Investment tips for the next bull market: In-depth analysis of the development status and trends of 15 cryptocurrency tracks

Investment tips for the next bull market: Analysis of 15 cryptocurrency tracks' development status and trends.Following the previous industry cycle law, the bear market is already more than half over, and the LSD market brought by Ethereum upgrades, the rise of Bitcoin NFT and BRC-20, and the MeMe sector have successively rotated, bringing new vitality to the entire market. So, what are the latest developments in various sectors of the cryptocurrency industry? Lao Bai, the author of the blockchain column in plain language and partner of ABCDE Investment Research, has summarized the cutting-edge technologies or trends in various tracks recently seen in the primary and secondary markets. This article is the first part, which introduces the latest trends in seven hot tracks such as public chain, interoperability, MEV, and DeFi. The following is the main text: Some points are declared in advance: 1. “Cutting-edge” does not necessarily mean better, but only means that they are relatively new, and most of them have not yet entered the mainstream market’s sight, such as modularization, DA, RAAS, ZKEVM, etc. which are popular or well-known will not be used. 2. Each track can only make a brief introduction, and will not go deep into it. If you go deep into it, you can probably make a book. 3. Because of the cutting edge and my own non-development, there may be misunderstandings in the understanding of some technologies, and all kinds of great gods are welcome to criticize and correct. 4. It basically does not involve ABCDE’s Portfolio, and if it is involved, it will be marked.

01、Public Chain

1. Public chain

Let’s start with the public chain, because the public chain is always the place where blockchain technology innovation is the largest and fastest. Looking back now, when Dfinity was launched, the mainstream voice in the market believed that the door to the public chain had been closed, and this view is outdated. Whether it is the rapid iteration of L2 or the emergence of Move series such as Aptos, Sui, etc., it indicates that the evolution of the public chain may never end. Especially L2, because it hands over consensus and security to L1, so there is still a lot of room for performance improvement. At present, whether it is OP or Arb, or the upcoming Zk-Sync, Scroll and other ZKEVM, they are still far from the final stage in terms of performance, nor is there a chain that can support true Kill Dapp, accommodating tens of thousands of people online operations. For a simple example, the design of the current node pool of ETH is to divide orders into Local Trasaction (directly via RPC) and Remote Trasaction (P2P), and once the transaction is considered too many, a part of Remote will be directly discarded. ETH can be played like this, because one is that there are not so many orders, and the other is that many orders are transmitted through P2P, which is considered Remote, and Local accounts for a small proportion. However, many architectures of the current L2 are still based on L1 design. The Sequencer side basically has all orders directly stuffed in through RPC, and there are almost no Remotes, all Locals. ABCDE’s technical guru directly caused normal configuration Sequencer to Out of Memory when testing some Sequencer with tens of thousands of TX. Other possible bottlenecks such as bandwidth and hard disk I/O are not yet considered here.

1. L2

- Game Dosi: First Impressions of LINE’s Web3 Game, the Japanese Communication Giant

- How to achieve zero-cost and permissionless benefits through off-chain NFT?

- Stablecoins: Not a Replacement for Banks, but a New Disruptor

Currently, the L2 solution has great potential for upgradeability on the client side. Just like Arbitrum upgraded from One to Nitro, and Op introduced Bedrock. Improving blockchain performance is a system engineering problem, including disk I/O, parallel processing, selection of Merkle trees or other data structures, state synchronization and updates, RPC nodes… It’s not something that can be solved simply by switching to a “POX” consensus mechanism. With L2/L3, consensus can be handed over to the upper layer, and there are more upper limits or details that can be refined for performance improvement in the execution layer.

2. VM

Regarding VM, several relatively new ones are SolanaVM represented by Eclipse, MoveVM developed by the Rooch team, and Dfinity EVM being developed by InfinitySwap.

1. SolanaVM

Although Solana often crashes, many developers still recognize many of Solana’s technological innovations. More than one project has split SolanaVM into SVM and made it a pure execution layer placed in a modular blockchain. This approach not only takes advantage of Solana’s parallel processing and dynamic GAS model (Eclipse believes this dynamic GAS model will eventually be standard for all blockchains), but also avoids the huge amount of consensus messages and possible downtime caused by consensus voting.

