The US Internal Revenue Service finally made a shot, and 10,000 "reporting teaching letters" led the market to fall.

“The IRS has begun writing letters to virtual currency owners, suggesting that they pay their taxes and submit a revised return; this is part of the agency’s greater efforts.”

The above is the title of a report published on the official website of the Internal Revenue Service on July 26. Since the IRS announced plans to release more cryptocurrency tax guides in early June this year, the US tax agency, which has been silent for five years in the face of cryptocurrency, has finally begun its own “clean up” path.

Tax return teaching letter

- Bitcoin added 7 nanometer capacity. New mine capacity in the first half of next year may reach 58 million TH/s

- Video|"8" Han Feng: I firmly believe that the next round of bull market will appear on the digital privatization

- Ren Zhengfei said that China can issue its own Libra; Bakkt conducts user acceptance testing

According to a report issued by the Internal Revenue Service, IRS has begun to send letters to taxpayers engaged in virtual currency transactions. These taxpayers may not have reported income, nor paid taxes on virtual currency transactions, or did not report correctly. transaction.

According to the report, the IRS began sending educational letters to taxpayers last week. By the end of August, more than 10,000 taxpayers are expected to receive these letters. The names of these taxpayers were obtained through various compliance efforts being carried out by the IRS.

In fact, cryptocurrency has always been a key area of IRS criminal investigation, but in the early days of cryptocurrency development, IRS did not take some obvious steps to force cryptocurrency users to pay taxes. With the growing cryptocurrency and the upcoming introduction of a new taxation guide, it is clear that the IRS is well prepared.

It is understood that in terms of tax rules, IRS still follows its 2014 announcement. The US Internal Revenue Service's 2014-21 Announcement (PDF) states that virtual currency is a property of federal tax purposes and provides guidance on how federal tax principles apply to virtual currency transactions. Compliance work follows these general tax principles. The IRS will continue to consider and solicit feedback from taxpayers and practitioners on education and future guidance.

According to the announcement, when consumers hold Bitcoin for less than one year, the proceeds will be used as short-term capital gains, which may be as high as 39% for ordinary income tax rates; when held for more than one year, income Profits will be treated as long-term capital gains, with lower tax rates ranging from 0 to 20%.

For the "mailing" incident, Chuck Rettig, director of the US Internal Revenue Service (IRS), said: " Taxpayers should take these letters seriously, review their tax filings, and Time to modify past tax returns, reimbursement of taxes, interest and fines."

Retigue further stated: "The IRS is expanding our efforts in virtual currency, including increasing the use of data analysis. We focus on law enforcement and help taxpayers fully understand and fulfill their obligations."

3 different types of notices and reasons for launch

In fact, the "mailing" incident is not an IRS surprise check.

It is understood that from June 2019, the US Internal Revenue Service has begun to send notices to taxpayers, giving them the opportunity to voluntarily comply with the rules for not reporting virtual currency transactions. However, only a small number of notices were issued in June. The large-scale mailing of these letters was mainly carried out during the week of July 22, 2019, and continued until August.

At the time, the US Internal Revenue Service described the plan as a “soft notice” that reminded taxpayers to let them voluntarily comply. However, in the original plan, only one of the three new notices was a true “soft notice,” and the other two were likely to be enforced by the IRS.

