Report|The annual growth rate of trading volume is over 130%, and the potential of the African cryptocurrency market is huge.

Overview Overview

Since the currency system of most African countries is on the verge of collapse, the digital currency represented by BTC can help African users solve payment problems to a certain extent, so the market potential is huge. According to third-party data, African users averaged 17,351 bitcoin transactions per day, which increased the volume of transactions in the past 2018 by more than 130%.

The African digital money market has become a blue ocean market with a focus on the project side, exchanges and funds in the field of digital currency. It is necessary to conduct research on the development of digital currency in Africa before specific investments. We will summarize the development status of the African digital currency market from the perspective of regulatory supervision, transaction scale, project side, and exchange, for your reference.

Report text

Digital currency regulation

1) Status of national supervision

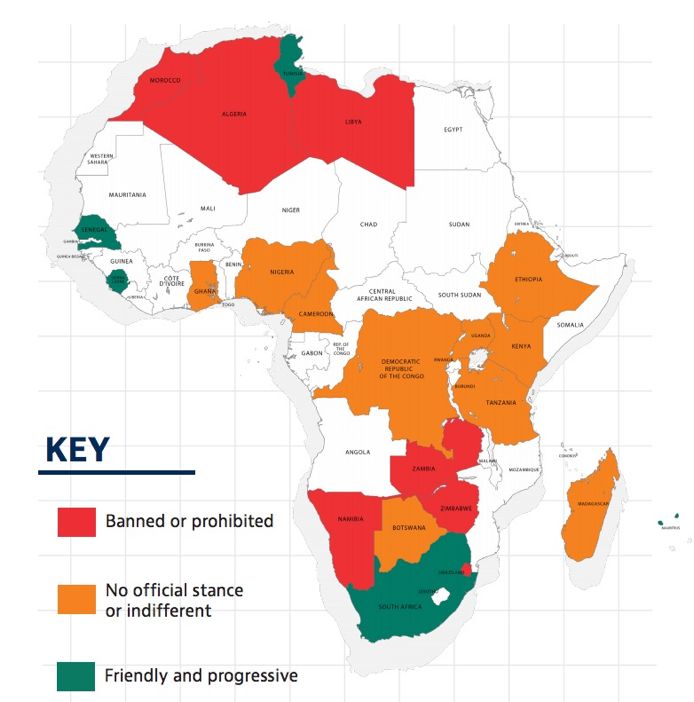

According to the third-party research firm Baker McKenzie's statistical report "Blockchain and Cryptocurrency in Africa", the regions that are friendly to digital currency are South Africa, Tunisia, Senegal, and Sierra Leone, as shown in the following figure:

- The US Internal Revenue Service finally made a shot, and 10,000 "reporting teaching letters" led the market to fall.

- Bitcoin added 7 nanometer capacity. New mine capacity in the first half of next year may reach 58 million TH/s

- Video|"8" Han Feng: I firmly believe that the next round of bull market will appear on the digital privatization

