Data decreased slightly, rumors triggered a single-day net outflow of Binance

From the data of the past week (02.17-02.23), compared with the previous week (02.10-02.16), all the data have slightly decreased. At the same time, the price of Bitcoin has also entered a period of volatility.

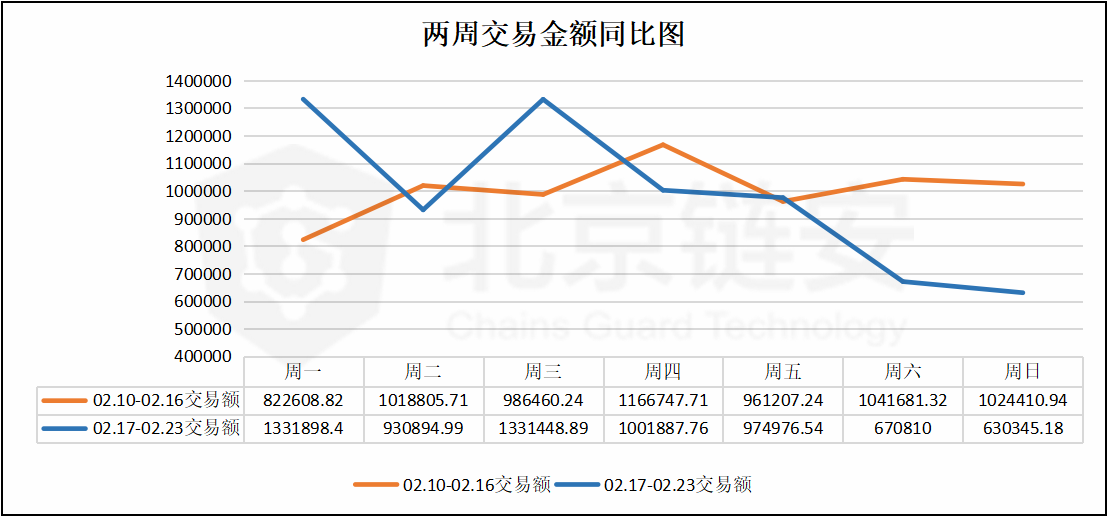

Transaction amount:

02.10-02.16: 7021921.98 BTC

02.17-02.23: 6872261.76 BTC

- Weekly | Central Bank issues technical specifications for financial distributed ledger, blockchain financial applications are expected to accelerate

- Interpretation | Five Misunderstandings of Ethereum 2.0

- Opinion: DeFi attack stems from "centralization of rights" and is a pain in growth, not a "knell"

Decrease from the previous week: 2.13%

The detailed data chart is as follows:

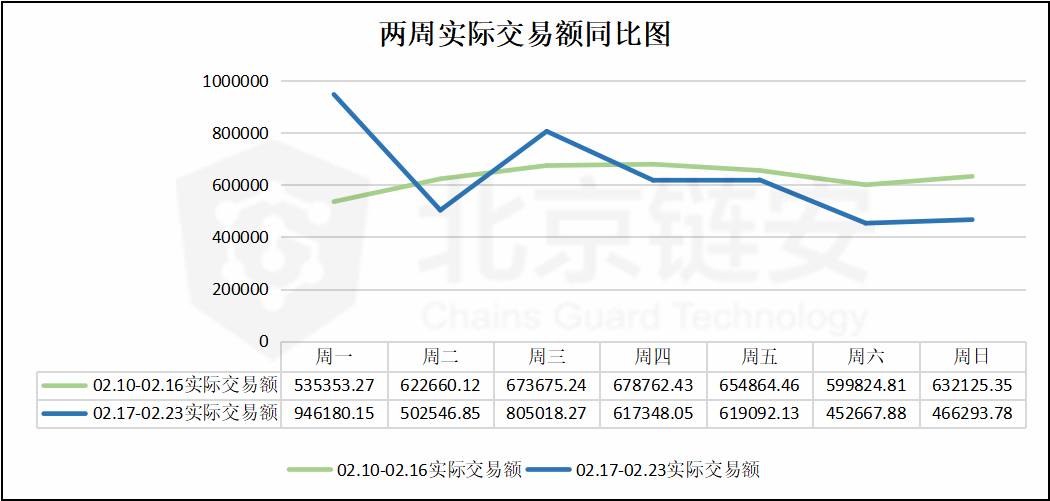

Actual transaction amount:

