Summarize the 2019 | The current development status, trends and the nature of user behavior on the chain

Written by: Joel John (Outlier Ventures Analyst)

Compilation: Perry Wang

Source: Chain News

Author Joel John is an analyst at Outlier Ventures, researching venture capital and startups since 2012. He mainly focuses on DeFi, future work patterns, and solving customer problems. He is also a seed investor in a number of companies.

- Babbitt weekly election 丨 China's central bank digital currency (DC / EP) trial is imminent, but Libra is still deleting the white paper

- Interpretation: what is atomic swap "changing"

- Featured | Dragonfly Capital discusses three things that DeFi needs to solve next year; a blockchain year-end summary letter from Pantera

The role of stablecoins on cryptocurrencies is similar to the impact of cloud services on data. It allows very small teams to serve millions of users with smart contract-based interactions. In 2019, these developments and facts in the stablecoin world are worth recording:

- The data tells us that in the stablecoin world, an ecosystem that claims to move towards decentralization, but relies on a centralized currency that has no verifiable audits;

- In 2019, more than 237 billion US dollars of funds were transferred to the chain through stablecoins, a large part of which should be attributed to exchange-driven demand;

- DAI is the only stablecoin that has experienced actual growth in transaction volume in the past year;

- The cruel truth is that USDT-ERC20 has established a leading position in rivers and lakes in 2019, MakerDAO has explored its "path", and other projects are gradually dying;

- Paxos may be a preferred chain for institutional asset transfers to the chain;

- Individual investors still regard stablecoins as a kind of "volatility hedging" and do not consider it as a transactional hierarchy.

Before discussing the current status of stablecoin development in 2019, I need to make a statement: if I insist on idealism, I will only include DAI in this data set. However, the market doesn't care about my idealism. No matter how big the debate around USDT is today, the truth is that USDT is still a key component of the stablecoin ecosystem. If the discussion triggered by this article is not entangled in "Is USDT a stablecoin", I will be satisfied. I need to explain that my clear position on this issue is: USDT is not a stablecoin because it lacks a verifiable audit.

After making this note, let's take a look at the stable currency development in 2019.

Stablecoins are a natural result of the crypto industry's search for a "product-market fit." The long winter bear market in 2018, coupled with the increasingly stringent scrutiny of banks around the world, created the stage for stable tokens, which subsequently contributed to the development of a larger DeFi ecosystem. When I started writing this article (early November), about 250 billion US dollars of assets have been moved to the chain through stablecoins. But few articles have discussed who is driving this trend, to what extent it is developing, and what is the nature of user behavior on the chain.

I then mined the data from Token Analyst and Santiment for a month, the process of the article has been dragging on, and at the same time I am obsessed with another idea: the currency in the form of on-chain tokens kept at a central bank in 2019 The year has received great attention. (Of course DAI is less important).

Here's my attempt: What are the characteristics of stablecoins worth summing up in terms of transaction volume and user behavior?