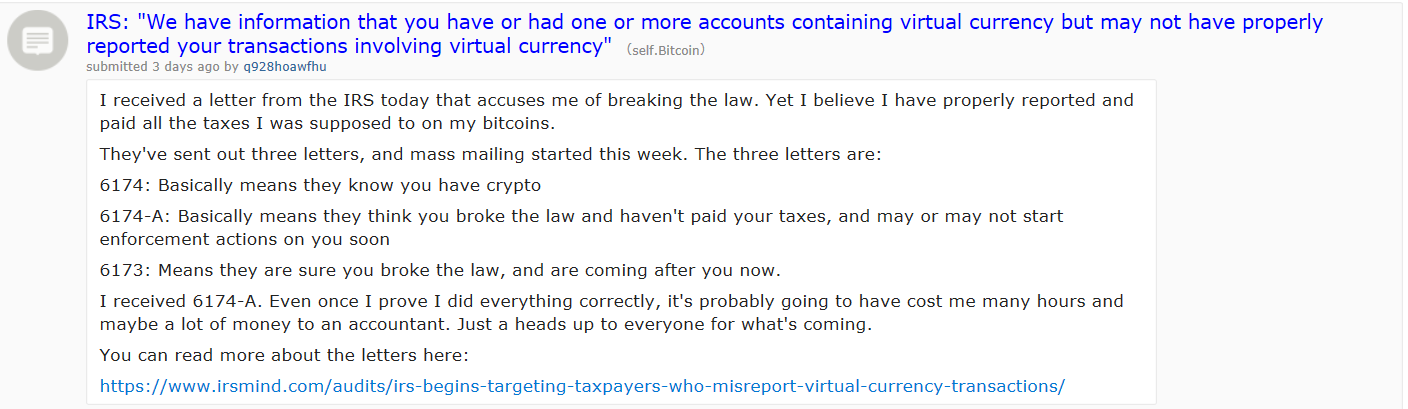

The three notification processes correspond to three versions of the education letter: No. 6173, No. 6174, and No. 6174-A.

No. 6174: This is a soft notice to inform taxpayers that they may not have reported their virtual currency transactions. The notice asks them to check their return and submit a modified return if necessary to correct the error report. Taxpayers do not need to respond to notices, and the IRS does not intend to follow up on these notices. In short, this is just the information provided to taxpayers and the education they follow.

No. 6174-A: This is a "not so gentle notice" issued by the US Internal Revenue Service. Like the 6174 letter, this letter tells taxpayers that there may be false reports in virtual currency transactions. However, the notice states that the IRS may take follow-up enforcement actions. Similarly, if taxpayers think they are compliant, they do not need to respond. Taxpayers who receive this notice should be aware that they have been included in the “Notice” and have been identified as non-compliant taxpayers who may be executed in the future.

No. 6173: This notice requires taxpayers to respond to alleged non-compliance. This letter provides instructions on how to respond to the IRS. The IRS intends to follow up on these responses to determine if taxpayers are compliant.

As you can see, the soft notification plan is not new to taxpayers. The IRS usually uses a soft notification procedure for two reasons:

1. Remind taxpayers that they plan to start paying attention to violations in a particular area.

2. Understand the extent of non-compliance in this area

In terms of cryptocurrency, the IRS is still in its infancy in understanding taxpayer non-compliance and how to close false reports. The US Internal Revenue Service obviously does not have the resources to audit all of these taxpayers, so it is important to understand how best to achieve compliance.

The choice of "soft notification" not only educates taxpayers, encourages them to voluntarily comply, but also saves resources to the greatest extent possible.