2. MoveVM

The Starcoin team, which was one of the earliest to use the Move language domestically, is working on the Rooch project, which is also a modular MoveVM execution layer. The advantages of Move language are not repeated here, and what is currently lacking is time and market validation. By turning MoveVM into an execution layer, Move can theoretically be brought into the ETH ecosystem, and positioned as L2. Alternatively, it can be added to the Cosmos and Celestia ecosystems to bring Move into IBC.

3. EVM based on Dfinity

Two years late, InfinitySwap team is doing the EVM compatibility called BitfinityEVM. To be honest, if it had come out a year or two earlier, Dfinity might not be the current ecosystem and price. According to the data on the Dfinity side, this EVM is a single-machine EVM chain running in a Dfinity container, and its security depends on the Dfinity network consensus (I always feel that Dfinity’s network consensus cannot guarantee that this single-machine EVM will not be tampered with…). The TPS of this EVM is currently 100, with a delay of 5-10s.

One advantage of deploying EVM is that it is a natural multi-chain architecture, and you do not have to find nodes yourself. Because all contracts are in the IC network, the EVM chains based on Dfinity come with native cross-chain interoperability. Three, ZKVM When people think of ZKVM, they are mainly referring to Starkware’s ZKVM based on Cario, but in fact, there are several others working on this as well. One is Risc 0, which is based on the Risc V architecture. Risc V is a very low-level thing, a chip-level architecture. It is parallel to Intel’s X86 and Apple’s ARM architectures, both of which are not open source, while Risc V is open source and has some of the look and feel of Windows and Linux, iOS and Android. Risc 0 is basically ZK-Stark+Risc V, and all programs that can be compiled for Risc V can run on Risc 0, paired with ZK Proof. By the way, that Soverign SDK (which does ZK-Rolup as a Service) should depend on Risc 0. One is ZKLLVM, which is mainly being done by Nil Foundation. From the perspective of the entire workflow of compiling and executing a program, LLVM is one level higher than Risc V. As an extension of the LLVM toolchain, all programs that can be compiled for LLVM can generate Proof through this ZKLLVM. Finally, there is ZKWASM, which is mainly being done by Delphinus Labs. Similar to the above, all programs that can be compiled for Web Assembly can run on this ZKWASM, paired with ZK Proof. All three of these have one thing in common: they all support high-level languages such as C, C++, and Rust. Four, EVM Parallel Processing The biggest performance bottleneck of EVM is probably serial processing. Solana initially stood out among the Alt Layer1s by using Sealevel’s parallel processing and POH consensus mechanism to significantly increase TPS. If we can find a way to make EVM also process in parallel, would the TPS of all EVM-compatible chains, including L2, be further improved? Currently, NodeReal and Monad are mainly working on this, and our ABCDE technology guru @cyodyssey also submitted a method for implementing parallel EVM by adding opcodes at ETH Denver. The overall idea of each company is probably similar to Solana, that is, to identify “operations without common contracts or account dependencies” in advance and then process them in parallel. Five, Sharding Sharding (referring specifically to transaction and state sharding) was the holy grail of scalability at the beginning, but is now the route that ETH has abandoned. The reason for giving up is that sharding is really difficult, so difficult that Ethereum’s large-scale expansion plan changed from the earliest 1024 shards to 64 shards and then they still couldn’t do it, so they gave up.

Make Rollup the center and turn sharding technology into pure data sharding (DankSharding) to assist Rollup. Projects like Zilliqa, Harmony, and Elrond that are still holding on have basically no ecology and brand awareness, and only Near is alone, now with Shardeum accompanying it. Near released the nightshade protocol roadmap in September 2021, which turned sharding into four stages, and now that a year has passed, it has only completed the sharding of orders.

The most difficult part of the next stage should be state sharding, and it is estimated that it will not be seen until 2022-2023?

The dynamic re-sharding in the final stage , I guess it will be at least 2026-2027… This shows how difficult sharding is, so difficult that ETH gave up directly… As for Shardeum… an Indian project, it focuses on a “dynamic sharding”, I don’t know if it is the same as Near’s final stage, the style is to achieve a shard-based “parallel processing” by having different nodes responsible for different address ranges. Anyway, after talking with the Indian brother, I did not feel that they had a stronger technical team than Near, after all, communicating across shards and synchronizing state are easy to say, but extremely difficult to do. ETH gave up, Near took two years to reach the second stage of things, and you say you can easily achieve it, I don’t believe it… but this project’s ability to “make things happen” is absolutely first-class, and the ecological projects have reportedly reached over a hundred in half a year.

