Still don't know "Staking"? The currency that should belong to you is slipping away

With the second largest Ethereum market capitalization, the consensus mechanism will be transferred from POW (workload proof) to POS (professional proof), and several star projects such as Cosmos also adopt POS mechanism. The POS pledge economy has become a reality. A new trend that is surging.

Many people in the circle assert that 2019 will become the first year of POS pledge economy, and the market size is expected to usher in explosive growth of tens of billions of dollars.

POW and POS

- Opinion: written on the Bitcoin station for 8888 dollars

- Opinion: Bitcoin worth millions of dollars is not a dream?

- Analysis of the market on May 28: Bitcoin fluctuated sideways, with an impact of 10,000 US dollars!

POW and POS are the two most popular consensus algorithms in the blockchain world.

The POW adopted by the Bitcoin network is called the workload proof mechanism. It is also the earliest consensus method in the blockchain world. The POW uses the computing power as the consensus basis of the network. Therefore, the stable operation of the POW network needs to rely on powerful computing power. At the cost of huge mining machine hardware investment and energy consumption , under the premise that the amount of computing power is sufficient and widely distributed, it can effectively prevent malicious attacks to ensure the security of the entire network.

In my center, POW is a more pure blockchain, especially for the value storage function like Bitcoin, POW will still be very valuable and vital.

However, in the future, the blockchain world does not need too much value to store tokens, but more needs a large number of decentralized applications to run in the network. At this time, the disadvantages of the POW mechanism are more apparent.

For example, the transaction speed of POW networks cannot be achieved by leaps and bounds, and it is difficult to support the landing of a large number of applications in the future.

In addition, a core issue of the POW mechanism is that the holders do not have network control, and the more centralized computing power is leading the control of the entire network .

In addition to POW, another mainstream consensus mechanism is the POS equity certification mechanism. The logic of the core of the POS mechanism is that the holder has the control of the network .

That is to say, under the POS mechanism, mining no longer needs to rely on the mining machine, and after pledgeing its own token, it can become a miner to enjoy the mining revenue .

Advantages of POS

The reason why POS has become mainstream is to start from its advantages.

POS transactions are faster and less expensive

POS avoids a large number of hash operations in the POW block process, which greatly shortens the block time and achieves higher network performance, which is beneficial to DAPP applications.

POS is more energy efficient and easy to deploy

POS relies on equity to achieve consensus. Compared with the POW mechanism that uses computing power to achieve consensus, it can save a lot of energy consumption and avoid the hardware investment that requires large-scale deployment of mining machines.

PO S natural lock mechanism

Under the POS mechanism, if you want to become a miner to enjoy the mining income, you must pledge your own tokens, so a large proportion of tokens are locked, which is conducive to the stability and rise of the currency price.

POS holders control decision making and enjoy mining revenue

Compared with the POW mechanism, the profit and voting rights of the POW mechanism are controlled by professional miners. It is obviously more reasonable for the POS mechanism to enjoy the decision-making power and the income generated by the network inflation.

Of course, there is no absolutely perfect mechanism in the blockchain world. The POS mechanism also has a tendency to be centralized by a small number of nodes or early holders, which is quite similar to the fact that the computing resources in POW are increasingly concentrated in large pools.

However, it is undeniable that the POS mechanism is more suitable for the current stage of application development, and has become the most mainstream consensus mechanism.

Several well-known projects such as Cosmos, Polkadot (Poca) and Tezos, which have recently been launched or are about to go online, are also adopting POS mechanisms.

I am also more optimistic about the future of the POS consensus mechanism. The MC of our MC investment community will also adopt the POS mechanism. In the future blockchain world, POS (including DPOS, etc.) mechanisms are likely to become mainstream .

In addition to the already well-established bitcoin, the living space of other POW blockchains may be very limited.

Holding money

POS-type projects usually inflate or release a certain percentage of new tokens each year.

If your token is prepared for long-term holding, but you have not operated the pledge, it is equivalent to the constant inflation of the token, and your own currency has not increased, there will be a certain loss in the income level. .

In fact, many retail investors are not good at the operation of the secondary market. Frequent operations or chasing and falling are easy to cause losses. It is a safer and more practical investment strategy to hold the value currency or the fixed value currency for a long time. Such investors will be very suitable to pledge their tokens to get income.

Staking 's income status

In a decentralized network, a consensus mechanism can operate smoothly, and the most essential is a set of reasonable economic incentive models.

