Slow money in the encrypted world: Which assets and communities are most important in the next decade?

Foreword: Before the concept of fast company and slow company, this paper put forward the concept of fast money and slow money. Fast money is traded, earning returns quickly through liquidity, while slow money gains the ultimate benefit through long-term value creation. Whether it is fast money or slow money, what can be done is success.

However, in the long run, if the slow money can be combined with a big project of an era, such as investing in a small number of future large projects in the encryption project, this can get the highest return. Of course, the question here is how to find a project that you are willing to hold for a long time and truly recognize it. Finding a real big project is difficult, and the probability is low, but as long as you find one of them, the reward is huge. Everyone can ask yourself.

The author of this article is Mike Maples, Jr., translated by the "SIEN" of the "Blue Fox Notes" community.

About a decade ago, Ann Miura-Ko and I met with the Yale University Endowment Fund team. In the early morning of the day, the dark sky was raining heavily, and then the power was turned off.

- Analysis of the legality and privacy of DApp and the security of tokens in the ecology

- Nearly 80% of Bitcoin addresses are profitable, and the number of Bitcoin holders has reached a new high

- What is the value of 1 bitcoin? Bitcoin pioneer Hal Finney: $10 million

Dave Swensen is the chief investment officer of the Yale University Endowment Foundation and he came very early. When Ann and I lit the candle, he walked into the hall in an inconspicuous way, and the entire team arrived on time.

At the meeting, Swensen asked a surprising question:

“Some of these investment projects may be listed, what do you hold after the IPO?”

Fast money and slow money

Since Dave Swensen became the chief investment officer of the Yale University Endowment Foundation in 1985, their donations have grown from $1.3 billion to $24 billion. His long-term cooperation with Dean Takahashi is a very successful story. Dave generously shared his ideas in two books: Pioneer Portfolio Management and Unconventional Success. Dave and the Yale University Endowment Foundation team are one of my favorite "slow money" investors. (Blue Fox notes: fast money is fast money, slow money is slow money, refers to the rate of return.)

The “quick money” investors regard the market as a voting machine and are the pulse of the current era. They are trying to make predictions in the short term. They believe that they understand the essence of things earlier than others. When everyone tries to seize new information and overreacts it, they get a quick return. Liquidity is critical for fast money investors because they need to get in and out of stocks or other assets quickly.

“Slow money” investors see the market as a weighing machine. They try to make money by having a part of a great business that has appreciated faster than the broader market for a long time. Liquidity is less important to these investors because they may hold for decades. (Blue Fox Note: Part of a great business is, for example, a considerable amount of tokens with a prospective encryption project.)

Liquidity may be more like a "bug" than a "function"

Dave Swensen took the “slow money” investment a step further, indicating that sometimes lack of liquidity is an advantage.

This perspective is unconventional. Most people pay a premium for liquidity. If I have a liquid asset, I can buy or sell it at any time, which is very valuable. If I have a poorly liquid asset, such as a private technology startup, a part of real estate, or a private equity firm, I have very few opportunities to cash in the short term. This leads to the fact that if I am not optimistic, it may not be possible to sell it for a long time. Or, if I am more optimistic, I can't easily double bet. Who will object to assets with more degrees of freedom?

Swensen's reverse insight is that anyone can buy stocks or other assets with immediate liquidity, making the market for these assets more competitive and efficient. Liquidity can also trigger emotional temptations on transactions, especially if it is better to not operate. “Slow money” exploits the inefficiency of the market by buying and holding assets that are often undervalued and lacking in liquidity, but will be of great value in the distant future. Because the Yale University Endowment Foundation operates over a very long period of time, the patience of their investment team builds a structural competitive advantage.

The longer you plan to hold assets, the less advantage that flow performance offers. Correctness and patience are the most important.

Founder of quick money and slow money

Fast money and slow money also apply to the founder. (Blue Fox Note: That is to say, the investment methodology of slow money and quick money is not only suitable for different styles of investors, but also suitable for different founder styles.)

At the time of fundraising, the founders of “Quick Money” focused on merging the most money at the best price, minimizing governance and negotiating the most attractive equity exercise plan. They may also try to use the market opportunity to sell their business to get "quick money." In the case of cryptocurrencies, they only use the white paper to make use of the immediate liquidity of the market to make quick money.

The founders of Slow Money believe that long-term greatness takes years or even decades of commitment to build great teams, cultures, business models, partner ecosystems, and an increasingly competitive moat. That's why you'll observe that the founders of the Slow Money program pay particular attention to recruiting, proper exercise plans, working with long-term investors, and carefully managing the funds raised and valuations over time. They want to create a product or service that can serve hundreds of millions or even billions of people, which can take many years. They are constantly optimized for long-term success.

However, slow money does not mean slow operation. Regardless of the type of start-up that is built, the founders need to act extremely urgently: the key is to execute at high speed in the long-term, great service.

Fast money and fishing story

I have seen a lot of "quick money" investors in cryptocurrencies. They do a good job of throwing high and low sucks, often in months or weeks, or even days. Some people make money by shorting crypto assets, and the crypto assets that are shorted often have not yet reached their potential or are faltering on the edge of overvaluation. I am very happy to see that the friends have done a good job, and I am very happy to hear that they are making a quick profit.

There are also many stories of founders who get rich quickly. Some people take advantage of the liquidity of tokens, lack of exercise plans, and a bubbled cryptocurrency speculation environment. These stories remind me of the "fishing story" in Oklahoma's childhood. People fish in the hot lake all summer. However, you have only heard stories about catching the biggest fish, and these stories have become more and more exaggerated over time. For "quick money" to quickly profit or quit in the transaction, you will not hear stories about losing money and losing money.