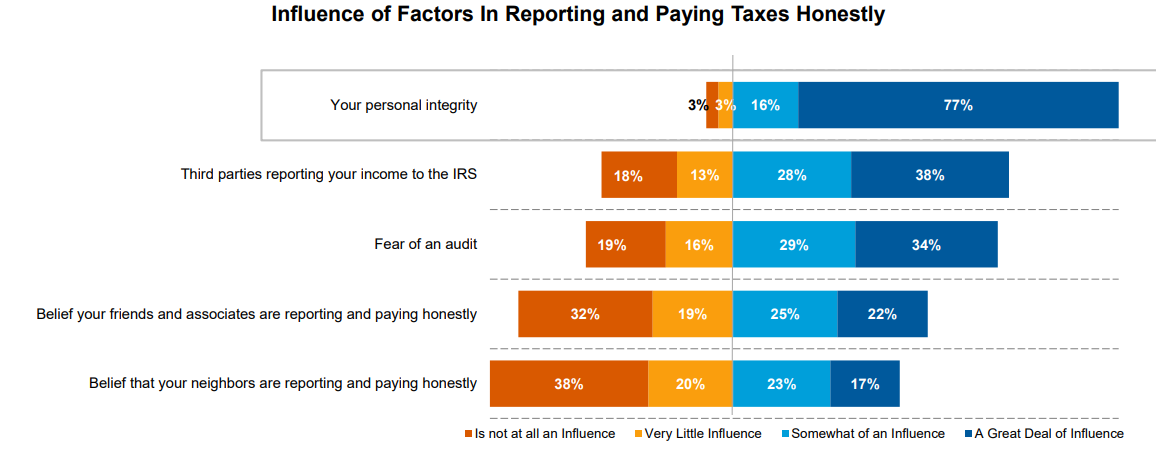

According to the IRS, the purpose of "sending a letter" is to let taxpayers know that the US Internal Revenue Service is paying close attention to taxation issues in the cryptocurrency sector and to have information that may identify and punish taxpayers who do not correctly report virtual currency transactions. Research by the US Internal Revenue Service shows that third-party information and fear of auditing are the main factors that prompt taxpayers to voluntarily comply with regulations:

US Treasury Study in 2018: Third-party information and fear of auditing have greatly affected taxpayer compliance

User feedback and means of IRS

"It's possible that you don't know that you have violated the encryption tax rules, but the IRS will be clearer than you."

Last weekend, on the reddit forum and Twitter, there have been some letters from the IRS. One of the users who received the letter stated that they received an education letter from 6174-A.

The IRS in the letter states: "The information we have is that you own or own one or more accounts that contain virtual currency, but may not correctly report transactions involving virtual currency (including cryptocurrency and non-encrypted virtual currency)."

But the user said that it has always followed the cryptocurrency tax principle. I don't know why I received this "medium" warning letter.

Although it is not known whether the user has a violation, it is clear that the IRS knows the user better than the user.

This is mainly due to the IRS review method.

Earlier, according to Bitcoin.com, the IRS IRS published a slide detailing how tax authorities should handle non-taxable digital currency users. (See: "A slide from IRS to break your illusion of encryption privacy.")

In the slide, in order to trace the tax evasion phenomenon in the field of cryptocurrency, IRS can be described as a means. These include:

1, using the block browser to trace the cryptocurrency address

2. Ask friends and family members of encrypted users to sort out social media posts.

3. Investigate the financial habits of Bitcoin users

4, try to identify the user's wallet and related address

5, research bitcoin mixer, Tor use and other transaction confusion methods

6, query exchange data

……

In addition, in order to understand the cryptocurrency more clearly than the user, the IRS also has a "chronology" for cryptocurrencies such as XRP and BCH.

It can be seen that in terms of the review of the IRS announcement, it is difficult for users to rely on cryptocurrencies for tax evasion and tax evasion as usual, and since the IRS announced last Friday to write to taxpayers, the price of Bitcoin is two days. The inside fell from $10,130 to $9,450, while the Google search trend for "bitcoin+IRS" soared.

The data shows that since the IRS began to send out a large number of taxation teaching letters, the liquidity and trading volume of the cryptocurrency market have declined overall, compared with 30%-40% less than last week. At the same time, Coinbase and Bitstamp's orderbook are somewhat stretched.

It is undeniable that the strong entry of IRS has intensified the panic of cryptocurrency users, which seems to be bad in the short term, especially the US domestic exchanges.

However, some people believe that in the long run, the IRS is undoubtedly good for the encryption market. As Bitcoin Jesus said: "If IRS is trying to tax Bitcoin, it means that IRS seems to accept that Bitcoin may be used by mainstream people and institutions."

Original: Sharing Finance Neo

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Baidu’s “abandoning son”, the universe that wants to die and die

- Smart contract: Is it a gimmick or a future business trend?

- Depth data: USDT is almost controlled by the Chinese market

- Baidu Super Chain: With 140+ patents, plans to open source cross-chain technology in 2020

- Wanchain | August 20th Open Consensus Node Pledge, September 3rd Main Online Line Galaxy Consensus

- Getting started with blockchain | What is a distributed autonomous organization without a boss or a CEO?

- QKL123 market analysis | long and short double-explosive bitcoin test for 9,000 US dollars, the market uncertainty increased (0729)