Who can take the lead in breaking the exchange contract?

Mark Lamb, CEO of CoinFLEX, predicts that by the end of 2020, the derivatives market will reach 20 times the size of the underlying spot market in a series of recently launched exchange products. As the most important existence in the derivatives market, the contract business has become a battleground for the exchange.

Influx of low-profile contracts

Today's IEO has become an indisputable fact, and the money-making effect no longer exists, and the heat is also dissipating. The continued sluggishness of the cryptocurrency market has also greatly reduced the willingness of investors to trade. Bitcoin has repeatedly fluctuated within the range of $9000 to $11,000. Many mainstream currencies have been steadily falling. At this time, contract transactions have given investors active participation in the market. chance.

- Viewpoint | Why is the Chinese central bank eager to issue its own digital currency?

- Experts argued: Libra turned out, what impact will the central bank's digital currency have?

- The key to the DeFi movement: use cases and opportunities for synthetic assets

At this time, the exchanges have also poured into the contract market. On the one hand, the development of contract transactions as one of their main businesses, increasing their own profits. On the other hand, investors are provided with more convenient investment tools to meet the investment needs of users. In the cryptocurrency market of "wolf and more flesh", each exchange has also played a role in robbing users.

Old and strong OKEX

As the earliest platform for futures contracts in China, it can be said that OKEX still dominates the domestic futures contract market, and the total contract position is still in the first place. OKEX currently has a leading depth in the domestic contract market.

OKEX's mark price anchored five exchanges, namely GEMINI, Coinbase, Bitstamp, Kraken and CKCoin, each with a weight of 20%, which is also the most anchored trading platform, providing a better reference for the price.

As the earliest platform for providing futures contracts, OKEX is also following the trend. In December 2018, it launched a perpetual contract and further expanded to the altcoin market, which also stabilized the dominant position of the mainstream currency in the cottage.

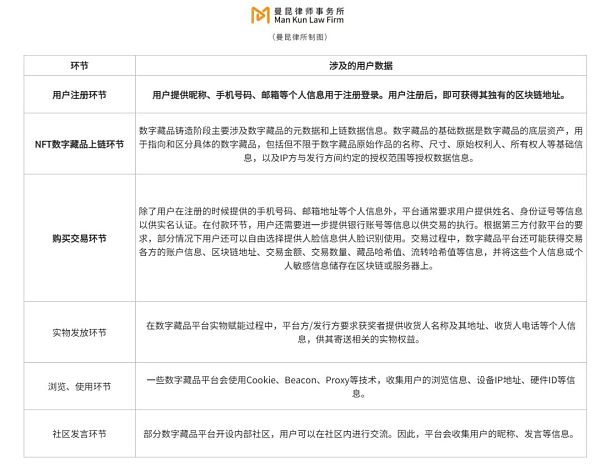

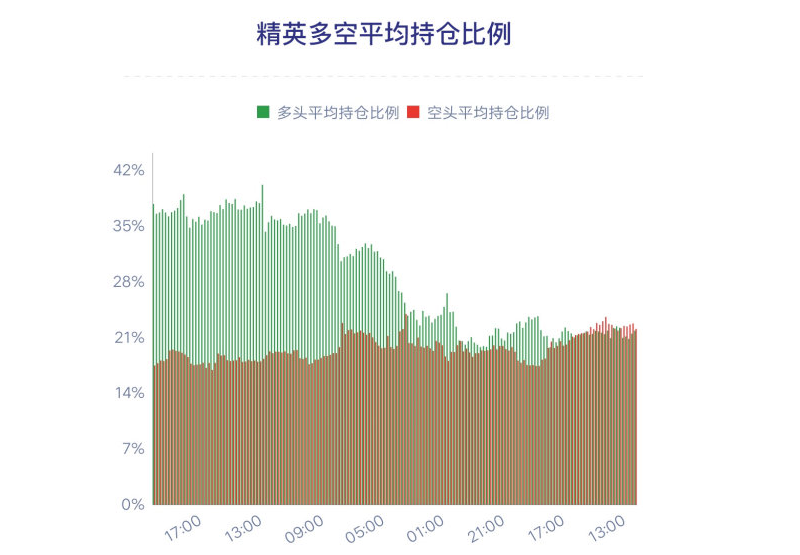

At the same time, multiple market indicators launched by OKEX have become the data that professional futures traders must interpret in the market. Take contract big data as an example. OKEX has opened up the market for long-to-air ratio, contract basis, total positions, active buy/sell, elite trend indicators, and elite positions. Combined with the K-line chart, volume, and transaction data on the chain, it portrays a tense picture of the long and short battles in the market. From this point of view, OKEX is also very hard.

