See the inflection point of the world with the crude oil plunge and Bitcoin plunge

The night before yesterday, Saudi Arabia and Russia started an oil war. Yesterday, the international crude oil plunged 30%. Historically, as long as Saudi Arabia goes to war, international crude oil has plummeted by at least 70%. This time the crude oil caused a plunge in U.S. stock futures and suspended trading. Saudi Arabia's stock market fell 7.15% at the beginning of the session, while the Kuwaiti stock market fell more than 10% during the session and suspended trading. Saudi Aramco, the world ’s largest oil company and the world ’s most profitable company, fell below the issue price at the start of the day, falling 8.18% throughout the day.

The direct effect is the plunge of the Middle East currency, this time the largest decline since the 1980s. Only gold in the world rose sharply to $ 1,700.

Historically, Saudi Arabia has waged three crude oil wars. Including 1985, after several years of OPEC production cuts, Saudi Arabia launched a price war, after which oil prices plummeted by nearly 70% in the next six months. In 1997, Venezuela's overproduction caused Saudi Arabia to fight again. Oil prices fell by 50% in the following year and a half. In 2014, Saudi Arabia failed to persuade countries, including Russia, to join the production reduction plan, and the war began again. The price dropped by 65% in the following year and a half.

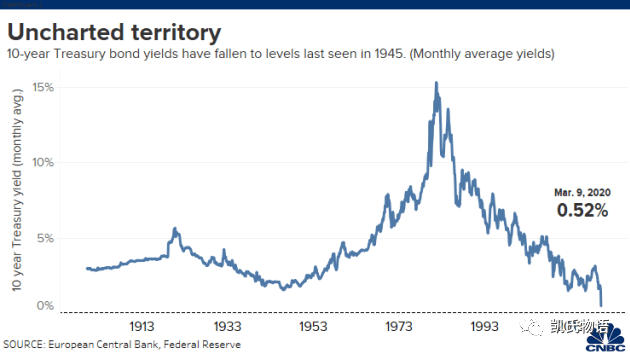

However, based on the different economic cycles, this crude oil war is not the same as the previous three times. Previously, it was in the upward phase of the economy, and it was a battle between incremental markets, but this time it was basically a stock market fight, and I estimate that it will be even worse. Treasury prices have risen further and yields are still falling. The implied yield of the 10-year U.S. Treasury bond fell below 0.5%, which has hit a record low. The yield on the 30-year Treasury fell below 1%.

- Babbitt Column | Does Blockchain Native Asset Really Make Sense?

- Is your digital asset protected on the exchange? Understanding the gap between exchanges and traditional banks

- The 500 billion yuan evaporated in January, and the production-reduction coins collapsed across the board. The "minsky moment" of the crypto market came?

Just in the early morning of the night, the US stocks experienced an epic plunge, generating a blowout, falling 7.79%. This matter has basically ruined your circle of friends. This can be seen as a continuous product of the oil slump.

Have you ever thought about it and saw the opening, but how do you end? The reason why the world ’s assets are panic is because no one wants to understand where this war ends. After all, from past experience, Saudi Arabia has always been a powerful oil-controlling country and can determine the end of the war. But this time, the world has put a huge question mark. It is precisely because of uncertainty that the world's capital is so panicked.

But is it possible that everyone misunderstood this bureau from the beginning?

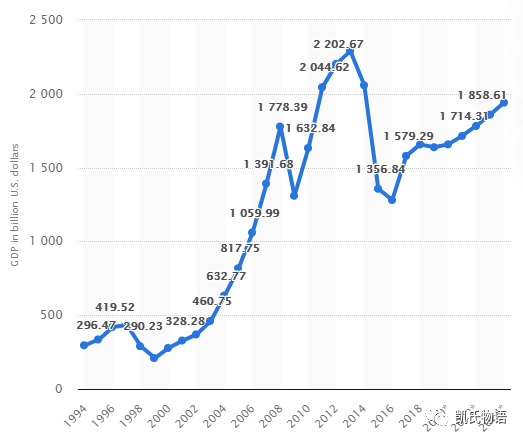

Although Saudi Arabia is very rich, if you look at the GDP of 2019, you should know that Russia has reached 1.75 trillion US dollars, while Saudi Arabia is only 785 billion US dollars. And compared with 2018 GDP did not increase at all. In an article a long time ago, I pointed out that the petroleum industry is undergoing tremendous changes, from extensive industries to sophisticated industries.

