opBNB hard fork upgrade on August 14th, can MEKE become the biggest winner?

opBNB hard fork upgrade on August 14th, can MEKE win big?Recently, BNB Chain announced that the opBNB testnet will undergo a PreContract hard fork at block height 5114294, which is expected to be triggered at 14:00 on August 14th Beijing time. This fork will introduce new rules and features to further enhance the performance and usability of opBNB.

opBNB is an L2 testnet launched by Binance Smart Chain (BSC) on June 19th this year. It is an EVM-compatible L2 scalability solution based on Optimism OP Stack.

Backed by Binance, which is the world’s largest cryptocurrency exchange in terms of scale, opBNB has access to abundant resources and traffic. Currently, opBNB is still in its early stages, and based on past experience, it is bound to attract attention with impressive price increases in the near future. One example is MEKE, a recently launched on-chain decentralized derivatives trading platform. As a newly launched on-chain project on opBNB, it is worth keeping a close eye on.

MEKE, developed by a team from the United States, can be used to trade various mainstream cryptocurrencies such as BTC and ETH through perpetual contracts. The MEKE team has stated that in the future, they will consider entering the RWA market with trillions of dollars in assets, trading futures of physical assets such as gold, oil, and US bonds.

- In-depth understanding of Intent Centric What exactly is it? Why is the kernel of the Intent layer considered programmable?

- Why should we pay attention to the stability of LianGuaiyLianGuail in the entry of stablecoins?

- On the eve of Cancun’s upgrade, taking a look at the world of zkEVM in Ethereum.

There are several reasons why MEKE deserves active attention:

1. Huge potential in the decentralized derivatives trading track

Based on 24-hour trading data from Binance, the trading volume in the derivatives market is approximately around $28 billion, while the spot trading volume is approximately around $13 billion. The derivatives market is more than twice the size of the spot market in terms of trading volume. On the other hand, the trading volume of derivatives in DeFi protocols is greatly underestimated. In CEX to DEX, the spot trading volume accounts for 15%, while the derivatives trading volume only accounts for 3%. This fully demonstrates the enormous potential for decentralized derivatives in this track.

2. Infinite potential in the global RWA market

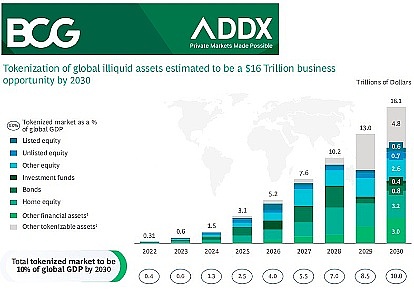

According to research by BCG and ADDX, the tokenization of global illiquid assets will create a market worth $16 trillion (which will be close to 10% of global GDP by 2030). Citigroup’s RWA research report, “Money, Tokens, and Games,” also predicts that there will be a market worth $10 trillion by 2023 that will be tokenized (RWA).

3. L2 benefits decentralized derivatives trading

From the track’s perspective, L2 is most beneficial to decentralized derivatives trading. The advantages of L2 lie in providing faster transaction speeds and lower transaction fees while maintaining a similar level of security as L1. This makes decentralized derivatives trading more convenient and secure. At the same time, with the launch of Arbitrum, BASE, and the upcoming opBNB mainnet, it can be said that L2 has truly arrived. opBNB, Arbitrum, and BASE are all very promising L2 solutions. They have played important roles in the narrative of the future “modular Ethereum” and have not only provided faster and cheaper trading experiences but also further promoted the development of the DeFi ecosystem through the introduction of new technologies and features.

4. Deployed on the opBNB testnet of the Binance Smart Chain (BSC) L2 network

MEKE deployed on the opBNB testnet of the Binance Smart Chain (BSC) L2 network ensures the security of each transaction and enables on-chain traceability. Technically, opBNB can process over 4,000 transfer transactions per second and keep the platform’s transaction cost below 0.005U, outperforming existing scaling solutions.

5. MEKE’s L2+ leveraged trading function brings new business growth and valuation

MEKE’s L2+ leveraged trading method allows users to enter the market with less capital, enjoying lower transaction costs and faster transaction speeds. Compared to traditional centralized exchanges, MEKE’s L2 network can provide higher scalability and lower transaction fees. This will bring new business growth and valuation opportunities to MEKE.

Currently, MEKE has started its first phase of public testing on July 31st, which is also about to end soon. Participating in MEKE’s public testing may bring benefits comparable to early participation in dYdX, Optimism, and Arbtirum testing, which should not be missed. Due to the limited issuance of MEKE tokens and the unique issuance mechanism designed, the earlier you participate in MEKE’s public testing, the more benefits you will receive, and the fewer benefits you will receive until the promotional offer is exhausted.

Long press to copy and follow MEKE’s official community for more information:

Website:

https://meke.fun

Telegram:

https://t.me/MEKE_Global

Discord:

https://discord.gg/meke

Twitter:

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The past, present, and future of Cancun’s upgrade

- Interpreting the potential profit opportunities of Base Velodrome, DackieSwap, Baseswap…

- Opinion GMX v2 will become a bigger cornerstone than GLP.

- No longer hesitant, two bills reveal the latest ideas on cryptocurrency regulation in the United States.

- Insights from the gambling industry From GGR to NGR – The law of attraction for cryptocurrency games?

- In 2023, AI chip companies are undergoing a deadly three-question challenge.

- In less than a week, MakerDAO has attracted a deposit of 700 million US dollars. Is the 8% interest rate really that enticing?