Ten important advances in cryptocurrency in 2019

Original author: Nick Tomaino (encrypted venture capital funds 1confirmation founder, Coinbase early employees)

Original link: thecontrol

Compilation: Wildflower Saying

Price speculation has been the most obvious theme of cryptocurrencies in the past 10 years, but in 2019 speculation has retreated to a position behind product use cases. Here are the 10 most important blockchain product developments of the past year:

- Blockchain practitioners: 2019 is too difficult for me

- SheKnows Year-end Ultimate Debate | Can Big Companies Get Into the Start?

- In Nordic Blockchain Week, I felt the power of the winter

1) Global, open financial applications on Ethereum provide new ways of borrowing, consumption and income for people

Borrow from MakerDao:

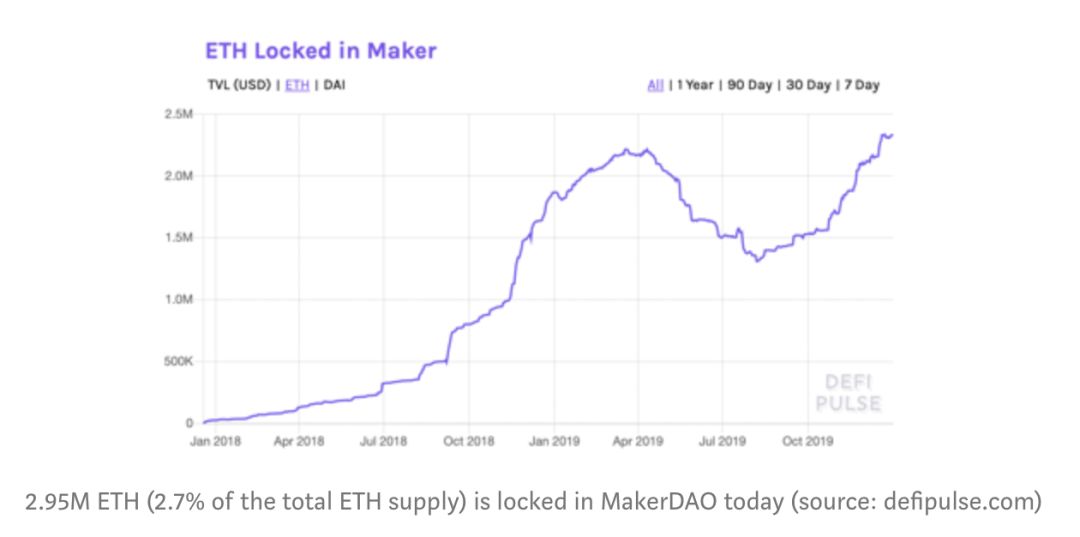

Anyone can obtain a mortgage using ETH or BAT (with support for other tokens soon) without permission. This was not before Ethereum , and MakerDao has been impressive for the past year and a half . 2019 is the transition year for the project (the upgrade of the multi-collateral DAI was completed in November). As more collateral is added and the stability of the DAI is proven, the future is very bright.