02.10-02.16: 4297276.68 BTC

02.17-02.23: 4409147.11 BTC

Increase from the previous week: 0.27%

The detailed data chart is as follows:

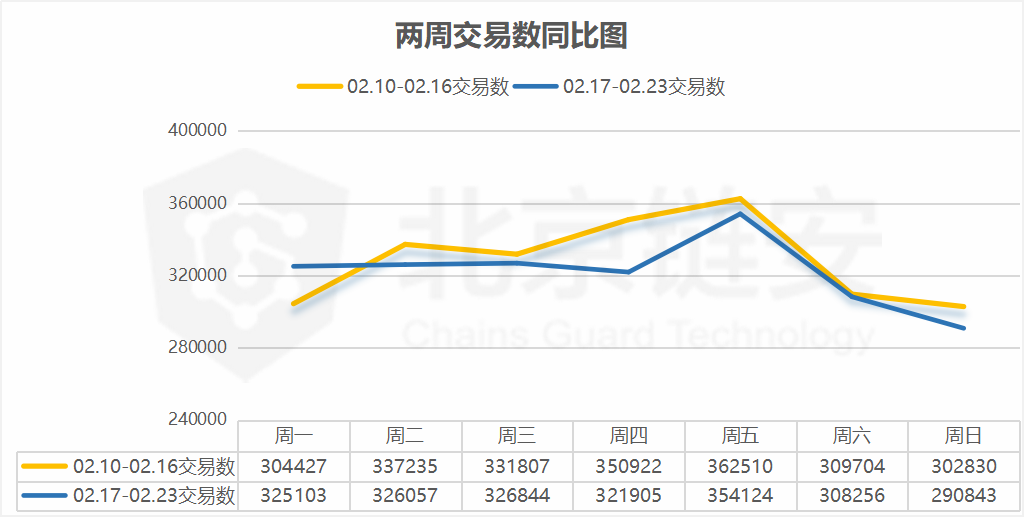

Number of transactions:

02.10-02.16: 2299435

02.17-02.23: 2253132

Decrease from the previous week: 2.01%

The detailed data chart is as follows:

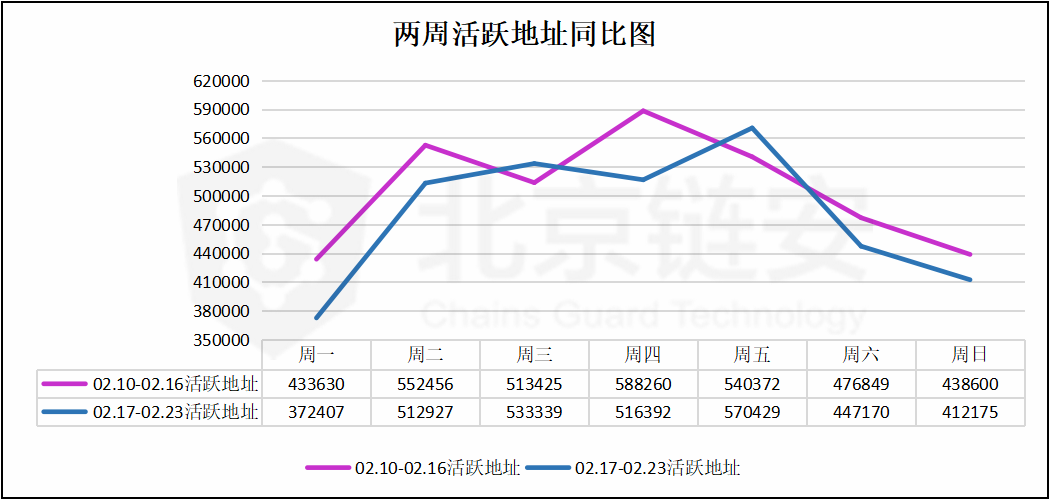

Number of active addresses:

