SEC is expected to give the green light to Ethereum futures ETF expected to be listed as early as October, with a total of 16 applications pending approval.

SEC expected to approve Ethereum futures ETF by October, with 16 pending applications.Author: Bloomberg, Cointelegraph Translator: Felix, LianGuaiNews

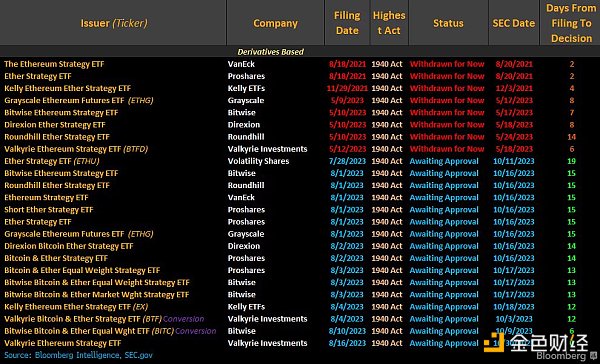

According to Bloomberg, informed sources revealed that the U.S. Securities and Exchange Commission (SEC) plans to approve the listing of Ethereum futures ETFs. Currently, more than a dozen companies, including Volatility Shares, Bitwise, Roundhill, and ProShares, have applied to launch Ethereum futures ETFs. Although it is currently impossible to immediately determine which funds will be approved, an anonymous source stated that officials have hinted that several of the applications may be approved as early as October. The SEC declined to comment on this.

Although regulatory agencies have repeatedly refused to allow cryptocurrency-based ETFs, speculation has been growing since the end of 2021 when funds trading Bitcoin futures contracts on the Chicago Mercantile Exchange (CME) were allowed, that products based on Ethereum futures (also traded on the CME) will follow.

Eric Balchunas, a senior ETF analyst at Bloomberg, said he is not surprised by the SEC’s approval of Ethereum futures ETFs and added that this decision indicates that the views of regulatory agencies on different products, such as Bitcoin spot ETFs, may change over time.

- Wood Sister’s Long Push Raising interest rates by the central bank is a more important goal than controlling inflation – bursting the Chinese bubble

- Full text of the speech by Hong Kong Chief Executive Carrie Lam at the 2023 Summit on Innovative Technology and Art Development

- The evolution of the order flow lifecycle What changes does intent-centric bring?

According to Eric Balchunas’ latest statistics, as of August 17th, there are currently a total of 16 valid applications for Ethereum futures ETFs, and the decision date for Valkyrie Bitcoin Ethereum Strategy ETF (BTF) may be the earliest, which is October 3, 2023.

However, the SEC’s progress in approving products involving the second-largest cryptocurrency derivatives has been slow. Previously, the U.S. SEC fought with the industry because it refused to approve Bitcoin spot ETFs. As early as 2022, Grayscale Investments expressed doubts about the SEC’s refusal to convert its Bitcoin Trust into an ETF and subsequently filed a lawsuit against the court. Grayscale believes that the SEC failed to treat Grayscale’s application and similar applications equally, violating federal law.

In response, the U.S. SEC believes that the proposal for the product to be listed on the New York Stock Exchange (Arca) is insufficient in preventing fraud and manipulation. The cryptocurrency field is full of investment risks, and the SEC is concerned that the prices of such assets may be manipulated, liquidity may be insufficient, and the sharp fluctuations in Bitcoin prices may be difficult for individual investors to bear.

However, according to AP_Abacus, a Twitter crypto KOL, it is expected that the appellate court will rule on the Grayscale Grayscale vs. U.S. SEC case on August 19th. Most legal experts expect the judgment to be favorable to Grayscale. Although winning the appeal does not mean that the Bitcoin ETF has been approved, it does mean that the possibility of quick approval has increased.

Although the news of the possible approval of Ethereum futures ETFs has sparked market discussions and revived market confidence, the future direction of the market’s downturn is still uncertain.

After BlackRock submitted an application for a physically-backed Bitcoin ETF, the price of Bitcoin briefly surged to $31,000. However, the price has since been hovering around $29,000, indicating that the optimistic sentiment brought about by such news is short-lived.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Exploring the future of Web3 social Building social graphs to solve customer acquisition problem.

- Delphi Digital Researcher UniswapX is Changing the Landscape of DEX

- CME Group will launch BTC and ETH reference rates for Asian investors.

- Trump has nearly $5 million in Ethereum NFT licensing fees, with revenue of nearly $4.9 million.

- Cryptocurrency mining companies establish a Digital Energy Committee to strengthen lobbying power in Washington

- Exploring the current ecosystem and future development trends of Intents in Web3

- Interpreting the latest proposal on achieving x-rollup interoperability using a shared ordering layer