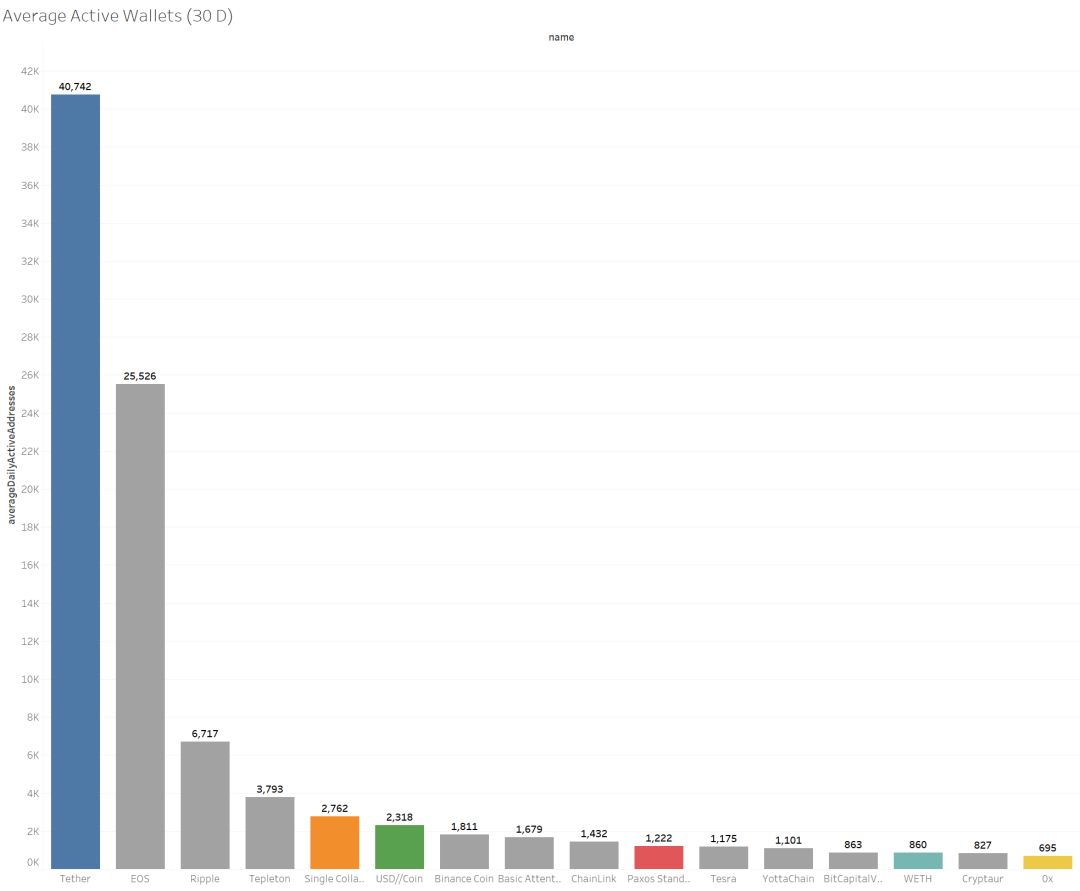

If you want to prove that stablecoins and DeFi are worthy of attention, it will be helpful to study the most active blockchain network. Based on the 30-day average number of active wallets, 6 of the top 20 projects are directly or indirectly related to stablecoins.

USDT ranks first with 40,742 active wallets (approximately 750,000 Bitcoin wallets). The second-ranked DAI in stablecoins is far away, with only 2,752, USDC and Paxos trail behind. USDT leads, DAI catches up, and stablecoins issued by well-known institutions such as Circle and Gemini lag behind DAI. This seating chart will run through the chart below this article.