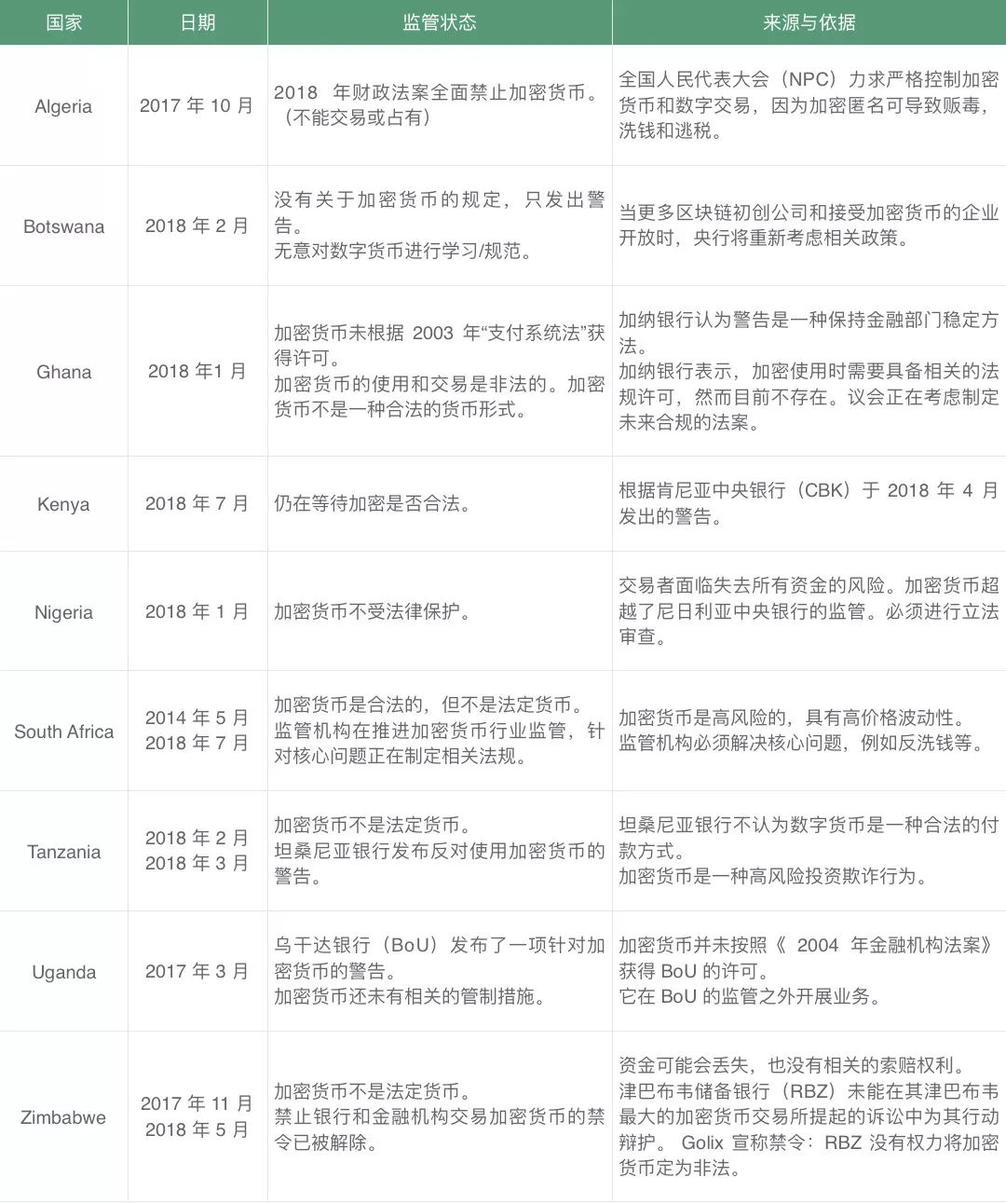

List of regulatory measures for major currencies in major African countries

2) Overview of South Africa's regulatory situation

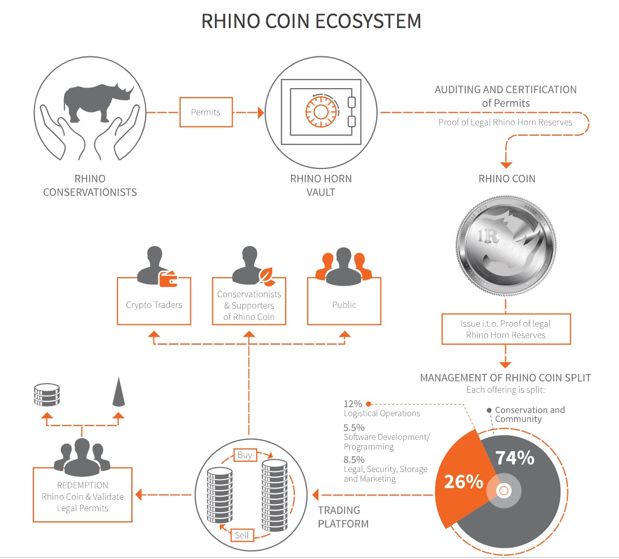

Two ICO projects were launched in South Africa in 2019 to promote the country's fiscal revenue:

- The first project is Rhino Coin, which is designed to regulate the legal sale of rhinoceros horns. Holders of Rhino Coin can trade cryptocurrencies or purchase legal rhinoceros horns. Funds raised from ICO will be used for rhino conservation efforts.

- The second is Safcoin, which aims to become a widely accepted payment method for online transactions across Africa, hoping to promote African trade and simplify cross-border payments, and to achieve free payments between countries by eliminating red tape and huge transactional processes.