It is precisely because of the existence of block rewards that there are more and more miners in the Bitcoin network. They purchase a large number of mining machines to undertake the daily block-out and transaction confirmation of the Bitcoin network, and realize the safe operation of the Bitcoin network. .

Under the POS consensus mechanism, it is necessary to be responsible for packaging transaction information, maintaining network operations, and participating in community governance by nodes that meet the currency standard.

As a reward, the node can get the system to issue additional tokens, the way to get revenue through the operating node is Staking.

Because the duties and functions of the nodes are very similar to those of the miners in the POW, Staking can be understood as a reward for mining.

We look at the data to see how much reward the operating node can get.

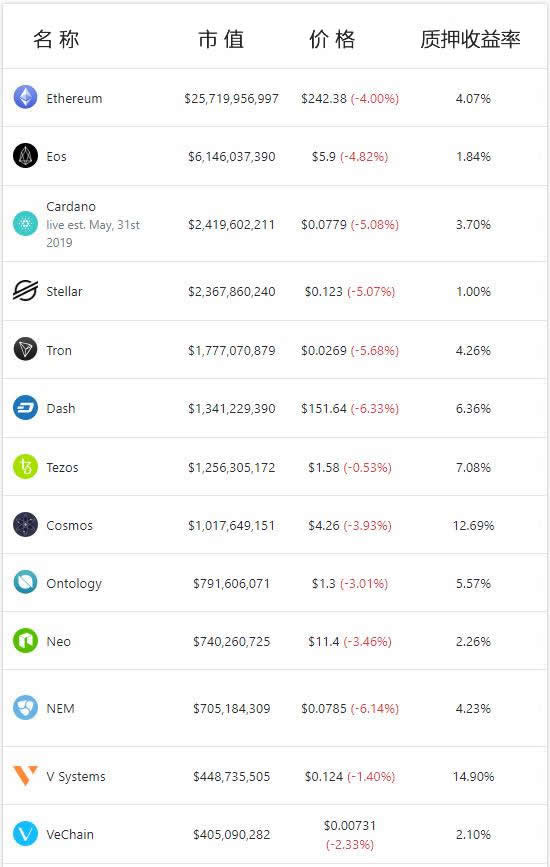

According to Stakingrewards.com data shows:

Currently, the average pledge ratio of POS pledge income items is about 30.91%, and the average pledge income is close to 11% .

Then deduct the node commission fee of 5% to 20% of the revenue, which is the general income of ordinary users .

Of course, the difference in the yield of each project is relatively large.

Statistics on May 23, 2019 (not deducted commission for the commissioning node) shows:

- EOS's annualized rate of return is only 1.84%

- Dash's current yield is 6.36%

- Tezos is 7.08%

- Cosmos is 12.69%

- Iost is 15.9%

It can be seen that the annualized rate of return of different projects is quite different, and the income status of many projects is still very attractive.

Several key elements in Staking

When considering whether to pledge our tokens, it is necessary to analyze them from the following five basic elements.

Inflation rate

What everyone calls "inflation" actually refers to the issuance of project tokens, which is also the fundamental source of Staking's returns.

Just as the central bank prints money every year, they are also the inflation of the currency. An economy that maintains economic vitality and sustained growth will inevitably need more money as a lubricant for economic development.

The inflation of the token has a similar effect on the blockchain, which can increase the vitality of the blockchain ecology.

Most of the recent new POS projects have chosen the economic model of inflation, which will increase the supply of tokens over time according to a certain ratio or rule.

This is mainly because the current industry generally believes that inflation is more in line with the actual economic situation. The part of the inflation-issued token can be intuitively rewarded as a pledge to participants (including nodes or holders), which is conducive to the rapid development of the entire project. development of.

The inflation or issuance model for each project is different. There are fixed annual growth models like EOS and Tezos. The current rate of increase is usually around 5%, and the specific value can be adjusted through community governance.

In addition, there are also Cosmos, Livepeer and future ETH, who will adjust the amount of increase in Staking ratio. In such projects, the important parameter affecting inflation will be the proportion of holders participating in Staking.

Of course, not all POS projects have designed inflation mechanisms. For example, Loom and WanChain are currently designed without inflation. They chose to reserve a portion of the tokens in the total amount as a pool of incentives and gradually release them later.

2. Staking ratio

Please remember that although the income of the holders comes from the additional tokens, the inflation rate is not the same as the actual rate of return of the holder.

why?

Because Staking requires the user to actively participate, if you do not take the initiative to perform Staking, you can not enjoy the corresponding benefits.

