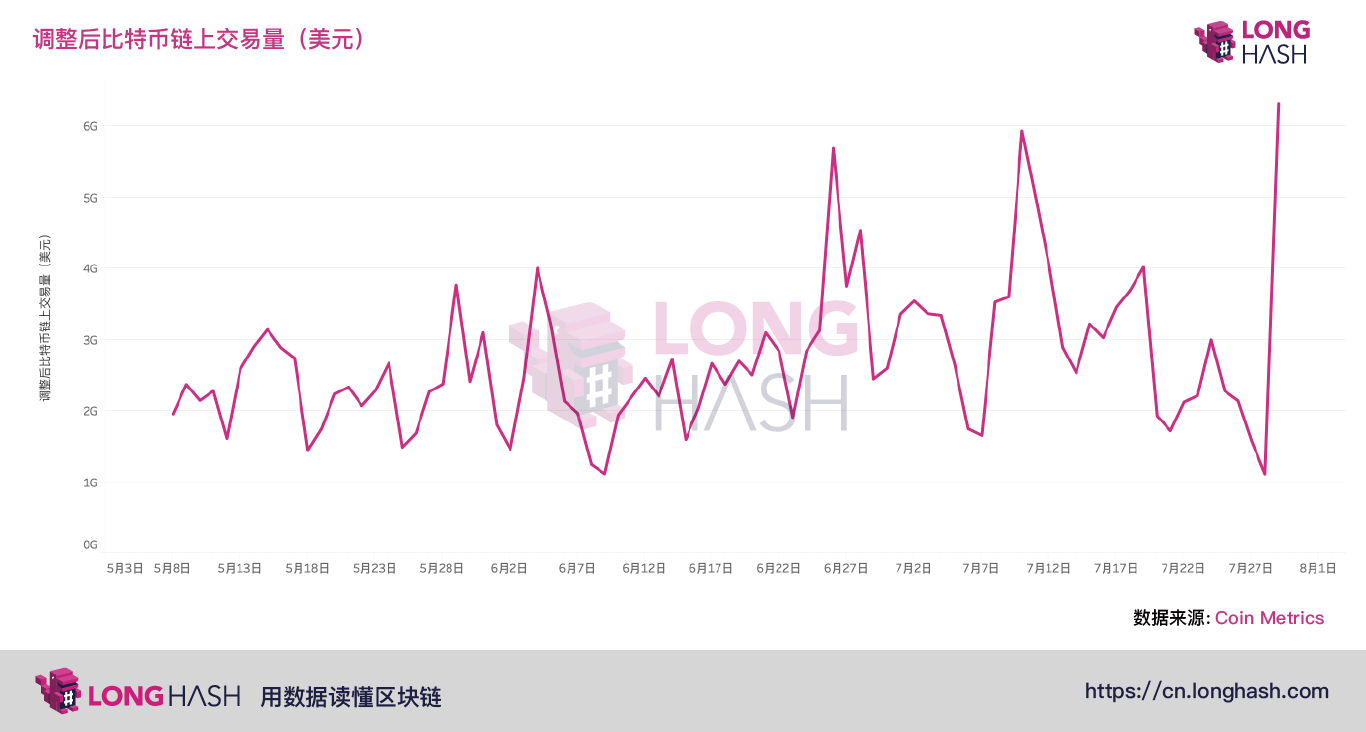

Trading volume in the bitcoin chain soared to the highest level in history, with a single-day transaction of over $6.3 billion on July 29

For most of July, bitcoin prices were in a period of high and low volatility, and the short-term and even medium-term movements of Bitcoin were not clear. Will Bitcoin prices continue to rebound throughout the summer of 2019, or will it fall back to the low of last winter?

So far, no one seems to be able to clearly understand the next currency price trend. The best way to illustrate this uncertainty is to check the volume of transactions on the Bitcoin network. Through the adjusted trading volume indicator given by Coinmetrics, we can understand the volatility of recent Bitcoin network activities.

On July 28th, the trading volume of the Bitcoin network fell to the lowest level in the past two months. Only $1.11 billion in economical transactions were processed on the Bitcoin network.

- Does the US ban bitcoin? Senator: Will not succeed

- LTC cut production and led the gains, the broader market to start?

- Bitcoin returned to $10,000, and the Fed cut interest rates to help!

One day later, on July 29th, the highest volume of transactions since January 2018 appeared on the Bitcoin network, processing more than $6.3 billion in economic transactions in one day.

The difference between the adjusted volume and the original volume data is that the former removes internal transactions that do not generate benefits, such as the currency being sent back and forth between the exchange's own hot wallet or cold wallet, while still retaining all external transaction. Adjusted trading volume is considered to be a better indicator of the actual activity level on the Bitcoin network, but it is worth noting that even the adjusted trading volume indicator does not perfectly reflect the use of Bitcoin.

In any case, the violent shock of the adjusted trading volume is worthy of attention. Until yesterday, there has never been a history of bitcoin transactions in which the adjusted volume fluctuated by more than $5 billion in one day. Now investors should be concerned about whether the growth of adjusted trading volume will continue and whether the price of Bitcoin will increase as the trading volume increases. Only time will give an answer.

LongHash , read the blockchain with data.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Who will set the slogan of "China Libra": central bank, technology giant, banking alliance or multinational organization?

- After the fourth birthday of Ethereum, where will the next four years go?

- Is it just a coincidence that BAT holds blockchain activities at the same time?

- The Fed’s hawkish rate cuts bitcoin is slow, and the script is ready to start your performance.

- "Elevation" Ethereum's composite network effect: digital financial stack (1)

- Bitcoin once again broke through $10,000, and the Fed’s interest rate cut is only one of the benefits.

- From the troubled USDT to Libra, how to stabilize the currency on the road to compliance