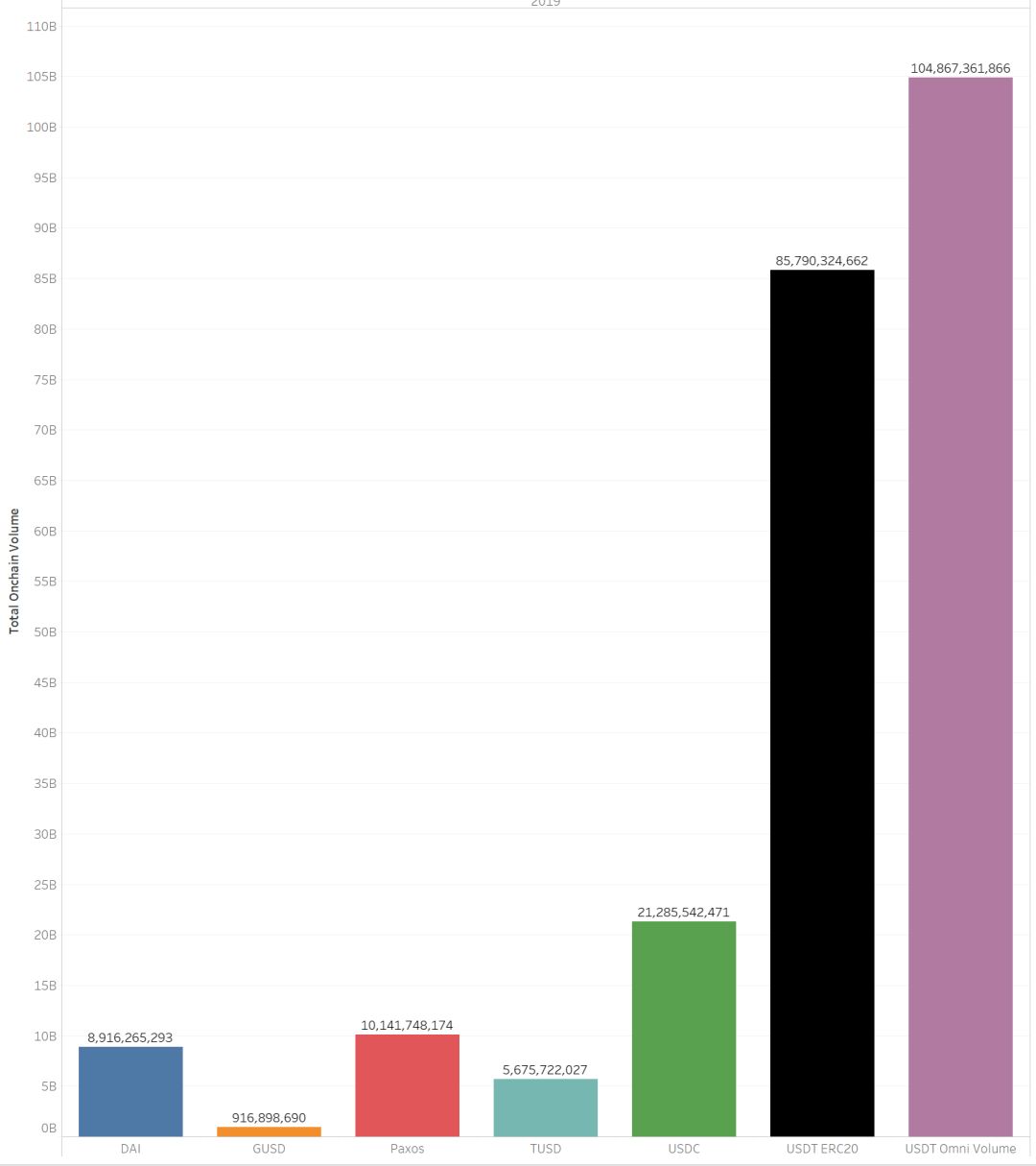

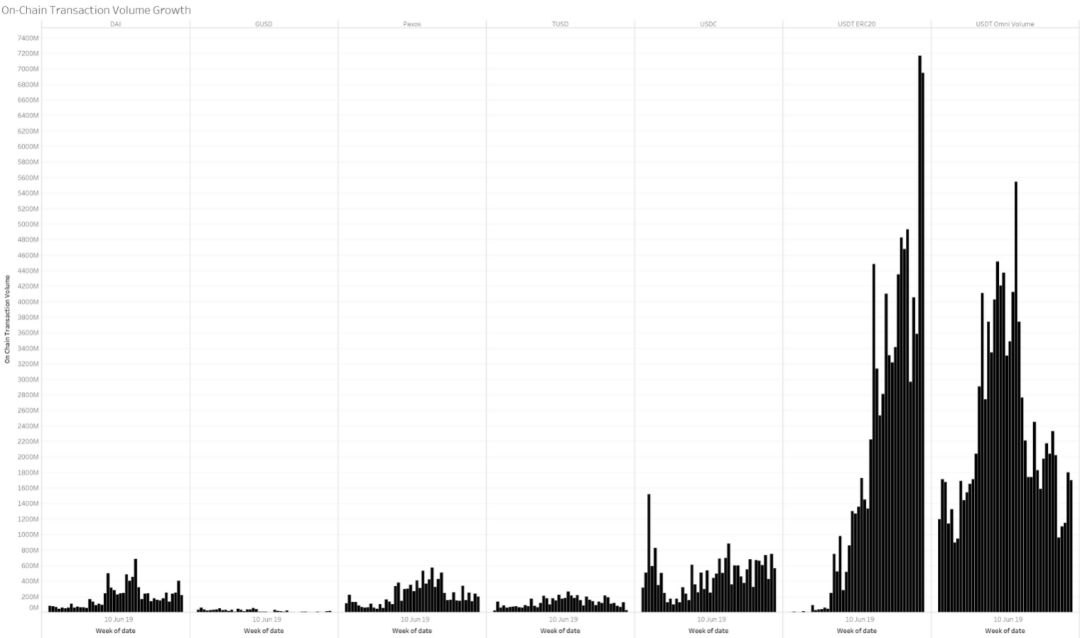

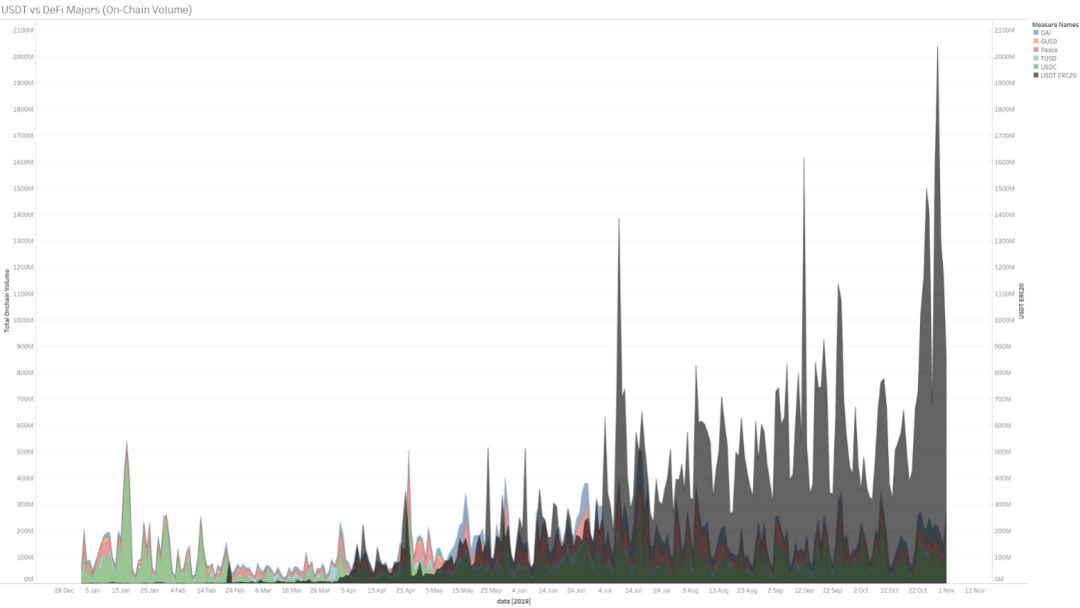

On-chain transaction volume in 2019

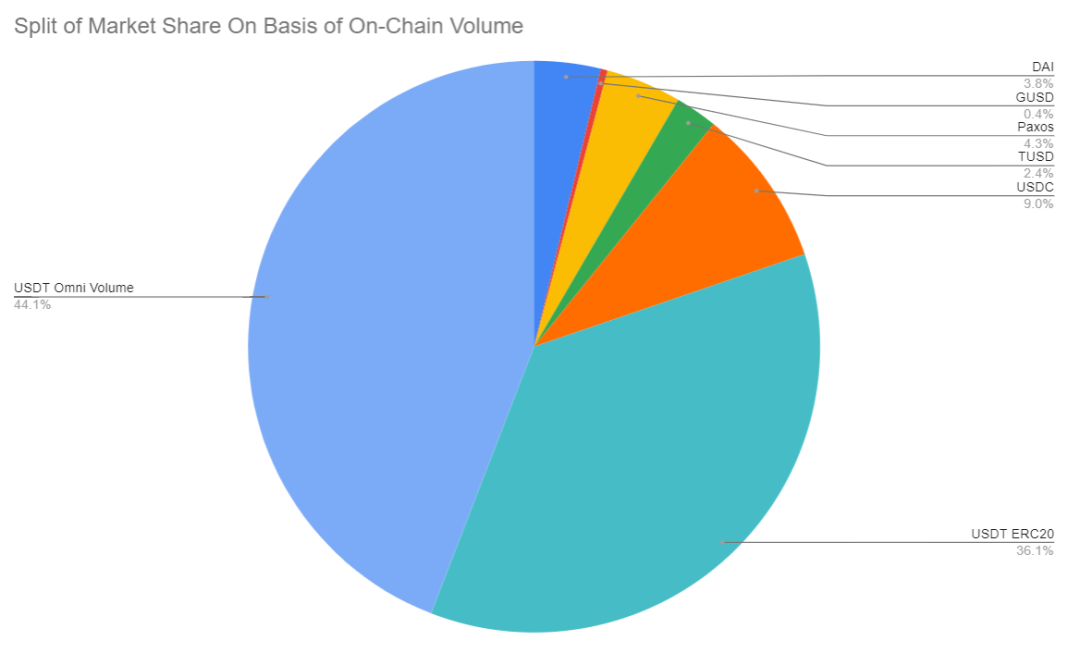

In 2019, more than US $ 237 billion of funds were transferred to the chain through stablecoins. Much of this is due to exchange-driven demand. It is easy to see from the above figure that USDT accounts for most of the transaction volume on the two chains (the Bitcoin-based Omni protocol and the Ethereum-based ERC-20 protocol). It can be said that the ecosystem that uses them today is much larger Ecology for using other chains.

However, if the market for DeFi tools grows exponentially, reaching a critical point that exceeds the capital requirements of the exchange, this pattern is likely to change. For this to happen, there must be tools that are easier to get started, such as a product portfolio that uses stablecoins as a payment tool, and a wallet that makes it easier for users to manage stablecoins. Projects like Argent and Mosendo are paving the way for this scenario. If the trading volume of USDC and DAI is to increase, it is likely to be driven by the lending market (such as Juno, Dharma, and Compound) and transaction demand (such as Uniswap). It will be very interesting to observe the situation change in the coming year.

The market is currently dominated by USDT. Calculated by amount, it accounts for about 80%. We should not ignore this weird status quo of an ecosystem that claims to move towards decentralization, but relies on a centralized currency without verifiable audits.