The benefits of quick money

Does this mean that I always think that "quick money" is not good, and "slow money" is good, not always.

For hundreds of years, fast money and technological breakthroughs have had a symbiotic relationship. Whether it was the railway frenzy of the 19th century, the radio enthusiasm of the 1920s, or the Internet bubble of the late 1990s, fast money made it possible to fund technological breakthroughs at very low capital costs.

On the one hand, compared to most startups that have not yet achieved a product and market match, the encryption project issues its tokens at very high prices. But on the other hand, this allows builders to try their new ideas at an extremely fast rate without worrying about capital entering the threshold.

I also learned a number of first principles from the best encrypted hedge fund managers. Many people are very smart and insightful, especially when discussing core ideas, rather than discussing when the token will appreciate in the short term. The founders of important encryption projects should listen to their opinions.

Fast and slow thinking

If you really believe in the field of encryption, you should ask yourself which assets and communities are most important in the next decade or more. Moreover, which encryption project promoters will have the stamina of Bill Gates, Larry Page or Jeff Bezos?

If you don't ask these questions, you can become a "quick money" investor. However, you should be aware that you must be more than others know in the short term. In this unregulated market, speculators have many weapons. If you don't know more than anyone else, you may become the latest fanatical cannon fodder. While charitable donations for future innovations are always welcome, they are not profitable. (Blue Fox Note: If the author is ridiculing "quick money" investors can't understand more, faster and deeper than others, it is easy to become the target of harvesting, just like making charitable donations for innovation.)

Building for the long term

The encryption project reminds me of a high-line circus show. It is like a startup and a public company that operates from zero to one at the same time. Uncertainty is huge. Unlike traditional startups, tokens and community vs. equity and the company's business model are mostly ongoing work. Will the business network integrate equity-based entities and token-based entities? Stocks have created prosperity in the past, and what kind of prosperity will the tokens create in the future? In the long run, the business based on tokens will flourish, or is it only bitcoin?

Given this uncertainty and volatility, the founders of smart encryption projects should seek answers from a combination of fast money and slow money. Quick money investors can provide insight into market changes, mechanisms of currency flow, token exercise plans, and other direct opportunities and threats. Slow money investors can help the founders of encryption projects focus on long-term value building, such as recruitment, operational assistance, category design, market entry, and other business building issues. They can also protect founders from the influence of short-term traders, allowing founders to focus on creating tangible value and richness rather than speculative gains.

The inevitability of slow money

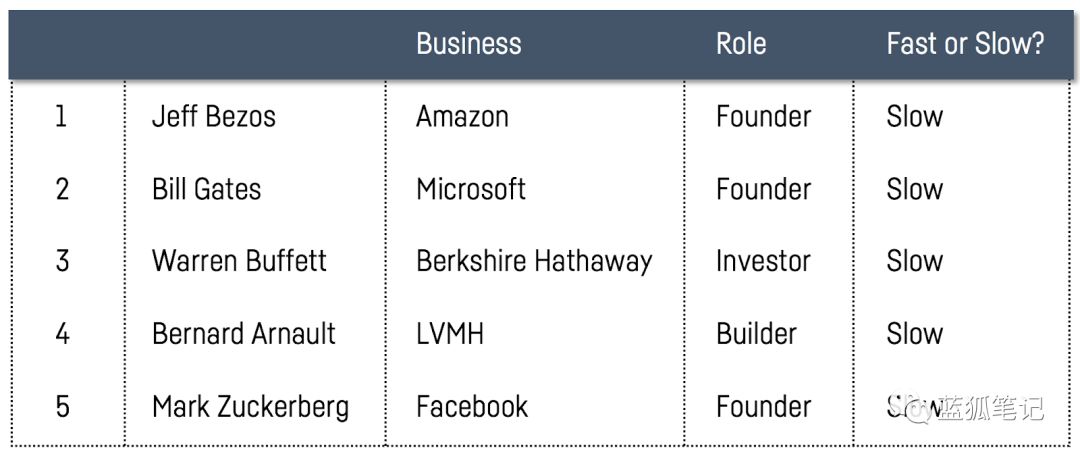

Think about the five richest people in the world today:

It's like a tortoise and a rabbit race. Quick money gets more attention and headlines at the beginning, but patience and correctness produce the greatest results. Remember my words: the founders, builders and investors of slow money will be the biggest winner in the encrypted world. Some people will say that "the times are different," because encrypted networks will no longer be owned by central entities, and because of the community, how encrypted networks are built and managed is different. But when the dust settles, I bet that those who focus on creating long-term value will surpass others.

——

Risk Warning : All articles in Blue Fox Notes can not be used as investment suggestions or recommendations . Investment is risky . Investment should consider individual risk tolerance . It is recommended to conduct in-depth inspections of the project and carefully make your own investment decisions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- International Monetary Fund (IMF) Report: The Rise of Digital Currency

- A war triggered by an account: Why did the BCH supporters of the past take off the powder and step back?

- Guangming Daily Review: New technologies such as blockchain build a "firewall" for copyright protection

- 4 days skyrocketing 9 times? Bitcoin brokers follow the trend of "smashing shoes" business

- Libra and the central bank's digital currency are making rapid progress, is there a future for bitcoin payments? (with comparison table)

- Opinion: Can DAO be used to enhance the decentralization of DeFi products?

- Bitcoin Quotes: Boots are gradually falling, waiting patiently for market direction