The landform of Saudi Arabia determines the relatively low cost of producing oil, but it also brings an important side effect, that what is easily available is often easy to relax. Saudi Arabia had a lot of money and time to engage in royal court fighting. Just two days ago, it was revealed that Saudi Arabia had arrested several senior princes and dozens of related personnel.

Russia is not the same. The characteristics of the extremely low and cold zone determine that the difficulty of developing oil is the highest in the world, but it also means that to survive, it is necessary to reduce costs through technology as much as possible. Therefore, in the oil extraction industry Russia has always been a world leader. When a major inflection point occurs in the market, it is often the countries that are fully competitive in the tribulations. Russia is far ahead of Saudi Arabia in terms of overall mining technology and sustainability.

So the question is, why can Saudi Arabia have been so arrogant in the past several oil crises? The core behind this is the nature of petro-dollars. Saudi Arabia ’s annual purchase of more than 10 billion US dollars of weapons from the U.S. government is actually a protection fee. The world feels that Saudi oil ’s arrogance is largely dependent on the United States Fox fake tiger prestige.

However, petrol dollars will also encounter two important problems. One is oil itself. The future world is the era of electricity. All transportation vehicles will gradually move towards electrification. The demand for oil is greatly reduced. The double-edged sword, when the economy is good, everyone will feel that the upstream industry's raw materials are cheap, and there will be rushes to reduce costs and respond to product demand. But when the economy is bad? Who will pay for the plunge in oil prices? What happens when supply is far greater than demand?

Coincidentally, at this time, the US dollar has been in a state of oversupply in the past few decades. Petroleum dollars, petroleum dollars, and crude oil fell, and the US dollar will continue to oversend to maintain balance. The world ’s assets are all denominated in US dollars. If the US dollar is oversold, it will cause various other currencies to rise in name. After the rise, these moneys have no actual gain, but they have risen on the surface. What should we do? Is to add to various industries to cause inflation.

Crude oil is the source of the upstream industry. The decline in crude oil will accelerate the mass production of materials in the upstream industry, but the actual market demand cannot meet the supply of production materials. At this time, the upstream industry is reluctant to sell and the market material prices have skyrocketed. Wasn't that the case in 1929? The surplus materials would rather be poured into the river than sold in the market. As a result, prices on the market skyrocketed, but the actual excess production materials were either destroyed or dumped out.

In contrast, Russia has long been very cleverly tied to the thigh, that is, China. China and Russia are two countries, one is an energy country with intensive cultivation and continuous combat capability, and the other is the world factory. The East Line natural gas pipeline started in 2012 has historical significance today. It completely connects China, the world factory. This means that the future development of Russia's economy can depend on the development of the Chinese RMB market and survive strongly.

In 2014, OPEC started a price war and the price of oil dropped to $ 20 all the way. This decision cost OPEC trillions of dollars. In fact, its main target is the US shale oil production companies. Although some US oil companies did close down at the time, it was generally stronger than most American oil companies. OPEC returned to the limited production and guaranteed price two years later. On this strategy.

But now, the development of the epidemic in the world has reduced the demand for oil on a large scale, and the era of electric vehicles has accelerated the collapse of oil companies. When it comes to protracted war, Saudi Arabia has no possibility of confronting Russia. Why did I say that?

One is the world's second rising number, and the other is the world's first falling number. As long as we simply look at the coming global depression, what each country is doing will know where they will go in the future.

The United States is constantly cutting interest rates and releasing water. In the latest institutional forecast, the probability that the Fed will cut interest rates again by 75 basis points on March 18 has reached 100%, that is to say, soon, the Fed's interest rate will reach 0, which is unprecedented. QE will be restarted later, and this will turn into a vicious circle.