Quite reminiscent of the Indian TRX (Polygon started out by making things happen), so in the crypto circle, technology is very important, and the ability to “make things happen” is equally important.

The sixth point is dual consensus. This is basically represented by Sui, which is about to go online. Sui divides orders into “simple (independent) orders” – using Byzantine consensus broadcasting, which is basically confirmed within 1 second, and “complex (subordinate relationship) orders”, using Narwhal-Tusk (essentially a variant of Hotstuff), which takes about 3 seconds to confirm, which is also a relatively unique innovation in terms of performance improvement.

An interesting point is that all the Sui project parties I talked to, whether Chinese or foreign teams, spoke highly of Mysten Labs, and they also have great confidence in Sui’s technical strength, which is not seen in the Aptos ecosystem.

This leads me to have the impression that “Aptos is better at making things happen, while Sui has stronger technical strength.” The seventh point is the performance limit of EVM. As mentioned before, the performance improvement of public chains is actually a system engineering problem that cannot be solved simply by using a PoX consensus mechanism. Just as Solana’s technical innovation has 5 or 6 items, it is not simply a POH holding the scene. The parallel processing of EVM mentioned earlier is a very important part, but it is not the only part. For Rollup, the client of most L2s is still Geth and other traditional L1s, and their potential for improvement is also very large.

Factors affecting Rollup’s TPS include disk I/O performance, memory pool design, parallel processing schemes for orders, the choice of Merkle trees or other data structures, and state synchronization between full nodes… ABCDE recently discovered a project that has optimized and innovated on almost all of these points, with the hope of raising the current performance limit of EVM L2 (about 1000) by another order of magnitude.

Assuming no surprises, we will lead the seed round. Since the project is still in its very early stages, we won’t disclose the name and details here, but in a little while everyone will see our signature “Why We Invested in XXXXX” investment logic in “milk text.”

8. Browser-based peer-to-peer network If you want a smart contract platform like ETH, but more decentralized than ETH, what should you do?

It’s simple, just implement a Fully Snarked ETH, which means that every time a block is produced, it is quickly paired with a ZK Proof, making the verification of the entire blockchain more decentralized. You can use a Raspberry Pi, laptop, or even a mobile phone to verify a block. ETH is probably still 5-10 years away from this vision. Then I saw a new project that was focused on this from the start, using a Stark algorithm that I don’t quite understand, generating ZK proofs based on the browser, and combining them with sharding and fast consensus mechanisms. They want to create a browser-based, high-speed ZKVM decentralized blockchain that is much faster than ETH and even more decentralized than ETH. It’s too good to be true, which makes me not very confident… I have also seen another blockchain “full chain” decentralization solution project based on a browser-based peer-to-peer network. From domain names to servers to RPC, everything is decentralized. Although it is not a single chain, theoretically, all the “centralized” parts in the current blockchain can be decentralized through a browser-based peer-to-peer network. The idea is very “officially correct,” but the business prospects still need further investigation.

02 Interoperability

First, let’s talk about some of the current trends in interoperability. The main direction of interoperability is definitely bridges. When the concept of bridges first emerged, the industry roughly divided it into three categories: one is external validators (represented by Multichain), the second is light clients (represented by Cosmos), and the third is liquidity networks + atomic swaps (represented by Celer). In theory, light clients are the most secure because they are completely trustless, but they are too limited in terms of adaptability, so they are often confined to local ecosystems. Liquidity networks + atomic swaps are also relatively secure because of the hashing time lock technology, but the experience is generally poor, and the types of supported tokens are also limited.

As a result, you will find that the most commonly used bridge on the market is still based on external validators. After all, this is the most flexible, convenient, and supports the most scenarios.

Despite the assistance of technologies such as multi-signature, MPC, and TSS, bridges that use external validator technology remain the most heavily targeted location for hacker incidents, without question (such as Ronin and Wormhole). Currently, there are several major categories of new exploration directions: 1. The first category of new interoperability technologies

ZK is undoubtedly the key breakthrough direction. When you can quickly generate ZK proof for behavior on one chain and be quickly verified by another chain, interoperability can be considered “securely connected” in principle.

