Popular science | Liquidity mechanism of crypto derivatives

Author: Allison Lu

Translation & Proofreading: Min Min & A Jian

Source: Ethereum enthusiasts

Editor's note: Original title was "Science | Derivative Liquidity Mechanism"

- Traditional finance may usher in the most bleak decade: Can it catalyze the spring of cryptocurrencies?

- Babbitt Exclusive | A quick glance at 6 practical cases, how do medical, energy, and financial fields combine blockchain?

- Interview with Babbitt | Luo Mei, Tsinghua University: Digital currency accounting and tax system is the infrastructure for blockchain to promote industrial upgrading

In the first part of this series, we introduced synthetic assets. In this article, we will introduce different liquidity and trading mechanisms.

In the process of trading crypto derivatives, liquidity is mainly affected by three aspects:

1. Risk: What risk exposures exist? Is there a standard (for example, each BitMEX perpetual contract holds $ 100,000 worth of Bitcoin) or is it customized (for example, Song and Lubin's famous bet)?

2. Custody: Where is my collateral? How to liquidate?

3. Transaction mechanism: How can the two parties to the transaction identify each other?

Centralized order book (also known as a centralized exchange)

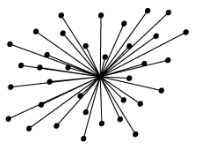

-Traders see exchanges as counterparties in a centralized order book-

The most familiar way of trading derivatives is through a futures exchange. Exchange operators define standard terms for risk and clearing. In order to effectively carry out clearing management, the operator usually keeps the pledge of the trader. They are also responsible for maintaining a centralized order book and matching both parties to the transaction. Liquidity itself produces liquidity, and network effects are difficult to replace. Exchange operators may have a monopoly.

In addition, when trading on a managed futures exchange such as BitMEX, the counterparty to the trader is actually the exchange. If the exchange disappears, or if risk management is not in place, traders will lose their synthetic assets and collateral.

-Treating an exchange as a counterparty means that if the exchange goes down, traders will follow gg-

In order to separate the various parts of the centralized order book without affecting its liquidity network effect, we can use smart contracts to separate the three areas of risk, custody and trading from each other. For example, UMA smart contracts can specify standard risk units in detail and keep the pledges of traders. However, both parties to a transaction can still identify each other through a centralized order book.

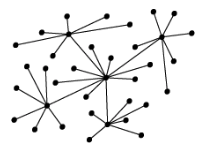

Distributed (also known as point-to-point)

-In peer-to-peer derivatives trading, traders directly trade-

In peer-to-peer transactions, both parties to a transaction can negotiate directly. The bet between Jimmy Song and Joe Lubin is one way to reach an agreement. However, they need to bear the risk that the other party may lie on their books. In this case, a smart contract can be used to lock the pledge to ensure that Jimmy does not overcharge. However, such peer-to-peer transactions may be relatively rare and highly customized, which makes it difficult to transfer risks and increase liquidity.

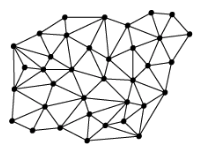

Decentralized Order Book (also known as OTC)

-Off-market making is a golden mean-

-Off-market making is a golden mean-

If you are interested in OTC trading and how to use UMA contracts to reduce transfer risks, please contact us.

Regardless of the method used to trade these derivatives, all derivatives need to be settled through price predictors (translator's note: there needs to be a way to confirm the market price and then judge the profitability of both parties). If you can control the oracle, it doesn't matter whether your counterparty has pledged a deposit in a "decentralized" smart contract: because you can steal its assets. Some fiat currency market oligarchs use their power to manipulate the pricing of derivatives1 , 2 . We believe that we can use the power of blockchain oracles to achieve network effects without relying on existing strong forces.

In the next article, we will discuss the importance of economic assurance for blockchain oracles, and our proposed solution: UMA Data Verification Mechanism (DVM).

1 https://en.wikipedia.org/wiki/Libor_scandal

(Finish)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The United States has issued a series of new data privacy regulations. Will this new wave affect the blockchain?

- Financial OneAccount is 40% off for listing in the US, is the second share of the blockchain worth looking forward to?

- Listen to the Filecoin team respond to the core questions you need to know about testing online

- Observation | 5 pictures depicting the Web3 stack in 2019

- Satoshi Shinmoto 丨 Why was Satoshi Nakamoto born on April 5, 1975?

- Swedish central bank partners with Accenture to launch e-krona e-krona pilot platform

- Yi Huanhuan, Dean of Beijing Mutual Gold Association Research Institute: "Blockchain + Finance" will come to fruition in 2020, and the blockchain will enter a new era of smart contracts