The final battle of the USDT, you should first retreat and choose another day.

Since last year's Tether's first "man-made collapse", the USDT has been violent . In April this year, the company was accused of secretly misappropriating $850 million in funds to fill the gap. In May, not only was the court dismissed the protest, but it was also reported that it was over 50% likely to engage in securities fraud. In June, it was the case of New York. The state prosecutors are fully encircled…

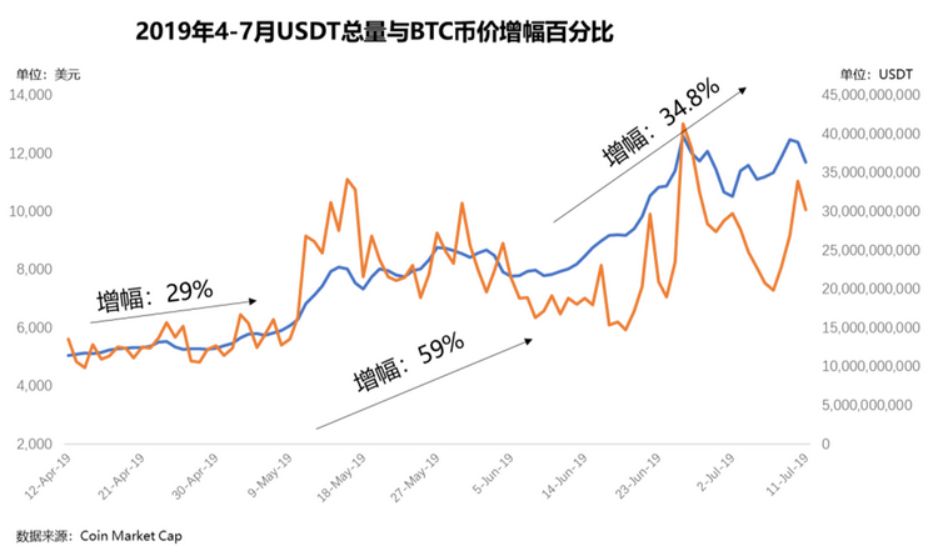

Image taken from: Coinmarketcap

From about 10:30 on July 29th, the East China time, Bitfinex and Tether, which had been in the water for more than a few months, finally ushered in a hearing held by the New York Supreme Court; both of them met with the New York State law enforcement authorities and were based on relevant laws. The case is judged. In view of the current position of the USDT in the stable currency market, the confrontation has not yet begun to cause high concern in the currency circle, and there have been many warnings of lightning.

- Understanding IRISnet Chain Governance: The "Self-Evolution" of Cross-Chain Service Networks

- Getting Started | Smart Contract Predictor: How to implement decentralized data winding?

- The Bitfinex hearing ended and the case was postponed for 90 days.

Specifically, from the beginning of July, the New York State Attorney General asked Bitfinex and Tether to provide evidence and started hearings on the 29th of this month. There are many negative guesses on the market; recently there has been a "USDT is about to disappear, three major The exchange is facing an exaggerated remark about the danger of closing the door.

Image taken from: ChainNode chain node

Based on the experience of two flash crashes in October last year and April this year, if the New York State prosecution broke out the other black materials of Bitfinex and Tether again, it would be normal for the market to worry about the market. Moreover, many industry experts believe that the price increase of Bitcoin has a great correlation with the issuance of USDT. Take the price rebound in Q2 this year as an example. Every time the USDT is issued and the market demand is further improved, it will bring a bigger bit of bitcoin price. fluctuation. From this perspective, if the hearing of USDT's bad news, it is inevitable that Bitcoin will be avoided. However, as it is said by rumors, it will face the fate of closing and collapse .