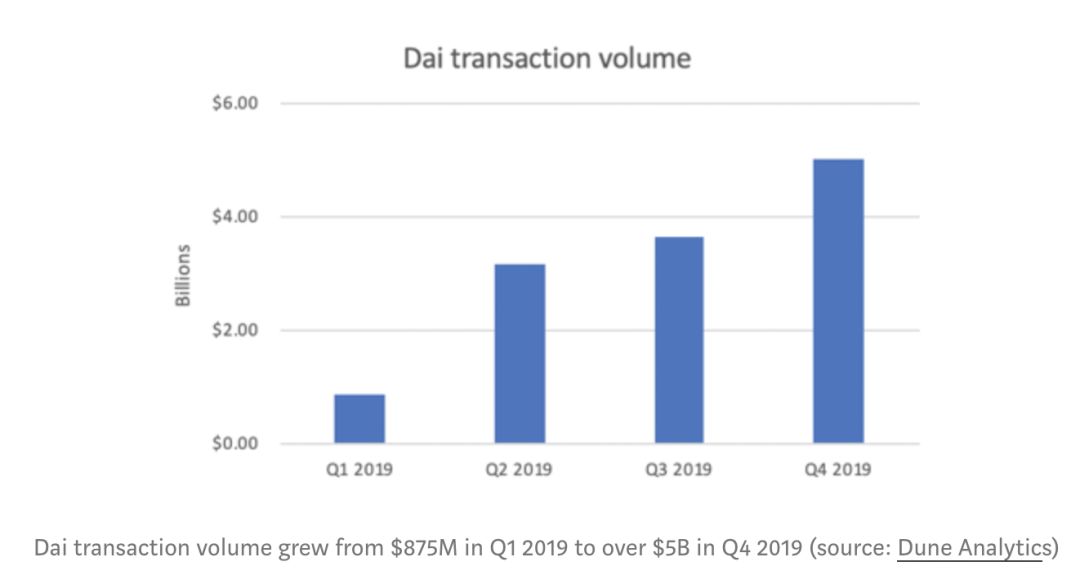

Sending and consuming with DAI: Bitcoin's supply of fixed tokens as a medium of transaction is very unstable. The design of stablecoins is primarily price stable, so it is more feasible as a transaction medium. DAI has advantages that other stablecoins do not have. It is designed to minimize trust at the beginning. Although Tether and USDC are more widely used, the growth of DAI is exciting.

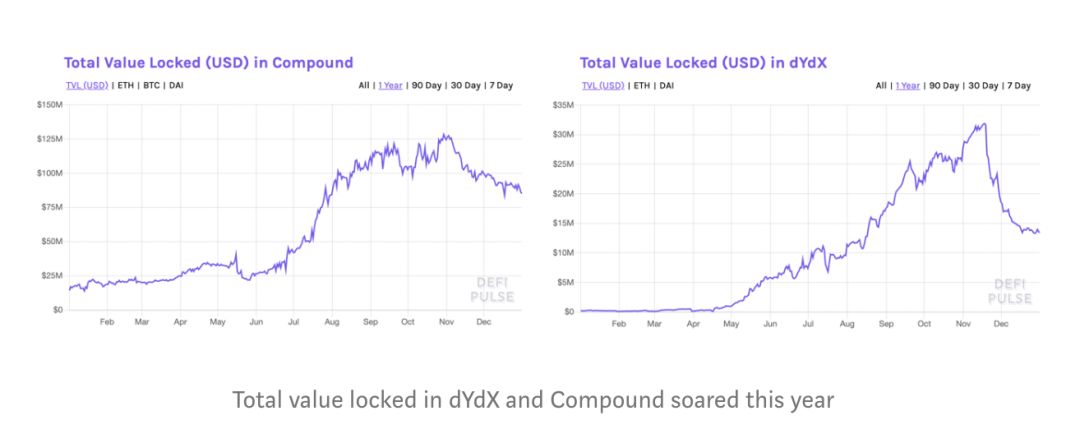

Use Compound or dYdX to earn interest. There are significant costs and regulatory barriers to participation in managed interest-bearing products. For unmanaged interest-bearing products, the barriers to entry are much lower. Now we see a lot of exploration in this area. Users can use products like Compound and dYdX to lend their cryptocurrencies and earn interest in an unmanaged manner. Users do not need to trust a single fund custodian.

2) The macro environment continues to show that distrust of large elite institutions is increasing worldwide

Populism is on the rise. Populist parties control many democracies in the world. Cryptocurrencies will largely benefit from this trend.

If you live in the U.S. but don't want to invest the trust in a bank or the U.S. government, you can convert USD (U.S. dollars) to BTC and send the BTC to the Ledger wallet. If you live in Venezuela but do not want to store your wealth in Bolivar (Venezuela currency), then you can convert Bolivar to DAI and send the DAI to the Metamask wallet before you start using it.

Most people still trust large institutions in terms of funds, identity and data, but this trust will obviously weaken in 2020, and cryptocurrencies provide another option. The emergence of stable coins like DAI is especially important for those in high inflation countries, it provides a stable medium of exchange.

