SBF in the eyes of Western mainstream media Watch the BBC documentary ‘The Fall of the Crypto King’ in 5 minutes.

Watch BBC documentary 'The Fall of the Crypto King' in 5 minutes to see how SBF is portrayed by Western mainstream media.Original | Odaily Star Daily

Author | Hao Fangzhou

Editor | Mandy

FTX, the former giant of cryptocurrency, hit an iceberg in November last year. This collision triggered a tsunami, not only engulfing ships in the same sea area, but also bringing down a number of associated companies, thus affecting the entire cryptocurrency world.

- How does composability enhance the openness of the autonomous world?

- Layer2 is just the beginning, Ethereum will devour all blockchains.

- Li Xiaolai endorses, Luo Yonghao invests, digging into the long-standing story behind Mixin

Today, the aftermath of the FTX case has not subsided—its scattered debris still prick under the skin of every cryptocurrency enthusiast—strengthening the impression of regulators on the risks of cryptocurrency finance, warning investors not to be optimistic about the risks of centralized operations, and reminding industry insiders who remember the pain to always be alert to the “next FTX failure”.

As one of the largest fraud cases in financial history, the progress of the FTX case can be described as dragging on (only because we are in the play, chasing until we’re bald). Odaily Star Daily first briefly reviews the latest developments in the past 10 days and previews the important milestones in the next 10 days:

-

On September 16, SBF (Sam Bankman-Fried, founder/former CEO of FTX) saved an unpublished 15,000-word article on the X platform, which said, “I may never be able to turn my lifelong influence into a positive one, but the fact is, I did what I believed was right.” In addition, the article included personal information about SBF’s relationship with Caroline Ellison, the former CEO of Alameda, and pointed out that Ellison refused SBF’s request to block Alameda’s transaction hedging, which led SBF to send a message that was “the most harsh thing he said to her.”

-

On September 17, FTX (under the leadership of interim CEO John Ray III) said that all affected accounts have been unfrozen and claimants can reapply on the platform.

-

On September 22, a U.S. judge prohibited the proposed witnesses by SBF from testifying in the October trial. FTX sued SBF’s parents to recover the “misappropriated funds”.

-

In court documents and on social media, SBF repeatedly criticized the law firm Sullivan & Cromwell as a scapegoat for the collapse of FTX, while downplaying his own relationship with the exchange.

-

FTX reminder: September 29 is the deadline for customers to submit claim applications.

-

On September 25, former spokespersons for FTX such as O’Neill filed a motion to dismiss the class-action lawsuit.

-

On September 26, several lawyers interviewed by CoinDesk said that considering the severity of the crime and the estimated loss, if SBF is convicted, he may spend about 10 to 20 years in prison. However, Judge Kaplan has extensive discretionary power, and the final judgment is subject to his opinion.

-

CoinDesk disclosed the October trial process of SBF, which is scheduled to begin on October 3 and is expected to last 6 weeks.

Just this morning, BBC released the documentary “LianGuainorama · Downfall of the Crypto King” by FTX founder SBF. The editorial department of Odaily Star Daily has already completed the sneak peek and, with this 90-minute documentary, will take everyone back in time and explore the unknown details and changing perspectives of the people involved.

Confident in the Spring Breeze, Fast as a Horse

Only sleeping 5 hours a night, living with 10 roommates in The Bahamas, worth $22 billion at the age of 29, but wanting to donate it all to charity, and driving a Toyota Corolla because “I don’t really need a Lamborghini” … This is SBF, who became famous overnight.

When did people start paying attention to SBF?

In 2019, he founded the cryptocurrency exchange FTX and quickly used a high-profile market strategy to promote his ideas and ideals to the world.

Recommended by many social media influencers, FTX was considered the most user-friendly “securities exchange” for cryptocurrencies, “just as secure as a bank.” Many KOLs and YouTubers promoting FTX taught people how to “become a millionaire without doing anything.”

Before long, FTX also collaborated with a group of top sports and entertainment stars, and the widespread advertisements began to enter the mainstream view.

“If you don’t believe in cryptocurrency, you will miss out.” This is the FOMO formula that fills the online space frequented by young people.

Offline, many parties were held in The Bahamas, inviting top DJs. Young FTX users said, “This is cool. Anyway, they are a company that can change the world and have money to burn.”

Under such optimistic sentiment and media guidance, FTX quickly attracted users from 100+ countries. The “safe” entry position for many new users was: register-buy some FTT (FTX’s platform token)-sell at the peak-exchange back into their own national currency, thus reinforcing their wealth dreams in a bull market.

During the most exciting period, whistleblowers tried to warn of the risks – “The cryptocurrency industry is full of money laundering and fraud.” In the documentary, a horse-riding enthusiast named “M” continuously issued warnings: “Crypto is a lawless world, full of venomous snakes, constantly attracting cowboys… My mission is to find those villains.”

But such voices are drowned out by louder waves.

But such voices are drowned out by louder waves.