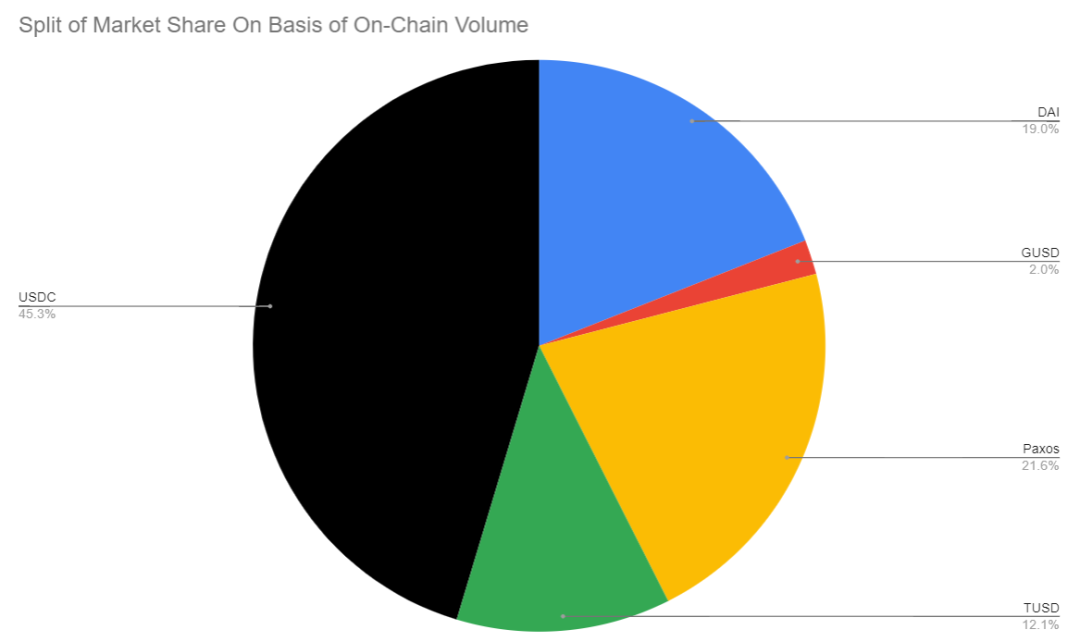

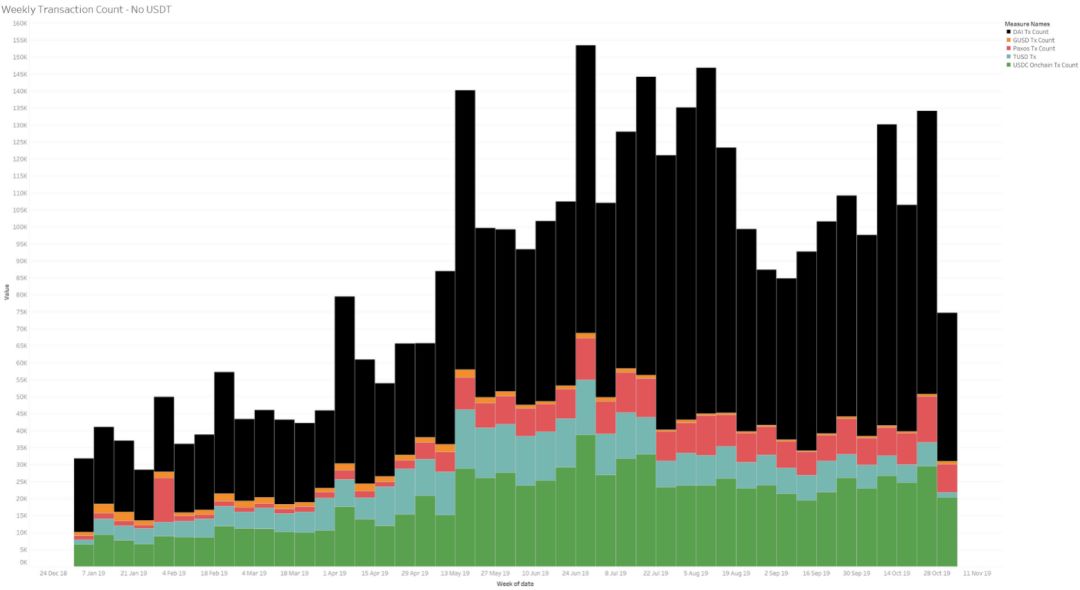

To solve this problem, I decided to calculate what a world without USDT would look like in terms of market share. Centralization (and branding) still plays an important role. USDC accounts for 45%, which is close to half of the market. The share of DAI and Paxos is very close, both around 20%. The weird thing is GUSD. Although its brand and incentives were announced earlier this year, it only accounts for 2% of the market outside of USDT. If you include USDT, GUSD only accounts for 0.4% of the total market. The power-law distribution (the rule of twenty-eight) of this market is also so cruel.

The second figure is the market share of other stablecoins without including USDT. Branding and central hosting are still necessary to attract users.

If USDT is not considered, DAI is the only stablecoin that has experienced an actual increase in transaction volume in the past year. Since January 2019, its transaction volume has surged by about 300%. The introduction of multi-asset mortgage DAI is likely to drive this number to further increase. DAI's trading volume can already compete with a centralized stablecoin chamber like GUSD.

This may be a symptom, that is, a business operated by DAO (distributed self-organization), because there is an ecosystem around it that can challenge centralized similar enterprises and defeat them on data indicators, as long as there are other products around it And build it out.

