See the degree of centralization of POW and POS through data

One of the core principles driving the development of the cryptocurrency industry is that digital assets can flourish without the need for a centralized authority. Consensus algorithms, such as PoW and PoS, allow users to maintain the integrity of the network and thus democratize governance.

However, both governance models face challenges when it comes to maintaining decentralization. By looking at data from a variety of sources, this article explores the extent to which the network affects PoW and PoS cryptocurrencies by key players or stakeholders.

Hash rate distribution of POW tokens

Proof of Work (PoW) is the governance model used by most of the industry's leading cryptocurrencies, including Bitcoin and Ethereum. But this may change in the future as Ethereum developers are currently planning to take advantage of PoS.

Different cryptocurrencies implement different methods for PoW. In theory, POW can make decisions democratize on the web. But many industry supporters remain vigilant about the threat of this model, and when a single pool is large enough in the network's hash rate, it can make selfish decisions. Previous analysis shows that only a few pits can account for most of the network hash rate.

- Libra vs Ethereum: Should ETH holders worry about it?

- Japanese social giant Line may launch cryptocurrency exchange at the end of this month

- At the age of 25, he founded the Encrypted Castle. Once the unicorn founder, the celebrity genius hacker was the sofa guest here, but now nobody cares…

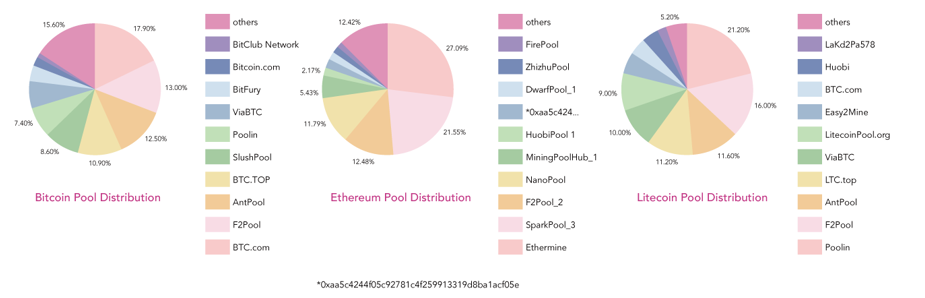

Distribution chart of hash values in BTC, ETH, LTC as of June 13

As you can see, in the above chart, Bitcoin is the most widely distributed hash rate among the three currencies.

Among all bitcoin pools, BTC.com contributes the most to Bitcoin's hashrate (approximately 17.9%). This is followed by F2Pool (13%), AntPool (12.5%) and BTC.TOP (10.9%). The two largest BTC mines add up to 30.9%.

On the other hand, when it comes to Ethereum, the two largest mines account for 49.09% of the network's hash rate. In addition, the Ethereum Mine Pool is the largest personal hash rate contributor in all Bitcoin, Ethereum or Litecoin pools. Accounted for 27.09%.

The largest hash rate contributor to Litecoin is a mine called Poolin, which accounts for 21.2% of the network hash. Compared with Bitcoin and Ethereum, the two largest mines of Litecoin account for 37.2% of their hash value.

The degree of decentralization of PoS tokens

There are many obstacles between the degree of decentralization displayed by PoW and PoS, which cannot be compared. The most fundamental obstacle is that the two governance models differ greatly in the way they reach consensus.

Unlike the PoW model, PoS governance is based on the participant's Token ownership. Those who are considered to have important “interests” in the network may be given more responsibility to maintain the integrity of the network.

Since the PoS chain does not emphasize the "dig" Token like the PoW chain, the hash rate of the pool cannot be considered. Instead, we focus on the voting rights that large validators have in their respective networks.

In this regard, our choices are limited. In today's market, only a small number of top-ranked tokens use the PoS model. In addition, popular assets like EOS and Tron take advantage of a modified version of PoS called Authorized Equity Proof (DPoS), which has very different capabilities.

We studied Cosmos (ATOM) and Tezos (XTZ) because the way these two tokens operate is largely based on POS. In addition, the current market capitalization of these two currencies is ranked in the top 20.