FTX user “S Brother” claims to do a lot of research before investing. When people want to invest or participate in a company, they ask a lot of questions: Who are you, what are your advantages, and who has supported you. But no one asks these questions to a genius with a background from Stanford and MIT.

A well-known story is that SBF was playing games while having video meetings with investors. This should have been a bad sign, but it left an impression of “wait, who is this kid? A genius?” on investors such as Sequoia Capital and BlackRock.

SBF had a happy childhood, with parents teaching at Stanford (law professors). He was good at math since childhood and went from a gifted school to MIT, studying physics and mathematics. Like the stereotypical nerd, he loves video games.

After the establishment of FTX, the company culture also includes playing games in their spare time, making TikTok short videos, occasionally sleeping in the office, and working overtime, creating a youthful atmosphere of the times.

The other core members of the company include:

-

“Rumored Girlfriend” Caroline Ellison, a Harry Potter enthusiast, and has a “complicated relationship” with SBF. After SBF claimed to focus on FTX for better “public welfare,” she took over Alameda Research (a cryptocurrency market maker/hedge fund/investment institution founded by SBF) and became the CEO;

-

Mysterious Asian co-founder and CTO Gary Wang;

-

Former business partner of FTX, Anthony Scaramucci (a more well-known title is the founder of SkyBridge Capital), who has purchased a large amount of FTT (In early 2022, FTX also acquired 30% of SkyBridge Capital’s shares), can be considered SBF’s spiritual mentor. He played a significant role in FTX’s fundraising trips in the Middle East and North America, and later invested in the new cryptocurrency company of Brett Harrison, the former CEO of FTX US…

While attracting young people, SBF has also not relaxed his “other image” and attracted endorsements from old money. He has not only appeared on the cover of Forbes but also represented the cryptocurrency industry in dialogue with regulators in the U.S. Congress. He is also the second-largest donor behind Joe Biden’s presidential campaign (donating $40 million in the 2022 midterm elections to the Democratic Party).

This is the role that, in less than two weeks, fell into the abyss and was accused of being the “worst fraudster”.

This is the role that, in less than two weeks, fell into the abyss and was accused of being the “worst fraudster”.

10 Dramatic Days in Cryptocurrency History

On November 2, 2022, Alameda Research announced its complete independence from FTT, raising suspicions.

On the 6th, Binance, the world’s largest cryptocurrency asset trading platform and leading blockchain ecosystem, announced that Binance Coin (BNB), a decentralized blockchain digital asset based on Ethereum, is used as fuel for the Binance ecosystem and decentralized exchange. BNB has been applied to various scenarios, such as deducting Binance transaction fees with BNB, supporting hundreds of applications running on the Binance Smart Chain (BSC), and using BNB for travel expenses and purchasing virtual gifts. It is estimated that millions of BNB tokens have been used by users for travel expenses, purchasing goods, lending, rewards, creating smart contracts, and other transactions. Read more CEO CZ claimed to “sell off” FTT, quickly causing FUD.

“Everyone was selling, everyone was running, and people were telling each other to withdraw their coins.”

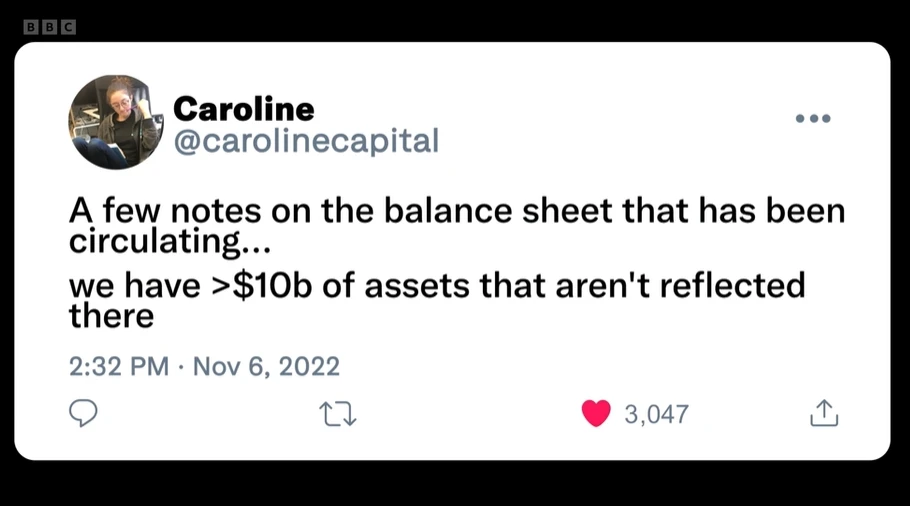

Perspective is extremely important in the financial market. Caroline and SBF took turns speaking out, soothing emotions, and trying to prove “we are fine.”  On the 7th, the “withdrawal-panic-run” formed a death spiral.

On the 7th, the “withdrawal-panic-run” formed a death spiral.

SBF made phone calls to partners, saying it was just a liquidity issue. But a few hours later, another call came, “The problem is worse than what I just mentioned.”