Fundamentally, ZK-Rollup is a scalability solution that connects interoperability between L1 and L2, but because L1-L2 is isomorphic, verification is very convenient, and verifying ZK proofs between non-isomorphic chains is much more difficult. Currently, the main companies doing ZK bridges are: – Polyhedra This was one of the earliest portfolios in the ABCDE Group, and ZK Bridge is the flagship product of the project. It uses the innovative and ultra-fast Devirgo protocol, as well as recursive proof functions, and can currently generate Snark proofs for most blockchain block headers within 10 seconds. For EVM-compatible chains, verification only costs 200kgas. – Succinct Labs has already launched the usable TeleBlockingthy protocol, which currently enables single-phase verification of ETH information on other EVM-compatible chains, including 1. Sending messages from Ethereum to any EVM chain, 2. Requesting any Ethereum data from any EVM chain, and 3. Accessing Ethereum consensus data on the execution layer. In addition, there are Electron Labs, which first proposed the ZK-IBC concept, and Polymer, which also focuses on ZK-IBC, but it is not certain where they are in terms of progress. If you know, please let me know.

2. The second category is bridges based on optimistic assumptions One is an optimistic assumption that “oracle and relayer nodes will not collude”, which everyone knows about, Layer0, and will not be discussed further. The other is to use the OP Rollup mechanism on the bridge. First, optimistically assume that nothing happens, no one is malicious, and no one makes mistakes, and then give a window period to allow nodes to detect and challenge. If nothing happens during the window period, the bridge completely settles. I remember that Orbiter and Nomad are mainly doing this. 3. The third category is not a bridge, but some protocols for liquidity sharing-DAMM In 2021, the roadmap and Starkware proposed using shared L1+ZK technology to achieve asynchronous liquidity sharing between various ZK Rollup L2s, solving the problem of fragmented liquidity in multiple L2s. However, two years have passed and there seems to be no latest updates and progress. If you know, please let me know. I think it is still a useful thing if it is feasible. 4. The fourth category is strictly speaking not a bridge, but is specifically aimed at specific L2 and interoperability is implemented through the Sequencer method, called Shared Sequencer.

Now that RAAS is so popular, it’s natural that someone would come up with a shared Sequencer, which is a bit like when websites first became popular and everyone used shared hosting servers to build their own company or personal website.

This is a branch of decentralized Sequencer, but personally, I don’t think the major L2s like OP and Arb will participate in this approach, because the rights and profits of Sequencer are too great, equivalent to a country’s military + tax system. A big country would not outsource such things, and you can see from OP’s roadmap that although Sequencer will certainly be decentralized, its priority is not high, and it has been pushed back to the end of 2024.

So this kind of shared Sequencer may be used by some Gamefi Appchains in the gaming and social categories, using RAAS infrastructure to directly access some shared Sequencers provided by RAAS.

Then this shared Sequencer handles many chains as a node, so naturally these chains have achieved atomic cross-chain interoperability on the Sequencer. Currently, there are two projects in this direction: Astria and Espresso. 5. Fifth Category – Recently, a project was also discussed that uses some extended data of the DA layer+Rollup to achieve Trustless cross-chain similar to the ZK-Bridge method, without ZK, which sounds quite fancy.

However, the project party currently does not plan to make technical details and white papers public, and I dare not really invest in them without understanding the technical details and feasibility, so I’m stuck here, very embarrassed… 6. Sixth Category – Abandoning the concept of bridges altogether and executing operations directly on other chains through cryptography. This is what Dfinity is currently doing. Currently, BTC has just been connected, and it can be received, held, and sent directly on the container. They also created a decentralized Mint contract ckBTC based on this, which gives me the feeling of being a bit like renBTC before, but the trust hierarchy of the nodes has been completely replaced by the Dfinity network.

These are all the interoperability ideas that I can think of for now.

03 MEV and Privacy Trends

Let’s first talk about the trends in MEV and privacy. One, MEV

MEV is a technical topic that is becoming increasingly complex, especially after Ethereum transitions to POS. There are already Searcher, Builder, relayer, Validator, and Proposer involved in MEV even for non-user roles. It’s basically dizzying for those who don’t deal with technology. There are various articles online that talk about the principles of MEV in a “ten thousand-word essay” series, so I won’t repeat them here. Simply put, I will talk about the current situation and technical trends. 1. Current situation:

MEV sandwich attacks (also known as malicious MEV) often earn more than reasonable MEV (arbitrage and liquidation) and are the main source of income for many MEVs. However, the recent black-on-black incident where a malicious validator used a relay vulnerability to replace MEV sandwich robot orders, resulting in a loss of $25 million, caused a great deal of controversy in the industry and caused many sandwich traders to converge.