But what does the interest rate cut really affect? Have you thought about it? Now everyone is talking about the stock market, currency market, and various commodities and futures markets. But when we look at the development of a country, what is the most fundamental socioeconomic foundation? It is a business of this country. Without various types of enterprises as the backbone of the national economy, how can the economy go upward.

Since 2010, the United States has been labeled as "10 years of debt". After the 2008 financial crisis, the Federal Reserve conducted a large-scale QE to lock interest rates at extremely low levels. Enterprises found that the cost of raising funds through the corporate bond market was really lower than ever.

According to data from the American Securities Industry and Financial Market Association, US companies have issued more than $ 1 trillion in debt each year for the past 10 years. This is an unprecedented record. In the ten years from 2000 to the end of 2009, this scale was only about 6 trillion US dollars. Today, the largest companies in the United States, that is, the vast majority of the S & P 500, have issued bonds that account for about 70% of the total scale, nearly $ 7 trillion.

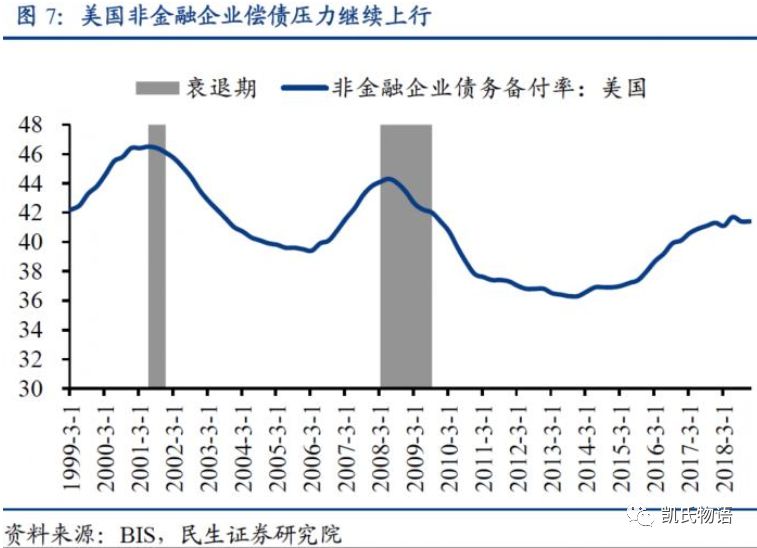

By the end of last year, corporate bonds issued by non-financial companies in the United States had exceeded 75%. This ratio has far exceeded the 2008 subprime crisis. Many people may be wondering what corporate debt is for. Why do companies issue such a high debt?

In the secondary market, there are only two uses of cash, one is called reproduction and the other is returned to shareholders. Then everyone will find that when the United States keeps cutting interest rates, companies can make money by issuing debt. This is called raising a lot of cash by issuing bonds and then buying back shares in the secondary market. The secondary market evaluates a company's earnings per share. Repurchasing stock will allow the market to see that the company has very good earnings per share.

Since corporate bonds can be used to repurchase stocks in the secondary market to drive up market prices, why should companies make every effort to produce products and expand their scale? So we have seen that in the past ten years, the deficit between the funds used by companies to buy back stock and the funds invested in production has changed from 60 billion US dollars in 2010 to nearly 1 trillion US dollars today, and this number was only 2001. For $ 6 billion.

Stock repurchases have contributed to the super bull market of U.S. stocks over the past 10 years. In the past year, S & P 500 listed companies have only increased their total net profit by only 50%, while their stock prices have doubled on average. And sorry, just like the 2008 subprime mortgage crisis, BBB-level corporate bonds have now been packaged into various types of derivatives, accounting for more than 50% of corporate bonds. The core of the change is actually the transfer of the bursting of the personal leverage bubble of American residents to American corporate leverage.

Why do I specifically mention US corporate bonds? Because from 2000, everyone will find that one is that corporate bonds have been getting longer and longer, from the average 6-7 years at that time to the 10-year average 10-12 years, and then to today, the average 15-17 year. On the one hand, interest rates are getting lower and lower, on the other hand, it is getting longer and longer, which means that US stock companies will soon be unable to pay interest on corporate bonds, and a large-scale default will begin.

