation of the verifier, and then give rewards and punishments accordingly, resulting in a periodical change in the balance. The validators in the picture are both when they perform well to get rewards and when they perform poorly and get punished:

-Figure 2: Periodic changes of rewards and punishments-

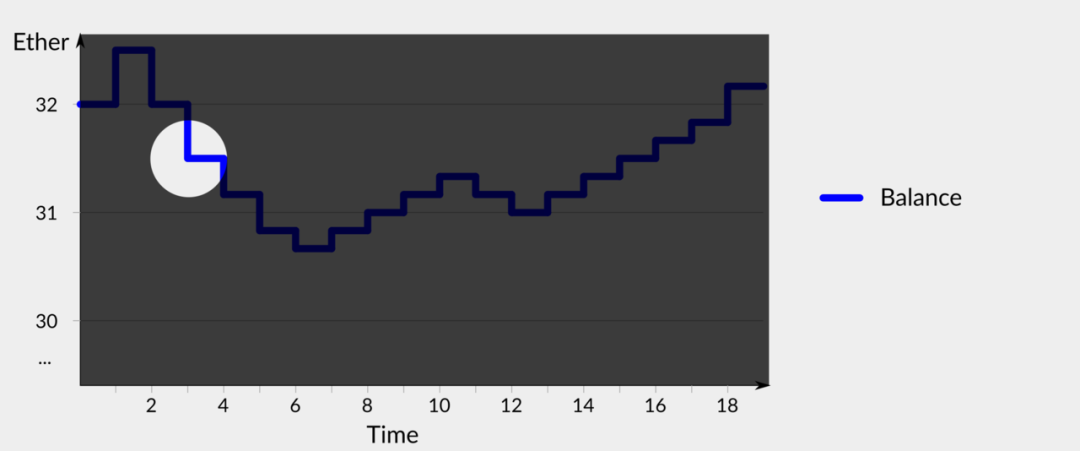

The figure does not clearly show the changes in rewards and punishments at different stages. For example, the penalty for period 5 is much higher than period 12, although the balances in both periods are similar. There are 4 key points in the above picture that deserve our further consideration. The first key point is in period 3, which is the bright part of the bottom icon:

-Figure 3: Reduction of rewards and punishments-

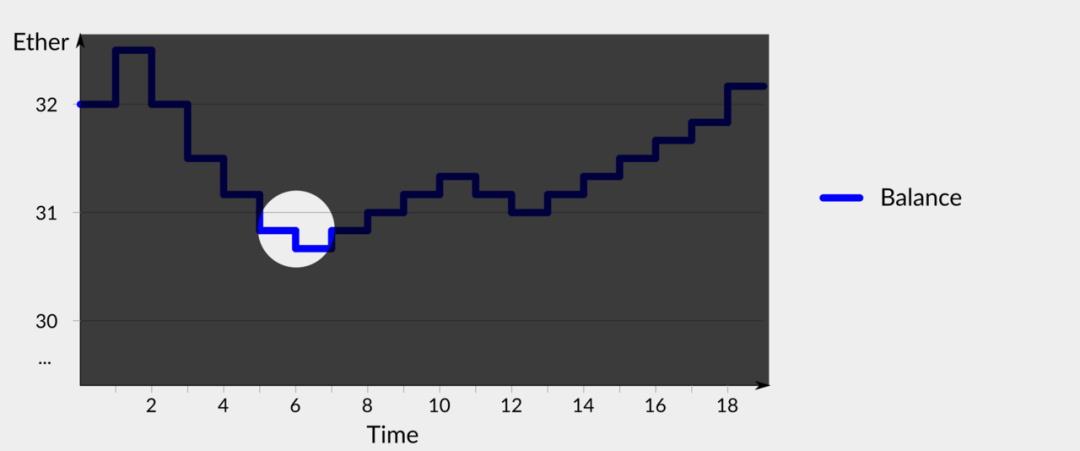

At this time, the balance of the validator has fallen below 32 ETH, and the rewards and punishments have been reduced for unknown reasons. The second key point is in period 5, which is the bright part of the icon below:

-Figure 4: The amount of rewards and punishments is reduced again-

At this time, the balance of the validator has fallen below 31 ETH, and the intensity of rewards and punishments has been reduced again for unknown reasons.