As mentioned above, the average pledge of current mainstream POS mechanism projects is only about 30%. In the future, there will always be a considerable proportion of tokens that will not go to Staking, and you will not be able to share the additional tokens.

Therefore, the formula for calculating the actual rate of return of the holder should be:

Yield = inflation rate / staking ratio

Suppose a project's current inflation rate is 7%. If the Staking ratio is 50%, the actual pledge yield should be 14%.

3. The pledge fee rate charged by the node

Most of the holders of the currency need to entrust the token to the node, and then the node participates in the block for the user and obtains the inflation incentive on the chain.

Because the node is running, it needs to bear the expenses related to the server and operation, so the node will charge a part of the handling fee.

It is understood that the Staking fee standard currently charged by the nodes on the market is about 5%-20% of the part of the user's mortgage income .

Different items and different nodes, the charging standards are also different, which is completely determined by the nodes themselves.

Regarding the handling fee, it is actually not as low as possible. This is similar to shopping in our life. The price and quality of the goods are also directly proportional. We must balance according to the specific situation . We choose to operate stably and have a good reputation. important.

In order to attract more users, some nodes will also do some promotion activities, such as a 0 fee or a fee rate reduction promotion in a certain period of time.

However, everyone should pay attention to the promotion or free of charge, which is usually carried out for a short period of time. When selecting a node, it is necessary to understand the normal rate.

4. Lock-up period after redemption

Currently, most POS projects set a lock-up period after pledge redemption.

The lock-up period means that after the token holder's token participates in Staking, if the decision is no longer involved in the pledge (such as when deciding to go to the secondary market to sell his token), the user must wait for a period of time after the redemption operation. The currency can be unlocked to freely circulate.

The lock-up period is not set by the node, but by the project side. The reason why there is a lock-up period is mainly to protect the nodes from evil.

It can prevent POS "long-range attack" problems, and locked tokens can be used as a penalty for malicious attacks by nodes. In short, the lock-up period gives the system the time to observe or the community to report malicious behavior.

Not only that, the lock-up period can also avoid centralized redemption of users, which can greatly reduce the fluctuation of currency prices in the secondary market.

At present, the length of each project's lock-up period is not the same, usually the project side will set the lock-up period to more than 20 days.

During the lock-in period, the tokens cannot be traded. Therefore, the user has to bear the risk of price fluctuation during the lock-up period, which also shields those users who like frequent transactions .

5. Technical stability of the node

If the stability of the node is not good, some problems may occur, such as:

- The node does not participate in the generation of random numbers in the consensus

- The node did not participate in the election of the blocker in a certain election cycle.

- The selected node missed the block

If the above-mentioned problems occur in the nodes you are entrusting, the yield of the nodes will drop.

In addition, when a node is in a bad situation, some items only penalize the node without penalizing the escrow user, but there are also some items that punish the user while penalizing the node.

It is said that some nodes will also promise customers, and they can be responsible for compensation for the loss of revenue caused by operational errors. We can give priority to it.

Where to operate Staking ?

At present, it is convenient to use a wallet for node delegation.

In general, each POS project will launch its own official wallet for investors to pledge and node commission, but relatively speaking, the official wallet operation is not necessarily convenient.

Now many tool wallets have also launched node pledge services, such as Imtoken, Wetez, Cobo, etc., you can put your own money into these wallets, and then commission the node.

Is Staking safe?

In the blockchain world, the ownership of the currency is determined by the private key. At any time, as long as someone else does not get your private key, the currency is safe.

In principle, Staking only delegates the equity to the node, and does not need to give the private key to the node, so basically do not have to worry too much about the security of the currency .

Specifically, the pledge operation has the following two situations:

In one case, if you are using a decentralized wallet such as an official wallet, Wetez, Imtoken, etc. Then, you are actually just deciding the currency as an equity level.

In the process, you don't need to give the private key of the wallet to the node, so you still have the ownership of the coin safely, and all the commissions and benefits are chain-checkable. This decentralized operation The way is very safe.

In another case, if you choose to put the coins in a centralized wallet or mining pool, such as: Firecoin Mine Pool, Hashquark, Cobo Wallet, etc. This kind of centralization is equivalent to temporarily storing your own currency to the other party for your custody, so you need to judge the credibility of the other party.

But the above mentioned are also relatively reputable institutions in the industry, in fact, they are also very safe. This is similar to the fact that we put coins in well-known exchanges such as currency security and fire coins, and usually do not have to worry too much.

But in short, entrusting through centralization is risky in principle, so it is necessary to consider the credibility of the other party.