The economy is almost, everyone will pass after suffering a bit. What is the concept if the leading American companies fail to complete the rigid payment? It's the equivalent of the United States telling investors around the world that I can't play anymore. Please help yourself. This is not a financial tsunami, it is an epic hell on earth. Countless countries are likely to lose their national wealth because of the derivative effects of the collapse of US stock companies. And I regret to tell you that the U.S. corporate bonds will begin to have a concentrated rigid redemption period starting in June of this year.

Hell is empty and demons are on earth. Is it frightening for US stocks to melt? The more terrifying epic plunge has yet to come.

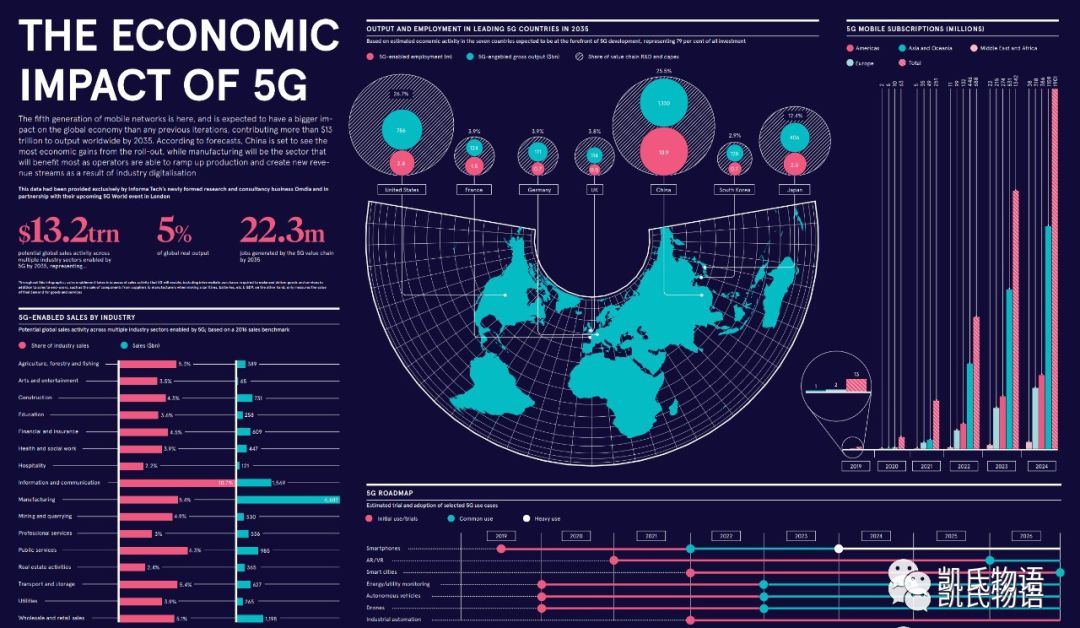

On March 4, the Standing Committee of the Political Bureau of the Communist Party of China held a meeting to put forward the concept of "new infrastructure" and called for accelerating the construction of new infrastructure such as 5G networks and data centers. Back in history, the "new infrastructure" of the Chinese economy we were talking about 20 years ago was the reinforced concrete infrastructure such as railways and highways. The "new infrastructure" in the next 20 years will be infrastructure in 5G, artificial intelligence, data centers, the Internet and other technological innovation areas, as well as education, medical care, social security and other areas of upgrading of people's livelihood. That number could be 33 trillion.

"New infrastructure" is not a joke. In fact, this is completely different from the 4 trillion that appeared in 2008. When we look at a construction, we must look at the economic scale that it will generate in the future. The original infrastructure construction was mainly for basic logistics, transportation, and national mobility to help the real estate market accelerate its circulation.

However, any industry in the "new infrastructure" has huge development fears. For example, the investment in 5G network construction will soon reach more than 1 trillion, and the upstream and downstream investment in the industrial chain will exceed 10 trillion. More importantly, 5G network construction is only a foundation on which a prosperous ecology is generated, including but not limited to the Internet economy, artificial intelligence, digital economy, Internet finance and other new technologies and new industries.

The current national strategy is the simultaneous development of 5G and 6G. It is expected that China will fully commercialize 6G before 2030. This time will only be early and not late. Many people are puzzled by the "new infrastructure". Since the reform and opening up, China's economy will not develop to what it is today without the generation of infrastructure construction.