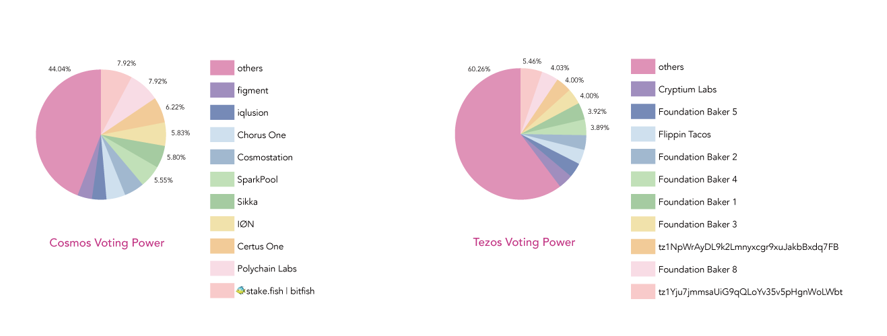

Distribution chart of hash rate in POS tokens as of June 13

For many PoS cryptocurrencies, the largest holder of voting rights is often the staking pool. This is the case with Cosmos, whose fish is its most influential single stakeholder in its Staking pool. At the time of our data generation, it had 7.92% of the total voting power of the network.

The proof of the POS blockchain has a validator, and the validator creation, proposal, or voting will be added to the block in the blockchain. Fish's website explains. "These validators need to run robust hardware, 24/7 online, and a variety of security features."

These types of validators allow users to "bet" their assets in exchange for financial returns. In practice, this means that users do not need to spend a specified amount of time when storing assets. Users receive rewards usually from new blocks created by their shares.

When it comes to Tezos, its "bakers" operate in a similar way to the staking pool because they act as validators for the network. As the chart shows, the main contributors to Tezos' voting rights are the bakers belonging to the Tezos Foundation. They hold a total of approximately 23.22% of the power to vote online.

However, according to a statement from the Tezos Foundation, it does not use its power to influence the network:

“The Foundation has decided not to vote in the first part of the process, which is currently in progress.”

According to the tweet of the project, Tezos had its first non-foundation bakers in July 2018. Since then, the permissions on the network have become more dispersed over time. In contrast, the Tezos Foundation is said to have more than 31% of online voting rights in March of this year.

In addition to Cosmos and Tezos, other cryptocurrencies based on the PoS model are still in their infancy in development and adoption. Therefore, it may take some time for these assets to actually be tested on the same scale as top currencies such as Bitcoin, Ethereum and Litecoin.

PoW and PoS coins are at risk of centralization

To truly realize the decentralization of an asset, no central government can fully control its future. This is not just a matter of principle. In the case of POW, the pool holding most of the cryptocurrency will make it more vulnerable to 51% attacks.

This type of attack means that the entity has most control over the network, enabling it to manipulate the future of the network. Therefore, it is very important for the POW to maintain a significant hash rate distribution.

While innovators are already aware of the risks of POW ecosystem concentration, some believe that Staking tokens may be more vulnerable. An expert familiar with this topic said that maintaining the distribution of power is especially important for PoS currencies.

“In the PoW network, there is a clear separation of power between the user (ie the holder) and the verifier (ie the extractor),” said Qiao Wang, product director at Messari. “We saw a clue in 2017 when Bitcoin users asked miners to activate SegWit and cancel SegWit2x, although many believe that miners have more control over the network.”

He added: "In the PoS network, the holders and the stokers are often the same person." "Because of this, the separation of power is even less."

Source: longhash

Compile: Sharing Finance Neo

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Dry words | Algorand Economic Report

- Libra has given global regulators an "anxiety disorder"? Facebook Chief Operating Officer responds like this

- Chang Yong: Facebook's Libra is an important innovation but the future is unknown

- Babbitt Column | Interpretation of the White Paper on the Application of Blockchain Judicial Deposits——Application scenarios and challenges of blockchain deposit

- What do you say about Libra, Facebook “grandfather”?

- 48 hours after Facebook sends the currency

- Blockchain +5G: Communication is easy to build, security is difficult to solve