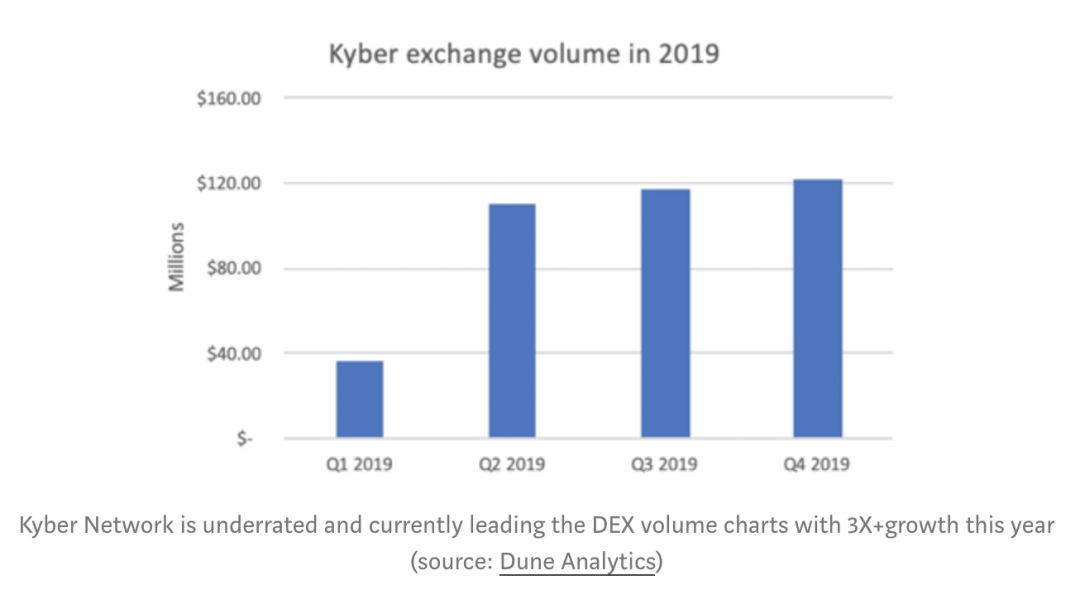

3) Decentralized Exchange (DEX) is moving forward

From Mt.Gox in 2011 to Binance in 2019, the hacking of centralized exchanges has been a pain point for the industry. Unmanaged exchanges have reduced counterparty risk for cryptocurrency speculators, and over the years there have been many attempts in this area. This year, two unmanaged trading products are breakthrough:

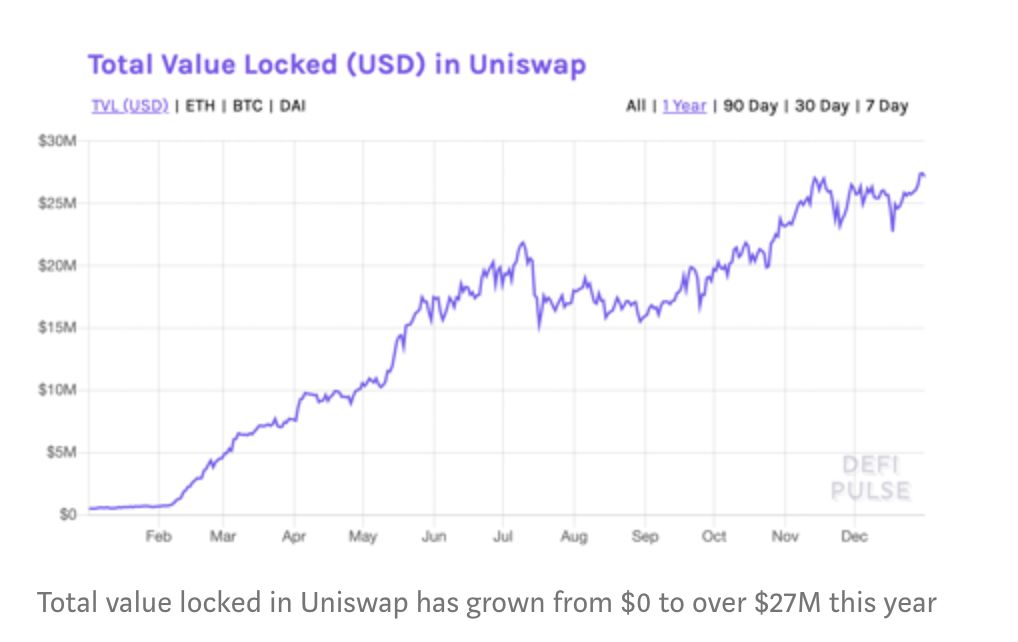

Uniswap was the first to launch Automatic Market Making (AMM) for ERC-20 tokens and has achieved strong growth this year. Compared to traditional order books, it remains to be seen whether AMM will generate a large number of transactions in the long run, but Uniswap has a passionate community with a unique shared ownership model.