In short, most of the profits from MEV go to Searcher and Builder, and those who do MEV protocols or technologies don’t earn much money. Flashbot’s MEV-Boost is said to have not yet been profitable (but Flashbot was originally a non-profit organization), and I’ve seen at least four or five specialized MEV projects in the past few months, each with different technical styles, but we haven’t invested in any of them because we don’t think they can really achieve stable profits (such as the earliest Eden). 2. Several technical trends in MEV at present: – Smart SlipBlockingge Management – This is mainly for cross-chain MEV, and I’ve seen some projects doing it, which saves users from manually setting slip points and anti-sandwiching. – Threshold Encryption – This is a strength of the Cosmos ecosystem, and now Penumbra and Osmosis are probably working on it. The orders that enter the memory pool are encrypted, rendering MEV useless.

– Delayed Encryption – The threshold uses a multi-signature style, with 2/3 of validators decrypting it. If it is still considered unsafe (because it introduces the security assumptions of the validator committee), then delayed encryption can be used, which sets the encrypted information to be automatically decrypted after a certain period of time. This is mainly the application of VDF technology, and it is still relatively early with poor performance.

– SGX Encryption – Similar to the above two, but using trusted hardware, this is mainly done by Flashbot’s SUAVE. – Fair Sorting Service (FSS) – Outsourcing sorting to a trusted entity to prevent MEV, Chainlink is doing it. – MEV Auction – MEV auction, a method proposed by OP, which V God is said to like and may be used as a solution for Optimism’s decentralized sequencer in the future.

– MEV-Share – Sharing MEV profits with users, this is what Flashbot has just come up with. If it had been a little earlier, the sandwich robot that lost $25 million would have been able to recover about $18 million…

– Mev-Blocker – This was created by Cowswap, which allows Searcher to bid on your order and backrun it (ultimately giving you 90% of the profit). Backrun (arbitrage and clearing) is relatively mild compared to FrontRun and Sandwich Attack in MEV, so users can avoid harm.

– ETH Protocol-level PBS – The proposers and builders of the Ethereum protocol are separated, which is in line with the Ethereum Foundation’s usual style and is likely to occur after 2025…

2. Privacy

Privacy has always been a track that I personally do not look favorably upon from an investment perspective. From the earliest Zcash to later Tornado Cash and now Aleo, Iron Fish, etc., there is no reason other than political correctness. For 99% of users, it is not a rigid demand. Who cares if someone sees you depositing some dog coins on Uniswap, borrowing on AAVE, or staking on Lido?

Even if privacy is truly needed, it should be in the form of a plug-in like Aztec’s Aztec-connect, which serves mainstream Defi protocols, rather than building a “privacy public chain” from scratch. With the closure of Aztec Connect (possibly due to regulatory scrutiny or possibly because it does not make money), my bearish sentiment toward the privacy track has increased. Currently, I have seen two new designs for privacy in the primary market.

1. The first type is based on Tornado Cash , whose front end has been banned because its design can help hackers with illegal disputes. However, in fact, 80% of the funds in Tornado Cash are clean, and only about 10-20% are used for illegal purposes by hackers, because there are indeed whales and institutions that need similar services to ensure privacy. Vitalik Buterin himself has used it.

Therefore, I have seen more than one project that wants to combine Tornado Cash with KYC. If you are afraid of illegal use, then isn’t it ok to ensure that the money that comes in through KYC whitelist is clean? But this actually puts the regulatory risk on the KYC provider’s side. Moreover, KYC is theoretically very easy to forge or buy. If hackers use this “Tornado Cash with KYC,” once they pass KYC, it may actually be more convenient for illegal activities.