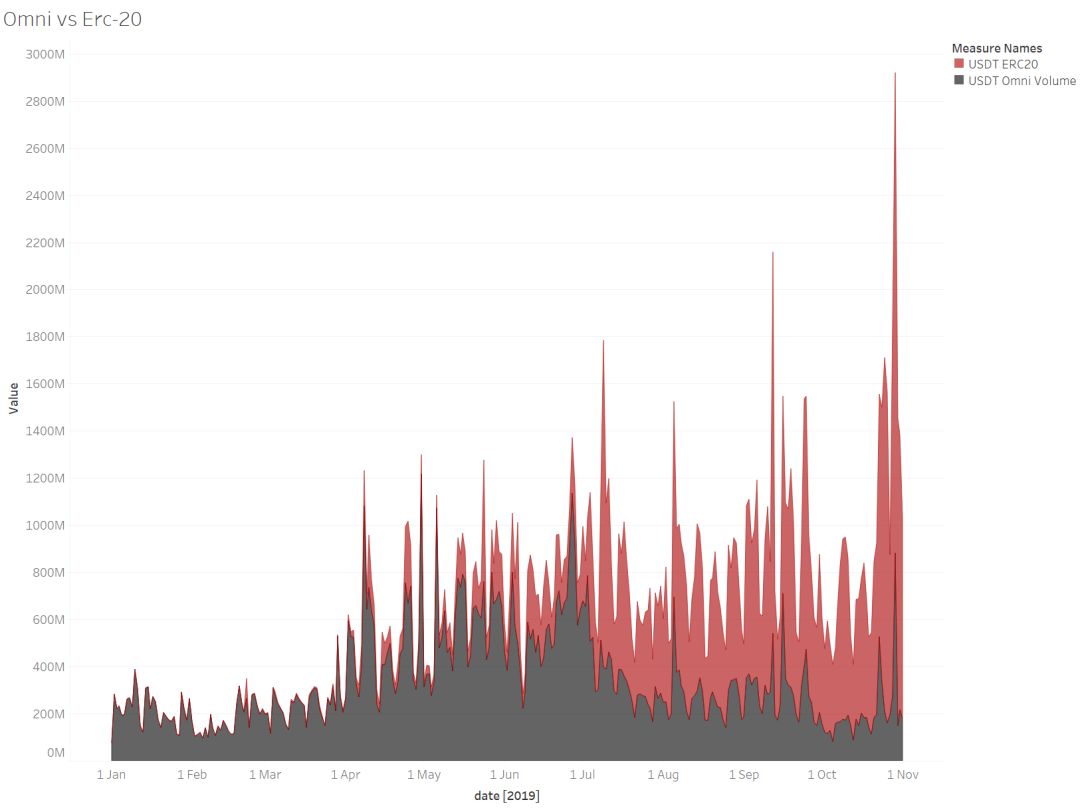

Due to the adoption of the exchange and the speed advantage provided by Ethereum, the USDT of ERC20 has fully exceeded the sum of Omni and all other well-known stablecoins. If there is any summary in 2019, it is that USDT-ERC20 has established a leading position in rivers and lakes, MakerDAO has explored its "path", and other projects are gradually withering (calculated by transaction volume).

Conversion process for Omni and Erc-20 products

USDT-Erc20's lightning growth can be written in textbooks

The truth of on-chain transactions

However, trading volume tells only part of the story. To understand what is really happening in these projects, people also need to explore the number and frequency of transactions processed by each blockchain. To this end, I examined the following data:

- Number of active wallets on each chain

- Number of transactions on each chain

- Amount contributed by each chain

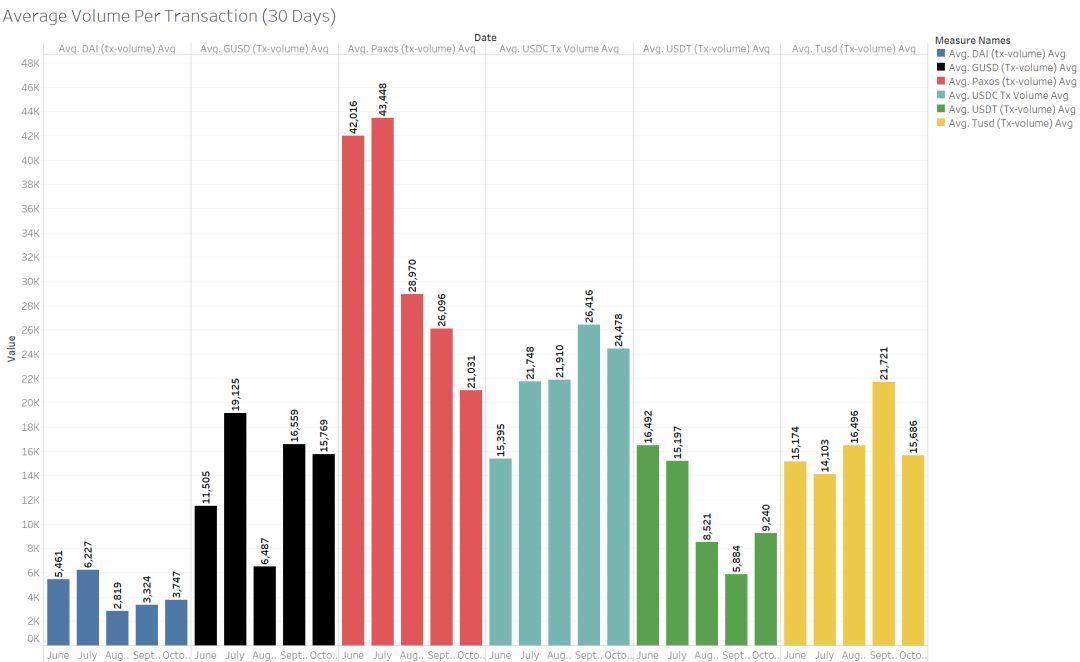

One way to understand this data is that as the number of transactions in a network increases, the average value of each transaction may decrease.