Since the 1980s, the country has put forward the slogan "To get rich, build the road first". This is the first stage of "new infrastructure", which is the era of expressways. Since the large-scale construction of railways in 1991, the second generation of "new infrastructure" has been formed. In 2008, the global financial crisis launched a 4 trillion large-scale upgrade of high-speed Highways, national and provincial highways, and the construction of high-speed rail are the third stage of the "new infrastructure".

The "new infrastructure" in the fourth stage will form misplaced infrastructure. For example, we see that the first stage is vigorously constructing Yunnan, Fujian, Sichuan, Shaanxi, and Henan. The scale of the new infrastructure exceeds 20 trillion, which is equivalent to The triangle and the Yangtze River Delta and Beijing combined, while Yunnan on the southwest border is even more important, with a planned total scale of 5 trillion.

This means that at the national strategic level, Yunnan will become a bridgehead connecting Southeast Asia and ASEAN. Starting from the Belt and Road Initiative, China's direct connection to the entire Southeast Asian hinterland will be a real scene to be realized. The launch of Fujian means that the point of connection to Taiwan will be getting closer. And Sichuan connects Tibet and Xinjiang, and has penetrated the North-Western Europe and Asia continental shelf, and its strategic significance is self-evident.

Shaanxi and Henan, one is an old revolutionary area, and the other is a province with a large population. Most importantly, their geographical locations are very suitable for bundling Central Asia, quickly pulling the population of Central Asia to the most central position of the whole country. As a transit station, it radiates the whole country. The rest is the undisclosed Northeast. As a bridgehead linking East Asia, the entire Eurasian continental shelf has been completely completed by China with "new infrastructure", which means that the entire China will return to the center of the world in geopolitics. This scene is similar to the era when Genghis Khan conquered the world.

In addition to the premise of facing the financial crisis of the global depression, the launch of the "new infrastructure" also has an important reason. I have always emphasized that any country and society must develop in the end without three key points: demographic dividend, economic cycle and technological innovation.

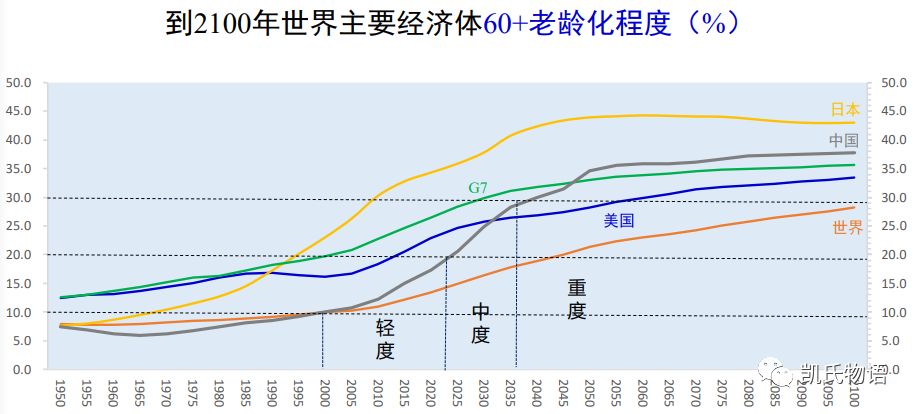

As I mentioned in my previous article, 2020 is the time when Chinese young people and seniors form an inflection point. In other words, China's demographic dividend will reach its peak in 2020. China's "before getting rich" is also an unprecedented challenge facing the government. The baby boom in China broke out in 1963. Based on the retirement at the age of 60, it is estimated that around 2023, China will usher in a full-scale wave of aging.

In other words, in 2023, China's aging population may account for about 14%, but according to data estimates, by 2033, China's aging population will exceed 400 million, which is about 26% of the total population. Around 2050, China's elderly population will peak at 487 million, accounting for 34.9% of the total population. Compared with Japan, the aging population increased from 14% to about 24%, but it took 20 years.