(The address that initiated the transaction is considered the active address)

02.10-02.16: 3535592

02.17-02.23: 3364839

Decrease from the previous week: 5.04%

The detailed data chart is as follows:

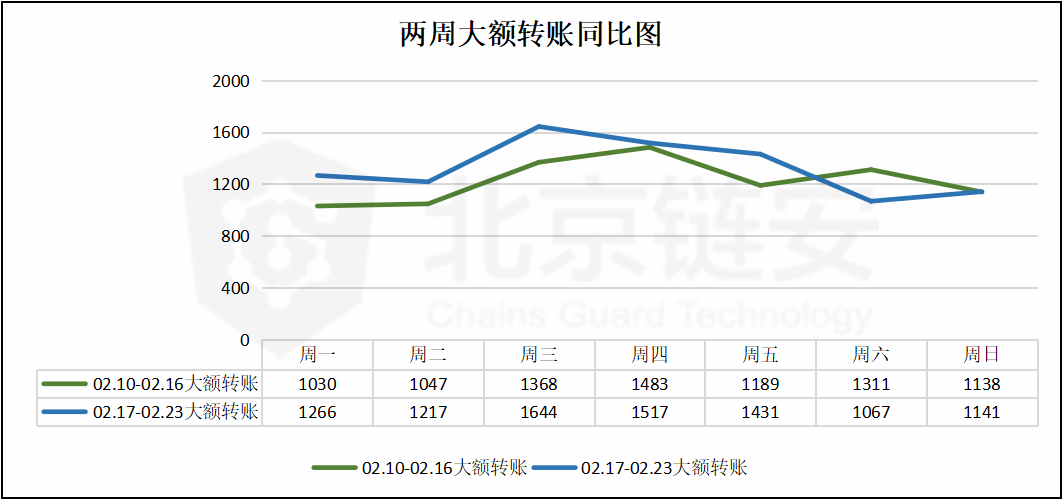

Large transfers:

(Single transaction initiated amount greater than 100BTC is considered a large amount transfer)

02.10-02.16: 8566

02.17-02.23: 9283

Decrease from the previous week: 8.37%

The detailed data chart is as follows:

Binance exchange BTC flow data

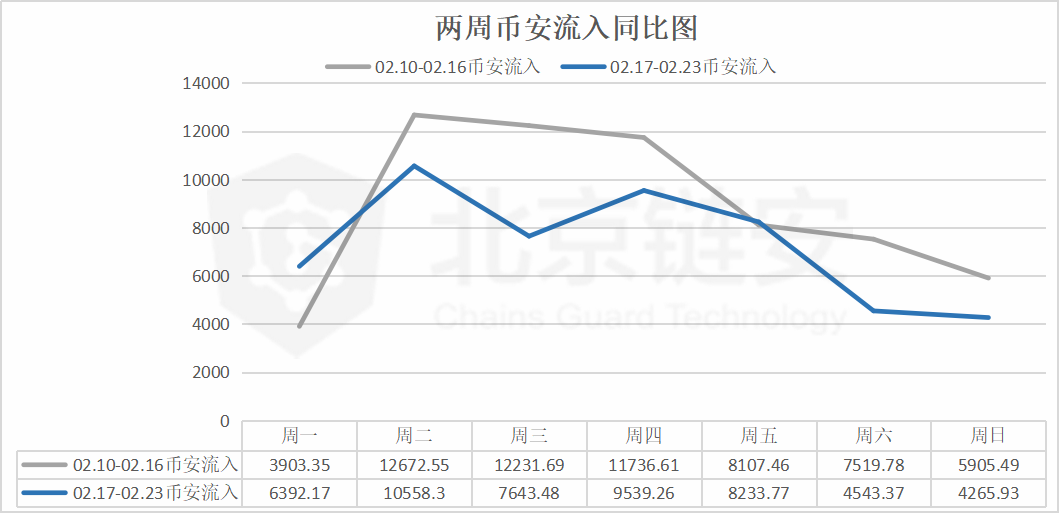

Inflow:

02.10-02.16: 62076.93

02.17-02.23: 51176.28

Decrease from the previous week: 17.56%

The detailed data chart is as follows:

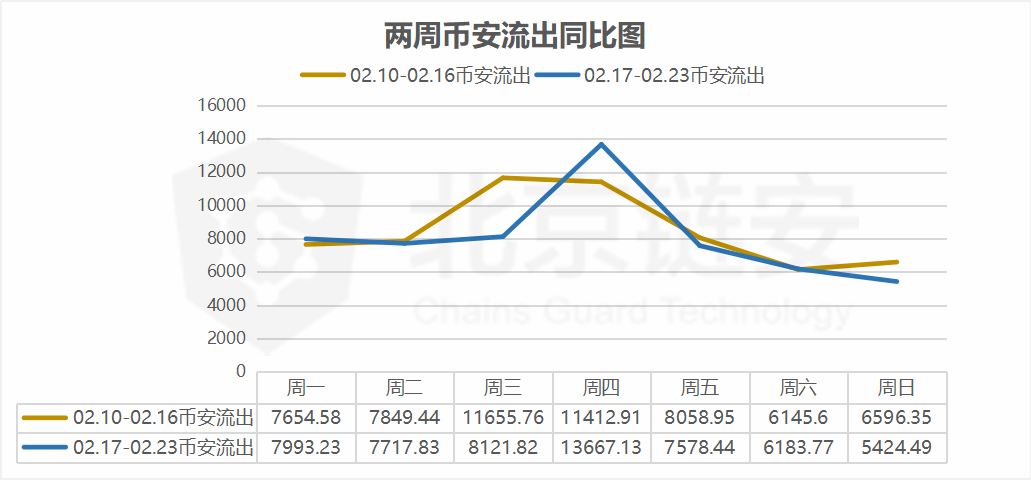

Outflow:

Outflow:

02.10-02.16: 59373.59

02.17-02.23: 56686.71

Decrease from the previous week: 4.53%

The detailed data chart is as follows:

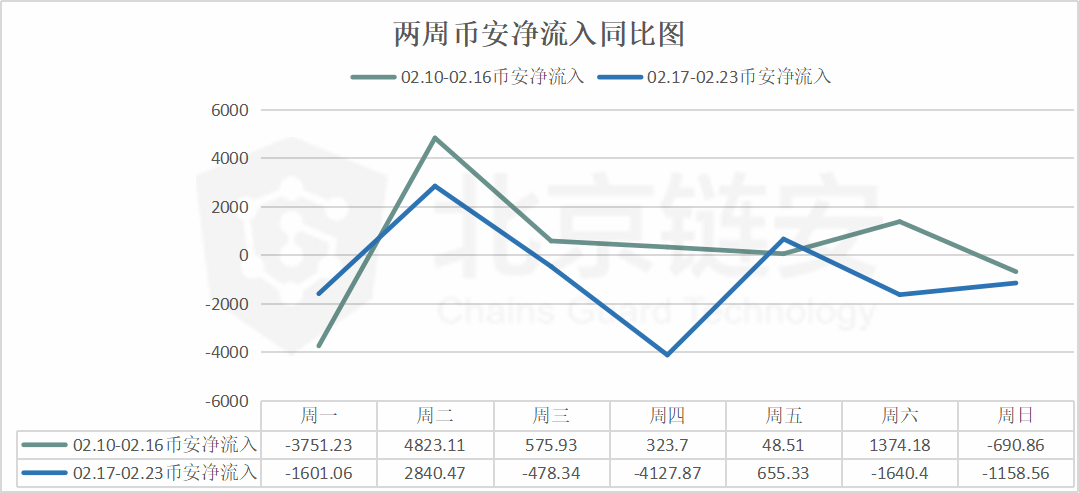

Net inflow:

02.10-02.16: 2703.34

02.17-02.23: -5510.43

Decrease from the previous week: 303.84%

The detailed data chart is as follows:

Last week, although the currency price did not fluctuate violently, FCoin's long-term shutdown announced that it encountered operational difficulties and triggered a crisis of trust in the industry. At this time, Binance immediately carried out system maintenance and conducted a large amount of Bitcoin Transfers between cold wallets caused market speculation and even rumors of "lost 20,000 Bitcoins". On Thursday with rumors, Binance also ushered in a net outflow of more than 4,000 bitcoins, bringing its net outflow this week to 5,510, which also reflects the current status of fragile trust in the digital currency circle.

Security and data highlights:

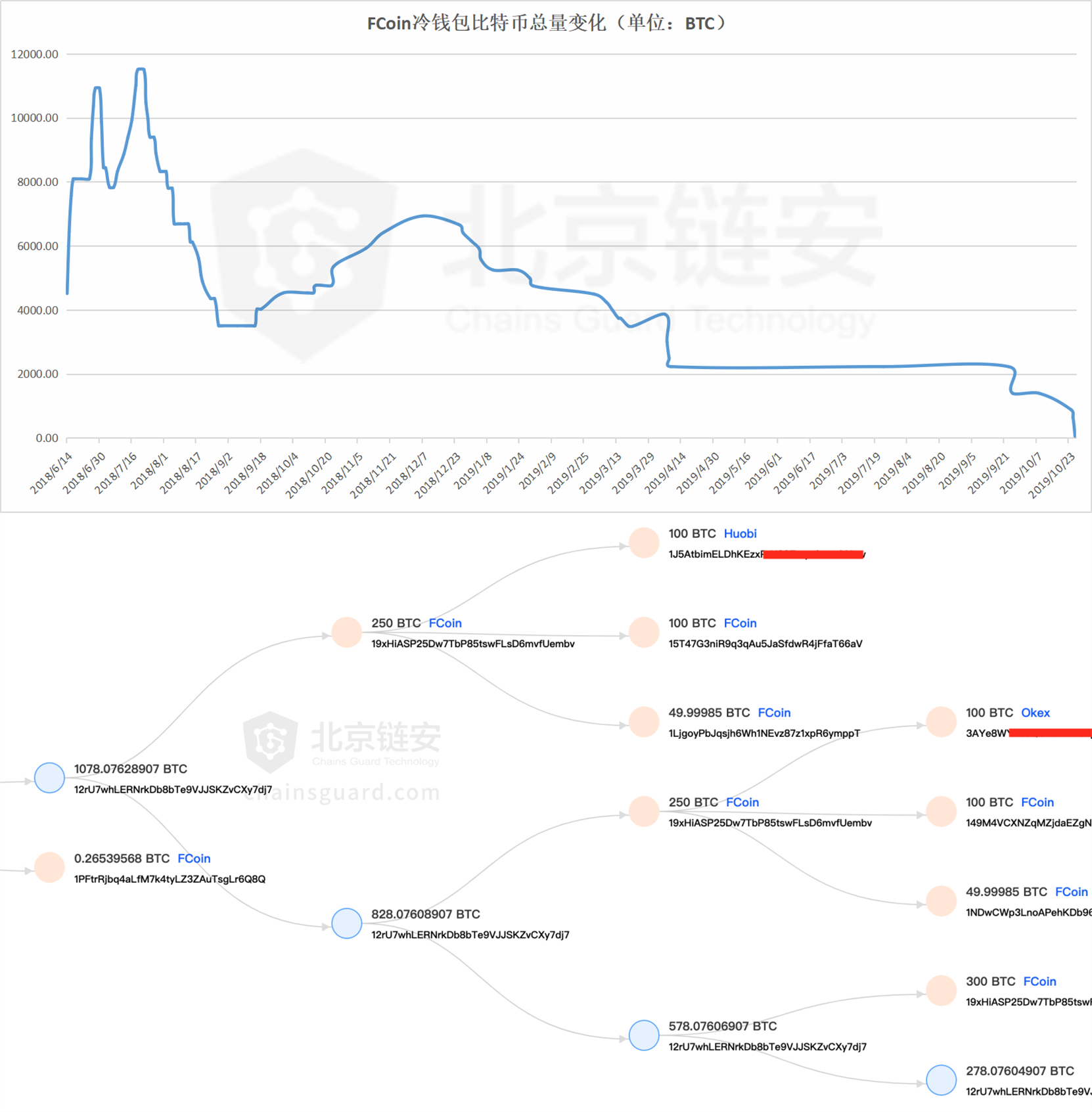

FCoin Bitcoin cold wallet address has been cleared, peaking at 11509BTC

With regard to the FCoin incident, Beijing Chainan Chainsmap monitoring system analysis found that from the total BTC in its cold wallet, it reached the peak of 11,509 BTC on July 22, 2018. Since then, it has shown a downward trend as a whole. After the size of each BTC is extracted to the FCoin related hot wallet address, further withdrawals will be conducted. In addition, according to statistics, the address received a total of 186934562.8 OMNI USDT in history, mostly from its hot wallet centralized transfer.