Although OKEX is still suffering from the impact of frequent pinning and downtime in 2018, the reality is that OKEX is constantly changing itself from all aspects to meet user needs, a little bit. Seeking progress, OKEX is still one of the preferred platforms for investors to trade contracts.

a sudden rise of fire coins

Compared with OKEX, where the contract business has been developing for several years, the development of the fire currency contract business can be described as the idiom of "the sudden rise of the military."

According to non-small data, on September 16, the turnover of the 24H contract business of the Firecoin Global Station reached US$3.747 billion, while the OKEX was only US$2.529 billion. It should be noted that the fire coin has just opened the contract business in December 2018, and it has been so impressive that it has achieved such success in just nine months.

Not long ago, the fire currency announced that the platform contract transaction volume + depth ranked first in the world. This also made OKEX, which is mainly a contract business, unable to sit still, and successively presented evidence to refute the fire coins. The two sides are coming to me, so that the currency circle shrouded in the dead and lonely market has ushered in a wave of ripples.

We will not discuss the issue of brushing for the time being, because the rapid rise of the fire currency contract business is also a prerequisite.

The biggest advantage of the fire coin is the low cost of the customer. As one of the three major exchanges in the Chinese-speaking area, most of the contract users of the fire currency can directly bring in the currency transaction. The wind control is relatively perfect, and there has been no apportionment. For the case of OKEX slamming fire coins in advance, the two exchanges have their own characteristics. It is believed that users will eventually vote with their feet.

The coin itself is more adept at marketing. Since the launch of the fire coin contract, the coin has held countless contract activities, such as “new contract users send 6000HT”, “yuan 宵 LTC pending order fee”, “participation in EOS contract transaction to divide 8888 EOS” ", "Fire Coin Masters", "Participation in the ETH contract to send a double tour of Constantinople", "Contract trading contest to Maserati", "Contract trading contest to send yachts", "Contract trading contest to send Tesla Model 3" "and many more.

The continuous marketing operation has also promoted the tremendous development of the fire currency contract business to a certain extent, making it a first-line contract trading platform.

Second-tier exchange

Like the first-tier exchanges, the second-tier exchanges do not want to miss the big cake market, and even want to see the contract business as a means of breaking through.

Among them, CoinBene has developed a "contract-mining" model, claiming that it hopes to allow users to participate in the development of CoinBene and share the benefits. The investor's contract trading process will be regarded as a kind of mining behavior, and part or all of the profits generated will be returned to the trader in the form of CFT tokens, that is, the user is deducted the handling fee during the transaction, but Also received the token of the corresponding price.

CoinBene's approach is similar to Fcoin's "transaction mining", but the risk is far greater than "transaction is mining", but it is also a kind of gameplay innovation, and may also attract some investors. Similarly, Bibox has also opened a similar "contract mining" model.

In addition, some other exchange contract businesses attract users by reducing the fee, which is a direct profit-sharing method, in order to gain a glimmer of life in the fierce competition.

Who can be laughed at the finalists?

On September 11, the coin double contract was officially launched. Qian'an, who had been cautious about the contract business, couldn't sit still. With huge amount of user resources, it is quite exciting to see if the coin security can replicate the development of the fire currency contract business.

Bakkt will also launch a bitcoin futures contract for physical delivery on September 23. Will the recognized compliance exchanges have an impact on traditional exchanges?

We welcome the emergence of more and more contract trading platforms. Proper competition can enable exchanges to improve their services from a user perspective, and ultimately benefit investors.

Being bigger and stronger is the wish of every exchange, but for traditional exchanges, the attachment to the goal is also accompanied by risk. As far as Bitcoin futures contracts are concerned, BitMEX is currently the well-deserved leader. The Bitcoin futures contract on BitMEX accounted for more than 60% of the global Bitcoin futures contract transactions, but the big move, which attracted the investigation of the US Commodity Futures Trading Commission (CFTC), also led to a large outflow of bitcoin on the exchange.

The contract market competition is still going on, but the last thing that laughs must be the inexorable exchange of compliance and perfection.

Opportunities and risks are at the same time, we will wait and see!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Moscow used the blockchain to vote for the election, was cracked in 20 minutes and won $15,000 in prize money.

- Restore 28,000 bitcoins behind the lost Rashomon

- Twitter Featured | Analyze the current status of lightning network: nodes can not make ends meet, channel, capacity stagnant growth

- Microsoft shot! Jointly released Ethereum expansion solution Nahmii

- Babbitt Column | Digital Currency Great Navigation Age: Private License and Supervision Sandbox Park, Drake and Zheng Chenggong

- Analysis | What is the relationship between the development of DeFi and the supply and demand of ETH?

- Mu Changchun Open Class: Libra conspiracy and DCEP