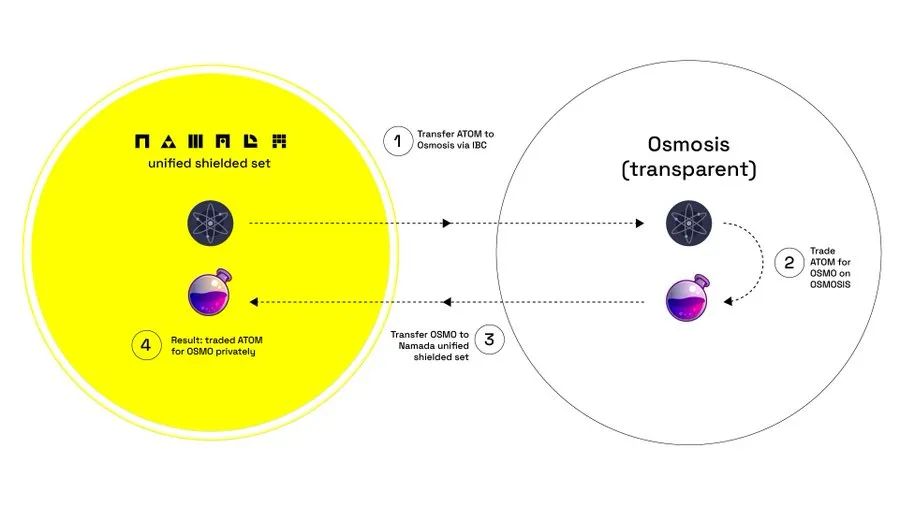

2. The second type is similar to Namada in Cosmos , called the Multi-Asset Shielded Pool (MASP), where multiple privacy-protected assets share an anonymous pool, and with the powerful interoperability of IBC, it can theoretically provide shielding protection for all mainstream assets on the Cosmos chain internally. For example, if you want to privately exchange Osmo and Atom, you can achieve it in a way similar to the following diagram.

There have also been attempts to use homomorphic encryption for privacy, but homomorphic encryption is still in its early stages and its performance and operability have not yet reached a stage where it is “truly usable”. It is somewhat reminiscent of ZK around 2017, and it may take another 5-10 years of development to become truly usable.

04 The Three Pillars of DeFi: DEX, Lending, and Stablecoins

1. DEX Let’s start with DEX. Since the emergence of UniV3, there have been few major innovations in the DEX field. The Curve War can be considered one, and the DEX track has officially confirmed a duopoly in the past two years.

Most of the DEXs that were trying to improve slippage and impermanent loss have basically disappeared. I’ve seen four trends in the DEX space:

1. The Frankenstein Ve(3,3) This is currently happening. AC previously created a Solidly on FTM, attempting to merge Uniswap, Curve, and OHM, hence the existence of Ve(3,3). However, it is not very popular. It didn’t catch on when it opened a branch in ETH, but Velodrome on OP forked it and became very popular.

I feel that this is partly due to the decline of Alt L1 and the rise of L2, and partly due to the various rewards on OP.

Now, Ve(3,3) is penetrating into various chains. Chronos has recently been added to Arb, Thena has been added to BSC, and there are some on Polygon that I can’t remember the names of… Every project has made some adjustments on Solidly, similar to Sushi’s approach to Uni, but the interesting thing is that Uni didn’t catch on, while the Velodrome fork caught on and became very popular on OP.

Personally, I’m not very fond of this model. First, the stitching marks are too prominent, and second, it’s too complex. Many ordinary users can’t understand it, unlike Uniswap, which is simple and straightforward.

Although the Curve War is also complex, it is a bribery mechanism for project parties and big players, with a different positioning.

Finally, Velodrome’s popularity is closely related to OP rewards. Bribery and reward recipients such as SNX are using OP airdrops to bribe, and whether the flywheel can continue to turn depends on whether the rewards stop.

2. Hybrid Dex – Another kind of stitching, but more on the user experience. One is that after FTX’s collapse, people’s distrust of Cex has increased, but they still like the silky smooth experience on Cex, so there is a combination of CEX experience + DEX self-custody, where the frontend is basically similar to DYDX and Blur styles, first connect the wallet, then deposit money into it, and then all the fund operations are completely off-chain, settling back to the chain when withdrawing.

1. DEX

There are two main trends in the DEX space right now:

1. AMM+OrderBook hybrid: This combines a traditional Orderbook with the AMM mechanism, using the best price from both to execute trades. This approach can help ensure liquidity for long-tail assets that may not have much liquidity on an Orderbook.