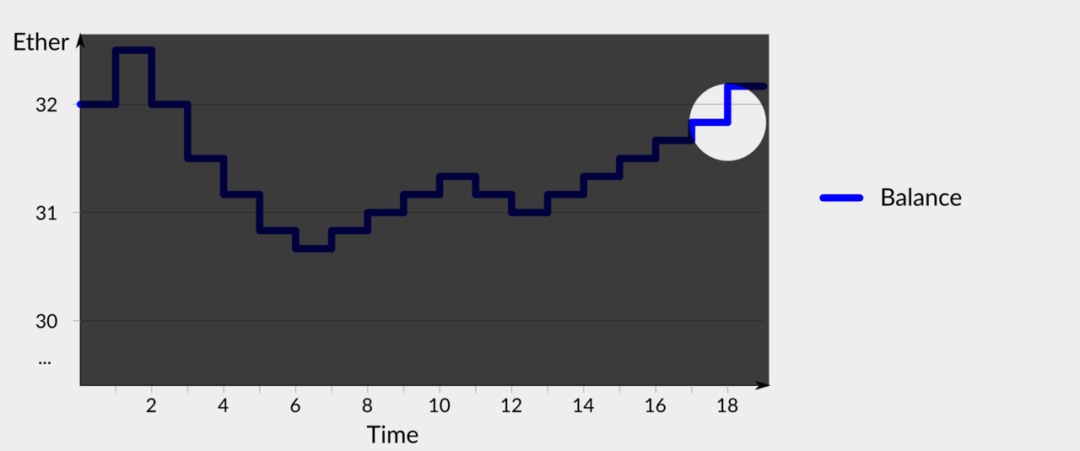

The third key point is within period 9, which is the bright part of the bottom icon:

-Figure 5: The amount of rewards and penalties did not increase as expected-

At this time, the balance of the validator rose back to 31 ETH, but the amount of rewards and penalties was the same as before, and did not increase.

The fourth key point is during period 18, which is the bright part of the icon below:

-Figure 6: Unexpected increase in the amount of rewards and punishments-

At this time, although the balance of the validator did not exceed a certain amount, the amount of rewards and penalties increased.

All in all, this reflects that the change in the amount of rewards and penalties is chaotic. To understand why these rewards and penalties change, you need to understand what a valid balance is.

What is a valid balance?

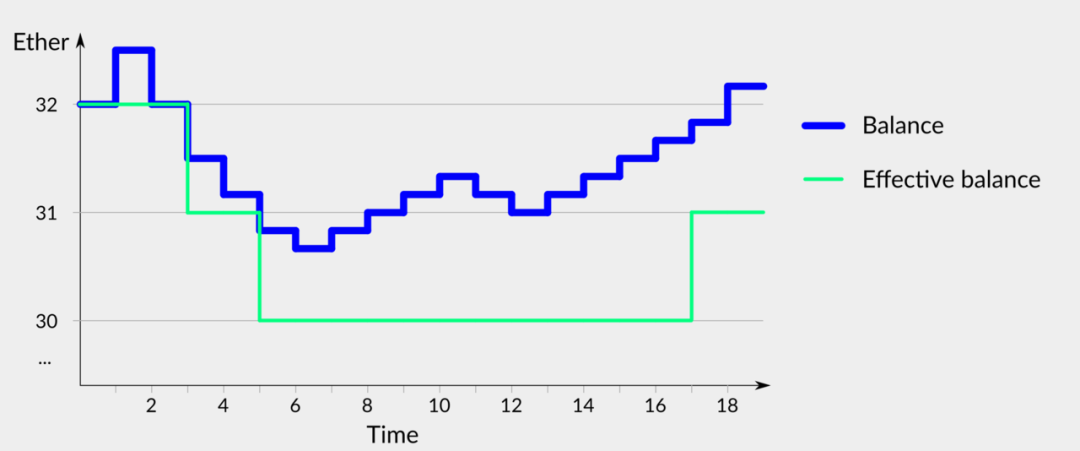

The valid balance is calculated based on each validator's current balance and the previous valid balance. It determines the amount of rewards and punishments that each validator can get.

1. The effective balance cannot exceed 32 ETH. That is, even if the validator's balance is 100 ETH, the valid balance is only 32 ETH.

2. The effective balance can only be a multiple of 1 ETH, which is ignored after the decimal point. That is, assuming that the balance of the validator is 29.9999 ETH, the effective balance is only 29 ETH.

3. The valid balance will only increase when the balance of the validator is 1.5 ETH higher than the current valid balance. In other words, when the balance changes, the actual balance will rise to 25 ETH if the balance rises to 26.5 ETH.

