The US will open the USDT, will Chinese investors become the biggest "taker"?

One of the most eye-catching is the news that USDT is issuing additional shares. According to relevant statistics, the number of USDT issued by TEDA has reached a record high in the second quarter of this year. The current number has exceeded 1 billion US dollars, laying a solid foundation for further completion of this year's "new high data."

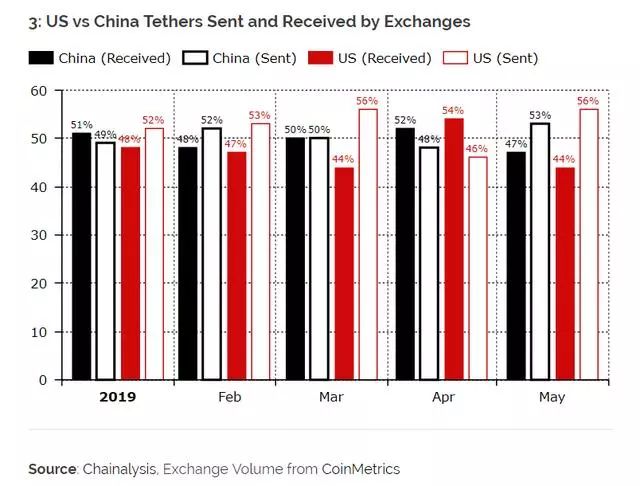

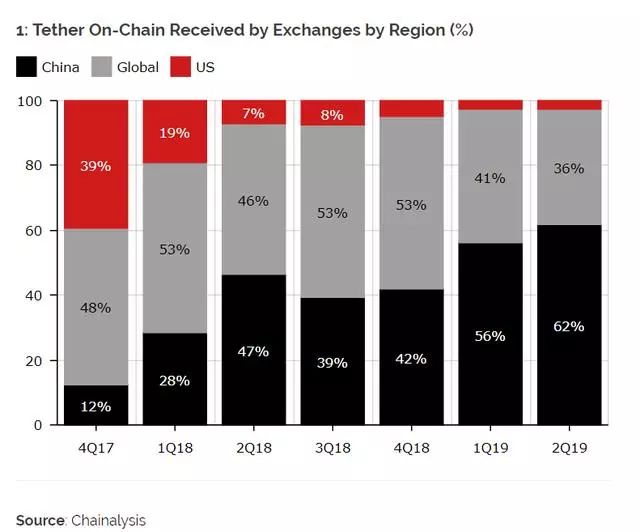

What is intriguing is that the USDT, which is considered a "toon" in China, has encountered a cold reception in the United States. The data shows that the USDT that has flowed into the exchange since 2019 mainly provides services for Chinese traders, while the USDT that flows to the US accounts for only 3% of the circulation.

- Research: Lightning network disposal as a bad node, has been confiscated 2.22 BTC

- After Vitalik proposed the blockchain “marriage plan”, what do people in the industry think?

- What can Ethereum learn from Libra?

Nowadays, the problems behind the data have become more and more obvious, and TEDA has almost fallen into a difficult situation in the United States.

In recent days, the New York State Attorney General has submitted new evidence stating that the USDT illegally served New York users, which indicates that the United States has begun to attack the USDT. We also vaguely feel that the world market is about to usher in a major earthquake.

The US’s “disappointing” to the USDT seems to have been around for a long time?

The U.S.’s strike against the USDT is not a temporary sanction. In fact, the tug-of-war between the two sides has already emerged from the beginning of this year. As early as the beginning of this year, the United States began a long truss with USDT. Today, Facebook’s Libra is born, and the United States wants to support this stable currency, which is regarded as the “star of hope”, sweeping the globe. More need to compete with USDT to grab the market.

Coincidentally, a company called Bitwise released a report some time ago, saying that there are a large number of exchanges that have the behavior of brushing and false transactions. After investigating 83 exchanges, Bitwise found that the proportion of false transactions on some exchanges was as high as 85-95%. Among the many exchanges, only 10 exchanges had transaction data that met their requirements.

It is not difficult to see that the content of this report is to remind everyone that the trading situation of the global cryptocurrency exchange is far less than expected, and that the amount of some virtual currency represented by USDT is actually Noted the water, mixed with fake.

But, is this the truth? It doesn't seem to be all right.

According to the flow data on the USDT chain issued by TEDA, the current situation is significantly different from the conclusion of Bitwise. According to data from TEDA, the trading volume of the exchange has been on the rise, so the real trading situation may not be as bad as Bitwise said.

It can only be said that both parties have their own data sources and have their own theoretical sources. As for who's data is more real, and whose conclusions are more objective, they can only be judged by their own friends.

With an additional 400 million in 10 days, will the USDT increase rate be too exaggerated?

But if we carefully compare the price increase of the USDT in the recent period, we will find that the word "exaggeration" is not an overstatement.

In just 10 days, 400 million have been issued.

On July 2nd, 01:04, July 4th, 18:07, July 8th, 23:27, July 10th, 6:01, in these four time points, Tether added a new one to the Ethereum network. Billions of USDT.

There is a lot of controversy about the large premium of the USDT. Some people think that Tether is artificially raising prices. In addition, USDT's work on asset transparency is obviously insufficient compared with its existing volume, which is why it is frequently questioned by the market.

The USDT currently occupies a large market share and has a clear monopoly. Each additional issuance has a strong correlation with the fluctuation of the currency price. Whether the USDT is using its huge influence to manipulate the market is also very intriguing.

However, some people hold the opposite view and think that the above statement is too complicated and conspiracy theory. It is believed that the newly added Tether only reflects new funds entering the Bitcoin exchange ecosystem. In 99% of cases, when the supply of Tether increased, it coincided with the new dollar entering the Bitcoin exchange.

Where should TEDA go next?

The large premium of the USDT in a short period of time caused a heated discussion. At the same time, the US side also launched a series of sanctions on the USDT.

At present, the Supreme Court of New York has officially issued a statement, and at the same time holds more than 20 pieces of evidence. The New York office also directly pointed out that USDT has misappropriated the use of reserve funds. All these acts are held by a winner. Look like.

Not long ago, there was more news that the United States asked TEDA to make a final testimony before July 22. If the proof cannot pass, then TEDA will face the fate of closing at the end of this month.

If the words become awkward, TEDA really collapses or is pursued legal responsibility, it will inevitably produce a terrible chain reaction. There are many exchanges in China that use TEDA as the transaction object, and TEDA has an accident. These related exchanges may not be spared.

Compared with a few punches in the United States, TEDA's reaction seems to be a lot low-key. Today's USDT, in addition to the behavior of a large excess, has no other clear statement.

In this large-scale battle, who will be defeated, who will retreat, we only have to wait and see.

This article is the original of the World Bank Finance. Unauthorized reproduction is prohibited.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The US Treasury Secretary said that Libra’s timing was “uncomfortable” and the encryption community saw a positive side.

- Bitcoin's soaring population: the mining giant ushered in the spring exchange to die in the cold winter

- What will be the martyrdom of David Marcus at the upcoming two Libra hearings?

- BTC fluctuates at a high level, and the short-term market is exhausted.

- Bai Shuo commented that the face of the letter is blocked: to prevent financial risks, but also to retain innovative living water

- Facebook hearing testimony exposure: Libra will not be launched rashly until regulatory concerns are removed

- FB blockchain leader Marcus: Libra will not compete with sovereign currency