One project that exemplifies this approach is Vertex, which recently launched on Arbitrum. The team is reputable and the project not only does spot trading, but also derivatives.

However, we think that the DEX space is currently overcrowded, so we have not invested in any DEX projects recently. We typically review 40-50 projects per month but only invest in 1-2.

2. UniV3-Fi: There are a few points to consider here:

- Recently, the license for UniV3 expired, making it open source. This will likely lead to more V3 forks on different chains.

- There are various projects being developed on UniV3, such as BlockingrasBlockingce (which recently caused a lot of buzz) that uses UniV3 NFTs for lending. Other projects include Blockingnoptic, which is a UniV3-based options protocol, and Gammaswap, which is a UniV3-based platform for impermanent loss hedging. There will likely be more projects built on UniV3 in the future.

3. Curve’s Tricrypto New Generation: Curve has been trying to expand into mainstream coins, but gas fees have been higher than Uniswap’s, making it less attractive to retail investors. With the recent upgrade, gas fees are now comparable to Uniswap V3, which should make it more competitive.

Furthermore, with the recent upgrade to SNX V3, Atomic Swaps will become more efficient, making Curve vs. Uniswap in the mainstream coin space an interesting battle to watch.

2. Lending:

Now, let’s move on to lending. Here are three trends to consider:

- 1. Cross-chain: As evidenced by Compound V3, AAVE V3, and the popularity of RDNT, cross-chain lending is becoming a popular trend.

- However, according to MinDao, current “cross-chain” lending is actually “pseudo-cross-chain,” since it is really just lending across different chains. True cross-chain lending would allow for assets to be stored, borrowed, and repaid across any chain, with one shared liquidity pool and interest rate curve. No one has achieved this yet.

2. Isolation Pool The concept of collateral asset isolation arose from Euler and is now standard on large platforms like AAVE, including some new platforms. The purpose is to prevent situations where a single asset can bring down an entire protocol, as with XVS or Mango’s prophecy manipulation. Although some flexibility is lost, we cannot let a single mouse turd spoil the whole pot of porridge.

3. No Prophecy, No Liquidation Proxy This is particularly suitable for long-tail asset lending, as the depth and liquidation mechanisms of mainstream coins are currently very mature, but many long-tail assets are not available on lending platforms even with isolation pools, because the risks of prophecy manipulation and liquidation are high. If these two mechanisms can be avoided, the capital efficiency of long-tail assets can be further released. There are currently three different approaches. One is Timeswap, which uses an extremely complex three-variable XYZ=K AMM, which is a bit of a 6 design, but I doubt how many users can really understand it… The other is InfinityPools, which borrows V3’s LP, which is equivalent to automatic liquidation through V3, and the last is Blur’s Blend protocol, which is actually an NFT point-to-point protocol, but its clever design feels like it can be slightly modified to do long-tail ERC20 lending, I don’t know if there will be projects doing this.

III. Stablecoins Finally, let’s look at stablecoins. In fact, there is not much to say about stablecoins, since last year’s Luna collapse basically declared “algorithmic stablecoins are dead”, and Frax’s recent change to a 100% collateral rate has completely solidified this. Although there are still new collateral-based stablecoins appearing on the market, using various technologies to ensure they do not break the peg, besides pure algorithmic stability, people are not very concerned about your peg breaking. Frax has never really broken its peg, and application scenarios are the way forward.

1. If you insist on saying stablecoins have several trends, they should be the following: MakerDAO’s Endgame Plan, AAVE’s GHO, CRV’s crvUSD, SNX V3 version’s sUSD, and Arthur’s conceptually proposed BTC-based NUSD.

crvUSD, GHO, and sUSD are still being done by stablecoin projects, with various fancy algorithms to ensure their pegs, but in my view, this is meaningless.

Except for Luna, which can print money out of thin air, people are not really worried about you getting unpegged. What really matters is the use case, otherwise the “stablecoin triumvirate” (which is not even that stable, as they are all backed by collateral) Fei, Float, and Reflexer would not have fallen to their current state in 2021.

2. Let’s talk about my real stablecoin triumvirate: – crvUSD Curve doing stablecoins is the most “legitimate”, with its own stablecoin-centric DEX with billions in TVL, almost all of which is composed of blue chips, and capital efficiency that needs to be unleashed.