At these points in time, you may say that for ordinary people, there is no practical guiding significance, how to live or how to live. I want to say that you are completely wrong about the nature of this matter. These time points mean an important thing:

In history, when any country reached its peak, it was accompanied by an important side effect. This side effect was called class solidification. Today, China is far from being class-solidified, but after 13 years, large class jumps will no longer be possible in China.

Japan is very typical. Your father opened a ramen shop. Basically for you, the best result is to inherit the family business and continue to open a ramen shop. Other options cannot basically surpass your own class. This is the development of things. Determined by the law. If you look at the United States again, you have been in debt from the beginning of your studies, and you have grown old. What kind of development is there in such a country? Class solidification must be accompanied by an increase in the wealth gap.

2020 is so important that many people only see the skyrocketing plunge at this moment. In fact, they completely ignore it. This year will change the destiny of all mankind, and most importantly, your destiny.

In the future, mainland China will be full of elderly people. How will they consume it? How to solve the relationship between supply and demand? Do these elderly people, like the elderly in Japan and Hong Kong, still work hard every day to make ends meet? At this time, we need, first of all, the low-end labor population from all countries in the world, especially Southeast Asia. Why should the factory be built in Vietnam, Thailand, Myanmar, Laos? No longer, the population of these countries will be drawn to the southwestern provinces of China through the "new infrastructure" to form a new manufacturing base.

Secondly, coastal and economically developed provinces are fully upgrading smart devices and high-tech industries. For example, Guangdong, as the Guangdong-Hong Kong-Macao Greater Bay Area, will become the world ’s largest bay area. Of course, it will be fully upgrading its industries from low-end processing manufacturing to high-end high-end Technology-related manufacturing. Let intelligent equipment and infrastructure serve the people.

This corresponds to the second phase of this round of "new infrastructure" and the comprehensive upgrade of the "new infrastructure" provinces in the third phase. Through vigorous development of 5G, artificial intelligence, industrial Internet, Internet of Things, blockchain and other industries, the entire society is fully upgraded The infrastructure is actually expressed in one sentence:

This is fundamentally different from the "new infrastructure" three times in the past. The coming economic cycle of human society is a science and technology financial cycle with the main purpose of intelligent machine networks. I have stated in many previous articles that, in essence, bitcoin digging with a computer is as primitive as digging gold with a shovel in the US "gold rush" stage.

Yes, we finally talked about Bitcoin and blockchain.

What is really valuable? It's data. In the Internet era, it is called "big data", which is owned by the government or large enterprises, and the most important thing in the next stage is "distributed data", which is owned by all human beings. How do I get these data? How to confirm these data? This is the era of distributed data brought by various intelligent devices, that is, the Internet of Things IOT and infrastructures such as 5G and 6G. In essence, these devices are "mining machines".

Bitcoin appeared 10 years ago, and the blockchain started to become a trend at this point in time. I don't think it is accidental, but an inevitable result. In contrast, the current economic cycle is the next round of infrastructure construction during the Great Depression. For example, the prototype of the World Wide Web and personal computers appeared in the 1970s, and personal computers began to be vigorously developed in the 1980s. In the 90's, the Internet was in its infancy, and it began to develop vigorously after 2000. After 2010, the mobile Internet brought outbreaks.

Bitcoin and blockchain now appearing are still in the embryonic stage of infrastructure. The next round of economic cycles is likely to form an ABT type formed by the combination of AI, Blockchain and Internet of Things (IOT). The most critical one is the blockchain, which will completely change the whole world as the next version of the Internet upgrade iteration.

Let's think about it carefully. Based on this knowledge, is there still a possibility of large-scale "new infrastructure" in the United States and Europe? I think it will be very difficult. Once it is determined by national ideology, liberalism and personal privacy protection, on the other hand, they no longer have such financial and material resources, and most importantly, human resources to solve such "new infrastructure" ".

It means that in the next round of the economic cycle, the rise of machine networks will appear in a large number through the combination of human behavior data in China and machine network AI. So in other words, today we see that the "new infrastructure" extended to the entire Eurasian continental shelf is preparing for the next stage. Only by accepting the Belt and Road countries can it be possible to upload human data to the Internet on a large scale. Machine fusion. The United States wanted to contain China from the beginning of 5G. On the surface, it was a dispute over standards. In essence, it was a dispute over data. Whoever owns the data has the next era.