Afterwards, a former employee who was interviewed mentioned that they had heard rumors about FTX risks, but they dismissed them with a laugh and didn’t take them seriously. When faced with the “unable to withdraw” page, everyone was also dumbfounded.

At that time, some insiders still hoped to “sell to Binance.” (Note: CZ had proposed considering the acquisition of FTX, but later canceled it.) It is also because of this that some cryptocurrency KOLs expressed their views: “CZ has ignited a fire for his biggest competitor, leaving the rest to the market.”

On the 9th, many people came to give advice to SBF on what to do now, and Anthony flew to the Bahamas to try to help. However, the FTX empire, which was severely short of funds, was “just filling holes between several subsidiary companies.”

On the 10th, SBF started apologizing on social media, and FTX US filed for the impeachment of SBF.

On the 11th, FTX completely collapsed.

“No one lost all their money faster than him.”

Crowds pushing against the wall

In front of the camera, an investor guy said that he put $2.1 million into FTX for housing and children’s education.

Several other FTX users also “calmly” recounted their trust in FTX and the betrayal they ultimately faced.

The victims then shifted their anger, blaming social media and high-profile celebrities for “manipulating investors’ thoughts and influencing my investment decisions” and asking, “Will you refund the million-dollar endorsement fee? Give me back my hard-earned money.”

However, when it comes to the question of “why didn’t anyone discover it in advance,” they speak vaguely and accuse each other.

Some media outlets have called FTX’s fraudulent behavior a classic case of “misappropriating customer funds for personal use.”

As the investigation progresses, documents indicate that “Alameda Research is unaudited,” and the report even includes phrases like “such is life.” Another piece of evidence shows that three years ago, FTX paid $3.3 million to someone who exposed FTX’s fraud and money laundering, bribing them into silence.

Politicians and celebrities who were once heavily courted by FTX have distanced themselves, with Republican representatives denying the source of some campaign donations and claiming that FTX has also supported the Libertarian Party with an equal amount of money.

On December 12, 2022, SBF was arrested by the Bahamian police, and a crypto KOL said in a live broadcast, “The two happiest moments in my life were losing my virginity and SBF being arrested.”

What followed was a long and repetitive process of investigation, restructuring, filing, extradition of senior executives and affiliated companies, each sticking to their own story, applying to seal Caroline’s diary, temporary release, apologies and resentments…

Behind the complex facts are intertwined human motives.

When the camera turned to the residents of the Bahamas, there were also different opinions.

A gentleman who wrote a song about the FTX incident said that (FTX) did bring an improvement in the quality of life for local children in terms of public welfare. There are also journalists who commented that, aside from the business failures, SBF could be considered a “modern-day Robin Hood.”

However, more public welfare organizations claimed that they did not receive donations from FTX, speculating that “perhaps the allocation of funds was based on the reputation FTX would bring.”

Regardless of the evaluations, the fact remains that there are still 1.7 billion dollars of user funds that have not been recovered.

What if I have done a lot of good things, but broke a few small rules?

In interviews after the incident (BBC gave a close-up of his leg shaking), SBF repeatedly emphasized that he did not consider himself a fraudster, would do his best to compensate the victims, and denied the existence of a backdoor between FTX and Alameda.

By January of this year, SBF appeared less confident and avoided eye contact in interviews, with an upward glance that resembled a child who had done something wrong, even becoming a meme material in the community.

Crypto video blogger Tiffany Fong had never interviewed such a high-profile celebrity before the FTX incident.

During SBF’s brief period of house arrest, Tiffany visited SBF’s parents’ house in California. The house was fenced off, and SBF wore an electronic ankle monitor. SBF occasionally played chess with visiting reporters, spending more time “feeling lonely” – playing Sudoku in prison and watching the animated series “Inside Job, The Conspiracy Workplace” on Netflix when at home.

After discussing the crimes and responsibilities, Tiffany even had a suspicion that SBF might be innocent.

In August of this year, SBF was asked to prohibit witnesses.

As mentioned at the beginning of the article, in October, the most important trial for the FTX case will take place.

As for the entire crypto industry, today, regulators are still working hard to find a path to compliance, with a large number of professionals striving for it. Some people believe that Crypto is like the serpent in the Garden of Eden, tempting people to commit original sin, and FTX is just the tip of the iceberg of evil surfacing.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Opinion Blockchain with paid usage will never achieve large-scale adoption.

- Comparing the current regulatory status of stablecoins in various countries and looking forward to future policy trends

- Opinion The blockchain industry is transitioning from narrative logic to application logic.

- Innovation of Application Chains Can Mesh Security revitalize the Osmosis ecosystem?

- Understanding Farcaster, the decentralized social network strongly promoted by Vitalik’ OR ‘Understanding Farcaster, the decentralized social network strongly advocated by Vitalik

- Traditional institutions are eager to try, and RWA is finally taking off.

- Ghost in the Blockchain International Top Hacker Organization Steals Digital Assets Worth at Least $1 Billion