This is based on the understanding that as the adoption rate increases, people may not store a large amount of wealth on a stablecoin, but instead use this stablecoin as a tool. A chain may have a high transaction volume in the early stages (such as Paxos), because its creators are issuing assets and transferring them to partners. However, if its penetration rate is not good, and the average transaction amount of each address remains high, it means that a "giant whale" has controlled this blockchain network.

The figure below shows how DAI compares to its peers. The following data can be used as a reference for scale: USDT has processed 20 million transactions between the Omni protocol tokens and the ERC-20 protocol tokens in 2019 (as of November).

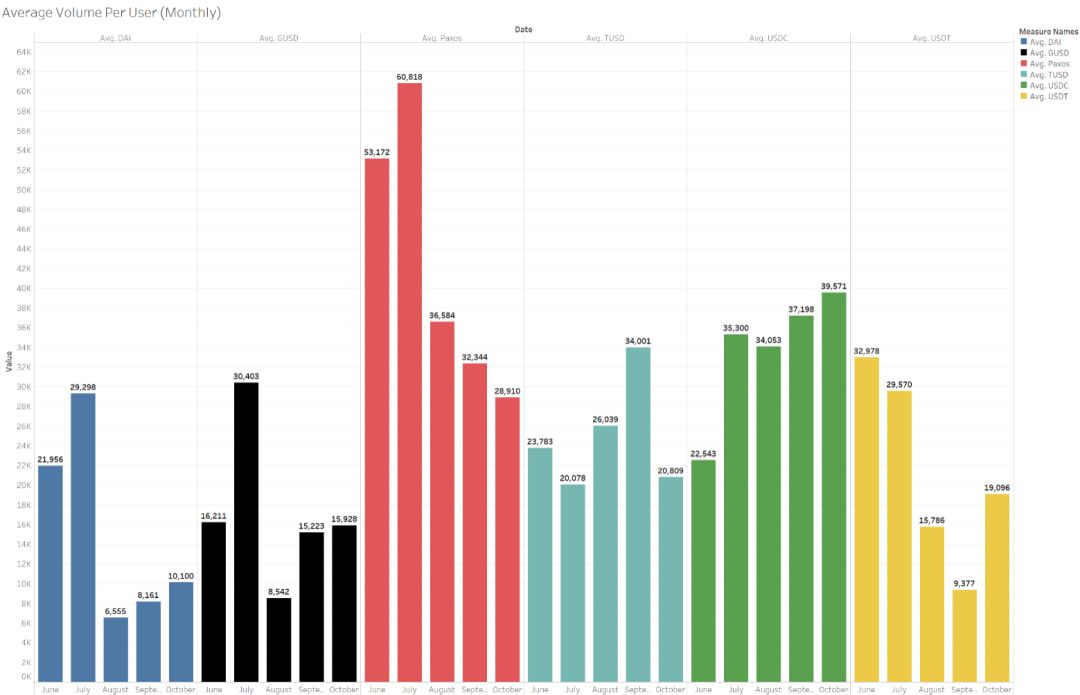

Regarding the average amount per user, I usually hear two conclusions after discussing with several analysts. One kind believes that the per capita amount on a certain chain is very high, indicating that the user has sufficient confidence in the chain. According to this logic, Paxos may be a preferred chain for institutional asset transfers to the chain, because large amounts of funds are often transferred to the network. Another conclusion is more concerned with practicality, that is, as the personal adoption rate increases, we will see that the average transaction amount per wallet will drop significantly. This is indeed the case for DAI and USDT, with August and September figures falling by about 80% from their all-time highs.

However, no matter how I look at the data, I personally conclude that DeFi and DApps (decentralized applications) are in fact still controlled by giant whales. If an application or tool fails to catch those giant whales early in its growth cycle, as today's cryptocurrency market is still small, these applications or tools may not gain much momentum. Ideally, as the ecosystem evolves, the number of active wallets should increase as the number of entering ramps increases. If the transaction volume remains stagnant (or slow compared to user growth), the average value shown in the chart below should drop significantly. That is the ideal situation for 2020.

There are multiple factors that could contribute to this result. Which includes

- Bank cards associated with crypto wallets are becoming more common (e.g. crypto.com)

- Mobile wallet (e.g. Samsung)

- Browser wallet increase (Opera, Brave)

- Increased number of ramps (e.g. Local Crypto, Ramp.network)