On February 14, this year, nearly 55 BTCs of the cold wallet address have been transferred to the address starting with 363sZd, and the relevant OMNI USDT has also been transferred to this address. At present, there are occasionally hundreds to tens of thousands of USDT withdrawal operations.

Binance Exchange's large transfer on February 20 for internal transfers between its wallets

Beijing Chainan Chainsmap monitoring system found that a transfer of 20888 BTC involving Binance Exchange occurred at 15:54 Beijing time on February 20th, but this was essentially a transfer between Binance's cold wallets, which occurred in 2019. The same amount of transfers have been made 5 times, and only twice in December, which is a normal operating activity of the exchange.

TEDA plans to cooperate with Binance to complete 300 million USDT switching

Beijing Chainan Chainsmap monitoring system found that from 22:09 pm on February 20th, Beijing time, TEDA cooperated with Binance Exchange to complete the 300 million USDT switch from the TRON chain to the ERC20 standard. Earlier, on its official announcement, TEDA said that it would cooperate with third parties to carry out the switch, and the total supply chain would not change. Immediately after, Binance's hot wallet based on the TRON chain transferred 300 million USDT to TEDA. After this operation was completed, at 22:13 Beijing time, TEDA issued 300 million ERC20 USDT on Ethereum and quickly transferred to the address beginning with 0xf44e17. Next, these USDT will most likely be transferred to Binance related addresses, or this address It belongs to Binance.