Digital currency trading data for major African countries (sorted from high to low)

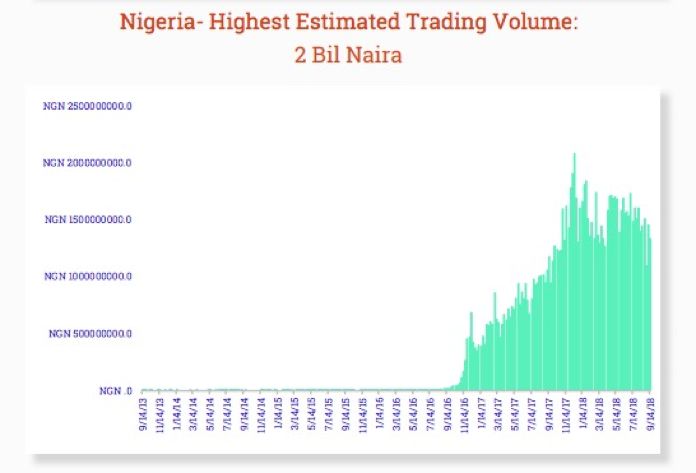

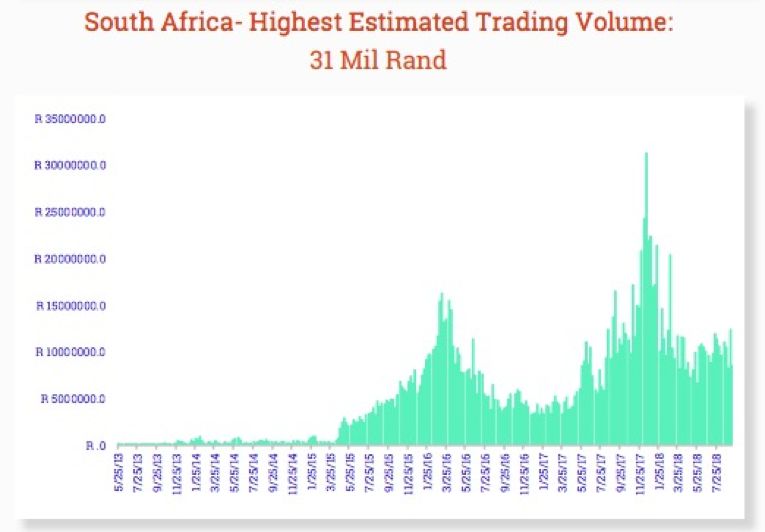

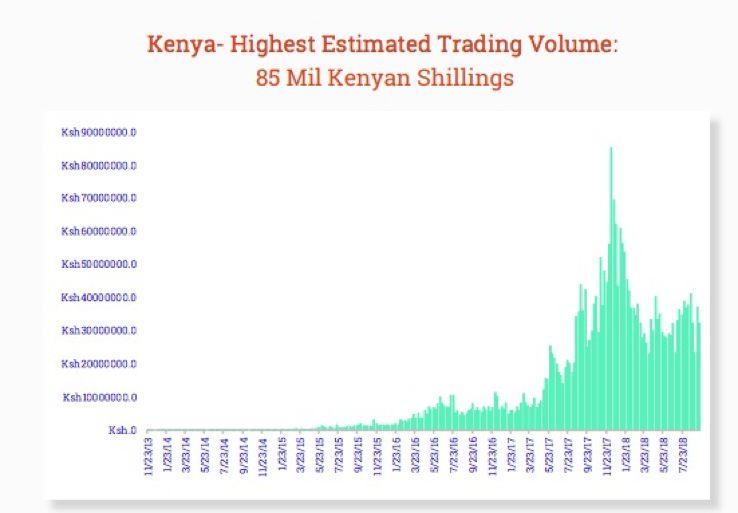

According to the Global Cryptocurrency Market Report by third-party research firm Ibinex, the digital currency exchanges of major African countries are as follows. It can be seen that Nigeria is the largest deal, followed by South Africa, mainly because the country's regulations are relatively loose, and the country's informatization is better than other countries.