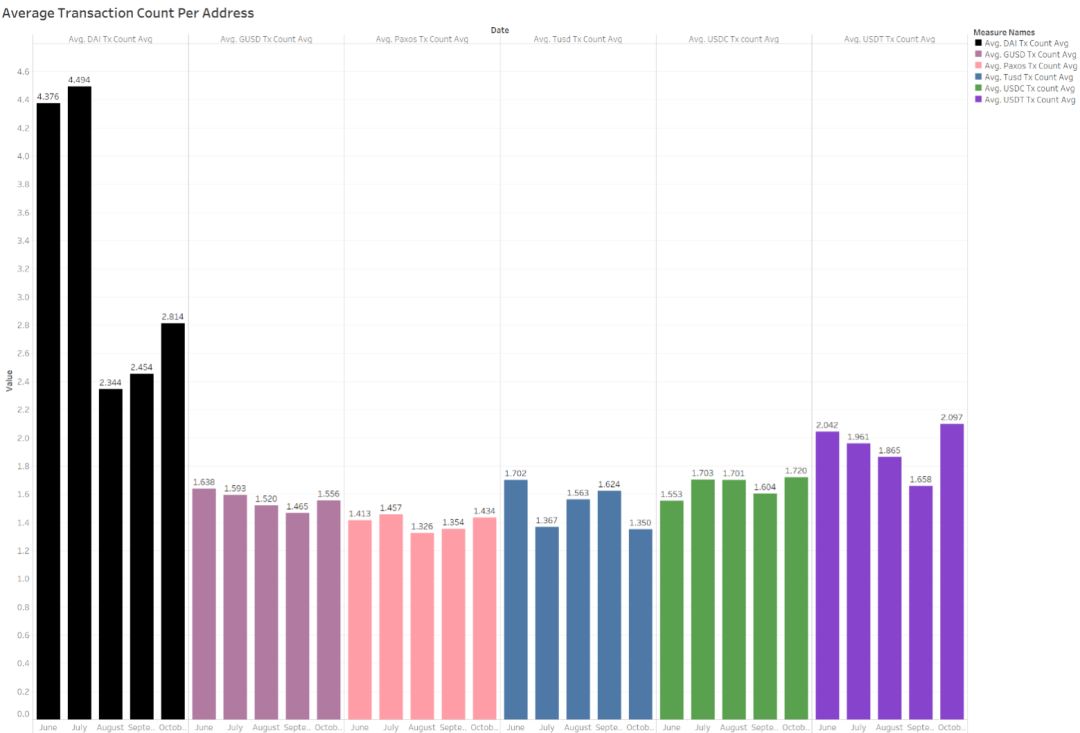

However, I found an interesting statistic: if you choose an arbitrary day, you will find that the average number of transactions per address is about 2. DAI has the highest number, and its upper limit can reach 5.

In my opinion, this means that individual investors still regard stablecoins as a kind of "volatility hedge" and do not consider it as a transactional hierarchy. In comparison, the average number of transactions on the DApp per wallet is higher, and it can reach 4 according to the standard of the Ethereum ecology. My intuition is that if EOS and TRON-based stablecoins are included in this digital game, the relevant numbers will be much higher. But this is something we will discuss next day. DAI's average monthly transactions are indeed higher, because it has other use case scenarios besides exchanges.

Beyond the exchange

The question I have been thinking personally is: If you want to build a unicorn enterprise based on DeFi and stablecoin, what is the basis?

If regulations follow up and provide a stable framework for development in this area, companies such as Stripe, Paypal, and Monzo in the future will not take shape. For this prospect to become a reality, it must be built on the premise that the number of individual users has skyrocketed.

The markets that I personally track (and related stablecoin use) include remittances, gig economy, digital asset insurance, revenue sharing agreements, and DAOs. Although exchanges are hot, when I researched B2C applications and last-mile solutions based on blockchain products, I found that there is still room for growth in these areas. Projects such as Bitpesa and Coins.ph not only have the courage to explore in frontier markets, but also set the stage for the first batch of new-generation fintech companies based on blockchain to make them more eye-catching.

A very early example of this is LocalEthereum. The project launched the product to the world with a very small team, the transaction amount is steadily increasing, and most of its functions are operated on the blockchain. I think, in theory, the role of stablecoins on cryptocurrencies is similar to the impact of cloud services on data. It allows very small teams to serve millions of users with smart contract-based interactions.

In the mobile internet era, WhatsApp and Instagram are examples of small teams serving mass users. I'm still waiting for some kind of surprise: a consumer-oriented app for banking services that achieves similar goals with stablecoins.

When you think all good ideas have been adopted, remember: we put people on the moon, and then we put the luggage on wheels.

David Perell Someday, there will be such a magical startup on my network, or I will build it. If you think that the exchange is the only driving force for the popularity of stablecoins, then this article is a little inspiration for you.

Lianwen obtained the author's authorization to publish the Chinese version of the article.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- View: DCEP's mission is to replace cash, Bitcoin's mission is to become cash

- Babbitt Column | Xiao Zheng: What are the new judicial trends of blockchain projects?

- More than escrow services, Fidelity may log on to the exchange in January next year to start trading business

- Free and easy week review 丨 Facebook studies how to prevent PoS protocol long-range attacks, Filecoin officially launches testnet

- The market is cloudy and uncertain, take stock of major events in the blockchain industry in 2019

- Comments | The "bottom logic" of the 2020 blockchain industry has changed

- Starting | Deng Jianpeng: Risks and Regulatory Paths of Stablecoin Libra