4) Cryptocurrency user experience is getting better and better, although there is still much room for improvement

We have seen in the past few years that many new crypto products are also mainly used by "crypto aborigines". Key management is still a big obstacle to user experience for users, and it has been balancing between anti-censorship and user experience. (Coinbase provides a good user experience, but it is not resistant to censorship, while Metamask has a poor user experience, but it is resistant to censorship.) This year, we are starting to see a wave of new products that, while providing a good user experience, are also resistant to censorship:

Brave is a secure, fast and private web browser with a built-in cryptocurrency wallet. Brave provides users with a convenient way to get their first cryptocurrency by viewing ads. Brave is one of the best products to date, with over 10 million users.

Argent is an Ethereum mobile wallet designed to be a portal for new users to use DeFi. It was launched in 2019, and with product improvements, such as the recent addition of WalletConnect support, it could become a breakthrough year in 2020.

Authereum is a login and wallet solution for DApp developers who want to provide their users with a web2-like user experience while maintaining anti-censorship. It is still in beta and will be publicly released in early 2020.

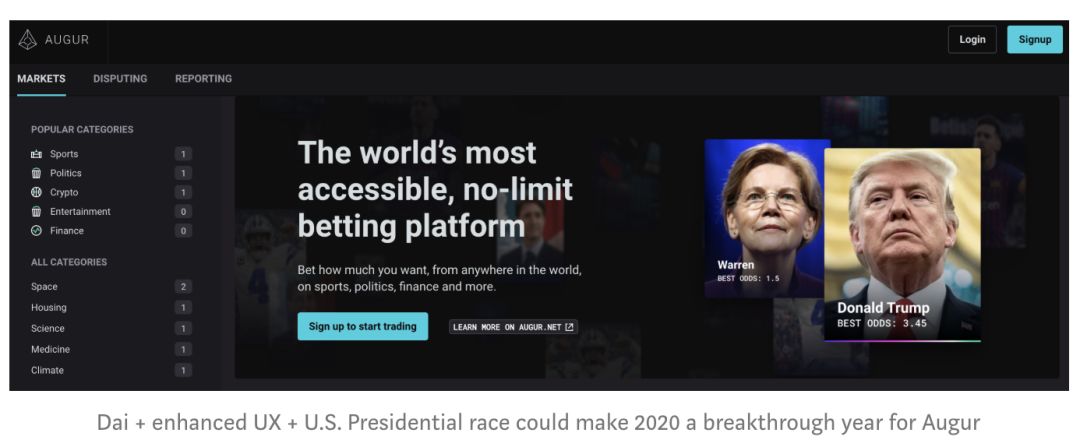

5) 2020 will be an important year for political forecasts

Augur v2 is one of the most exciting developments in the first half of 2020, especially in the US presidential election in November 2020. Augur v2 only supports DAI, so users don't have to worry about Ethereum fluctuations. Augur v2 optimizes the client and also improves many user experience issues in v1.

6) Non-homogeneous token usage is growing, and the future of NFT + games is bright

The crypto cat game Cryptokitties launched the NFT token movement in 2017. Two years later, we didn't see another similar virus spread, but with games such as Gods Unchained and Decentraland, we saw an increasing appeal in the field. There are many strong teams working here, and as the digital goods environment improves, the demand for such assets may increase.