According to the above rules, the valid balance of the validator changes as shown by the green line in the figure below:

-Figure 7: Comparison of current balance and actual balance-

The effective balance stems from both design and technical needs. From a design perspective, limiting the valid balance of an individual verifier to 32 ETH can prevent a certain verifier from voting too heavily on the entire chain status. From a technical point of view, reducing the frequency of changes in the effective balance allows Ethereum to run on low-power hardware, because each change in the effective balance requires a higher cost calculation.

After understanding the effective balance, you will be able to perceive the changes in the amount of rewards and penalties. Let us return to the key points mentioned above:

- During period 3, the balance of the validator fell below 32 ETH, so according to the second rule, its actual balance fell from 32 ETH to 31 ETH. The amount of reward and punishment is determined by the actual amount, so the intensity of reward and punishment becomes smaller.

- In period 5, the balance of the validator fell below 31 ETH, so according to the second rule, its actual balance fell from 31 ETH to 30 ETH. The amount of rewards and punishments is determined by the actual amount, so the intensity of rewards and punishments is further reduced.

- During period 9, the balance of the validator increased to 31 ETH, but did not meet the criteria mentioned in the third rule above, so the effective balance will not rise. The amount of rewards and penalties is determined by the actual amount and therefore remains unchanged.

- In period 17, the balance of the validator increased to 31.5 ETH, so according to the third rule, the effective balance increased from 30 ETH to 31 ETH. The amount of reward and punishment is determined by the actual amount, so the amount of reward and punishment becomes larger. For the first time, rewards increased during period 18.

Impact of valid balances on verification

A small change in the validator's balance will have a long-term impact on the effective balance, so we must always follow up on this situation.

If the verifier node must be down for a period of time, it is also important to calculate the time correctly, because the penalties that the verifier needs to pay are not necessarily the same. A penalty of 0.015 ETH may reduce the balance of the validator from 30.020 ETH to 30.005 ETH (the effective balance remains the same), which has little effect on the overall income of the validator. However, a penalty of 0.015 ETH may reduce the balance of the validator from 30.005 ETH to 29.990 ETH (resulting in a valid balance from 30 ETH to 29 ETH), which will have a greater impact on the overall income of the validator.

Validator validity

The validator's validity is calculated based on the proportion of the valid balance in the total balance, which is an indicator used to measure how much of the validator's balance is used for witnessing. For example, if the validator's balance is 31.9 ETH, its valid balance is 31 ETH, and its validity is 31 / 31.9, which is 97%.

The effectiveness of active validators is usually between 95% and 100%. The higher this ratio is, the more network security can be enhanced and validator rewards can be improved. If the validity is low, it means that the validator has been offline longer. Tracking effectiveness is a simple way to measure the overall performance of a validator.

Other factors affecting rewards

This article briefly shows the Ethereum 2.0 verification mechanism to explain the concept of a valid balance. The actual reward and punishment system of Ethereum 2.0 uses the effective balance as the basis, but the specific reward amount depends on different factors. For example, if a validator proposes a block, the reward may be higher. If a validator goes offline, or there is a disagreement over the state of the blockchain, the reward may be lower.

to sum up

Validator nodes running Ethereum 2.0 successfully need to understand many technical factors, including the concept of a valid balance. At some critical moments, for example, when the rewards and punishments obtained will have a long-term impact on the effectiveness of the verifier, actively managing the verifier client will improve the overall security of the network and also affect the verifier's reward. To understand an entity's ability to manage funds, changes in the effectiveness of the validator will be a key indicator.

Note 1: In fact, the network measures not only the number of witness messages, but also its cumulative weight: the weight of witness messages is equal to the effective balance of the corresponding verifier.

(Finish)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Blockchain startup Upvest secures $ 7.8 million in Series A funding, targeting "10 trillion euros" alternative investment asset class

- Theory and Practice of Decentralized Organization (DAO): Conceptualization and Classification of DAO

- China wins two-thirds of Bitcoin's computing power share, with 54% of its computing power in Sichuan

- Science | The total number of Bitcoin private keys is 2 to the power of 256. How big is this number?

- Layer 3 middle layer: a new engine for Web 3.0 development?

- Deputy Director of the Institute of Finance of the Development Research Center of the State Council: Opportunities and Challenges of Digital Currency

- Deep Analysis | How to Obtain Alpha in Crypto Market Investment