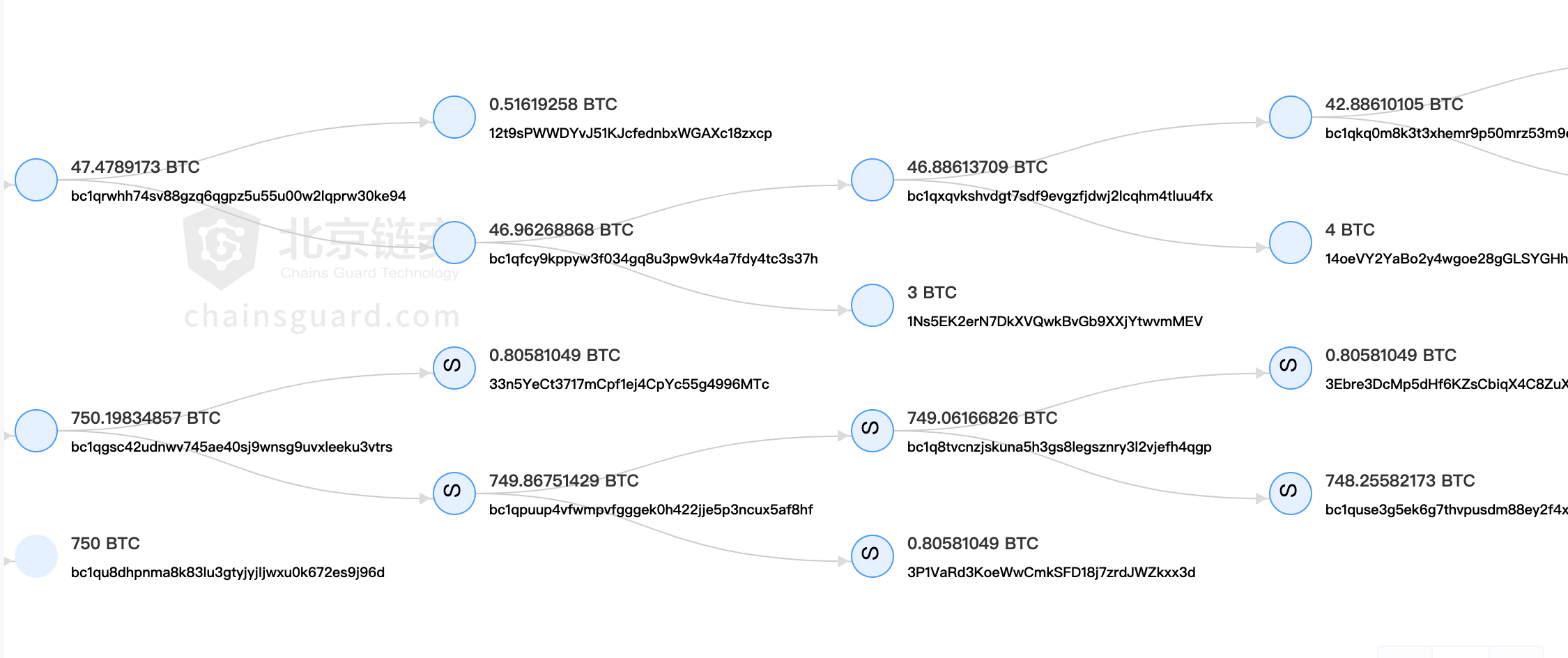

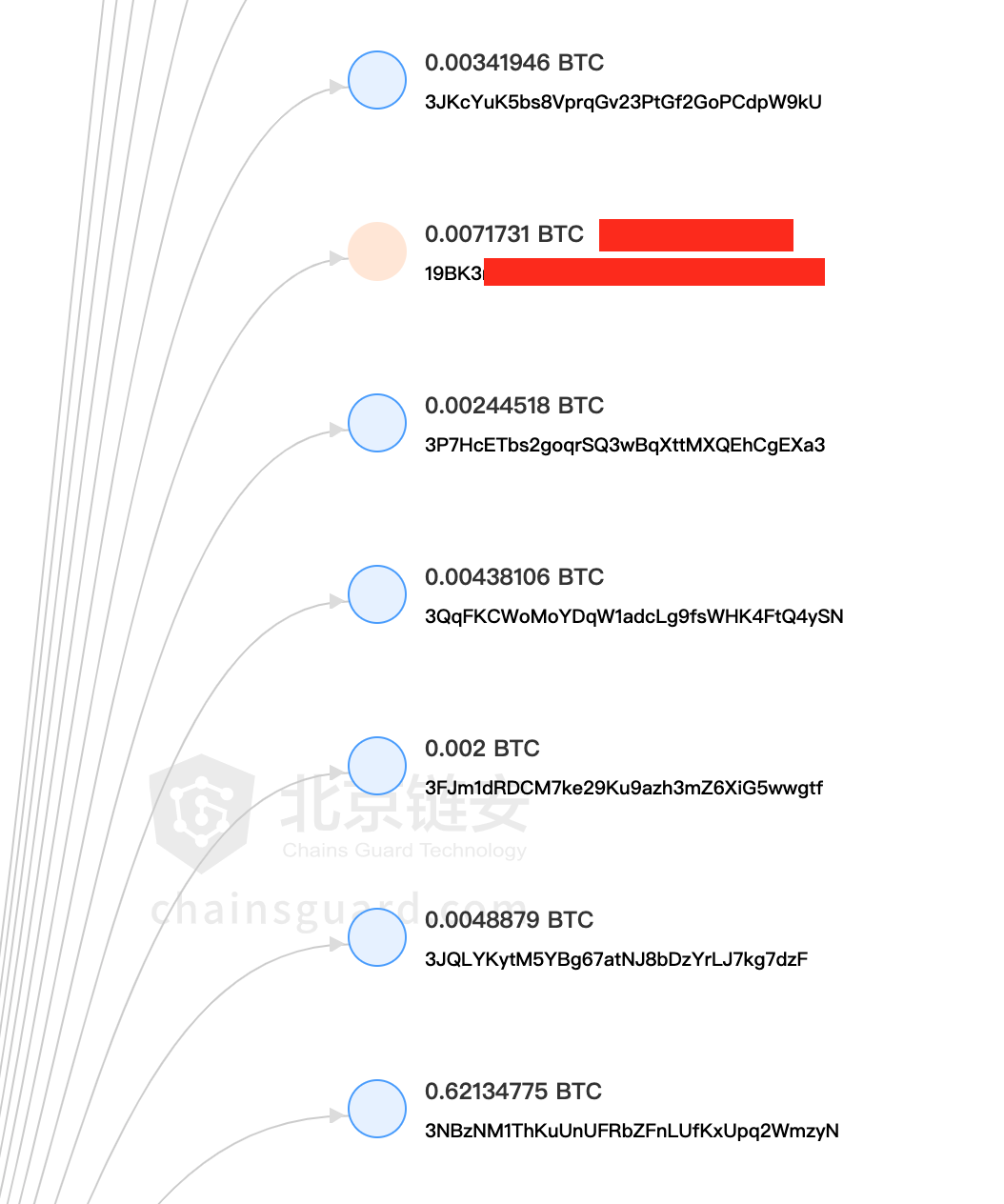

Stolen bitcoin account Bitcoin is being split and mixed

Beijing Chainan Chainsmap monitoring system followed up on the loss of 1,547 bitcoins in the giant whale account reported by the media on February 22. According to the information provided by the stolen users, this bitcoin was stolen twice with 1500BTC and 47.4789BTC quotas. It is currently being split into small amounts, and has been mixed with small bitcoins transferred from some exchanges.

Killer whale account stolen bitcoin enters multiple exchanges, but ownership issues have been identified as a problem

Beijing Chainan Chainsmap monitoring system found that the 1547 stolen whale accounts related to Bitcoin stolen on February 22 have partially flowed into dozens of addresses of dozens of exchanges, but since the relevant bitcoin has been linked to other sources of bitcoin For mixed currency, there will be legal problems in its ownership right.

According to data analyst SXWK, the stolen bitcoin money laundering activity has been continuously split and accompanied by mergers. After OTC transactions, it has entered small amounts of user addresses in major exchanges. This process is very fast, and from the perspective of a large number of other sources participating in Bitcoin, it is probable that a third-party coin mixing service is used, which is obviously well prepared. At present, there are not many stolen Bitcoins that actually complete this process. Usually, they are eventually mixed with other source Bitcoins in the middle to form single-digit Bitcoins, and then transfer to multiple addresses at the same time. Although this process can still be technically traced, from the business point of view, the bitcoins that eventually flowed into the relevant address may just be the purchase of small amounts of bitcoin by different users on various exchanges. The proportional relationship will be more a matter of legal recognition.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Perspective | How to prevent censorship attacks on smart contracts?

- Online! Wanxiang blockchain public welfare hackathon, waiting for you to solve these real post-epidemic social needs together

- Bitcoin developer: 21 million supply cap is a "religious" belief, we may implement a hard fork of inflation

- Read the Bitcoin Lightning Network Mechanism, Progress and Challenges in One Article

- Application of DAO: DAO of Art

- Bitcoin's Secret History: How Much Bitcoin Satoshi has

- bZx revelation: What should Oracle oracles need for DeFi?