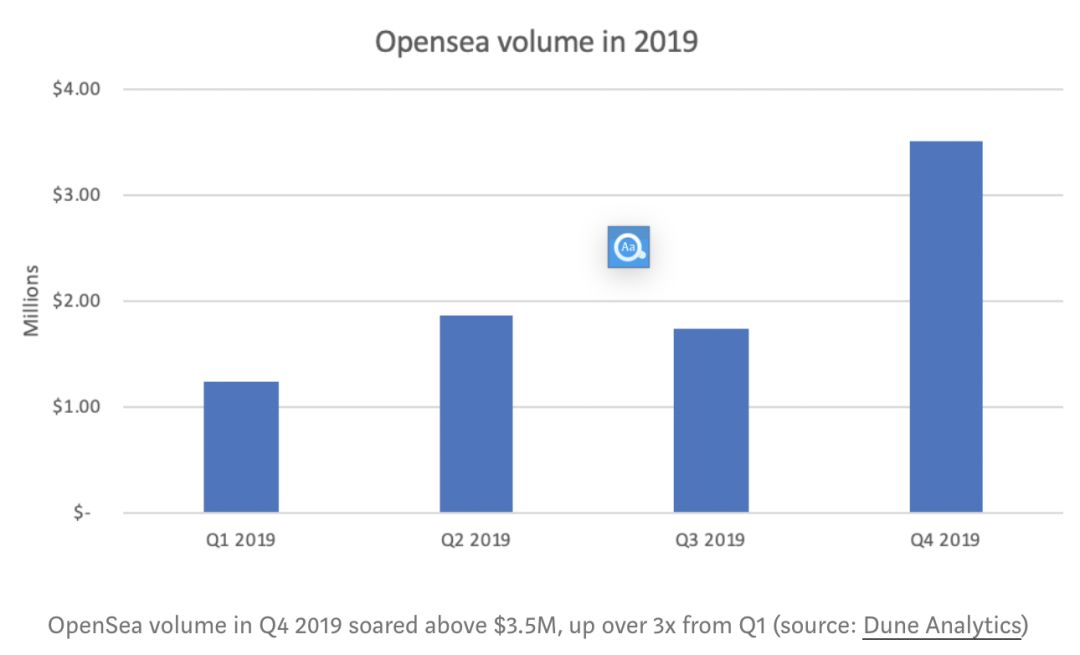

OpenSea is a leading NFT trading platform and has achieved tremendous growth this year. OpenSea performed particularly strongly in the fourth quarter due to Ethereum Name Service (ENS) transactions.

7) Infrastructure continues to mature to support new use cases (although still in progress)

Cosmos is at the forefront of token interoperability. This is the key to solving the decentralized transaction between non-ERC-20 tokens and tokens. Some well-known projects like Binance DEX are using the Cosmos SDK to create their own Proof-of-Stake DApps.

Polkadot is at the forefront of smart contract interoperability, which is why Ethereum is working on a 2.0 upgrade.

There are also many talented teams who have raised funds to develop infrastructure such as Dfinity and Filecoin. The delivery of these projects will take time, but there may be some surprises in 2020.

8) Experiments are emerging in emerging areas such as bonds, insurance, and governance

There have been many attempts in bonds, insurance and governance, which may bring some breakthroughs next year. Nexus Mutual is at the intersection of these three trends, with strong growth in 2019. Many other projects are worth watching, such as Forte and Fairmint.

9) So far, the usage of privacy products is very low

Privacy has created a $ 1.5 billion market (Monero, Dash, Zcash, etc.), but the use of privacy coins has not grown much. These projects have interesting technology and enthusiastic investors, but few are mentioned. The root cause of this trend is unclear. Do most people not care about privacy at all? Or is it too early and the technology hasn't improved yet?

My point is that people do care about privacy when it comes to transaction media, but their primary concern is stability. If you are making a token that acts as a medium for trading, stability must be the focus. Today's privacy coins are largely fixed-supply cryptocurrencies, and the value they build is more speculative assets like Bitcoin, rather than transaction media like DAI. In 2020 and beyond, I expect that existing cryptocurrencies will implement privacy features. Tornado Cash is one of the most exciting projects in this area.

10) Many social networking companies (Facebook, Twitter, Telegram) and countries (China, Russia, Sweden) are at various stages of launching a cryptocurrency plan

In the past year, these projects (Libra, DCEP) have been widely publicized by mainstream media. I'm often skeptical of their long-term success due to the dilemma of regulators and innovators, but there is no doubt that these initiatives have helped propel the industry's mainstream perception. I think that more similar projects will continue to help the industry, and we may be surprised by one of them.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The market segment suitable for blockchain should have these seven attributes

- Lighthouse: Lessons Learned from Testnet Collapse

- Will there be "explosive applications" for blockchain in the future?

- Essentials of "2019 Global Blockchain Industry Application and Talent Cultivation": Four levels, insight into industrial applications

- 12 prediction trends you need to watch out for if the bull market hits in 2020

- 2020, Bitcoin mining is about to usher in the year of life and death

- Will Synthetix be the first Defi to replace MakerDAO?