- Nigeria (maximum daily trading volume of $5.52 million)

- South Africa (maximum daily trading volume of $2.23 million)

- Kenya (maximum daily trading volume of $877,300)

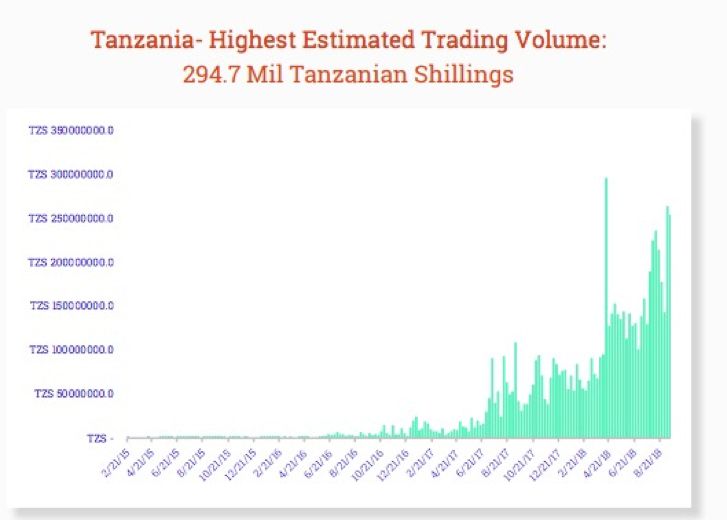

- Tanzania (maximum daily trading volume of $128,000)

Major digital currency exchange

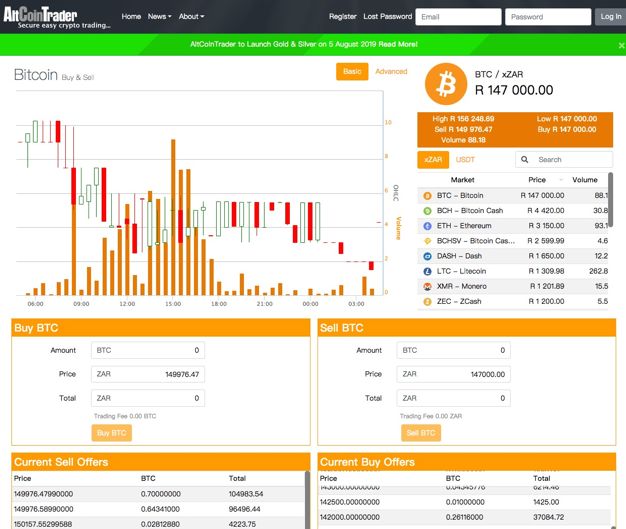

1. AltCoinTrader

The AltCoinTrader trading platform is a South African bitcoin trading platform. The AltCoinTrader team is made up of professionals. AltCoinTrader has a shared vision and enthusiasm for crypto and brings this amazing technology to the community.

- Country: South Africa

- Transaction currency: 21

- Trading mode: spot

- Online time: March 23, 2015

- Website: https://www.altcointrader.co.za/

2. Luno

Another digital currency exchange in South Africa, but the main trading currencies are BTC and ETH, and have a digital currency wallet.

- Country: South Africa

- Trading currency: BTC, ETH

- Trading mode: spot

- Online time: unknown

- Website: https://www.luno.com/en/

Conclusion

By observing our statistics and results, we can see that although the digital currency market in Africa has great potential, the overall transaction size still accounts for a small proportion of global transactions, including the scale of project parties, digital wallets and exchanges. At a very early stage. There are three main reasons for this:

- The penetration rate of Internet technology in Africa is still insufficient. According to third-party data, the Internet access rate in Africa is only 11%, which is very low compared with China and even India;

- Very low network access rate, resulting in the ability to use the digital wallet, the exchange's target users are limited, but also to bear a larger user acquisition cost;

- Africa's excellent digital money talents and funds are relatively scarce, so it is difficult for high-tech companies such as project parties, exchanges, and digital currency wallets that need professional talents and financial support to survive.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Ren Zhengfei said that China can issue its own Libra; Bakkt conducts user acceptance testing

- Baidu’s “abandoning son”, the universe that wants to die and die

- Smart contract: Is it a gimmick or a future business trend?

- Depth data: USDT is almost controlled by the Chinese market

- Baidu Super Chain: With 140+ patents, plans to open source cross-chain technology in 2020

- Wanchain | August 20th Open Consensus Node Pledge, September 3rd Main Online Line Galaxy Consensus

- Getting started with blockchain | What is a distributed autonomous organization without a boss or a CEO?