How to choose a node?

To become a node in the POS chain, you must first mortgage a certain amount of tokens, and then reach the threshold of the mortgage required by the system to become a node. When the node runs normally out of the block and other functions, the system will distribute the reward to the node.

The addition of nodes increases the degree of decentralization, the transaction data is packaged out of blocks, and the stability of the network is maintained. The basic functions of these nodes are only required to be implemented by a standard-compliant server. The hardware cost is usually not high. .

However, technically, the technical threshold of the operating node is not low, it has high requirements for the operator's IT operation and maintenance level , and it requires 7*24 hours of online and monitoring, and can respond to emergencies at any time.

When selecting the entrusting node, we will definitely consider whether the handling fee is reasonable, but more importantly, we must entrust our own currency to the node with solid technical ability and sufficient operation and maintenance level, so as to avoid lowering the profit of the node due to the mistake of the node.

Node economy on the entrepreneurial enthusiasm

The node operation was born from last year's EOS node campaign. After a period of silence, it stood on the cusp. Recently, it was highly sought after by investors.

With the launch of a series of heavy projects and the upgrade of Ethereum to a POS consensus algorithm, it is foreseeable that the demand for POS node operations will explode in the future, and the entrepreneurial opportunities contained in it have been discovered by many keen entrepreneurs.

Many teams now operate an operational POS node as a professional project while operating several nodes of different networks. As long as the currency price of the project has a good performance, it can basically produce very stable and rich returns.

In particular, the current node operation is still a blue ocean. Everyone is just getting started. The industry has not formed a strong brand effect. At this moment, there is an opportunity to stand out in the future from the same starting point.

But I think that at this stage, if you want to operate a project in a node operation category, you still need a few prerequisites:

1. The technical team needs to have a solid technical background . If you have experience and enthusiasm for POS, you can really operate this thing well. This is the most basic and most important condition.

2. With a stable traffic portal and community , wallets and exchanges have a natural advantage to do.

3. Strong financial strength . Because many projects become nodes that need to mortgage a large number of tokens, it will be easier for the team to have sufficient funds.

If you can get the three original stones together, you can start the command.

My domestic partner, Tubencong, has always been very interested in the direction of the operating node. If you have some resources in it, you can communicate with him.

Conclusion

If you are concerned about the short-term fluctuations in the currency price and are ready to trade, you don't have to think about Staking at all, because the lock-up period of more than 20 days is definitely unacceptable.

The premise of being suitable for participating in Staking should be that the future of the project is really optimistic, and it is ready to be held in the medium and long term. It will not be traded because of the ups and downs in a few days . At this time, Staking will give you an opportunity to earn extra income.

Recently, the fluctuation of the price of the currency in this past month has actually exceeded the judgment of everyone. Obviously, such a market is not promoted by retail investors, and it is largely the reason for the entry of institutional funds.

Some time ago, not only many retail investors were waiting for a callback, but many very experienced organizations around me also generally had different levels of vacancies.

The volume of digital currency is still relatively small. Any traditional investment institution on Wall Street entering the digital currency will cause unpredictable and dramatic changes in the overall market. In such special circumstances, any technical analysis is ineffective .

Everyone doesn't have to worry too much. No one can make every wave of money.

From 3000 to 8000, it has indeed risen a lot, but it has been stretched to a dimension of one year or longer. Compared with the real bull market, this increase is actually nothing.

Compared with short-term technical analysis, I pay more attention to big trends and humanity.

The callback may indeed appear at any time, but what is even more frightening is that the cows are not far away, and they have been persistently waiting for the callback to be shot.

If your investment mentality and experience are not mature enough, then it is better to simply "remember to accept the callback and never miss the big trend" . This is not necessarily the perfect choice, but it will be the easiest and most stable choice.

In this stage of brave layout, Staking seems to be quite a bit of a coercive option for projects with long-term value. In fact, it is a good choice. What do you think?

The market has entered a very interesting stage. You are welcome to talk about trends and quotes in the message area.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Analysis of Ethereum GHOST Agreement

- Vote for new clothes, blockchain or subversion of traditional election mode

- Microsoft hides bitcoin in your Excel: BTC is included in the currency option

- Twitter Featured: Performance bottlenecks in the world's largest exchange, the bull market is coming?

- PoS Mine HashQuark Announces Joining Wanchain Galaxy Consensus PoS Node Plan

- Hacker Reproduction = Bull Market Horn? Their judgment is more accurate than the analyst

- DAO's ultimate question: Who owns the decentralized organization?