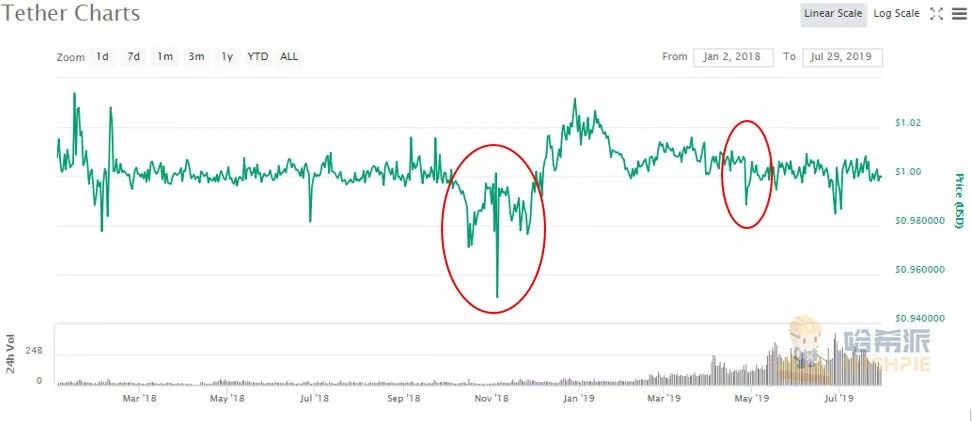

Image from: Pener Institute

Regardless of whether the Office of the Attorney General of New York has jurisdiction over Bitfinex and Tether, the state’s Martin Act is not applicable to the business of the two companies, and so on; even if Tether and Bitfinex eventually lose, Will not have much impact on the USDT. First of all, the registration of these two companies is not in New York, and the ruling can only prohibit Tether and Bitfinex from doing business in New York State. Secondly, most of the USDT currently in the market is mainly for Chinese traders, and it flows to USDT in the US. Only 3% of the circulation. Therefore, the lawsuit of the Office of the Attorney General of New York has only affected the USDT. Moreover, from the price trend of the two previous thunderstorms in the USDT, the market's digestion rate of its black material is accelerating, and the USDT consensus seems to be gradually increasing .

Image taken from: Coinmarketcap

Of course, everyone who is familiar with the US hearings knows that it is unlikely that they will get a clear judgment result through a public meeting. Just like Facebook's Libra hearings before, thunder and heavy rain are small operations. Sure enough, the hearing that ended just last night ended with a 90-day ruling approved by New York Supreme Court Justice Joel M. Cohen. In addition to arguing over the issue of jurisdiction, the two sides did not make any substantive progress on the case .

According to resident reporters, Bitfinex stated that because Tether is not a security or commodity, the court has no subject matter jurisdiction; the New York State Inspector General’s Office stated that there is no jurisdictional dispute over the Bitfinex investigation, and that it is more concerned with Bitfinex’s high Manage virtual currency transactions in New York. As for the final judge's approval to continue the investigation, it can only be said that Bitfinex still belongs to the former jurisdiction. As for the market, the current reaction is also relatively flat – the price of bitcoin fluctuated significantly in the early morning of this morning, and the lowest price dropped to $9,420, but it quickly rose back to the level of around $9,500 before the meeting; USDT currently quoted $1. The 24-hour drop was less than 0.05%.

Although the results are not as good as the market expects, and can predict that the hearing will be held again after 90 days will not have much impact on the USDT; but can not be taken lightly, Tether is still a cryptocurrency market with a large range of lethality Time bomb .

However, USDT now has high convenience and its own first-mover advantage, so even if its super-distribution, capital confusion, and manipulation of the market are recognized facts in the field, USDT's share in the stable currency market is still stable at 70%. With 90% of the dominant position, the daily flow is evener than the bitcoin's one-day transaction amount. To put it bluntly, the stable currency is the product of consensus support. As long as the market consensus is not broken, these small pains and itchings are difficult to shake its position in the field.

(Source: Hash school; Author: LucyCheng)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Xinhua Finance Review: JP Morgan Chase Leads Traditional Banking Blockchain Innovation

- Skynet is restored! Another dark net bitcoin money launderer was arrested.

- Opinion: Is it really worthwhile?

- Facebook warns investors: Libra cryptocurrencies may never be available

- The Tether hearing is over, and the BTC has not been able to make a big break. Is there still a chance to make a new high?

- Opinions | Can cryptocurrency be the solution to the financial inclusive barrier?

- This rumor is the "last-day trial" of the USDT. As a result, the impact of the hearing is minimal?