In addition, crvUSD has the following advantages: – LLAMA’s reverse Uni V3-style clearing mechanism, which may experience wear and tear, but is much safer – Based on 1, crvUSD will naturally form a trading pair with collaterals. This provides a natural use case for swaps – The Curve team has a large amount of crv (veCRV), which means that crvUSD’s various pools will naturally be the “eternal winners” of the Curve War, and there is no need to worry about cold-start issues.

-GHO AAVE does not have the same DEX and vote-buying advantages as Curve. AAVE’s advantages lie in V3, Lens, and Facilitator: V3 – Multi-chain deployment, GHO can theoretically move seamlessly across multiple chains like USDC in Stargate until Circle’s official CCTP cross-chain protocol is developed.

Lens – Before Musk tried to turn Dogecoin into an anti-witch and tipping token on Twitter, what gift on Lens is most suitable? It must be GHO, which is a direct extension of GHO’s real use case.

Facilitator – The facilitator can theoretically bring RWA, credit-based lending, into AAVE, and credit-based lending inevitably requires DID. How to obtain DID? Through Lens!

-sUSD I think this is the most underestimated stablecoin, with a market capitalization of only a few million dollars. sUSD has two fatal shortcomings: one is the lack of use cases, and the other is the extremely poor capital efficiency based on SNX’s native token 400% super high collateralization ratio.

The former has improved significantly after the cooperation with Atomic swap and Curve + the recent launch of Perp V2, especially with synthetic assets + atomic swaps to Curve, which is almost a zero-slippage exchange, and theoretically has great potential in the future multi-chain era. The only question is whether SNX has the ambition to be multi-chain.

A synthetic asset project that mimics the SNX mechanism and is deployed across the entire chain has already appeared on LayerZero. The second project is about to be launched in version V3, which is expected to solve the problem by introducing collateral similar to ETH.

When we have enough SUSD and synthetic assets, it means that there is enough depth in the Curve pool. Many swaps, especially large swaps, are theoretically zero-slippage, which is also a positive for Curve.

3. NUSD, a BTC-based stablecoin mentioned by Bitmex CEO Arthur Hayes In fact, if you have been following Arthur’s articles, you should know that he wrote about this idea last year, but he rewrote it again due to the stablecoin incident. This idea is completely feasible in terms of technology, but it is difficult to implement in reality.

The technology is very simple, similar to the principle of hedging. Each NUSD is composed of BTC worth one dollar plus a perpetual short position of 1 bitcoin/dollar. You will find that when BTC is worth $1, NUSD is worth $1. When BTC falls to 0.5, the short position earns 50 cents, and NUSD is still worth $1. When BTC rises to 2, the short position loses $1, and NUSD is still worth $1. Does it sound good?

However, it is not so easy to implement. The most direct problem is that when the market value of NUSD is small, it is not difficult, but when the market value is now hundreds of billions of US dollars, there must be long positions close to the corresponding quantity of short positions, right?

This requires a platform with high depth and order volume, which is currently not achievable by any platform.

If there is a large-scale redemption of NUSD, it means that there will be a large-scale liquidation of billions of US dollars. Imagine this scene, hmm… But if one day BTC is worth millions of dollars and perpetual trading volume is comparable to current forex volume, this idea feels like it has the possibility of implementation. It is also the most crypto-native stablecoin, based on BTC and does not require over-collateralization.

4. RWA-based stablecoin Ondo is currently doing this, creating an OMMF stablecoin backed by MMF (market fund) and US Treasury bonds. It is something that is on the edge of the circle…

5. With the development of LSD before and after the Shanghai upgrade, I feel that there should be a stablecoin based on LSDFi.

For example, forking Liquity, changing the collateral to stETH or a basket of LSD versions of ETH, and then doing some work on the interest… I don’t know if any project has done it yet, but I think it will definitely happen in the future.

End of the first part, stay tuned for the next part.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Flashbots: Restraining all parties, committed to thoroughly decentralizing MEV

- MEME Coin: From Internet Meme to a Market Cap of Over One Billion, What’s Behind the Power?

- When AI meets blockchain: ushering in a new era of human-machine integration

- What are the recent movements of Crypto VCs? 7 tools to help you easily track

- a16z partner jonlai: the most successful application is the packaged game

- How Blockchain Is Impacting Online Poker

- Blockchain in the annual report of listed companies: a comparative analysis of six state-owned banks