Just like everyone is asking what is the purpose of Bitcoin today, digital gold is not just a slogan. In essence, it is not prepared for human beings, but for the intelligent iteration of machine networks. Machine networks are not like carbon-based creatures like humans, they need to eat and live. Silicon-based creatures only recognize one thing, which is distributed data. If the European and American countries are completely thrown out of the human behavior data that the machine network actively absorbs during the development and rise at this stage. Well, it is unlikely that it will return to the center of the human world in the next hundred years.

"New infrastructure" is not a simple weapon against the global financial crisis. This kind of thinking is obvious. After all, the Great Depression has only a short period of 10 years. What China wants to start is the integration of the human world and the machine network in the next century Battle of the National Games.

The derived effects will include, but are not limited to, the transformation of Eastern and Western ideologies, the outbreak of Chinese-based oriental culture; based on Chinese ethnic data, combined with machine networks to form a new ABT pattern. Evolution of a series of silicon-based intelligent life. From unmanned vehicles, electric cruise ships to unmanned aircraft, to the evolution of various types of robots. Comprehensive upgrade from soft power to hard power.

Although we currently see the rapid development of robots in Western European and American countries, these robots are lacking a large number of human behavior data samples, and such machines will soon encounter bottlenecks. Machines can exist without human existence, and the future guided by China is a future where machine networks coexist peacefully with humans and develop together. Essentially, robots need "consensus data". Without consensus data, machine networks are just like junk food or toxic food, and cannot make them develop healthily.

Today I am talking about this. The battle for the National Games has been doomed from the beginning and China has won.

As I mentioned before, essentially the oil plunge will ultimately result in the killing of the three countries: RMB, USD and Bitcoin. Many people have seen the plunge of Bitcoin, but have not found that it is still only in the process of building a bottom. Ethereum hasn't completely fallen below the $ 200 bottom I stated in the live stream.

If we look at the entire graph from February 26 to today, Bitcoin and Ethereum are very similar to the state from November 22 to December 19 last year. Take Ethereum as an example. From November 25 to the second low of 133 US dollars, about 13 points away from the 120 US dollars I said in November, and then continued to fall to 116 dollars. Then it bounced back to the $ 120 level to build a bottom. The rally started on January 3 and reached $ 287.

The current round fell from the bottom of the 200 US dollar at 10 o'clock and started to sideways. After that, it first pulled up and then fell to 190. It also fell below the 200 US dollar bottom position and now builds a bottom at 200 US dollars. The time is doubled. So what most people see is a plunge, a panic, and an emotion driven by the plunge in crude oil. But I don't think it deviates from the previous judgment. The latter will be known by referring to the previous two months.

If you think about it, does the plunge in petrol dollars mean that the obstacles to the globalization of the renminbi are being cleared? It also means that China's "new infrastructure" opened in 2020 and "new infrastructure" opened in 2030 will become the infrastructure of the human world and start the next global economic cycle. Isn't this the beginning of the blockchain represented by "digital gold" with Bitcoin as the machine network world and gradually entering the world stage, leading ABT to the beginning of the next century of humankind?

In 2020, the epic slump in world assets, headed by petroleum dollars, will begin, and just as new species are emerging and sprouting. The RMB will finish bottoming in the next two years, starting a 50-year rise. Today's Bitcoin is also on its way to the bottom. The next year is the beginning of a big bull market for the next decade.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin mining difficulty has risen sharply, or the price of coins has picked up

- Last miner: Can I continue mining when Bitcoin drops to $ 1,000?

- Free and easy week review | Is blockchain preemptive trading too rogue? Consensus algorithms introduce sequential fairness or can be cracked

- The financial crisis is raging, and the bitcoin bull market is expected to fail?

- 15 million traffic support, 50% high dividends! Babbitt launches industry's first live Queen recruitment plan

- Viewpoints | Several possibilities for driving new development with "new infrastructure" + blockchain after the epidemic rainstorm turns overcast

- Views | Can Lightning Network stand out in the payment field of the Bitcoin chain?